- United Kingdom

- /

- Media

- /

- LSE:INF

3 UK Stocks Estimated To Be Trading At Up To 49.3% Below Intrinsic Value

Reviewed by Simply Wall St

As the UK market grapples with challenges stemming from weaker trade data from China, the FTSE 100 and FTSE 250 indices have experienced declines, reflecting broader global economic uncertainties. In such an environment, identifying undervalued stocks becomes crucial for investors seeking potential opportunities amidst market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.36 | £0.66 | 45.6% |

| On the Beach Group (LSE:OTB) | £2.345 | £4.64 | 49.4% |

| Informa (LSE:INF) | £7.86 | £15.52 | 49.3% |

| JD Sports Fashion (LSE:JD.) | £0.7952 | £1.54 | 48.4% |

| Victrex (LSE:VCT) | £9.84 | £18.31 | 46.3% |

| AstraZeneca (LSE:AZN) | £117.84 | £217.33 | 45.8% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

| Harbour Energy (LSE:HBR) | £1.974 | £3.69 | 46.5% |

| TI Fluid Systems (LSE:TIFS) | £1.97 | £3.76 | 47.7% |

| Kromek Group (AIM:KMK) | £0.0585 | £0.11 | 48.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

DFS Furniture (LSE:DFS)

Overview: DFS Furniture plc designs, manufactures, delivers, installs, and retails upholstered furniture in the United Kingdom and the Republic of Ireland with a market cap of £325.27 million.

Operations: The company's revenue segments include £784 million from DFS and £212.50 million from Sofology.

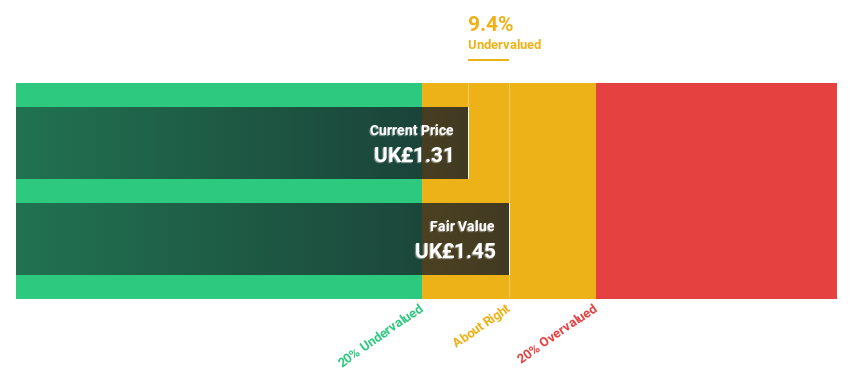

Estimated Discount To Fair Value: 12.9%

DFS Furniture is trading at £1.41, slightly undervalued compared to its estimated fair value of £1.62, with expected earnings growth of 63% annually outpacing the UK market. Despite a lower net profit margin than last year and interest payments not well covered by earnings, recent results show improved net income to £11.8 million from £0.6 million year-on-year. Revenue forecasts indicate moderate growth at 5.4% per year, above the UK market average but below high-growth benchmarks.

- The growth report we've compiled suggests that DFS Furniture's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in DFS Furniture's balance sheet health report.

Informa (LSE:INF)

Overview: Informa plc is an international company that specializes in events, digital services, and academic research across the UK, Continental Europe, the US, China, and other global markets with a market cap of £10.38 billion.

Operations: The company's revenue segments include Informa Tech (£423.90 million), Informa Connect (£631 million), Informa Markets (£1.72 billion), and Taylor & Francis (£698.20 million).

Estimated Discount To Fair Value: 49.3%

Informa is trading at £7.86, significantly below its estimated fair value of £15.52, suggesting it may be undervalued based on cash flows. Despite a decline in net profit margin from 13.1% to 8.4%, earnings are expected to grow substantially at 23.3% annually, outpacing the UK market's growth rate of 14.2%. The company has completed a share buyback worth £1,489.5 million and announced increased dividends for fiscal year 2024, indicating robust cash flow management amidst slower revenue growth forecasts of 8.4%.

- The analysis detailed in our Informa growth report hints at robust future financial performance.

- Dive into the specifics of Informa here with our thorough financial health report.

NewRiver REIT (LSE:NRR)

Overview: NewRiver REIT plc is a prominent Real Estate Investment Trust focused on acquiring, managing, and developing durable retail properties across the UK, with a market cap of £344.22 million.

Operations: NewRiver REIT plc generates revenue primarily from its operations in acquiring, managing, and developing robust retail properties across the UK.

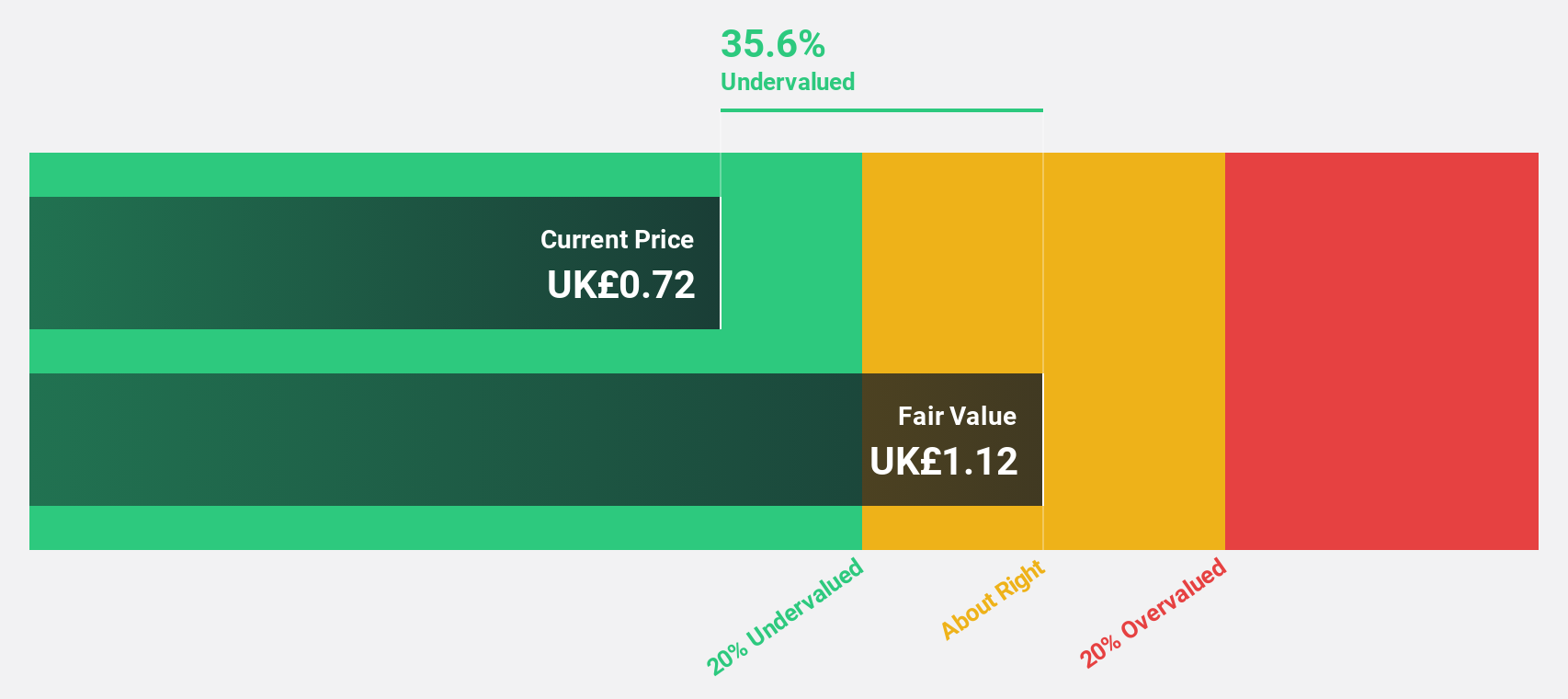

Estimated Discount To Fair Value: 24.7%

NewRiver REIT, trading at £0.72, is priced below its estimated fair value of £0.96, reflecting potential undervaluation based on cash flows. Despite substantial shareholder dilution in the past year and a dividend not fully covered by free cash flows, earnings are expected to grow significantly at 48.2% annually over the next three years, outpacing UK market growth rates. Recent strategic partnerships with Royal Mail and Sainsbury's enhance its retail portfolio's appeal and revenue prospects.

- Our earnings growth report unveils the potential for significant increases in NewRiver REIT's future results.

- Get an in-depth perspective on NewRiver REIT's balance sheet by reading our health report here.

Taking Advantage

- Take a closer look at our Undervalued UK Stocks Based On Cash Flows list of 60 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:INF

Informa

Operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally.

Good value with reasonable growth potential and pays a dividend.