- United Kingdom

- /

- Consumer Finance

- /

- LSE:FCH

Discover UK Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting concerns over global economic recovery. In such a climate, investors often seek opportunities in smaller or newer companies that can offer value and growth potential. Penny stocks, though an outdated term, remain relevant for those looking to uncover hidden value in companies with strong financials and promising prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.615 | £516.68M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.25 | £181.77M | ✅ 3 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.37 | £40.03M | ✅ 4 ⚠️ 3 View Analysis > |

| Ingenta (AIM:ING) | £0.675 | £10.19M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.57 | $331.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.44 | £123.7M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.22 | £194.23M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.75 | £10.33M | ✅ 3 ⚠️ 4 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.65 | £267.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.46 | £74.95M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 291 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Solid State (AIM:SOLI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Solid State plc, along with its subsidiaries, engages in the design, manufacture, distribution and supply of electronic equipment across the UK, Europe, Asia, North America and internationally with a market cap of £96.48 million.

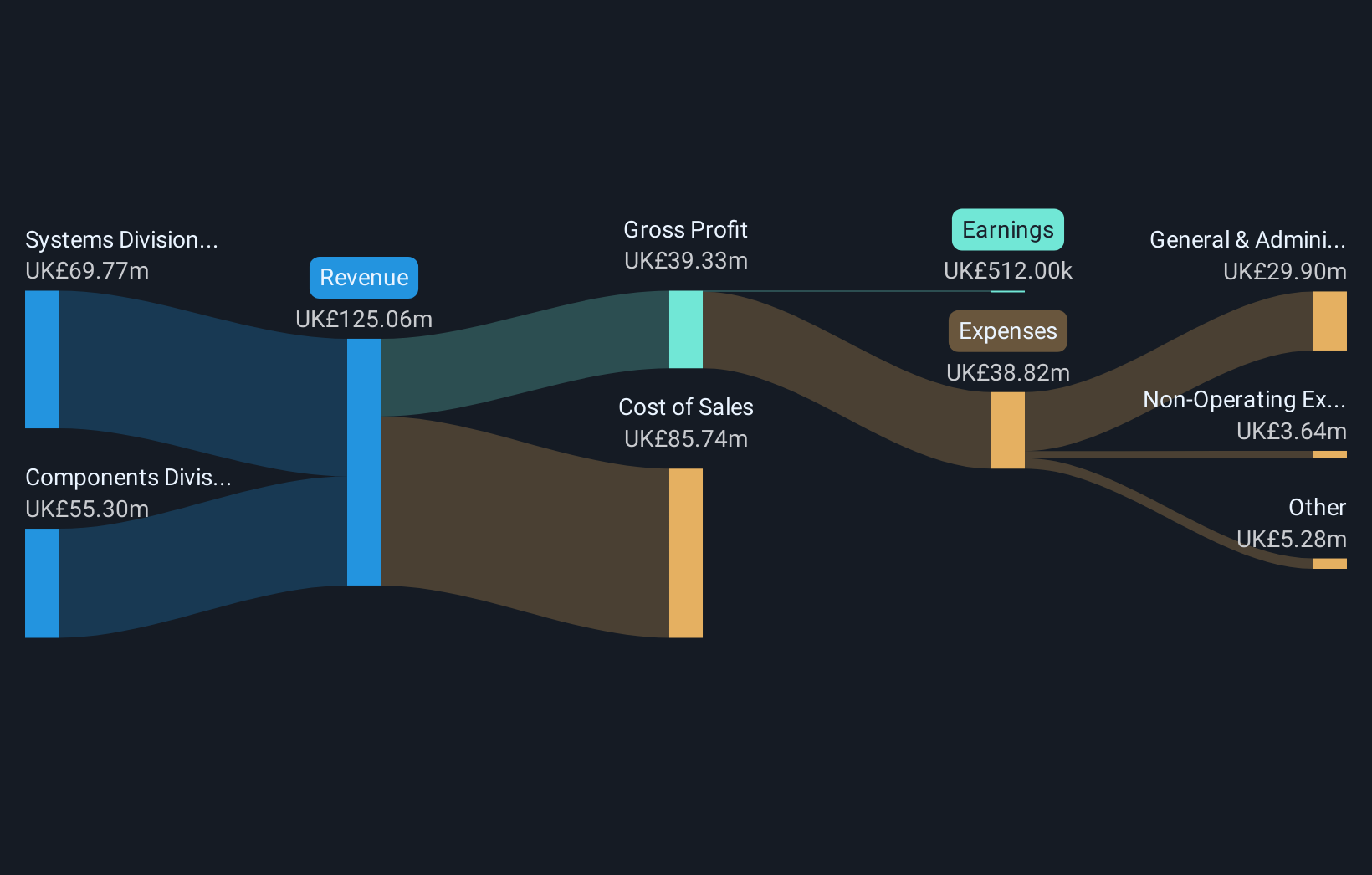

Operations: The company's revenue is primarily derived from its Systems Division, contributing £69.77 million, and its Components Division, generating £55.30 million.

Market Cap: £96.48M

Solid State plc, with a market cap of £96.48 million, is navigating challenges as it seeks growth through acquisitions, particularly in med tech and communications across the UK, Europe, and the USA. Despite a significant one-off loss impacting recent earnings and a decline in net income to £0.512 million for the year ended March 31, 2025, Solid State maintains a satisfactory net debt to equity ratio of 11.5% and has not faced shareholder dilution recently. The company’s short-term assets exceed both its short-term and long-term liabilities, indicating solid liquidity management amidst its strategic expansion plans.

- Navigate through the intricacies of Solid State with our comprehensive balance sheet health report here.

- Explore Solid State's analyst forecasts in our growth report.

Funding Circle Holdings (LSE:FCH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Funding Circle Holdings plc operates online lending platforms in the United Kingdom and internationally, with a market capitalization of £385.33 million.

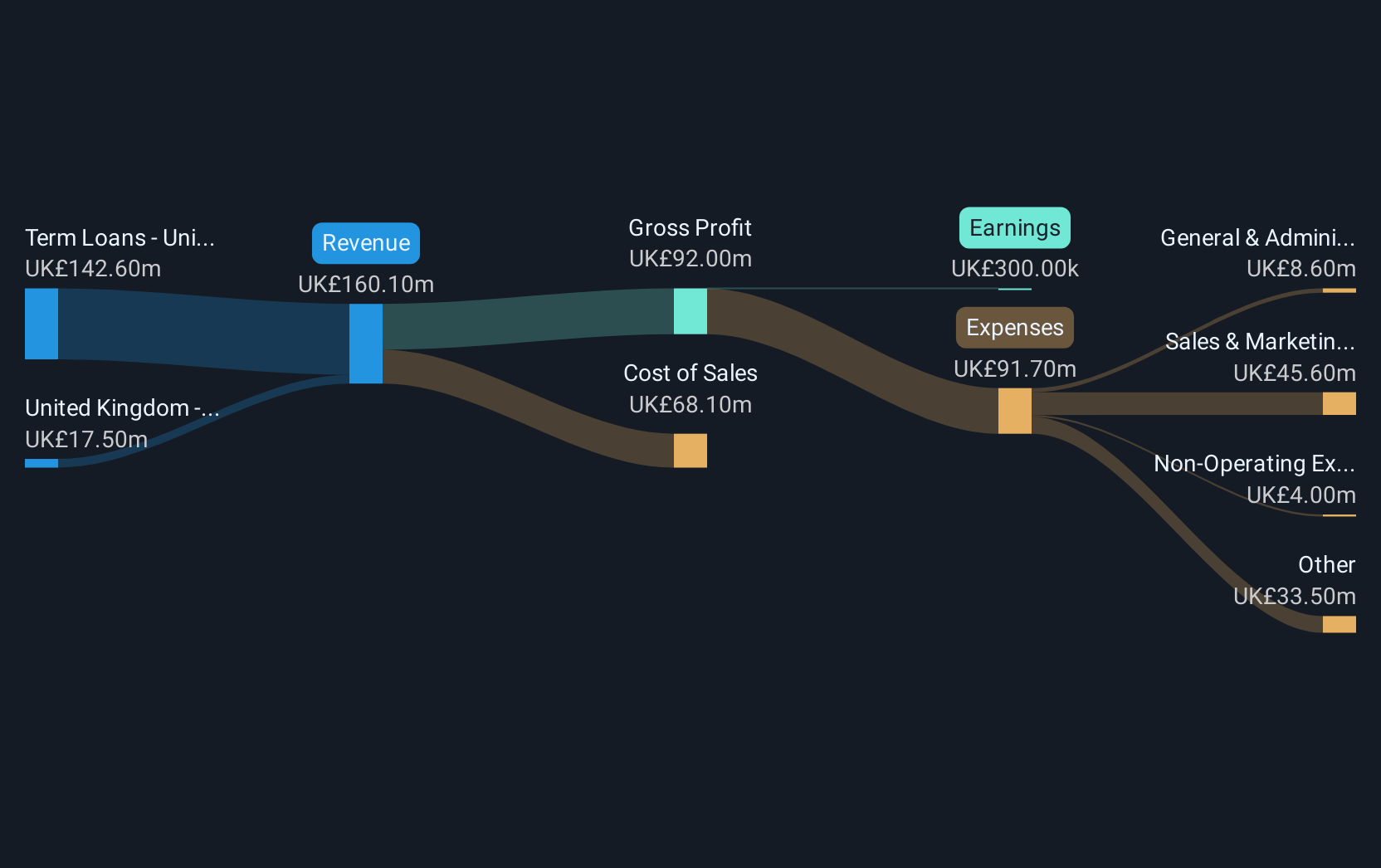

Operations: The company generates revenue through its United Kingdom operations, with £26.4 million from FlexiPay and £146.9 million from Term Loans.

Market Cap: £385.33M

Funding Circle Holdings plc, with a market capitalization of £385.33 million, has achieved profitability and reported half-year revenue of £92.3 million compared to £79.1 million the previous year, reflecting growth in its lending operations. The company maintains a strong financial position with short-term assets exceeding liabilities and more cash than total debt, although operating cash flow remains negative. Recent developments include a renewed £750 million funding commitment from Waterfall Asset Management and BNP Paribas, underscoring confidence in its lending platform's capabilities. However, significant insider selling over the past three months may raise concerns for potential investors.

- Take a closer look at Funding Circle Holdings' potential here in our financial health report.

- Gain insights into Funding Circle Holdings' future direction by reviewing our growth report.

FDM Group (Holdings) (LSE:FDM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FDM Group (Holdings) plc offers IT services across various regions including the United Kingdom, North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £138.17 million.

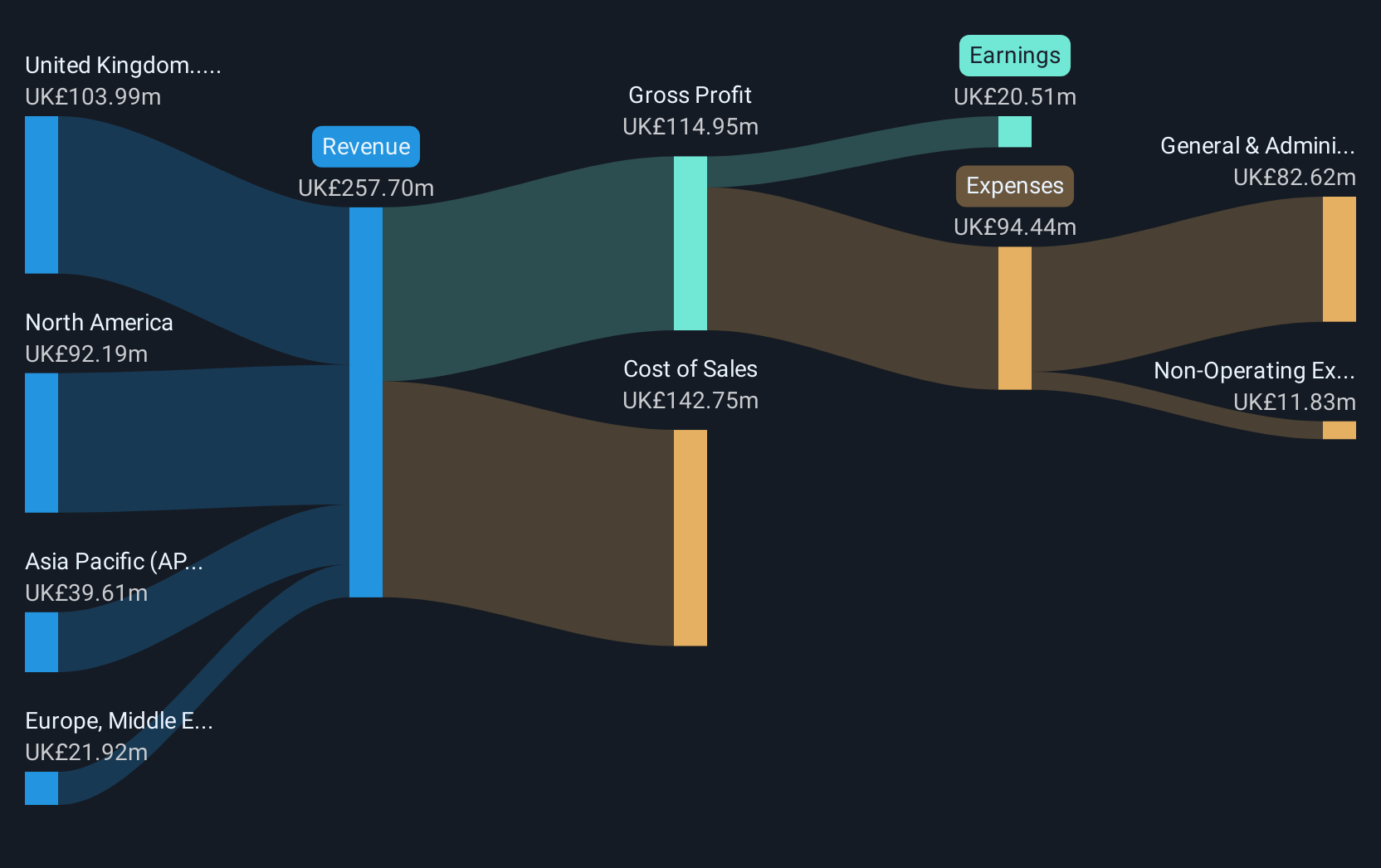

Operations: The company's revenue is primarily derived from the United Kingdom (£96.19 million), North America (£65.09 million), and the Asia Pacific region (£33.01 million).

Market Cap: £138.17M

FDM Group (Holdings) plc, with a market cap of £138.17 million, operates across several regions and faces challenges such as declining revenue and earnings. Recent half-year results showed sales at £97.28 million, down from £140.19 million the previous year, with net income also falling to £6.23 million from £11.25 million. Despite having no debt and a strong asset position covering liabilities, FDM's earnings are forecasted to decline by 10.8% annually over the next three years. The company offers high return on equity at 26.3%, but recent executive changes may impact strategic direction moving forward.

- Click to explore a detailed breakdown of our findings in FDM Group (Holdings)'s financial health report.

- Examine FDM Group (Holdings)'s earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Take a closer look at our UK Penny Stocks list of 291 companies by clicking here.

- Interested In Other Possibilities? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FCH

Funding Circle Holdings

Provides online lending platforms in the United Kingdom and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives