- United Kingdom

- /

- Media

- /

- AIM:SAA

Discover M&C Saatchi And Two Other Promising Penny Stocks On The UK Exchange

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China, which has affected global markets and highlighted the interconnectedness of major economies. Despite such fluctuations in larger indices, smaller stocks often present unique opportunities for investors willing to explore beyond the blue-chip realm. The term "penny stocks" might seem outdated, yet it continues to signify smaller or newer companies that can offer affordable entry points and growth potential when backed by solid financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.115 | £796.96M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £152.06M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

| Union Jack Oil (AIM:UJO) | £0.09 | £9.59M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £452.53M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.288 | £198.65M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.685 | £366.5M | ★★★★☆☆ |

| Impax Asset Management Group (AIM:IPX) | £2.515 | £321.35M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.1125 | £95.05M | ★★★★★★ |

Click here to see the full list of 467 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

M&C Saatchi (AIM:SAA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: M&C Saatchi plc offers advertising and marketing communications services across the UK, Europe, the Middle East, Africa, Asia Pacific, and the Americas with a market cap of £215.17 million.

Operations: M&C Saatchi generates its revenue through advertising and marketing communications services across various regions including the UK, Europe, the Middle East, Africa, Asia Pacific, and the Americas.

Market Cap: £215.17M

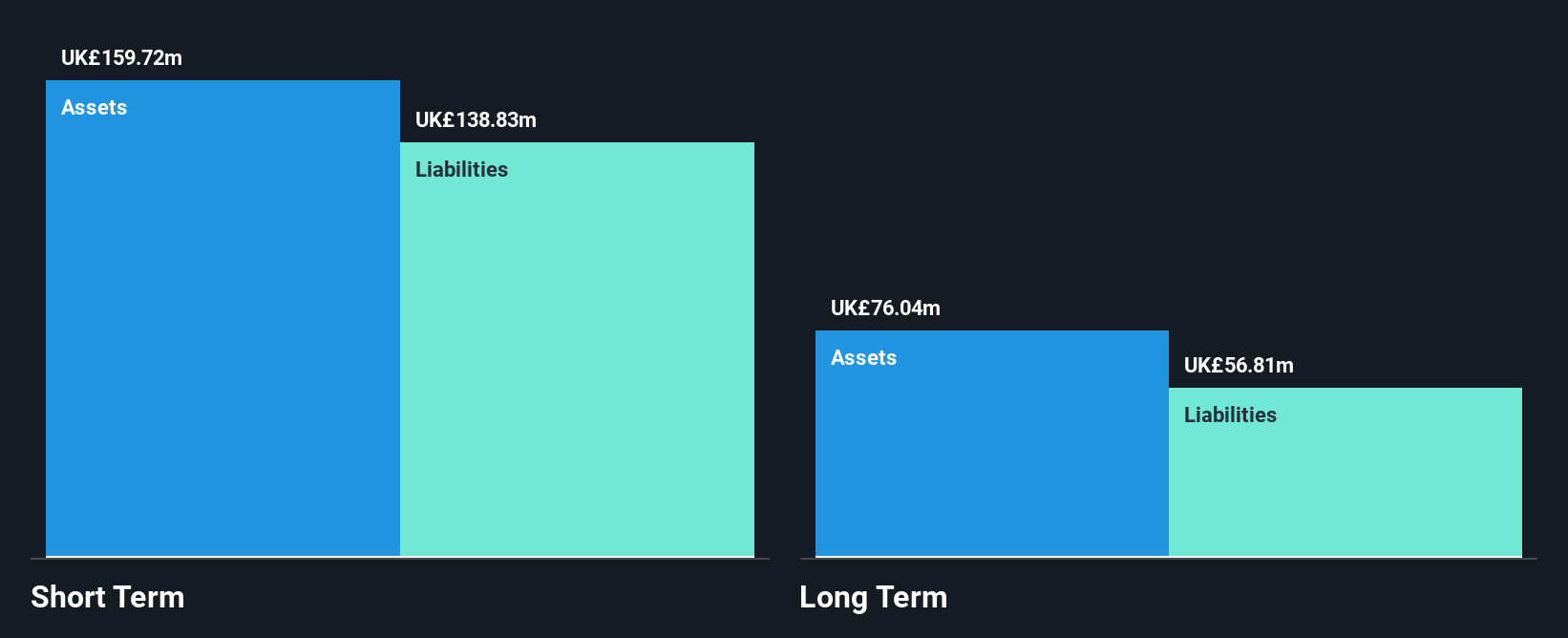

M&C Saatchi has shown resilience with a market cap of £215.17 million, becoming profitable over the past year despite a significant one-off loss of £17.3 million impacting recent results. The company’s short-term assets exceed both its short and long-term liabilities, indicating solid financial health. While the board is relatively new with an average tenure of 1.3 years, the management team is seasoned with 2.4 years on average, supporting stability in leadership transitions such as Nadja Bellan-White's appointment as CEO for North America to drive regional growth and integration efforts across various agencies under its umbrella.

- Navigate through the intricacies of M&C Saatchi with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into M&C Saatchi's future.

Vertu Motors (AIM:VTU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vertu Motors plc is an automotive retailer based in the United Kingdom with a market cap of £196.20 million.

Operations: The company generates revenue of £4.79 billion from its Retail - Gasoline & Auto Dealers segment.

Market Cap: £196.2M

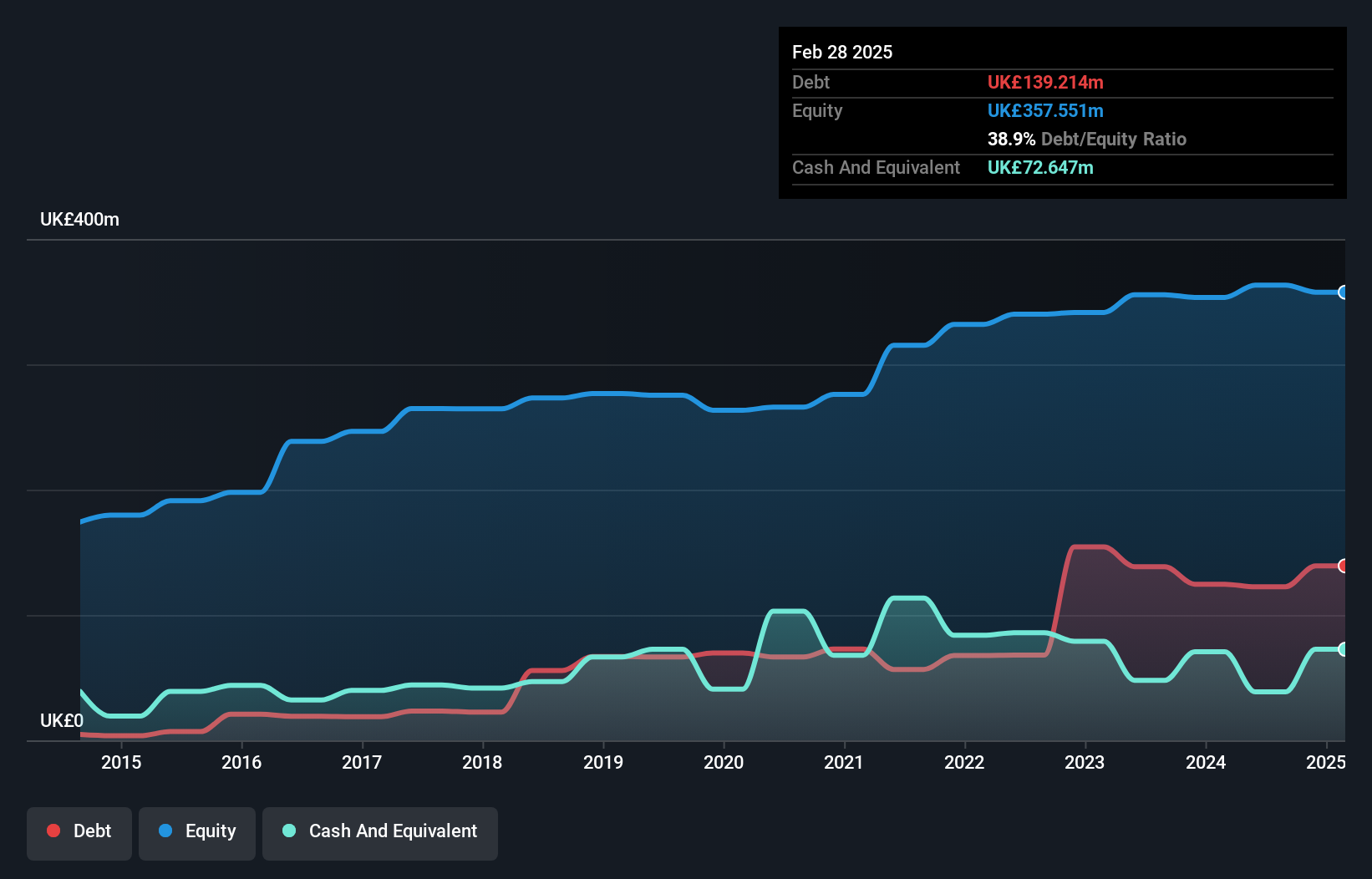

Vertu Motors, with a market cap of £196.20 million, has faced challenges recently, including a large one-off loss of £66.2 million impacting its financial results to August 2024. Despite this, the company maintains strong short-term asset coverage over liabilities and satisfactory debt levels with net debt to equity at 23.1%. The board and management team are experienced, averaging tenures of over six years each. Recent strategic moves include share buybacks funded by existing cash resources and the appointment of Amanda Jane Cox as an independent Non-Executive Director to strengthen governance amid fluctuating earnings growth trends.

- Click to explore a detailed breakdown of our findings in Vertu Motors' financial health report.

- Gain insights into Vertu Motors' future direction by reviewing our growth report.

Liontrust Asset Management (LSE:LIO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liontrust Asset Management Plc is a publicly owned investment manager with a market cap of £299.33 million, focusing on managing funds across various asset classes.

Operations: The company generates revenue of £180.38 million from its investment management segment.

Market Cap: £299.33M

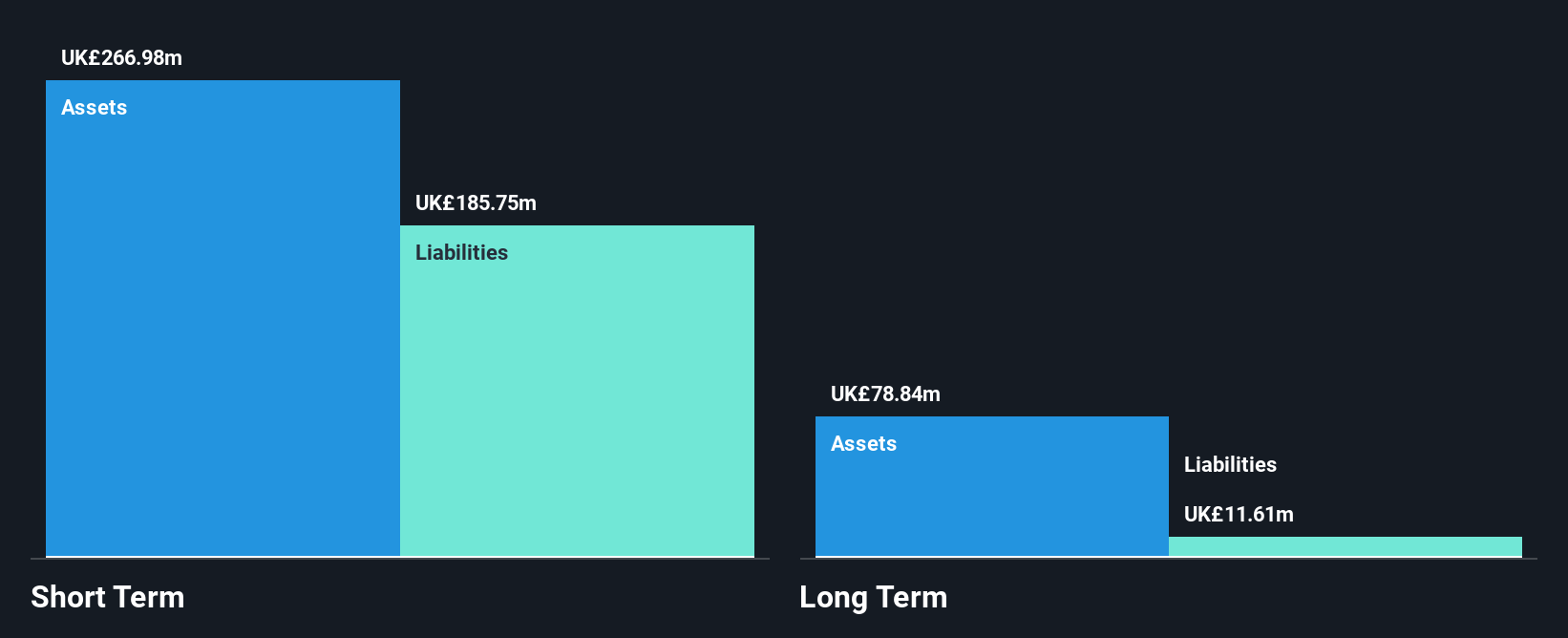

Liontrust Asset Management, with a market cap of £299.33 million, has seen mixed financial performance recently. The company reported sales of £87.04 million for the half year ending September 2024, down from £104.55 million the previous year, but it turned a net loss into an income of £8.74 million. Despite positive earnings growth forecasts and no debt obligations, challenges remain with low return on equity and a dividend yield that is not well covered by earnings or free cash flow. The recent share buyback program reflects strategic efforts to enhance shareholder value amid fluctuating profit margins and volatility concerns.

- Click here to discover the nuances of Liontrust Asset Management with our detailed analytical financial health report.

- Gain insights into Liontrust Asset Management's outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Investigate our full lineup of 467 UK Penny Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SAA

M&C Saatchi

Provides advertising and marketing communications services in the United Kingdom, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives