- United Kingdom

- /

- Specialty Stores

- /

- LSE:WIX

UK Stock Market's Hidden Value Gems For April 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces challenges from weak trade data out of China and global economic uncertainties, investors are keenly observing market movements for potential opportunities. In such an environment, identifying undervalued stocks becomes crucial, as these hidden value gems can offer resilience and potential growth despite broader market pressures.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gooch & Housego (AIM:GHH) | £3.75 | £7.19 | 47.8% |

| Aptitude Software Group (LSE:APTD) | £2.92 | £5.20 | 43.9% |

| NIOX Group (AIM:NIOX) | £0.62 | £1.10 | 43.8% |

| On the Beach Group (LSE:OTB) | £2.645 | £4.82 | 45.1% |

| Trainline (LSE:TRN) | £2.848 | £5.21 | 45.4% |

| Franchise Brands (AIM:FRAN) | £1.36 | £2.46 | 44.8% |

| Deliveroo (LSE:ROO) | £1.36 | £2.69 | 49.4% |

| Kromek Group (AIM:KMK) | £0.052 | £0.10 | 49.1% |

| Ibstock (LSE:IBST) | £1.752 | £3.27 | 46.4% |

| CVS Group (AIM:CVSG) | £10.06 | £18.67 | 46.1% |

We'll examine a selection from our screener results.

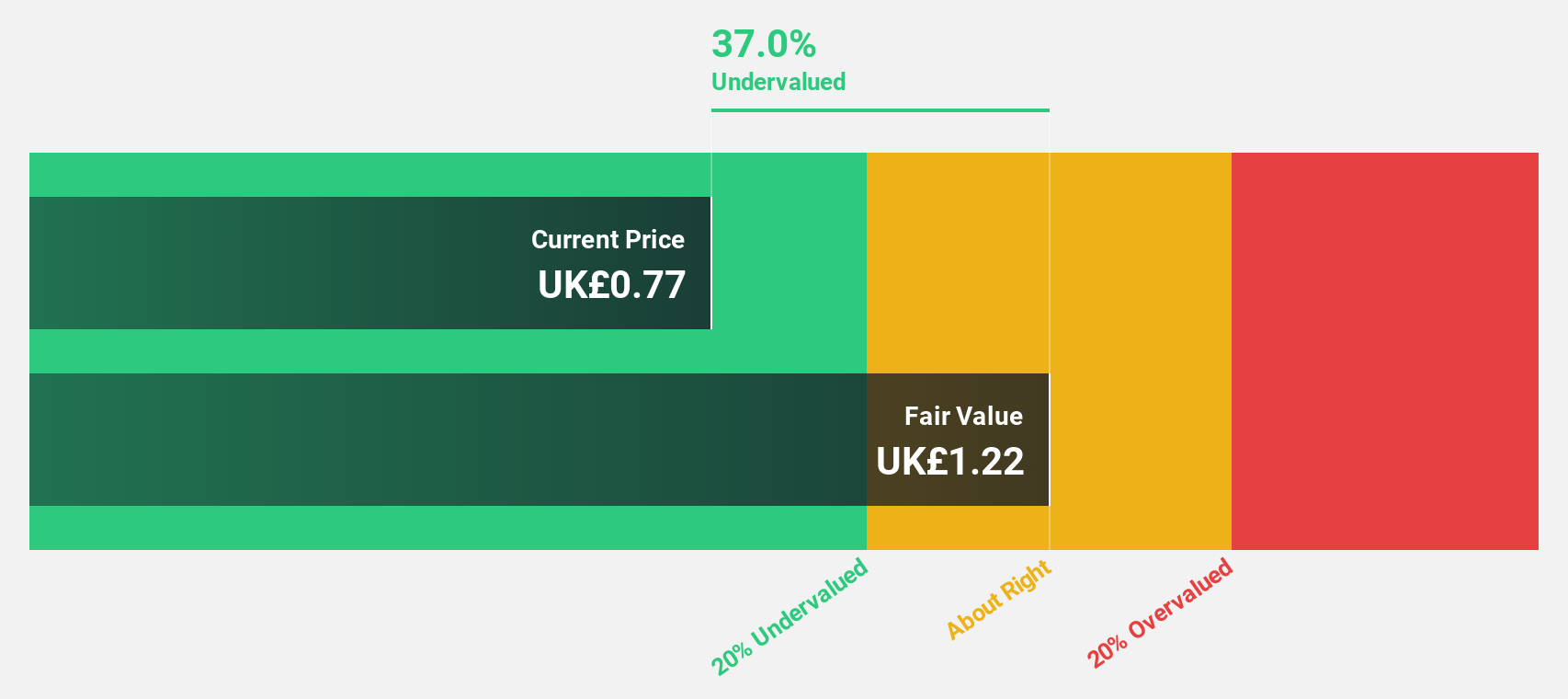

Victorian Plumbing Group (AIM:VIC)

Overview: Victorian Plumbing Group plc is an online retailer specializing in bathroom products and accessories for both B2C and trade customers in the United Kingdom, with a market cap of £322.66 million.

Operations: The company's revenue comes from its online retail operations, generating £295.70 million by selling bathroom products and accessories to both B2C and trade customers in the UK.

Estimated Discount To Fair Value: 25.7%

Victorian Plumbing Group is trading at £0.99, significantly below its estimated fair value of £1.33, indicating potential undervaluation based on cash flows. The company expects robust earnings growth of 35.8% annually, outpacing the UK market's 13.7%. However, profit margins have declined to 1.9% from last year's 4.1%. Analysts agree on a potential price increase of 22.1%, and a final dividend of 1.09 pence per share has been declared for fiscal year-end September 2024.

- Insights from our recent growth report point to a promising forecast for Victorian Plumbing Group's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Victorian Plumbing Group.

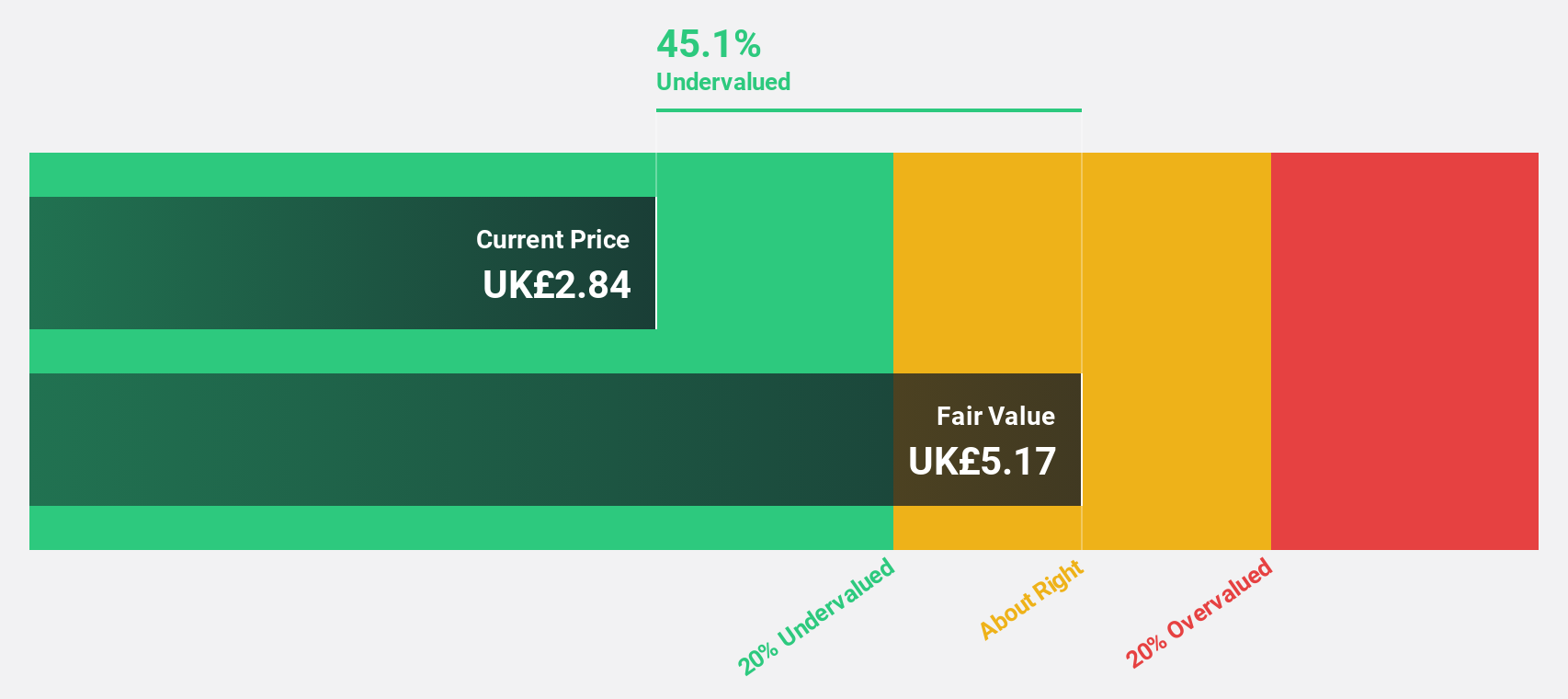

Trainline (LSE:TRN)

Overview: Trainline plc operates an independent platform for selling rail and coach tickets in the United Kingdom and internationally, with a market cap of £1.20 billion.

Operations: The company's revenue segments include Trainline Solutions at £146.08 million, International Consumer at £58.28 million, and United Kingdom Consumer at £224.53 million.

Estimated Discount To Fair Value: 45.4%

Trainline is trading at £2.85, well below its estimated fair value of £5.21, highlighting potential undervaluation based on cash flows. Earnings are projected to grow 16.6% annually, outpacing the UK market's 13.7%. Recent buyback activity includes a £75 million share repurchase program, with £69 million completed so far, enhancing shareholder value. Group net ticket sales rose to £5.91 billion from £5.30 billion last year, reflecting solid revenue growth prospects above the market rate.

- Our comprehensive growth report raises the possibility that Trainline is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Trainline stock in this financial health report.

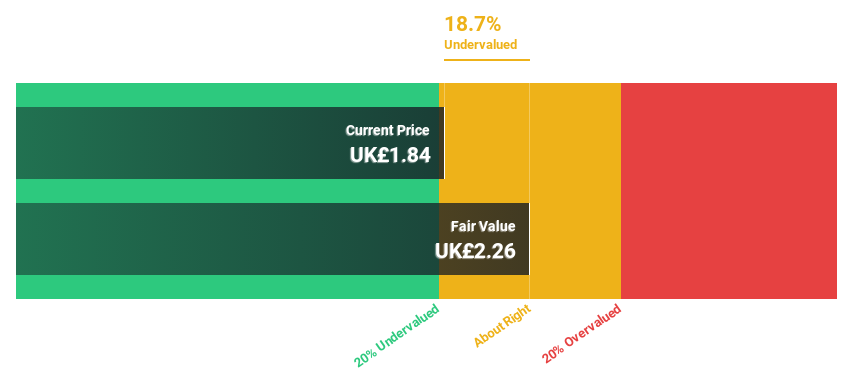

Wickes Group (LSE:WIX)

Overview: Wickes Group plc is a UK-based retailer specializing in home improvement products and services, with a market cap of £463.27 million.

Operations: The company's revenue segment consists of £1.54 billion from the retail of home improvement products and services in the UK.

Estimated Discount To Fair Value: 17.5%

Wickes Group is trading at £1.92, below its estimated fair value of £2.33, suggesting undervaluation based on cash flows. Earnings are forecast to grow significantly at 29.2% annually, outpacing the UK market's 13.7%. However, recent financial results show a decline in net income to £18.1 million from £29.8 million last year, and profit margins have decreased slightly. The company has initiated a share buyback program worth up to £20 million to enhance shareholder value.

- Upon reviewing our latest growth report, Wickes Group's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Wickes Group.

Next Steps

- Access the full spectrum of 52 Undervalued UK Stocks Based On Cash Flows by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wickes Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WIX

Wickes Group

Operates as a retailer of home improvement products and services in the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives