- United Kingdom

- /

- Building

- /

- LSE:NXR

Top UK Dividend Stocks Featuring HSBC Holdings And Two Others

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China, highlighting the interconnectedness of global markets and the impact of international economic conditions on domestic indices. Amidst this backdrop, dividend stocks present an attractive option for investors seeking steady income streams, as they can offer stability and potential returns despite broader market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.75% | ★★★★★★ |

| 4imprint Group (LSE:FOUR) | 3.11% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.73% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.14% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.28% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.58% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.28% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.90% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.74% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.55% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top UK Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

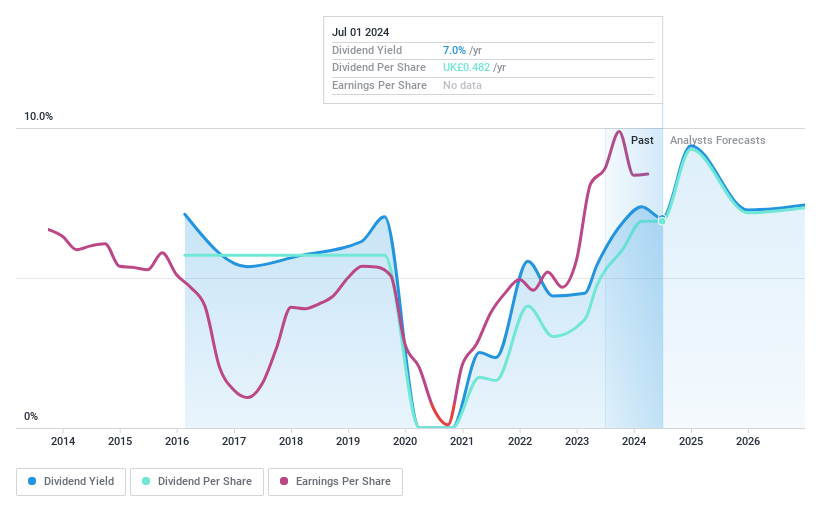

HSBC Holdings (LSE:HSBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HSBC Holdings plc is a global provider of banking and financial services, with a market capitalization of approximately £121.59 billion.

Operations: HSBC Holdings plc generates its revenue from several key segments, including Commercial Banking ($15.43 billion), Global Banking and Markets ($16.16 billion), and Wealth and Personal Banking ($40.10 billion).

Dividend Yield: 6.9%

HSBC Holdings' dividend yield is in the top 25% of UK payers, yet its nine-year dividend history shows volatility with a high bad loans ratio of 2.2%. The payout is covered by earnings, maintaining a reasonable payout ratio forecast to remain stable. Recent executive changes include Pam Kaur's appointment as CFO, potentially impacting strategic direction. Despite trading below estimated fair value, the unstable dividend track record poses concerns for long-term reliability.

- Unlock comprehensive insights into our analysis of HSBC Holdings stock in this dividend report.

- The analysis detailed in our HSBC Holdings valuation report hints at an deflated share price compared to its estimated value.

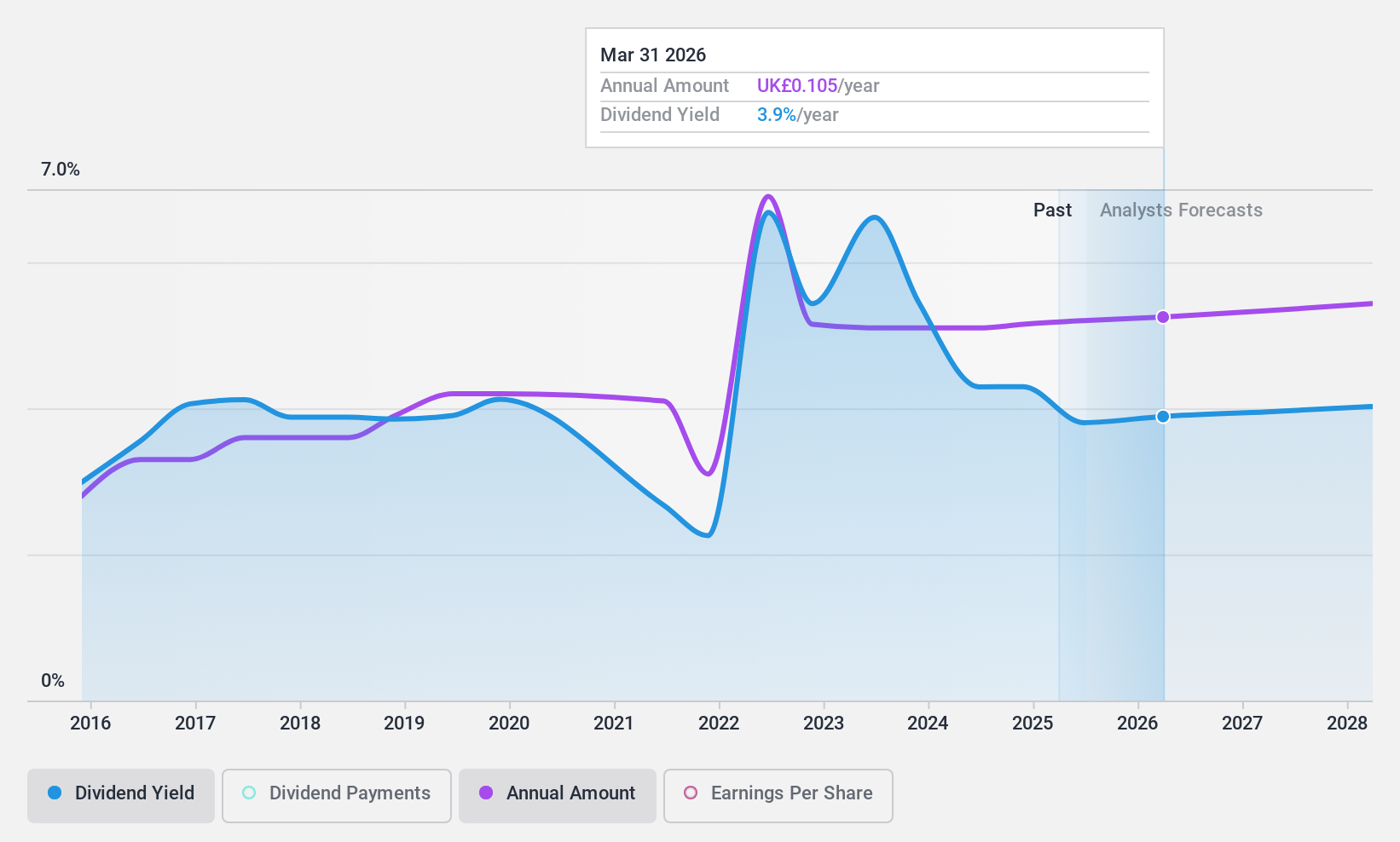

Norcros (LSE:NXR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Norcros plc, with a market cap of £231.65 million, develops, manufactures, and markets bathroom and kitchen products in the United Kingdom, Ireland, and South Africa.

Operations: Norcros plc generates revenue of £392.10 million from its Building Products segment, which encompasses the development and marketing of bathroom and kitchen products across the United Kingdom, Ireland, and South Africa.

Dividend Yield: 4%

Norcros offers a mixed dividend profile, with recent affirmations of a 6.8 pence per share dividend despite past volatility. The payout is well-covered by earnings and cash flows, with a low payout ratio of 33.9%. However, its yield of 3.95% lags behind top UK payers. Recent guidance indicates stable revenue but lower profits due to strategic exits like Johnson Tiles UK, impacting short-term financials while maintaining long-term market confidence.

- Click here to discover the nuances of Norcros with our detailed analytical dividend report.

- Our valuation report here indicates Norcros may be undervalued.

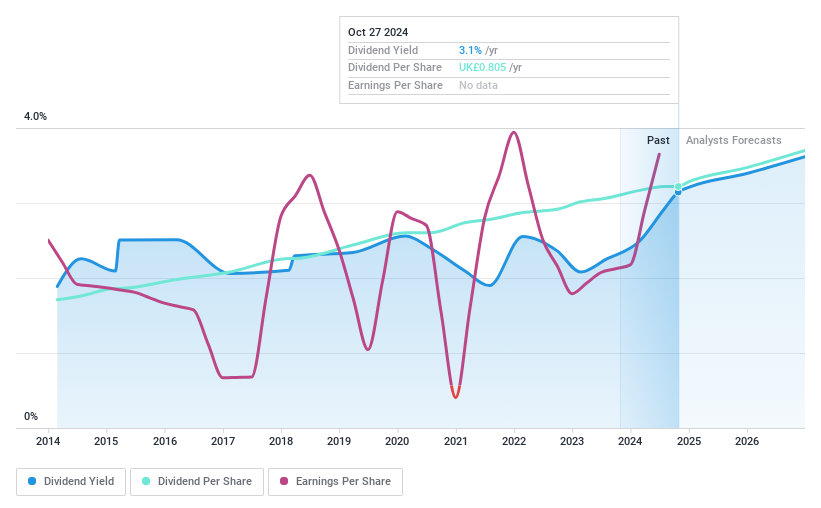

Spectris (LSE:SXS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Spectris plc is a company that offers precision measurement solutions globally, with a market cap of £2.50 billion.

Operations: Spectris plc generates revenue through its key segments: Spectris Dynamics (£527.70 million) and Spectris Scientific (£643.10 million).

Dividend Yield: 3.2%

Spectris offers a stable dividend profile, recently increasing its interim dividend to 26.6 pence per share. Despite a relatively modest yield of 3.18%, the dividends are well-covered by earnings and cash flows, with payout ratios of 29.9% and 67.4% respectively, ensuring sustainability. Earnings surged significantly over the past year, although future growth is uncertain with forecasts indicating potential declines. Recent board changes and strategic buybacks reflect ongoing corporate adjustments amidst these financial dynamics.

- Navigate through the intricacies of Spectris with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Spectris' share price might be too pessimistic.

Summing It All Up

- Unlock more gems! Our Top UK Dividend Stocks screener has unearthed 59 more companies for you to explore.Click here to unveil our expertly curated list of 62 Top UK Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Norcros, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Norcros might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:NXR

Norcros

Develops, manufactures, and markets bathroom and kitchen products in the United Kingdom, Ireland, and South Africa.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives