- United Kingdom

- /

- Trade Distributors

- /

- AIM:BRCK

3 UK Stocks That Might Be Undervalued In January 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces challenges amid faltering trade data from China and declining commodity prices, investors are keenly observing the market for potential opportunities. In such an environment, identifying undervalued stocks can be crucial, as these may offer value despite broader economic uncertainties and market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Fevertree Drinks (AIM:FEVR) | £6.715 | £13.12 | 48.8% |

| Bellway (LSE:BWY) | £24.30 | £48.33 | 49.7% |

| Brickability Group (AIM:BRCK) | £0.64 | £1.27 | 49.5% |

| GlobalData (AIM:DATA) | £1.965 | £3.76 | 47.7% |

| Tracsis (AIM:TRCS) | £5.10 | £9.80 | 48% |

| Zotefoams (LSE:ZTF) | £3.15 | £5.82 | 45.9% |

| Duke Capital (AIM:DUKE) | £0.305 | £0.58 | 47.6% |

| Vp (LSE:VP.) | £5.50 | £10.05 | 45.3% |

| Victrex (LSE:VCT) | £10.68 | £19.85 | 46.2% |

| Quartix Technologies (AIM:QTX) | £1.56 | £3.08 | 49.3% |

Let's review some notable picks from our screened stocks.

Brickability Group (AIM:BRCK)

Overview: Brickability Group Plc, along with its subsidiaries, supplies, distributes, and imports building products in the United Kingdom and has a market cap of £205.28 million.

Operations: The company generates revenue from various segments including Importing (£90.55 million), Contracting (£88.22 million), Distribution (£63.21 million), and Bricks and Building Materials (£380.56 million) in the United Kingdom.

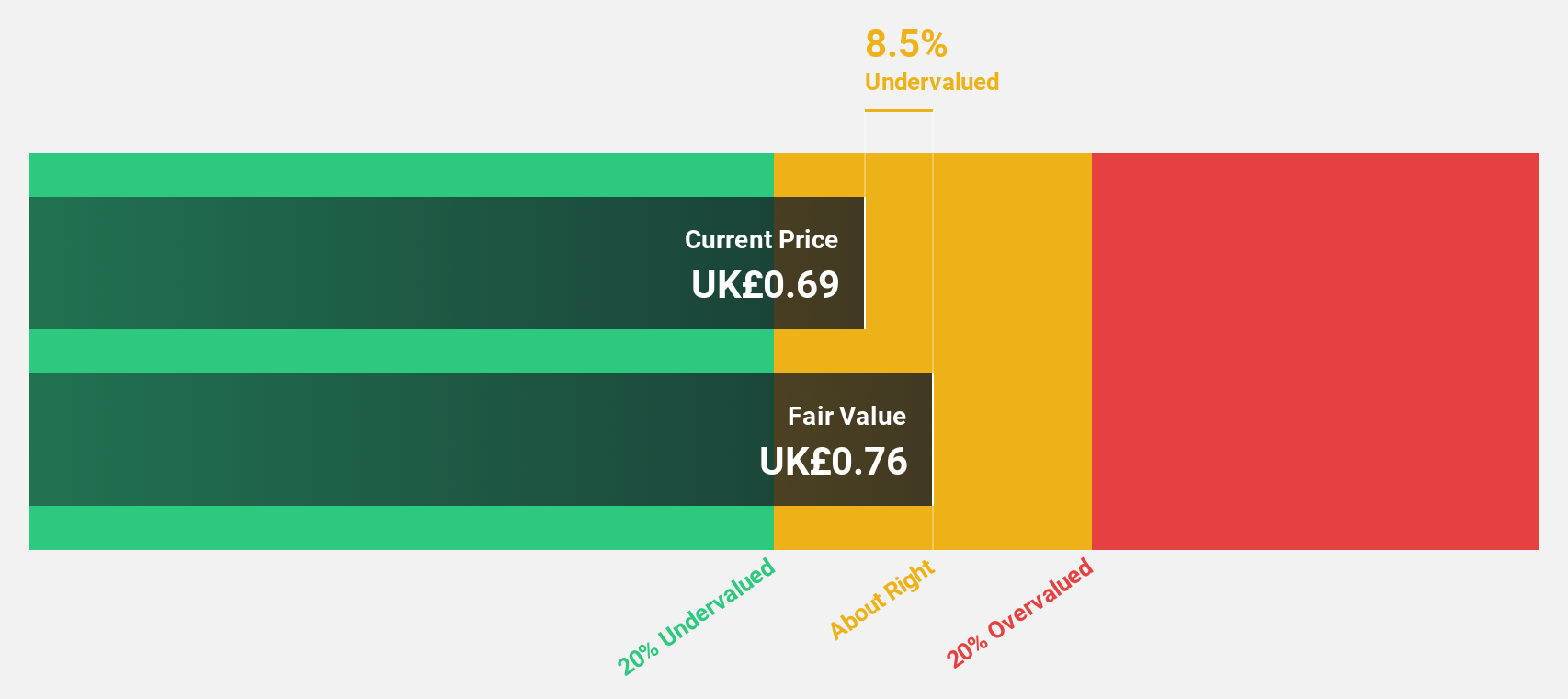

Estimated Discount To Fair Value: 49.5%

Brickability Group is trading significantly below its estimated fair value, presenting potential as an undervalued stock based on cash flows. Despite a decrease in net income and profit margins over the past year, earnings are forecast to grow significantly at 46.5% annually, outpacing the UK market. The company continues to explore acquisitions for growth while focusing on de-gearing its balance sheet. However, dividends remain poorly covered by earnings, indicating financial caution may be necessary.

- In light of our recent growth report, it seems possible that Brickability Group's financial performance will exceed current levels.

- Get an in-depth perspective on Brickability Group's balance sheet by reading our health report here.

Fresnillo (LSE:FRES)

Overview: Fresnillo plc is a company engaged in the mining, development, and production of non-ferrous minerals in Mexico with a market cap of approximately £4.79 billion.

Operations: The company's revenue segments are primarily derived from its operations in Mexico, with $195.82 million from Cienega, $607.29 million from Saucito, $439.76 million from Fresnillo, $633.78 million from Herradura, $546.80 million from Juanicipio, $404.32 million from San Julian, and $56.24 million from Noche Buena.

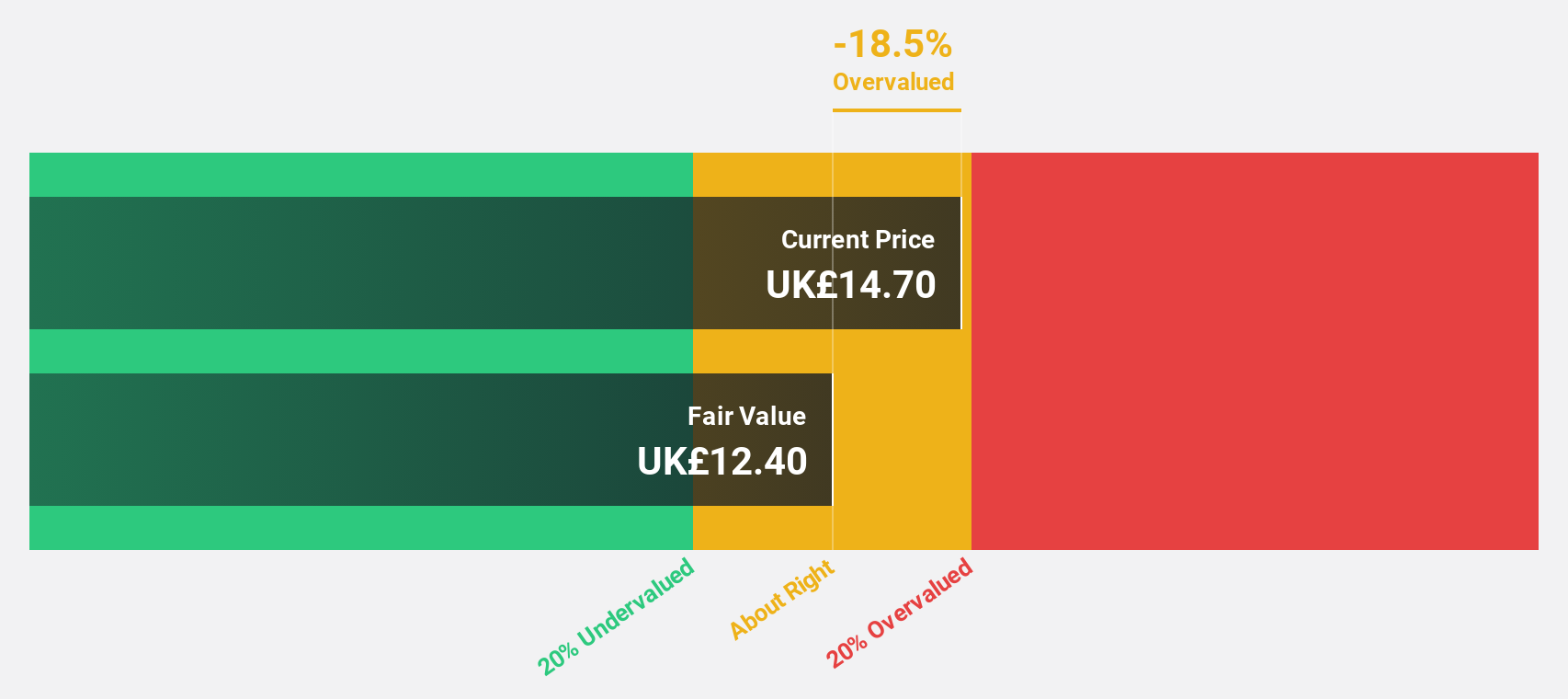

Estimated Discount To Fair Value: 25.1%

Fresnillo is trading 25.1% below its estimated fair value of £8.68, highlighting its potential as an undervalued stock based on cash flows. Analysts expect earnings to grow significantly at 33.8% annually, surpassing UK market growth rates, though revenue growth remains modest at 4.8%. Recent production results show increased output in gold and base metals compared to last year, despite a slight annual decline in gold production year-to-date, suggesting operational resilience amidst valuation concerns.

- Insights from our recent growth report point to a promising forecast for Fresnillo's business outlook.

- Click to explore a detailed breakdown of our findings in Fresnillo's balance sheet health report.

Pinewood Technologies Group (LSE:PINE)

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider serving the automotive industry in the United Kingdom and internationally, with a market capitalization of £298.95 million.

Operations: The company generates revenue from its software segment, amounting to £22.62 million.

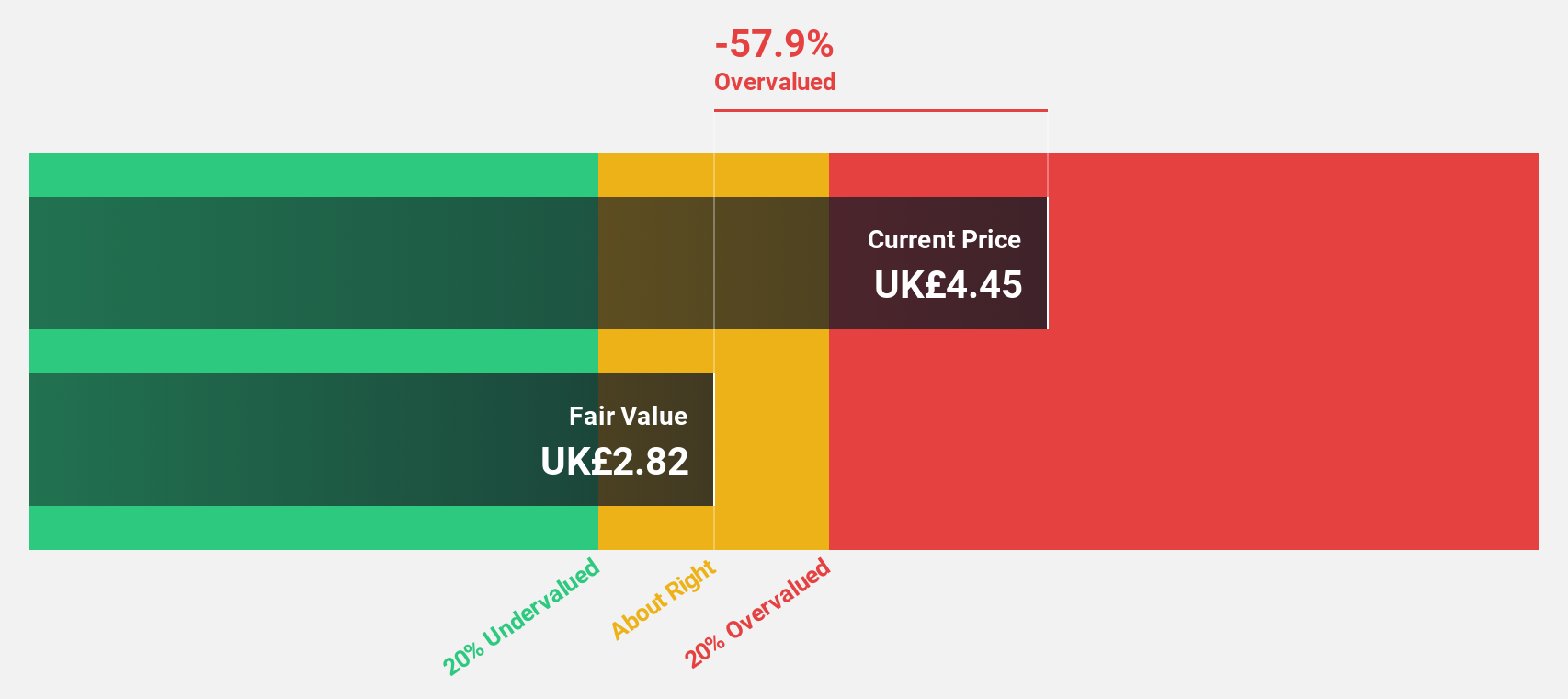

Estimated Discount To Fair Value: 33.5%

Pinewood Technologies Group is trading 33.5% below its estimated fair value of £5.37, reflecting undervaluation based on cash flows. Earnings are forecast to grow significantly at 25.1% annually, outpacing UK market growth, with revenue expected to rise by over 20%. The recent contract with Marshall Motor Group enhances Pinewood's market position in the automotive retail sector and underscores its growth potential despite past shareholder dilution concerns.

- According our earnings growth report, there's an indication that Pinewood Technologies Group might be ready to expand.

- Unlock comprehensive insights into our analysis of Pinewood Technologies Group stock in this financial health report.

Next Steps

- Reveal the 55 hidden gems among our Undervalued UK Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brickability Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BRCK

Brickability Group

Supplies, distributes, and imports building products in the United Kingdom.

Excellent balance sheet with reasonable growth potential.