- United Kingdom

- /

- IT

- /

- LSE:FDM

Character Group Leads The Pack Of 3 UK Penny Stocks

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China, highlighting the interconnectedness of global economies. Despite these broader market pressures, there remain opportunities within specific segments of the market. Penny stocks, though an older term, still capture the essence of investing in smaller or newer companies that have potential for growth at accessible price points. By focusing on those with strong financials and clear growth prospects, investors can uncover promising opportunities in this often-overlooked area of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.24 | £307.58M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.25 | £343.35M | ✅ 4 ⚠️ 3 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.63 | £207.58M | ✅ 4 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.884 | £1.17B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.44 | £47.61M | ✅ 5 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.876 | £323.92M | ✅ 4 ⚠️ 3 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.70 | £133.06M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.085 | £173.09M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.845 | £11.63M | ✅ 4 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.14 | £66.54M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 294 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Character Group (AIM:CCT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Character Group plc is a holding company that designs, develops, manufactures, and distributes toys, games, and giftware products in the UK, Scandinavia, the Far East, and internationally with a market cap of £48.76 million.

Operations: The company generates £118.82 million in revenue from the design, development, and international distribution of toys, games, and gifts.

Market Cap: £48.76M

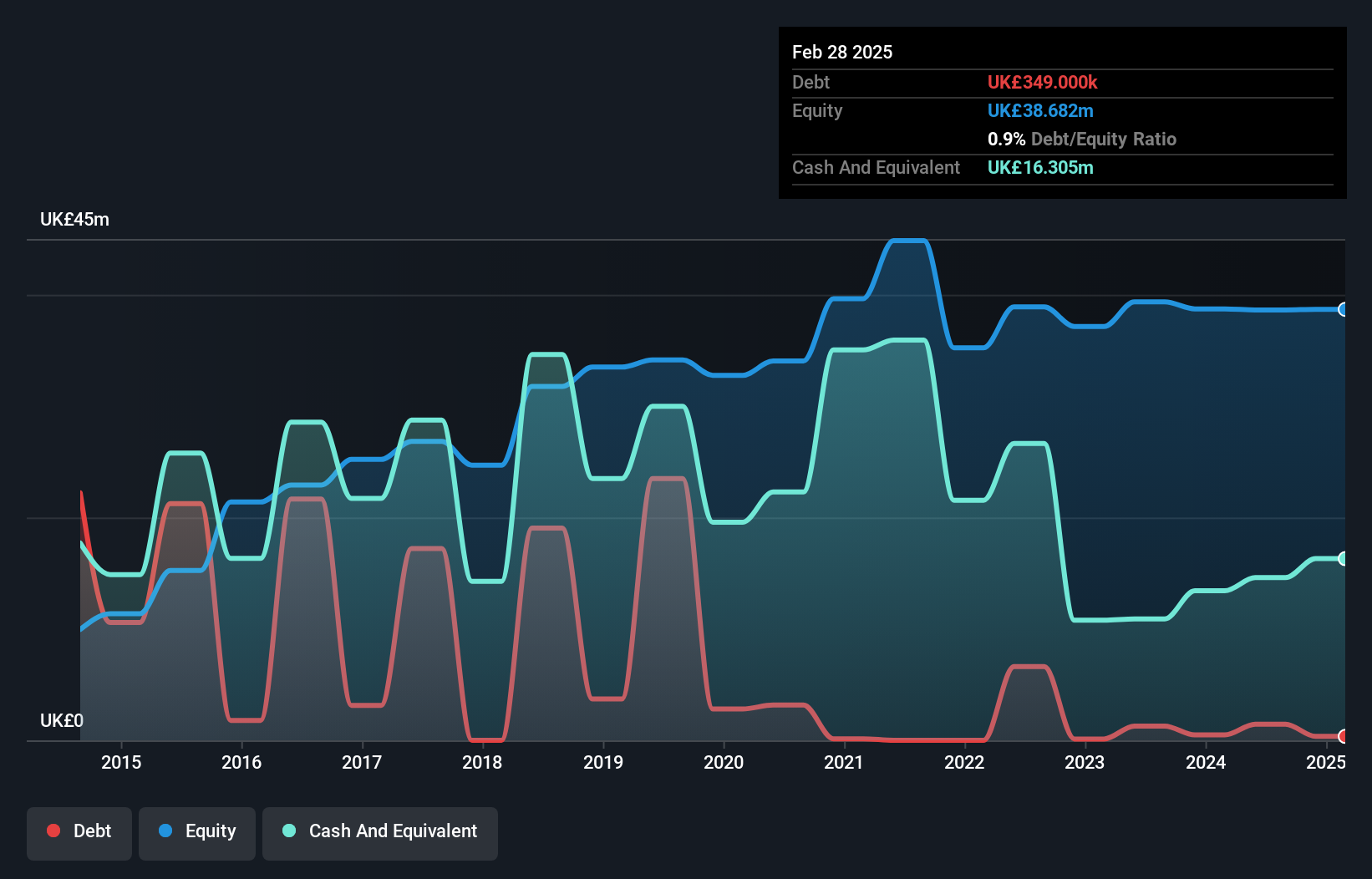

Character Group, with a market cap of £48.76 million, faces challenges from increased US-China tariffs impacting 20% of its revenue. Despite withdrawing market guidance for 2025 due to this uncertainty, the company remains confident in profitability. Recent earnings show improvement with net income rising to £2.4 million and basic EPS increasing to £0.1284 from the previous year. Character Group's financial health is strong, with more cash than debt and short-term assets covering liabilities comfortably. However, dividend sustainability is uncertain as evidenced by a reduced interim dividend amidst cautious customer demand globally affecting sales expectations.

- Navigate through the intricacies of Character Group with our comprehensive balance sheet health report here.

- Gain insights into Character Group's past trends and performance with our report on the company's historical track record.

Itaconix (AIM:ITX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Itaconix plc develops plant-based polymers for home and personal care applications across North America, Europe, and internationally, with a market cap of £17.40 million.

Operations: The company's revenue is derived from two main segments: Formulation Solutions, generating $2.04 million, and Performance Ingredients, contributing $4.46 million.

Market Cap: £17.4M

Itaconix plc, with a market cap of £17.40 million, is focused on expanding its product offerings in the plant-based polymer sector. The recent launch of BIO*Asterix® marks a strategic move into the $2.6 billion butyl acrylates market, presenting potential growth opportunities despite current unprofitability and increasing losses over five years. With no debt and short-term assets exceeding liabilities, financial stability is evident; however, profitability remains elusive in the near term. Revenue forecasts suggest significant growth at 34.82% annually, supported by sufficient cash runway for 1.8 years if historical free cash flow trends persist.

- Jump into the full analysis health report here for a deeper understanding of Itaconix.

- Learn about Itaconix's future growth trajectory here.

FDM Group (Holdings) (LSE:FDM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FDM Group (Holdings) plc offers IT services across various regions including the UK, North America, Europe, the Middle East, Africa, and Asia Pacific with a market cap of £236.12 million.

Operations: The company's revenue from its global professional services segment is £257.70 million.

Market Cap: £236.12M

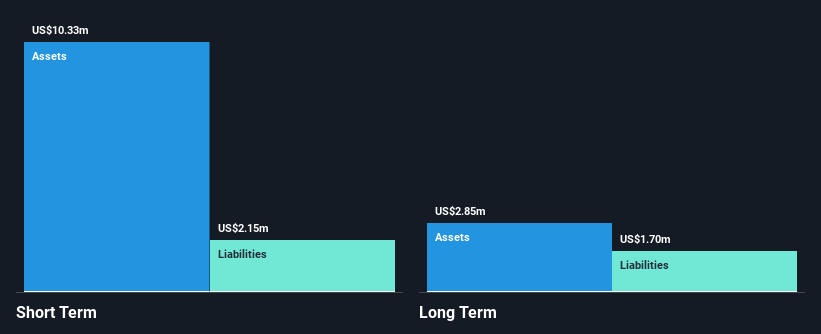

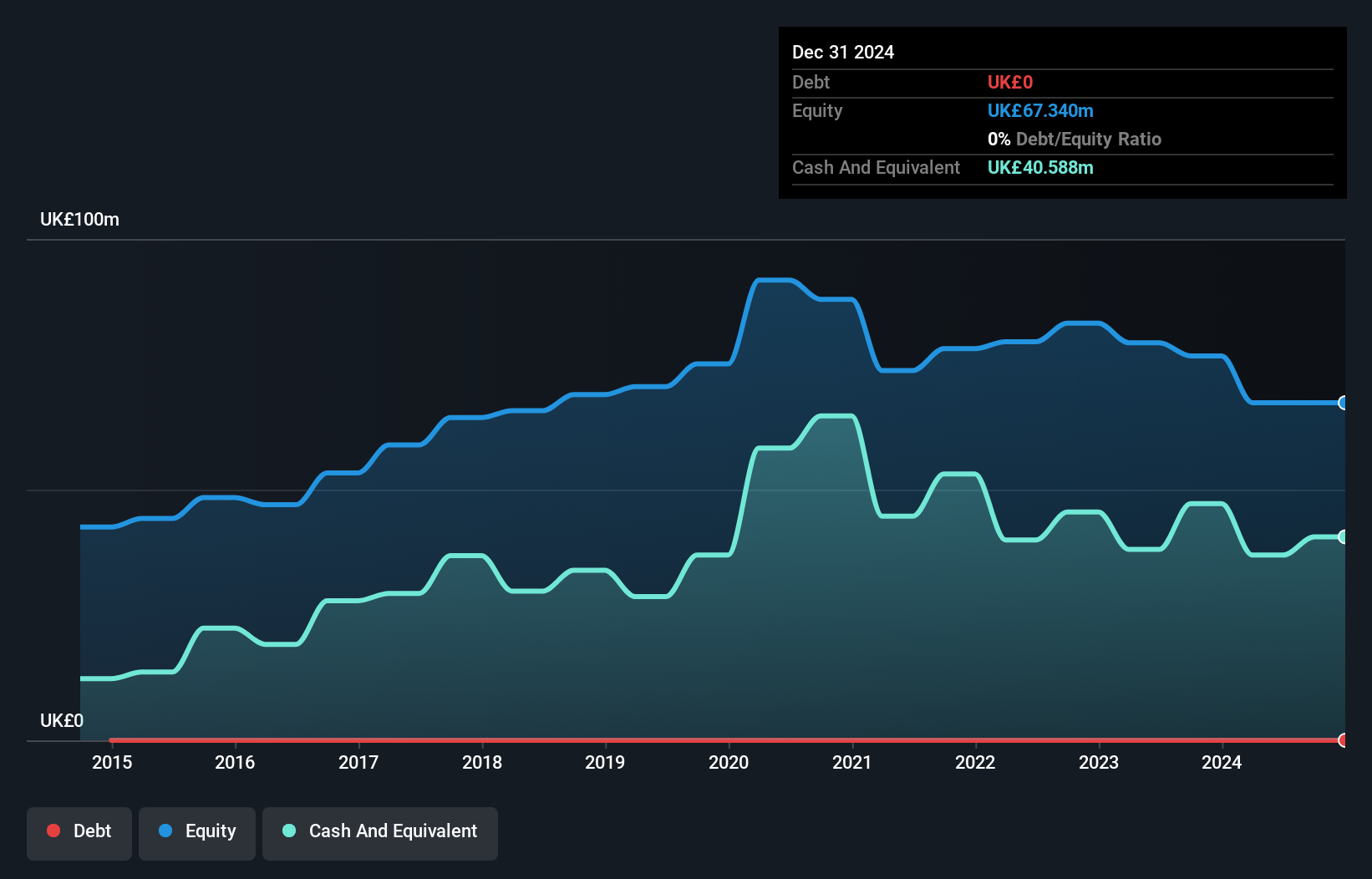

FDM Group (Holdings) plc, with a market cap of £236.12 million, offers IT services globally and maintains a stable financial position with no debt and short-term assets exceeding both its long-term (£17.8M) and short-term liabilities (£26.3M). Despite high-quality earnings and an experienced management team, the company has faced challenges with declining earnings growth over recent years, including a 49.7% drop last year. The dividend yield of 10.42% is not well covered by earnings, indicating potential sustainability issues despite trading at good value relative to peers. Recent board changes may influence strategic direction moving forward.

- Get an in-depth perspective on FDM Group (Holdings)'s performance by reading our balance sheet health report here.

- Evaluate FDM Group (Holdings)'s prospects by accessing our earnings growth report.

Taking Advantage

- Click through to start exploring the rest of the 291 UK Penny Stocks now.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FDM

FDM Group (Holdings)

Provides information technology (IT) services in the United Kingdom, North America, Europe, the Middle East, Africa, rest of Europe, and the Asia Pacific.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives