- United Kingdom

- /

- Software

- /

- AIM:FDP

Returns On Capital Signal Difficult Times Ahead For FD Technologies (LON:FDP)

If you're looking at a mature business that's past the growth phase, what are some of the underlying trends that pop up? When we see a declining return on capital employed (ROCE) in conjunction with a declining base of capital employed, that's often how a mature business shows signs of aging. This indicates to us that the business is not only shrinking the size of its net assets, but its returns are falling as well. Having said that, after a brief look, FD Technologies (LON:FDP) we aren't filled with optimism, but let's investigate further.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on FD Technologies is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.03 = UK£7.2m ÷ (UK£374m - UK£137m) (Based on the trailing twelve months to February 2023).

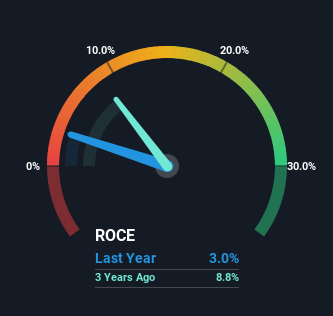

Therefore, FD Technologies has an ROCE of 3.0%. Ultimately, that's a low return and it under-performs the Software industry average of 8.7%.

Check out our latest analysis for FD Technologies

Above you can see how the current ROCE for FD Technologies compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering FD Technologies here for free.

The Trend Of ROCE

In terms of FD Technologies' historical ROCE movements, the trend doesn't inspire confidence. To be more specific, the ROCE was 8.9% five years ago, but since then it has dropped noticeably. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. Companies that exhibit these attributes tend to not be shrinking, but they can be mature and facing pressure on their margins from competition. If these trends continue, we wouldn't expect FD Technologies to turn into a multi-bagger.

On a side note, FD Technologies' current liabilities have increased over the last five years to 37% of total assets, effectively distorting the ROCE to some degree. Without this increase, it's likely that ROCE would be even lower than 3.0%. While the ratio isn't currently too high, it's worth keeping an eye on this because if it gets particularly high, the business could then face some new elements of risk.

The Bottom Line On FD Technologies' ROCE

In the end, the trend of lower returns on the same amount of capital isn't typically an indication that we're looking at a growth stock. Unsurprisingly then, the stock has dived 72% over the last five years, so investors are recognizing these changes and don't like the company's prospects. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

If you're still interested in FD Technologies it's worth checking out our FREE intrinsic value approximation to see if it's trading at an attractive price in other respects.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:FDP

FD Technologies

Provides software and consulting services in the United Kingdom and internationally.

Flawless balance sheet with concerning outlook.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)