- United Kingdom

- /

- Electrical

- /

- AIM:ITM

Discovering Opportunities: 3 UK Penny Stocks Under £4B Market Cap

Reviewed by Simply Wall St

The London stock market has recently faced challenges, with the FTSE 100 index slipping due to weak trade data from China, highlighting the interconnectedness of global economies. Amidst these broader market dynamics, investors often seek opportunities in smaller or newer companies that may offer growth potential at lower price points. Penny stocks, while an older term, still represent a viable investment area where strong financials and solid fundamentals can reveal hidden gems with promising prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.705 | £526.76M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.25 | £181.77M | ✅ 3 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 4 ⚠️ 3 View Analysis > |

| Ingenta (AIM:ING) | £0.70 | £10.57M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.60 | $348.8M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.88 | £295.83M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.175 | £114.17M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.215 | £193.43M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.75 | £10.33M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.48 | £75.56M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 291 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

ITM Power (AIM:ITM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ITM Power Plc designs and manufactures proton exchange membrane (PEM) electrolysers, operating in the United Kingdom, Germany, the rest of Europe, the United States, Australia, and internationally with a market cap of £392.65 million.

Operations: The company generates revenue of £26.04 million from its Electric Equipment segment.

Market Cap: £392.65M

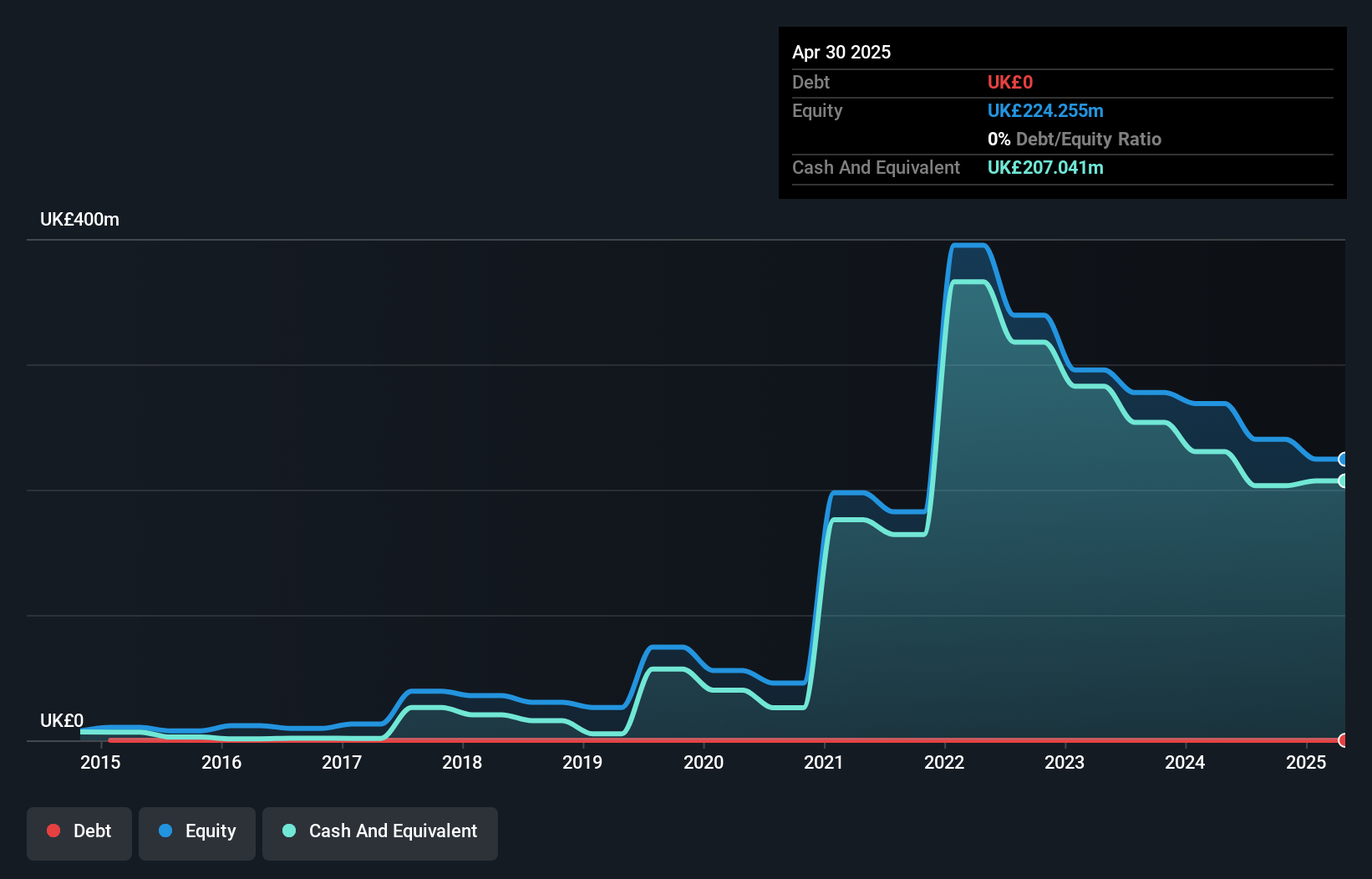

ITM Power, while currently unprofitable and experiencing increased losses over the past five years, is positioned for significant revenue growth, with forecasts suggesting a 42.33% annual increase. The company recently projected a 50% year-on-year revenue rise for fiscal 2026, driven by its contracted order backlog. ITM's strategic partnerships and supply agreements, such as the West Wales Hydrogen project and Hydropulse GmbH in Germany, highlight its expanding footprint in green hydrogen solutions. Despite high share price volatility and negative return on equity (-20.3%), ITM remains debt-free with sufficient cash runway exceeding three years.

- Navigate through the intricacies of ITM Power with our comprehensive balance sheet health report here.

- Evaluate ITM Power's prospects by accessing our earnings growth report.

AO World (LSE:AO.)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AO World plc, with a market cap of £537.63 million, operates as an online retailer specializing in domestic appliances and ancillary services in the United Kingdom and Germany.

Operations: The company generates revenue of £1.14 billion from its online retailing of domestic appliances and ancillary services.

Market Cap: £537.63M

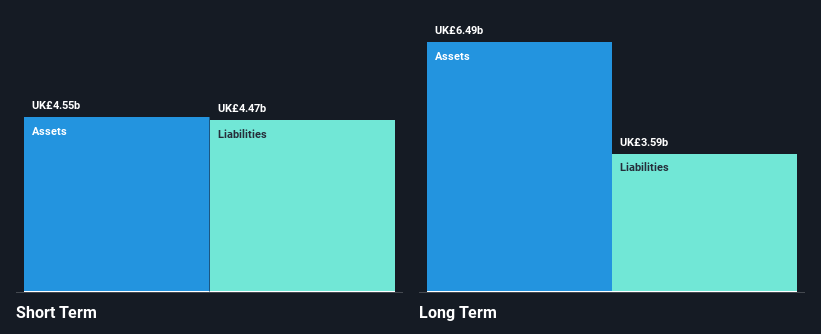

AO World plc, with a market cap of £537.63 million and revenue of £1.14 billion, has shown mixed financial performance recently. The company reported a decline in net income to £10.5 million from the previous year's £24.7 million, impacted by a significant one-off loss of £22.9 million. While its return on equity is low at 6.7%, AO has successfully reduced its debt-to-equity ratio over five years and maintains more cash than total debt, with interest payments well covered by EBIT (16.9x). Recent board changes aim to strengthen governance as part of succession planning efforts.

- Unlock comprehensive insights into our analysis of AO World stock in this financial health report.

- Review our growth performance report to gain insights into AO World's future.

easyJet (LSE:EZJ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: easyJet plc is a low-cost airline carrier operating in Europe with a market capitalization of approximately £3.55 billion.

Operations: The company generates revenue through its Airline segment, which accounts for £8.35 billion, and its Holidays segment, contributing £1.64 billion.

Market Cap: £3.55B

easyJet plc, with a market cap of £3.55 billion, has demonstrated financial resilience despite challenges in the airline sector. The company’s earnings have grown significantly by 56.8% annually over five years, though recent growth has slowed to 10.2%. Its price-to-earnings ratio of 8.6x suggests it is undervalued compared to the broader UK market average of 16.4x. While debt levels have increased, they are well covered by operating cash flow and exceed short-term assets (£5B) but not liabilities (£5.5B). Management tenure averages only 0.7 years, indicating a relatively new team steering the company forward amidst industry volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of easyJet.

- Gain insights into easyJet's future direction by reviewing our growth report.

Summing It All Up

- Dive into all 291 of the UK Penny Stocks we have identified here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ITM

ITM Power

Designs and manufactures proton exchange membrane (PEM) electrolysers in the United Kingdom, Germany, rest of Europe, the United States, Australia, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives