- United Kingdom

- /

- Commercial Services

- /

- AIM:SFT

3 UK Penny Stocks With Market Caps Over £70M To Watch

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Amidst these broader market fluctuations, investors may find opportunities in smaller companies that offer unique growth potential and value. Penny stocks, despite their somewhat outdated label, can still be relevant investment options when they are backed by strong financials and a clear growth trajectory.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.115 | £796.96M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £152.06M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

| Union Jack Oil (AIM:UJO) | £0.09 | £9.59M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £452.53M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.288 | £198.65M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.685 | £366.5M | ★★★★☆☆ |

| Impax Asset Management Group (AIM:IPX) | £2.515 | £321.35M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.1125 | £95.05M | ★★★★★★ |

Click here to see the full list of 467 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Michelmersh Brick Holdings (AIM:MBH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Michelmersh Brick Holdings plc, along with its subsidiaries, manufactures and sells bricks and brick prefabricated products in the United Kingdom and Europe, with a market cap of £93.06 million.

Operations: The company's revenue is primarily derived from its Building Products segment, totaling £70.69 million.

Market Cap: £93.06M

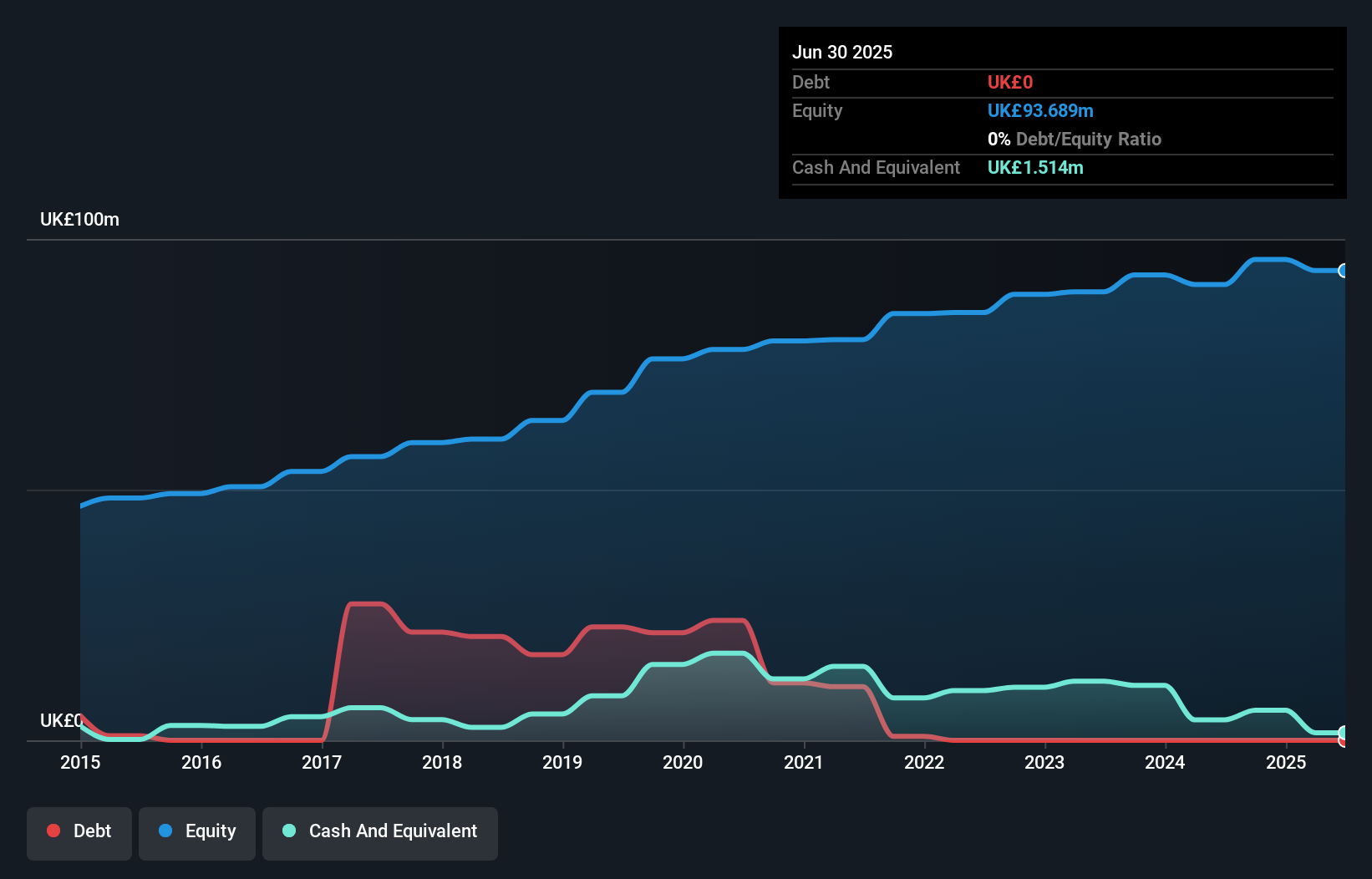

Michelmersh Brick Holdings, with a market cap of £93.06 million, operates debt-free and maintains high-quality earnings despite recent negative growth. The company trades at 38.4% below its estimated fair value and analysts agree on potential price appreciation by 50.5%. However, its dividend yield of 4.58% is not well covered by free cash flows, indicating potential sustainability issues. Recent executive changes include Ryan Mahoney succeeding Peter Sharp as CEO in 2025, ensuring continuity in strategic execution given Mahoney's experience as CFO since 2021. Michelmersh's board is experienced with an average tenure of 4.4 years.

- Unlock comprehensive insights into our analysis of Michelmersh Brick Holdings stock in this financial health report.

- Assess Michelmersh Brick Holdings' future earnings estimates with our detailed growth reports.

Software Circle (AIM:SFT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Software Circle plc, along with its subsidiaries, licenses various software products in the United Kingdom, Ireland, Europe, and internationally with a market cap of £91.28 million.

Operations: The company's revenue is primarily derived from its Graphics & Ecommerce segment (£9.53 million), followed by contributions from Health & Social Care (£2.89 million), Professional & Financial Services (£2.09 million), and Property (£1.58 million).

Market Cap: £91.28M

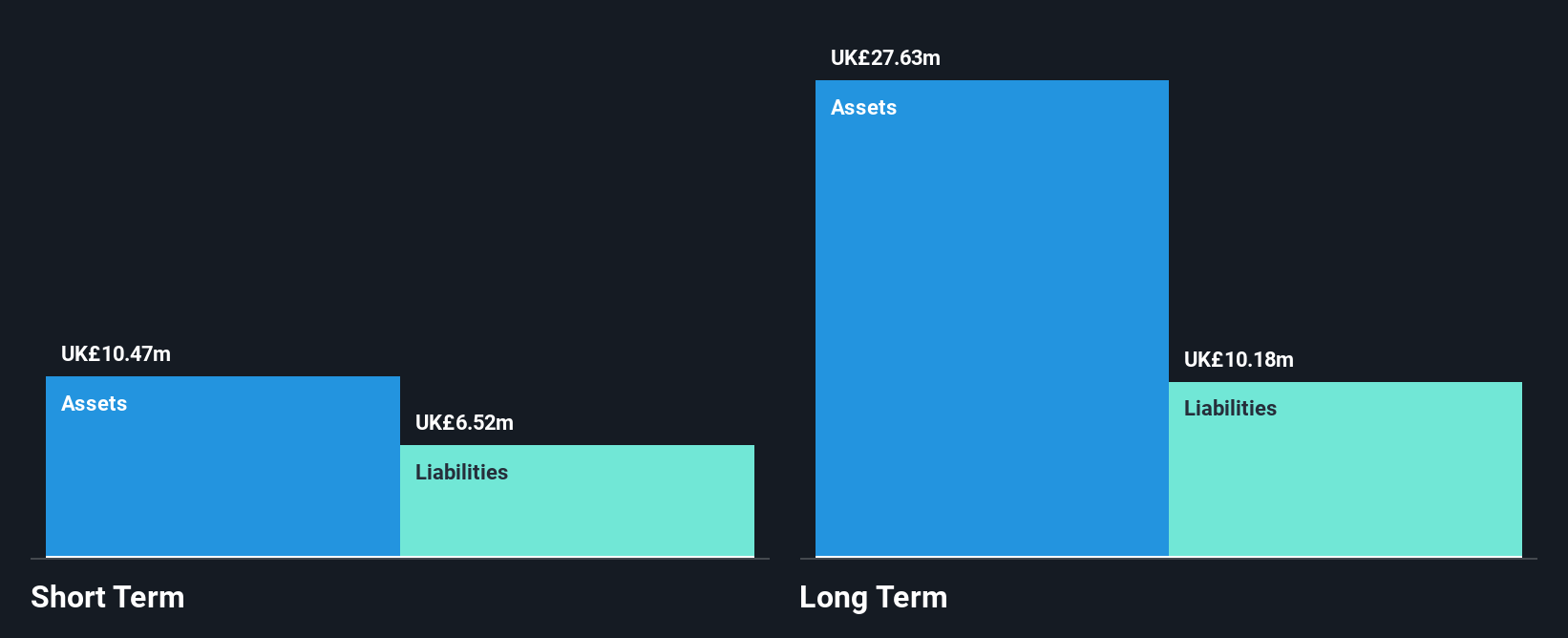

Software Circle plc, with a market cap of £91.28 million, has transitioned to profitability, reporting sales of £8.92 million for the half year ending September 30, 2024. The company's revenue is driven by its Graphics & Ecommerce segment (£9.53 million), though recent earnings were significantly impacted by a one-off gain of £2 million. Despite a low return on equity at 2%, Software Circle's financial health remains solid with more cash than total debt and short-term assets exceeding liabilities (£15.3M vs £12.4M). Trading at 30.2% below estimated fair value suggests potential investment appeal amidst stable weekly volatility (3%).

- Click here and access our complete financial health analysis report to understand the dynamics of Software Circle.

- Gain insights into Software Circle's historical outcomes by reviewing our past performance report.

Water Intelligence (AIM:WATR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Water Intelligence plc, with a market cap of £72.10 million, offers leak detection and remediation services for both potable and non-potable water across the United States, the United Kingdom, Australia, Canada, and internationally.

Operations: The company's revenue is derived from Franchise Royalty Income ($6.66 million), Franchise Related Activities ($10.83 million), US Corporate Operated Locations ($53.53 million), and International Corporate Operated Locations ($7.80 million).

Market Cap: £72.1M

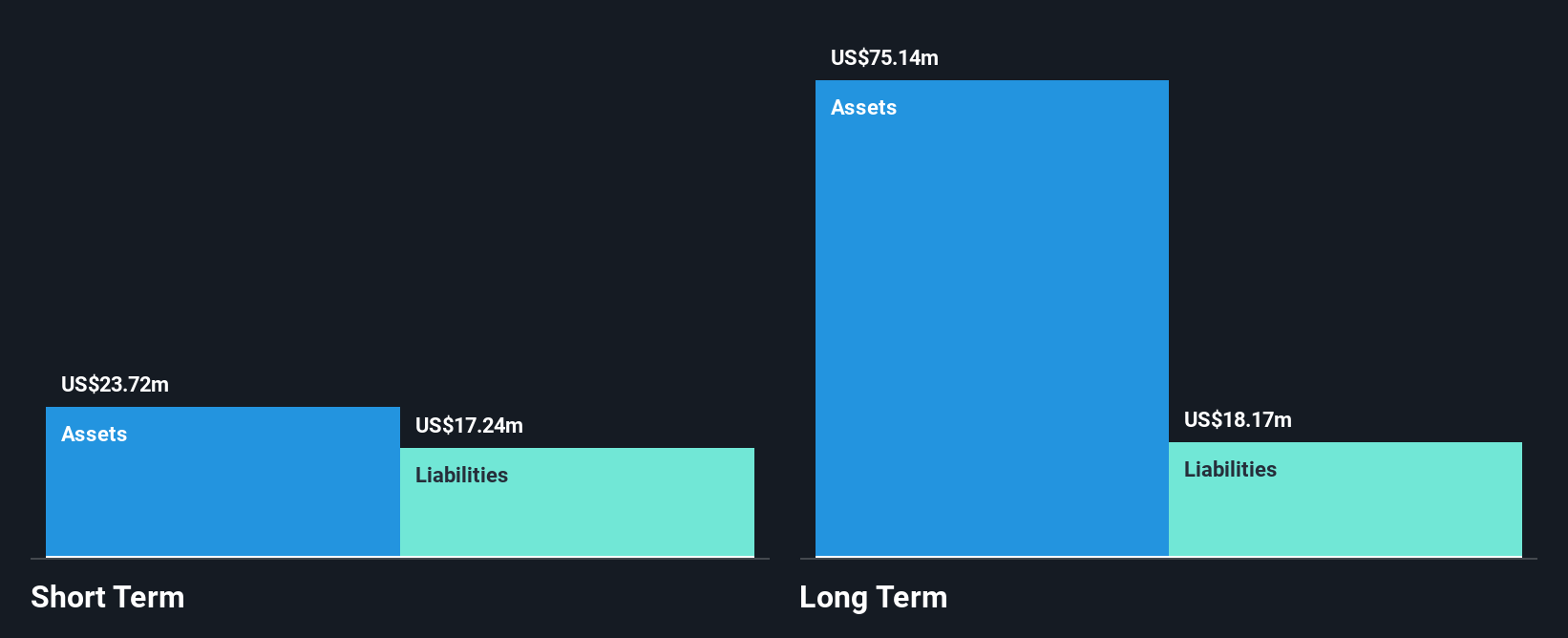

Water Intelligence plc, with a market cap of £72.10 million, demonstrates financial stability through robust cash flow covering its debt and short-term assets exceeding liabilities. The company is trading at 58.1% below its estimated fair value, indicating potential undervaluation. Earnings have grown consistently by 15.9% annually over the past five years, with recent growth accelerating to 20.7%. While Return on Equity remains low at 7.8%, interest payments are well-covered by EBIT (8x). Recent share buybacks may enhance shareholder value as the company repurchases up to 10% of its issued capital under a new mandate.

- Take a closer look at Water Intelligence's potential here in our financial health report.

- Evaluate Water Intelligence's prospects by accessing our earnings growth report.

Taking Advantage

- Unlock more gems! Our UK Penny Stocks screener has unearthed 464 more companies for you to explore.Click here to unveil our expertly curated list of 467 UK Penny Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SFT

Software Circle

Engages in the licensing of various software in the United Kingdom, Ireland, Europe, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives