- United Kingdom

- /

- Metals and Mining

- /

- AIM:MTL

3 UK Penny Stocks With Market Caps Under £500M

Reviewed by Simply Wall St

The London stock market has recently experienced fluctuations, with the FTSE 100 index closing lower due to weak trade data from China, highlighting challenges in global economic recovery. Despite these broader market concerns, investors seeking opportunities might consider penny stocks, which often represent smaller or newer companies and can still offer surprising value. While the term "penny stocks" may seem outdated, these investments can present compelling opportunities when backed by strong financial health and balance sheet resilience.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.976 | £153.96M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.095 | £789.32M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

| Union Jack Oil (AIM:UJO) | £0.0875 | £9.32M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.87 | £384.89M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.46 | $267.41M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.495 | £318.8M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.135 | £96.97M | ★★★★★★ |

Click here to see the full list of 468 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Metals Exploration (AIM:MTL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metals Exploration plc is involved in the identification, acquisition, exploration, and development of mining and processing properties in the Philippines with a market cap of £96.78 million.

Operations: The company generates revenue of $168.22 million from its operations in gold and other precious metals.

Market Cap: £96.78M

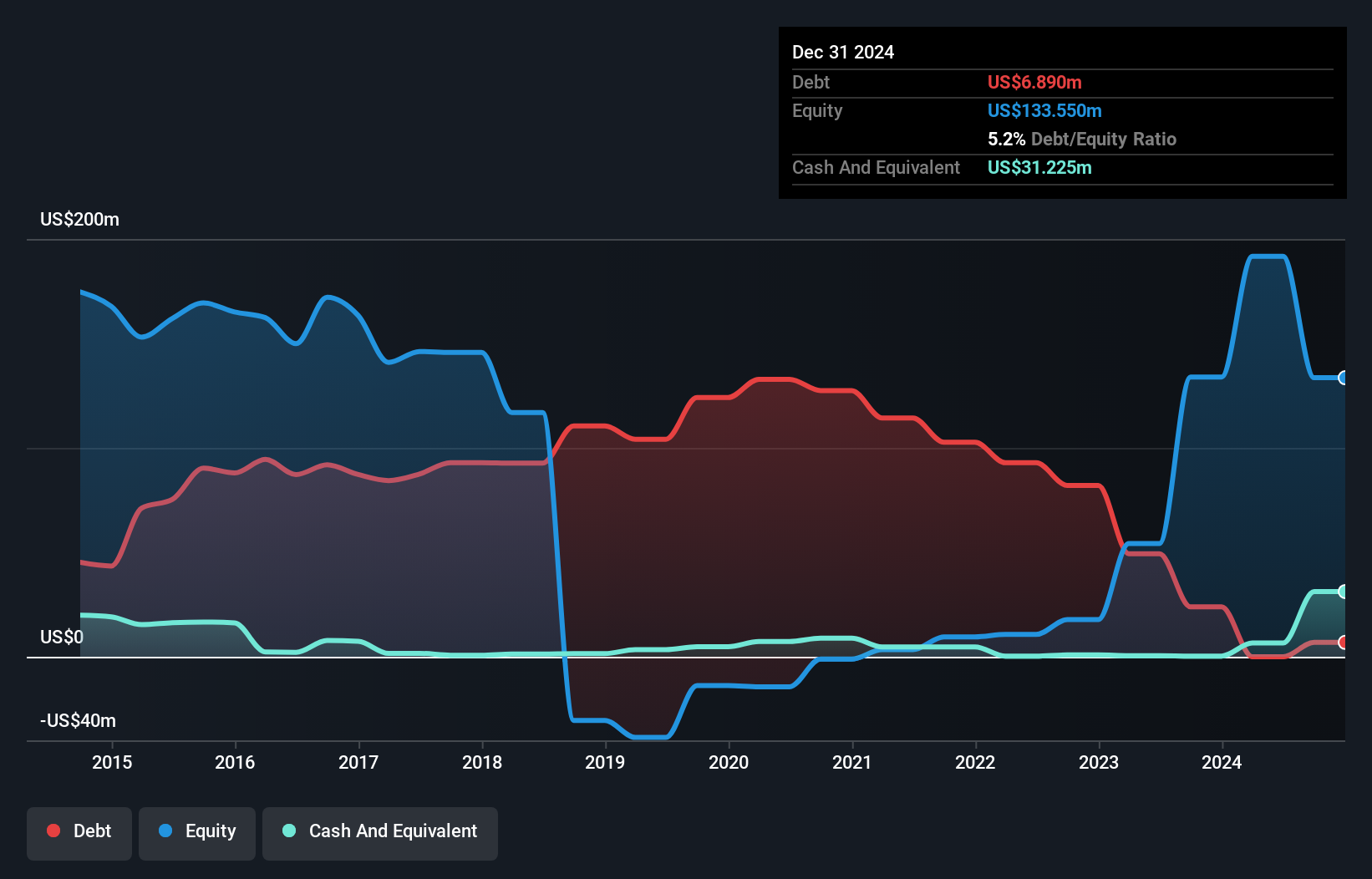

Metals Exploration plc, with a market cap of £96.78 million, has shown impressive earnings growth of 213.3% over the past year, significantly outpacing the industry average. The company is debt-free and maintains strong financial health with short-term assets ($37.3M) exceeding liabilities ($14M). Despite its high volatility and recent insider selling, Metals Exploration offers potential upside as it trades at 94.6% below estimated fair value. Recent production guidance suggests exceeding targets with forecasted gold production of 82,500 oz for fiscal year 2024, indicating robust operational performance amidst ongoing exploration activities in the Philippines.

- Click here to discover the nuances of Metals Exploration with our detailed analytical financial health report.

- Examine Metals Exploration's past performance report to understand how it has performed in prior years.

Supreme (AIM:SUP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Supreme Plc is a company that owns, manufactures, and distributes batteries, lighting, vaping products, sports nutrition and wellness items, and branded household consumer goods across the UK, Ireland, the Netherlands, France, rest of Europe, and internationally with a market cap of £212.23 million.

Operations: The company's revenue is primarily derived from its Vaping segment (£77.29 million), followed by Branded Household Consumer Goods (£67.25 million), Batteries (£42.00 million), Sports Nutrition & Wellness (£18.52 million), and Lighting (£17.13 million).

Market Cap: £212.23M

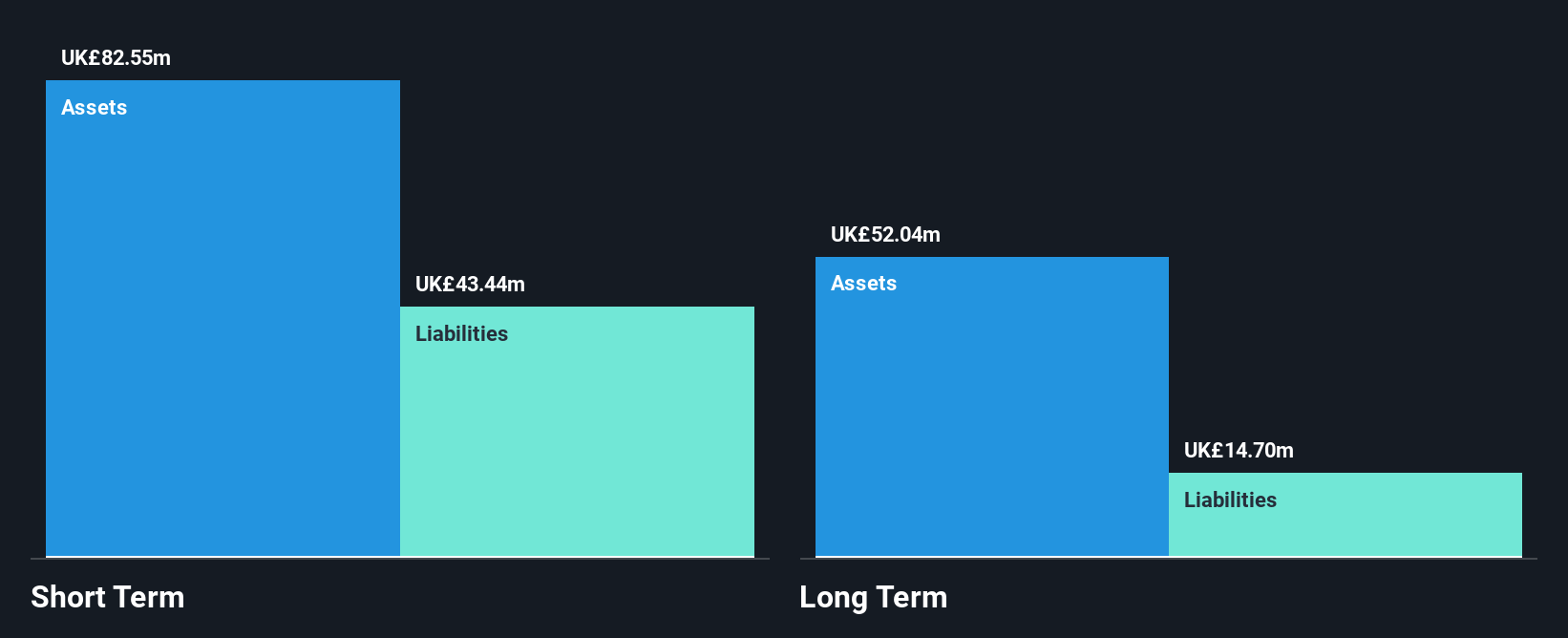

Supreme Plc, with a market cap of £212.23 million, demonstrates strong financial health and value potential as a penny stock. The company is debt-free, with short-term assets (£70.1M) exceeding both short-term (£38.2M) and long-term liabilities (£14.2M). Its Return on Equity is high at 36.5%, while its Price-to-Earnings ratio of 8.9x suggests it trades below the UK market average (15.9x). Despite recent insider selling and an unstable dividend track record, Supreme's earnings have grown significantly by 32.7% over the past year, surpassing industry averages and indicating robust operational performance amidst ongoing acquisition discussions with Typhoo Tea Limited.

- Navigate through the intricacies of Supreme with our comprehensive balance sheet health report here.

- Examine Supreme's earnings growth report to understand how analysts expect it to perform.

On the Beach Group (LSE:OTB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: On the Beach Group plc is an online retailer specializing in short haul beach holidays in the United Kingdom, with a market capitalization of £417.48 million.

Operations: The company's revenue is derived from two main segments: Classic Package Holidays, contributing £9 million, and its online platforms Onthebeach.Co.Uk and Sunshine.Co.Uk, generating £119.2 million.

Market Cap: £417.48M

On the Beach Group plc, with a market cap of £417.48 million, shows potential as a penny stock with its significant earnings growth of 90.6% over the past year, outpacing the hospitality industry. The company is debt-free and maintains strong financial health with short-term assets (£423.7M) covering both short-term (£310.9M) and long-term liabilities (£2.5M). Recent share buyback initiatives could enhance shareholder value, though high share price volatility remains a concern. Despite low Return on Equity at 11.1%, On the Beach's profit margins have improved significantly from last year, indicating operational efficiency improvements.

- Take a closer look at On the Beach Group's potential here in our financial health report.

- Assess On the Beach Group's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Reveal the 468 hidden gems among our UK Penny Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MTL

Metals Exploration

Metals Exploration plc identifies, acquires, explores for, and develops mining and processing properties in the United Kingdom and the Philippines.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives