- United Kingdom

- /

- Construction

- /

- AIM:RNWH

Undervalued Small Caps With Insider Action On UK Exchange In January 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced turbulence, with the FTSE 100 and FTSE 250 indices both experiencing declines due to weak trade data from China, highlighting the ongoing challenges in global economic recovery. In this environment of uncertainty, identifying promising small-cap stocks requires careful consideration of factors such as resilience to external economic pressures and potential for growth despite broader market sentiment.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| 4imprint Group | 15.3x | 1.3x | 41.60% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 35.58% | ★★★★★☆ |

| iomart Group | 23.8x | 0.6x | 34.71% | ★★★★☆☆ |

| Sabre Insurance Group | 11.7x | 1.5x | 9.76% | ★★★★☆☆ |

| NCC Group | NA | 1.4x | 21.72% | ★★★★☆☆ |

| Warpaint London | 24.2x | 4.2x | 0.25% | ★★★☆☆☆ |

| Telecom Plus | 18.1x | 0.7x | 29.78% | ★★★☆☆☆ |

| Alpha Group International | 10.2x | 4.7x | -32.39% | ★★★☆☆☆ |

| Breedon Group | 15.9x | 1.0x | 45.32% | ★★★☆☆☆ |

| THG | NA | 0.3x | -578.25% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

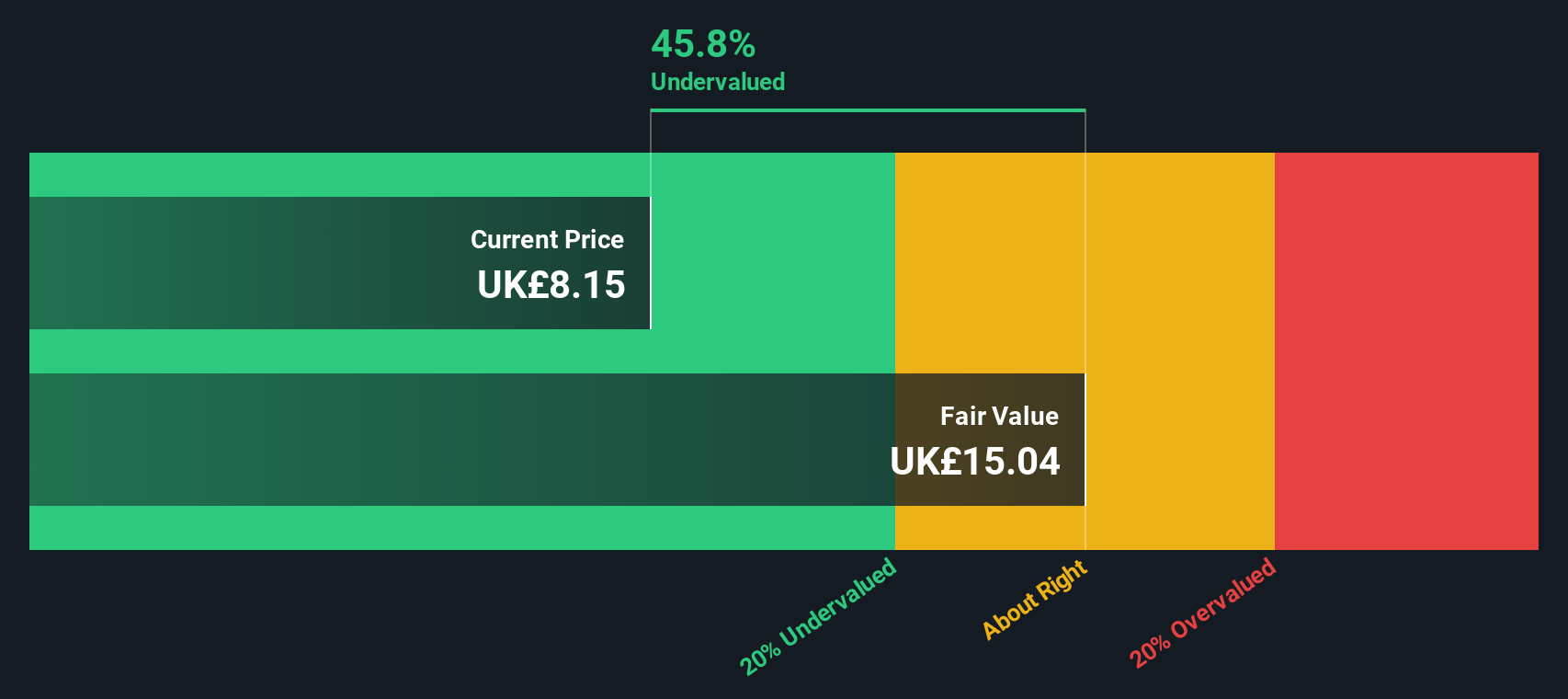

Renew Holdings (AIM:RNWH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Renew Holdings is a UK-based engineering services company focusing on infrastructure and environmental projects, with a market cap of approximately £0.54 billion.

Operations: The company's revenue primarily comes from engineering services, totaling £1.01 billion. Over recent periods, the gross profit margin has shown fluctuations, with a notable figure of 14.04% as of September 2024. Operating expenses have consistently impacted profitability, with significant allocations towards general and administrative expenses reaching £74.67 million in the same period.

PE: 16.6x

Renew Holdings, a UK-based company, recently reported a sales increase to £1.06 billion for the year ending September 2024, up from £887.6 million the previous year. Despite this growth, net income slightly decreased to £44 million from £46.1 million. Earnings per share rose to £0.659 from £0.623, indicating operational efficiency despite reliance on external borrowing for funding—a higher risk factor without customer deposits as a buffer. Insider confidence is evident with recent share purchases in November 2024, suggesting optimism about future prospects amidst projected annual earnings growth of over 10%.

- Navigate through the intricacies of Renew Holdings with our comprehensive valuation report here.

Review our historical performance report to gain insights into Renew Holdings''s past performance.

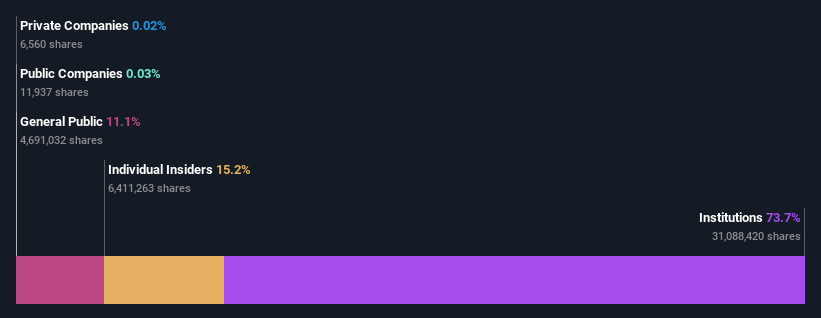

Alpha Group International (LSE:ALPH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Alpha Group International is a financial services company that provides payment and risk management solutions across various segments, with a market capitalization of £1.14 billion.

Operations: Alpha Group International generates revenue primarily from Alpha Pay and Institutional segments, with additional contributions from Corporate operations in Toronto, Amsterdam, and London. As of the latest data, the company reported a gross profit margin of 85.58%, reflecting efficient management of cost of goods sold relative to revenue. Operating expenses include significant general and administrative costs alongside non-operating expenses such as depreciation and amortization.

PE: 10.2x

Alpha Group International, a smaller company in the UK market, has caught attention due to its high-quality earnings and insider confidence. Clive Kahn's recent purchase of 50,000 shares for £1.04 million indicates strong belief in its potential. Despite relying solely on external borrowing for funding, which carries higher risk than customer deposits, the company's earnings are expected to grow by 6.31% annually. This growth forecast suggests promising prospects amidst industry challenges.

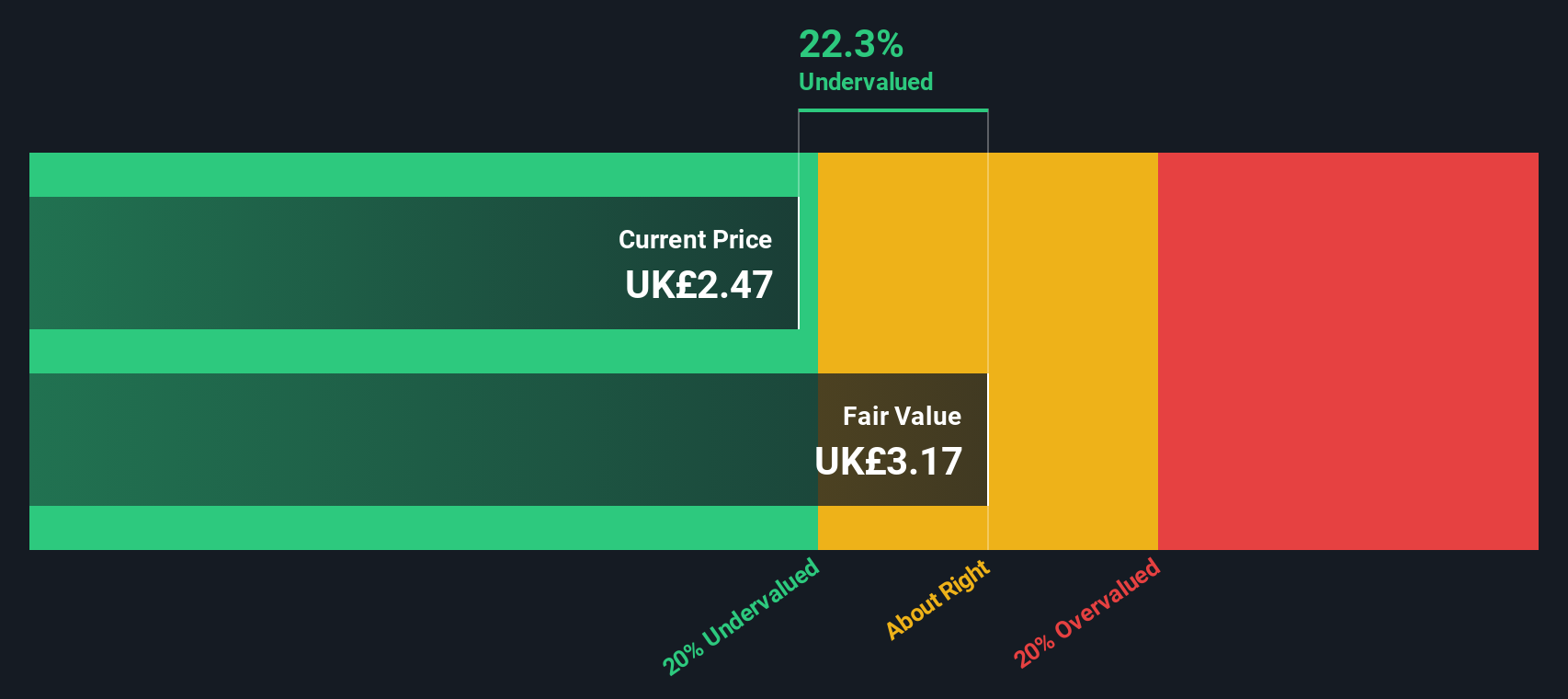

Pets at Home Group (LSE:PETS)

Simply Wall St Value Rating: ★★★★★★

Overview: Pets at Home Group operates as a leading UK pet care business, comprising retail and veterinary services, with a market cap of £1.44 billion.

Operations: PETS generates revenue primarily from its Retail and Vet Group segments, with the former contributing significantly more. Over recent periods, the company's gross profit margin has shown a decreasing trend, reaching 46.80% in October 2024. Operating expenses are largely driven by sales and marketing efforts, consistently exceeding £450 million.

PE: 10.1x

Pets at Home, a UK-based company, shows potential as an undervalued stock with growing profits and revenue projected to increase by 11.05% annually. Recent insider confidence is evident with share purchases in the past year, suggesting belief in future prospects. Despite relying solely on external borrowing for funding, the company reported impressive half-year sales of £789 million and net income rising to £37.6 million from £25.3 million a year ago. The Board's decision to raise dividends further signals financial strength and optimism moving forward.

- Delve into the full analysis valuation report here for a deeper understanding of Pets at Home Group.

Explore historical data to track Pets at Home Group's performance over time in our Past section.

Key Takeaways

- Delve into our full catalog of 33 Undervalued UK Small Caps With Insider Buying here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RNWH

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives