- United Kingdom

- /

- Real Estate

- /

- LSE:LSL

3 UK Penny Stocks With Market Caps Under £300M To Watch

Reviewed by Simply Wall St

The UK stock market has recently been influenced by weak trade data from China, causing the FTSE 100 and FTSE 250 indices to close lower. Despite these broader market challenges, penny stocks—though a somewhat outdated term—remain an intriguing investment area for those seeking growth opportunities in smaller or newer companies. When supported by strong financial health, these stocks can offer a mix of affordability and potential returns that larger firms might not provide.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.725 | £177.65M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.20 | £828.88M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.51M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.415 | £439.1M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.13 | £96.44M | ★★★★★★ |

| Solid State (AIM:SOLI) | £1.225 | £69.88M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.298 | £200.19M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.365 | £173.84M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.43 | $249.97M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.04 | £78.76M | ★★★★★★ |

Click here to see the full list of 469 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Liontrust Asset Management (LSE:LIO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liontrust Asset Management Plc is a publicly owned investment manager with a market cap of £292.38 million.

Operations: The company generates revenue of £180.38 million from its investment management segment.

Market Cap: £292.38M

Liontrust Asset Management, with a market cap of £292.38 million, has been trading at 53.9% below its estimated fair value, indicating potential undervaluation for investors interested in penny stocks. The company reported a significant turnaround with net income of £8.74 million for the half-year ended September 2024, compared to a net loss previously. Despite past earnings decline and low return on equity (9.8%), Liontrust remains debt-free and has commenced share buybacks authorized up to 10% of its capital, potentially enhancing shareholder value amidst stable weekly volatility and seasoned management oversight.

- Click here and access our complete financial health analysis report to understand the dynamics of Liontrust Asset Management.

- Evaluate Liontrust Asset Management's prospects by accessing our earnings growth report.

LSL Property Services (LSE:LSL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LSL Property Services plc operates in the United Kingdom, offering business-to-business services to mortgage intermediaries and estate agency franchisees, as well as valuation services to lenders, with a market cap of £275.69 million.

Operations: The company's revenue is derived from three main segments: Financial Services (£47.22 million), Surveying and Valuation (£79.49 million), and Estate Agency (£30.61 million).

Market Cap: £275.69M

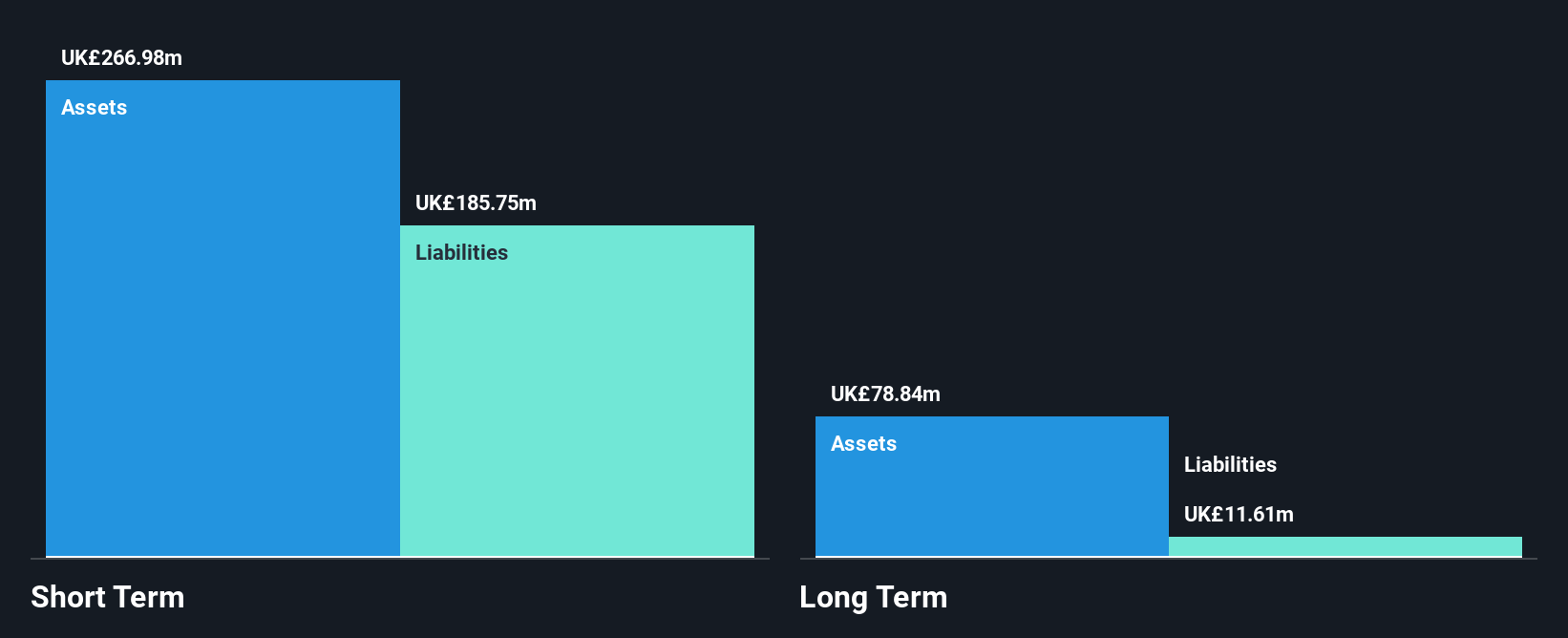

LSL Property Services, with a market cap of £275.69 million, has shown a significant financial improvement by becoming profitable this year, reporting net income of £9.95 million for the half-year ended June 2024 compared to a net loss previously. The company maintains more cash than total debt and its short-term assets exceed both short and long-term liabilities, indicating sound liquidity management. Despite earnings being impacted by a large one-off loss of £9.1 million, LSL's shares have not been meaningfully diluted over the past year and it trades significantly below estimated fair value, suggesting potential undervaluation for investors interested in penny stocks.

- Navigate through the intricacies of LSL Property Services with our comprehensive balance sheet health report here.

- Gain insights into LSL Property Services' future direction by reviewing our growth report.

Xaar (LSE:XAR)

Simply Wall St Financial Health Rating: ★★★★☆☆

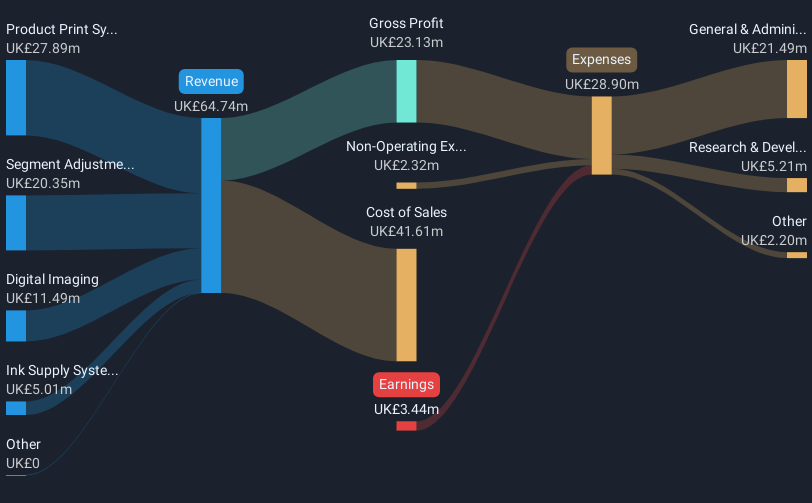

Overview: Xaar plc designs, develops, manufactures, markets, and sells industrial printheads and print systems across Europe, the Middle East, Africa, Asia, and the Americas with a market cap of £60.17 million.

Operations: The company's revenue is derived from Digital Imaging (£11.49 million), Ink Supply Systems (£5.01 million), and Product Print Systems (£27.89 million).

Market Cap: £60.17M

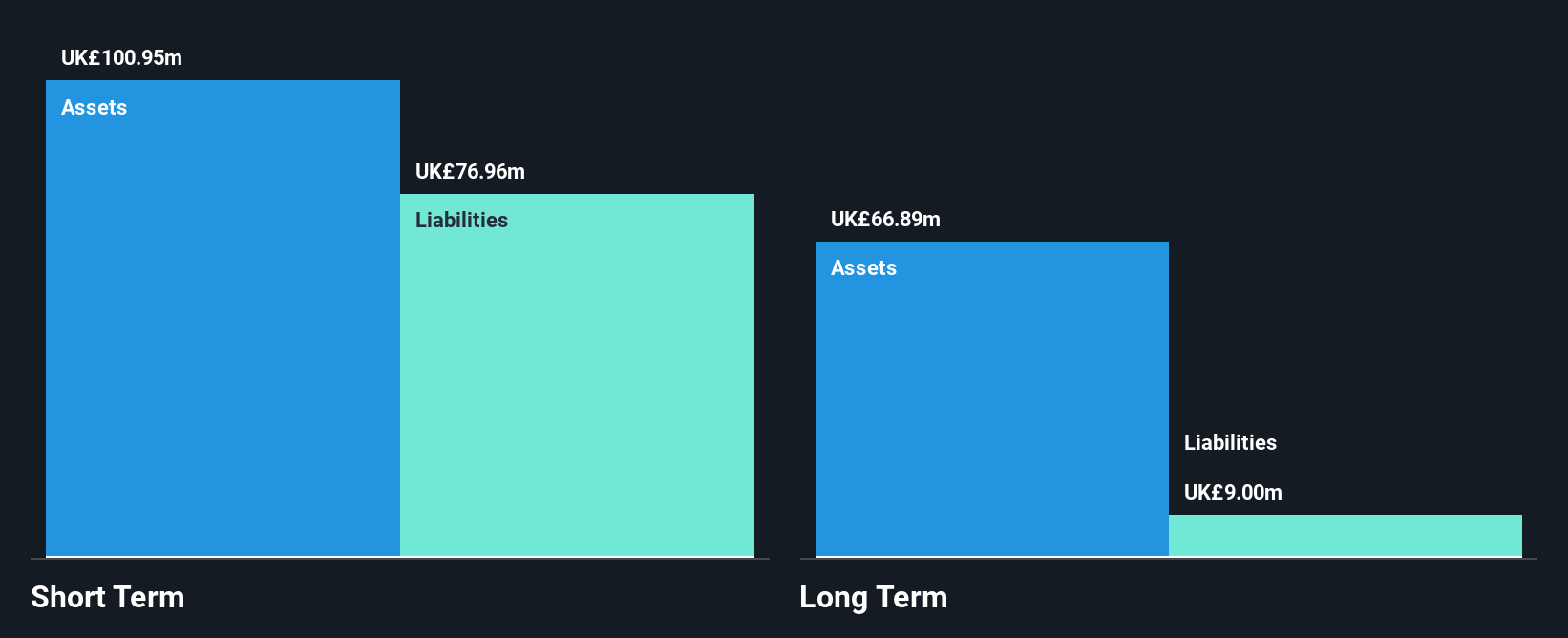

Xaar plc, with a market cap of £60.17 million, faces challenges as it remains unprofitable despite reducing losses by 38.9% annually over five years. Recent executive changes include the appointment of Paul James as Executive Director and Interim CFO, bringing extensive financial experience to the company. Xaar's short-term assets (£50.7M) comfortably cover both short and long-term liabilities (£18.7M and £6.7M respectively), indicating strong liquidity management despite its negative return on equity (-4.91%). Trading at 15.6% below estimated fair value, Xaar presents potential interest for investors seeking undervalued penny stocks in the UK market.

- Get an in-depth perspective on Xaar's performance by reading our balance sheet health report here.

- Examine Xaar's earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Unlock our comprehensive list of 469 UK Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LSL

LSL Property Services

Engages in the provision of business-to-business services to mortgage intermediaries and estate agency franchisees, and valuation services to lenders in the United Kingdom.

Flawless balance sheet with high growth potential.