- United Kingdom

- /

- Life Sciences

- /

- AIM:DXRX

3 Promising UK Penny Stocks With Market Caps Under £500M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting global economic interdependencies. In such a climate, identifying stocks with strong financials becomes crucial for investors seeking opportunities. Penny stocks, despite their somewhat outdated name, can offer significant potential when they exhibit robust financial health and growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.976 | £153.96M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.095 | £789.32M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

| Union Jack Oil (AIM:UJO) | £0.0875 | £9.32M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.87 | £384.89M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.46 | $267.41M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.495 | £318.8M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.135 | £96.97M | ★★★★★★ |

Click here to see the full list of 468 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Diaceutics (AIM:DXRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Diaceutics PLC is a diagnostic commercialization company offering data, data analytics, and implementation services to pharmaceutical companies globally, with a market cap of £114.89 million.

Operations: The company generates revenue of £26.10 million from its Medical Labs & Research segment.

Market Cap: £114.89M

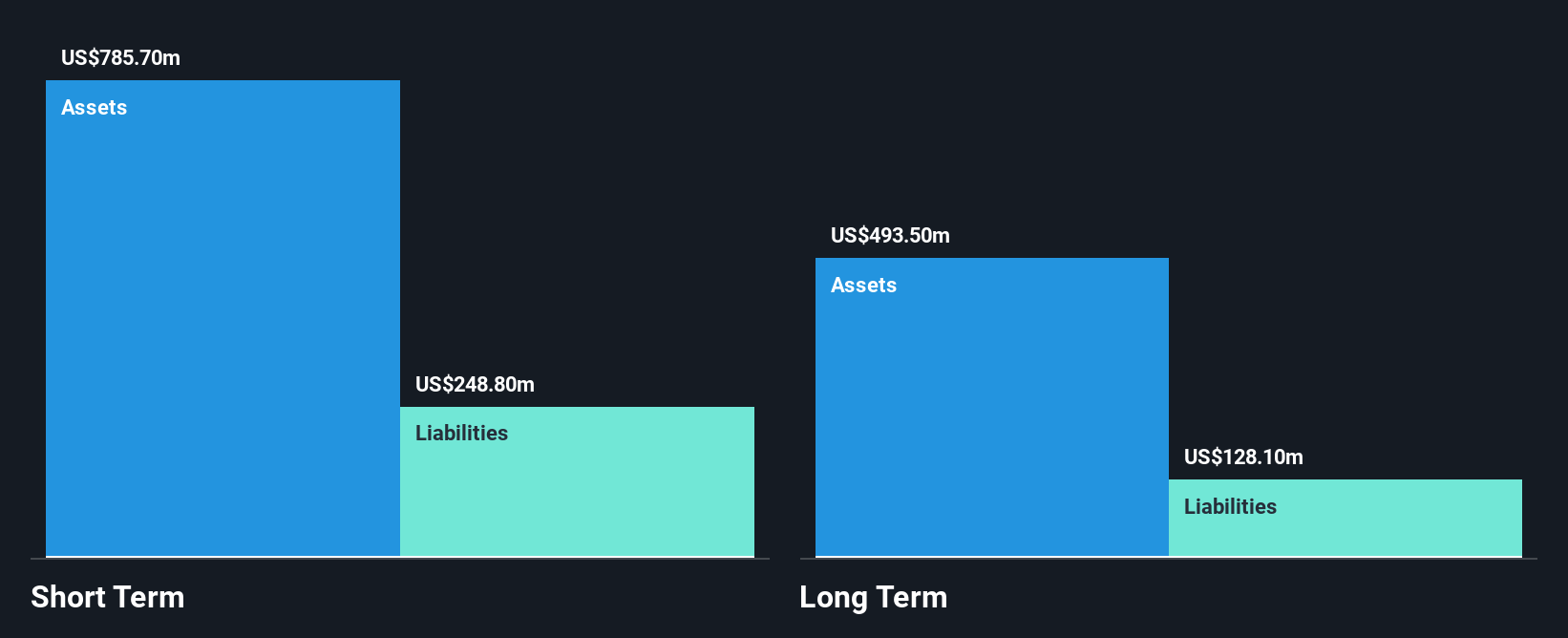

Diaceutics PLC, with a market cap of £114.89 million and annual revenue of £26.10 million, recently secured a significant $5.1 million contract with a global pharma customer, leveraging its DXRX platform to enhance oncology therapy outreach. Despite being unprofitable and experiencing increasing losses over the past five years, the company is debt-free and has strong short-term asset coverage for liabilities. Analysts anticipate an 83.52% annual earnings growth rate, indicating potential future improvement in financial performance despite current challenges such as an inexperienced board and management team with average tenures under two years.

- Navigate through the intricacies of Diaceutics with our comprehensive balance sheet health report here.

- Examine Diaceutics' earnings growth report to understand how analysts expect it to perform.

Hunting (LSE:HTG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hunting PLC, along with its subsidiaries, manufactures components, technology systems, and precision parts globally and has a market cap of £472.08 million.

Operations: The company generates revenue from several segments, including Hunting Titan with $247.6 million, Asia Pacific contributing $150.3 million, Subsea Technologies at $134.8 million, and Europe, Middle East and Africa (EMEA) providing $88.4 million.

Market Cap: £472.08M

Hunting PLC, with a market cap of £472.08 million, demonstrates strong financial health and growth potential. Its short-term assets ($667.1M) comfortably cover both short-term ($247.7M) and long-term liabilities ($39.0M), highlighting robust liquidity. The company has achieved significant earnings growth of 1285.4% over the past year, outpacing its five-year average of 35.7% per annum and the broader Energy Services industry growth rate of 16.6%. Despite an increase in debt to equity from 0.6% to 8.7%, debt remains well covered by operating cash flow (127%). However, its dividend track record is unstable, and future earnings are forecasted to decline by an average of 7.9% annually over the next three years according to consensus estimates.

- Click here to discover the nuances of Hunting with our detailed analytical financial health report.

- Assess Hunting's future earnings estimates with our detailed growth reports.

Symphony International Holdings (LSE:SIHL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Symphony International Holdings Limited is a private equity and venture capital firm that focuses on early-stage investments, management buy-outs and buy-ins, emerging growth, restructurings, special situations, and growth capital for later-stage development and expansion, with a market cap of $179.68 million.

Operations: Symphony International Holdings Limited does not report specific revenue segments.

Market Cap: $179.68M

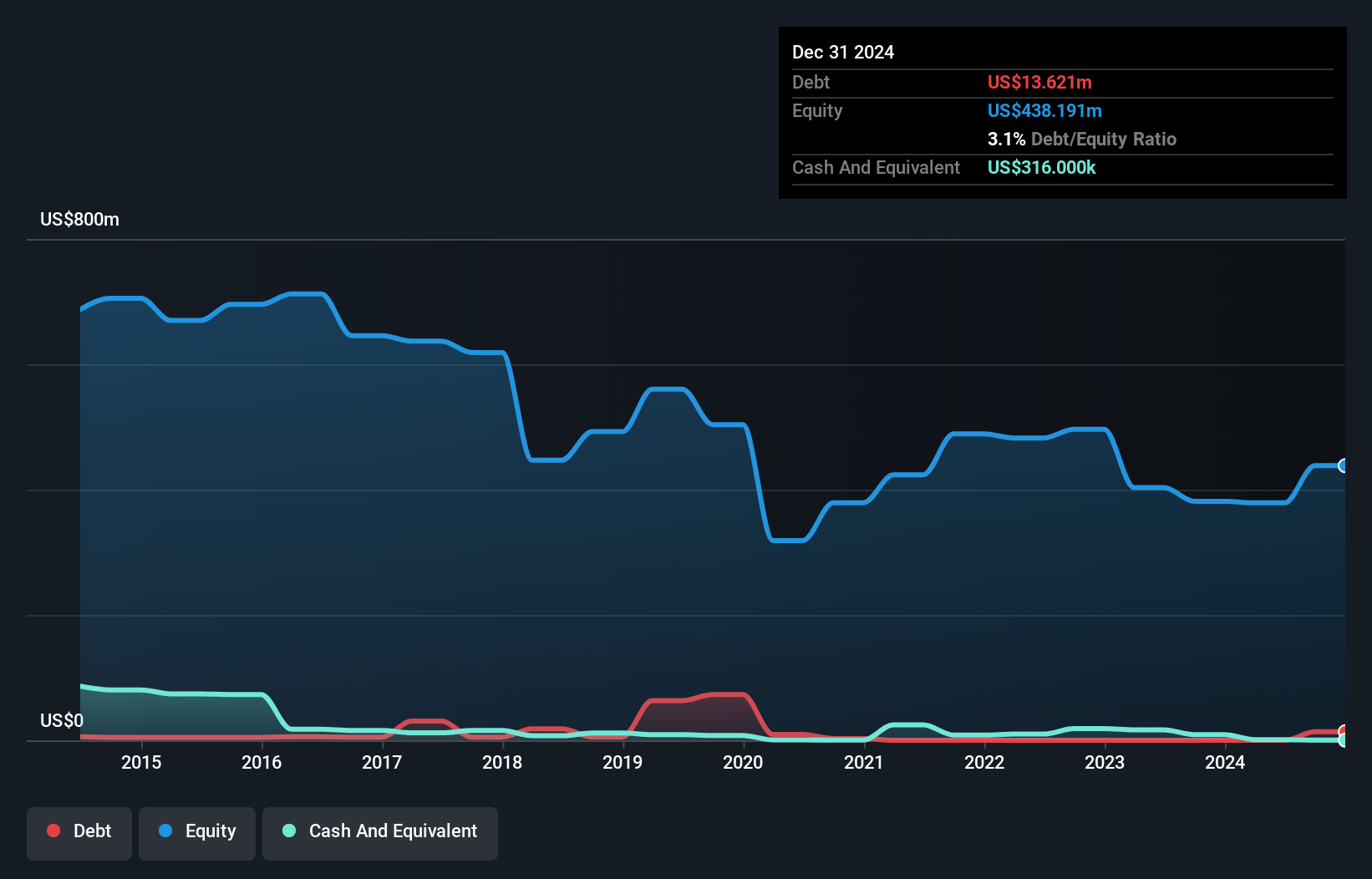

Symphony International Holdings Limited, with a market cap of US$179.68 million, is currently pre-revenue and unprofitable. The company operates debt-free and has no long-term liabilities, which reduces financial risk. However, its share price has been highly volatile recently, reflecting potential instability in investor sentiment. Despite offering a dividend yield of 6.33%, it is not well supported by earnings or cash flows due to ongoing losses that have increased by 6.8% annually over the past five years. The seasoned board of directors brings stability with an average tenure of 17.5 years, but challenges remain in achieving profitability and growth consistency.

- Unlock comprehensive insights into our analysis of Symphony International Holdings stock in this financial health report.

- Explore historical data to track Symphony International Holdings' performance over time in our past results report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 468 UK Penny Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:DXRX

Diaceutics

A diagnostic commercialisation company, provides data, data analytics, and implementation services for pharmaceutical companies worldwide.

Flawless balance sheet and good value.

Market Insights

Community Narratives