- United Kingdom

- /

- Software

- /

- LSE:ALFA

Should You Be Adding Alfa Financial Software Holdings (LON:ALFA) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Alfa Financial Software Holdings (LON:ALFA). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Alfa Financial Software Holdings

How Fast Is Alfa Financial Software Holdings Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Alfa Financial Software Holdings has managed to grow EPS by 23% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

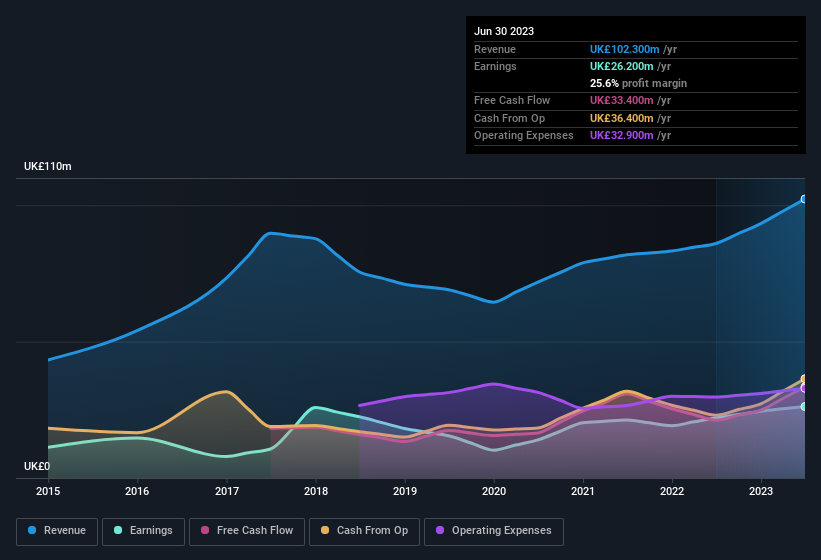

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Alfa Financial Software Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 19% to UK£102m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Alfa Financial Software Holdings' future EPS 100% free.

Are Alfa Financial Software Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

First and foremost; there we saw no insiders sell Alfa Financial Software Holdings shares in the last year. But the important part is that Senior Independent Non-Executive Director Christopher Sullivan spent UK£245k buying stock, at an average price of UK£1.55. Big buys like that may signal an opportunity; actions speak louder than words.

It's reassuring that Alfa Financial Software Holdings insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Alfa Financial Software Holdings with market caps between UK£157m and UK£629m is about UK£762k.

The Alfa Financial Software Holdings CEO received total compensation of only UK£27k in the year to December 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Alfa Financial Software Holdings Worth Keeping An Eye On?

You can't deny that Alfa Financial Software Holdings has grown its earnings per share at a very impressive rate. That's attractive. But wait, it gets better. We have seen insider buying and the executive pay seems on the modest side of things. All in all, this stock is worth the time to delve deeper into the details. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Alfa Financial Software Holdings (1 is a bit concerning) you should be aware of.

The good news is that Alfa Financial Software Holdings is not the only growth stock with insider buying. Here's a list of growth-focused companies in GB with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ALFA

Alfa Financial Software Holdings

Through its subsidiaries, provides software and related services to the auto and equipment finance industry in the United Kingdom, North America, Rest of Europe, the Middle East, Africa, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)