- United Kingdom

- /

- Machinery

- /

- AIM:XSG

Promising UK Penny Stocks To Consider In October 2025

Reviewed by Simply Wall St

The UK market has been impacted by weak global cues, with the FTSE 100 and FTSE 250 indices recently closing lower due to disappointing trade data from China. In such a climate, investors often seek opportunities that balance potential growth with financial resilience. Penny stocks, though an outdated term, still capture attention for their ability to offer value and growth at accessible price points when backed by strong fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.78 | £535.15M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.14 | £172.88M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.795 | £12M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.468 | $272.06M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.902 | £333.54M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.57 | £263.92M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.425 | £123.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £184.68M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.685 | £9.43M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £1.844 | £696.52M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 288 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Angling Direct (AIM:ANG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Angling Direct PLC, with a market cap of £40.16 million, operates in the sale of fishing tackle products and equipment across the United Kingdom, Europe, and internationally.

Operations: Revenue segments for Angling Direct are not reported.

Market Cap: £40.16M

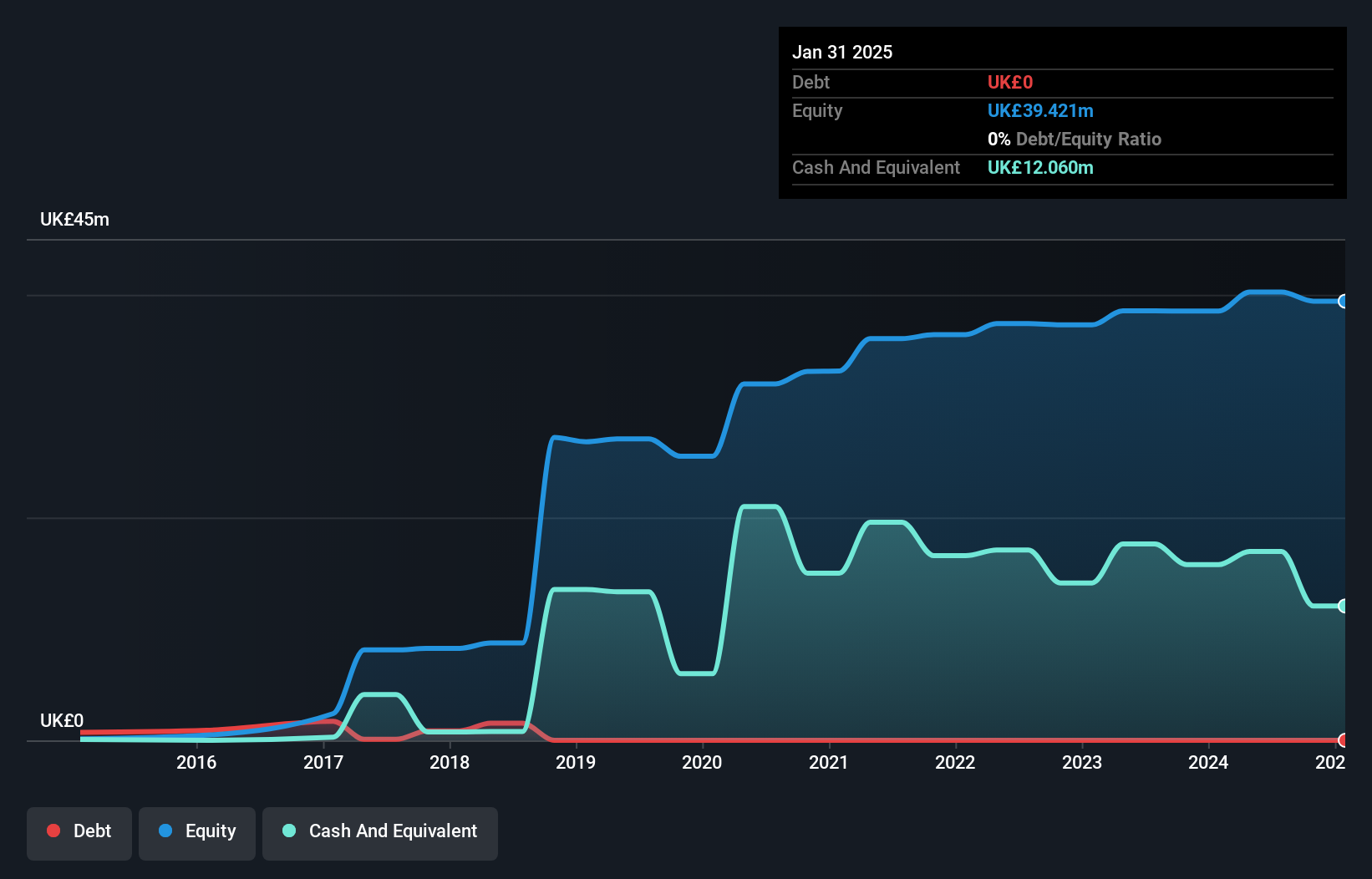

Angling Direct PLC, with a market cap of £40.16 million, has demonstrated solid financial performance in the penny stock space. The company reported sales of £53.63 million for the half year ended July 31, 2025, up from £45.84 million a year prior, and net income increased to £2.15 million from £1.73 million. It benefits from no debt obligations and strong asset coverage over liabilities (£40.3M vs short term liabilities of £16.6M). While earnings growth at 13.2% outpaced the industry average last year, return on equity remains low at 4.5%. Management and board experience averages over two years each.

- Click here to discover the nuances of Angling Direct with our detailed analytical financial health report.

- Evaluate Angling Direct's prospects by accessing our earnings growth report.

Landore Resources (AIM:LND)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Landore Resources Limited, with a market cap of £15.91 million, is involved in the identification, acquisition, exploration, and development of mineral projects in Canada and Guernsey through its subsidiaries.

Operations: Landore Resources Limited has not reported any revenue segments.

Market Cap: £15.91M

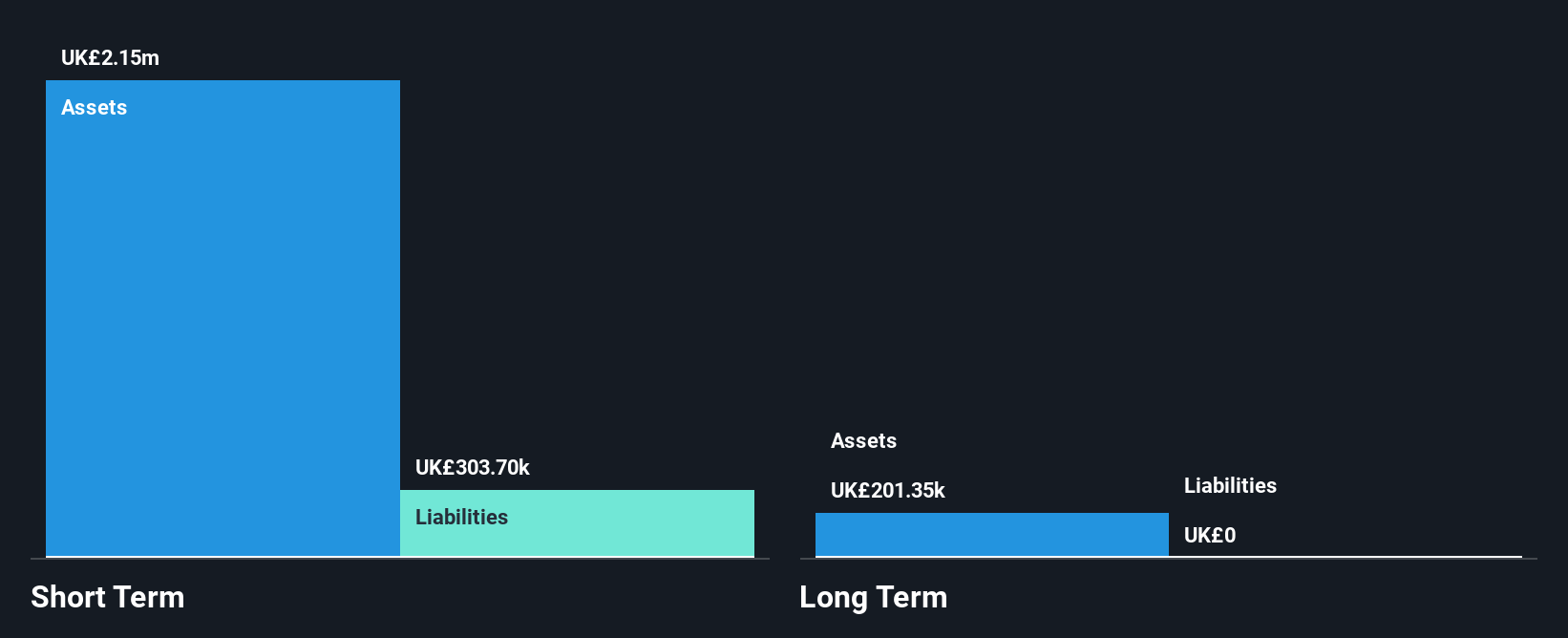

Landore Resources Limited, with a market cap of £15.91 million, operates as a pre-revenue entity in the mineral exploration sector. Despite being unprofitable, it has managed to reduce its losses by 8.6% annually over the past five years. The company maintains a debt-free status and its short-term assets (£2.2M) comfortably cover short-term liabilities (£303.7K). However, Landore's share price remains highly volatile compared to most UK stocks, and it lacks sufficient data to assess its cash runway capabilities fully. Both management and board members possess considerable experience with average tenures of 2.8 and 4 years respectively.

- Get an in-depth perspective on Landore Resources' performance by reading our balance sheet health report here.

- Gain insights into Landore Resources' past trends and performance with our report on the company's historical track record.

Xeros Technology Group (AIM:XSG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Xeros Technology Group plc, along with its subsidiaries, focuses on researching, developing, and commercializing polymer-based technology alternatives to traditional aqueous technologies across Europe, North America, and internationally; the company has a market cap of £9.48 million.

Operations: Xeros Technology Group plc has not reported any revenue segments.

Market Cap: £9.48M

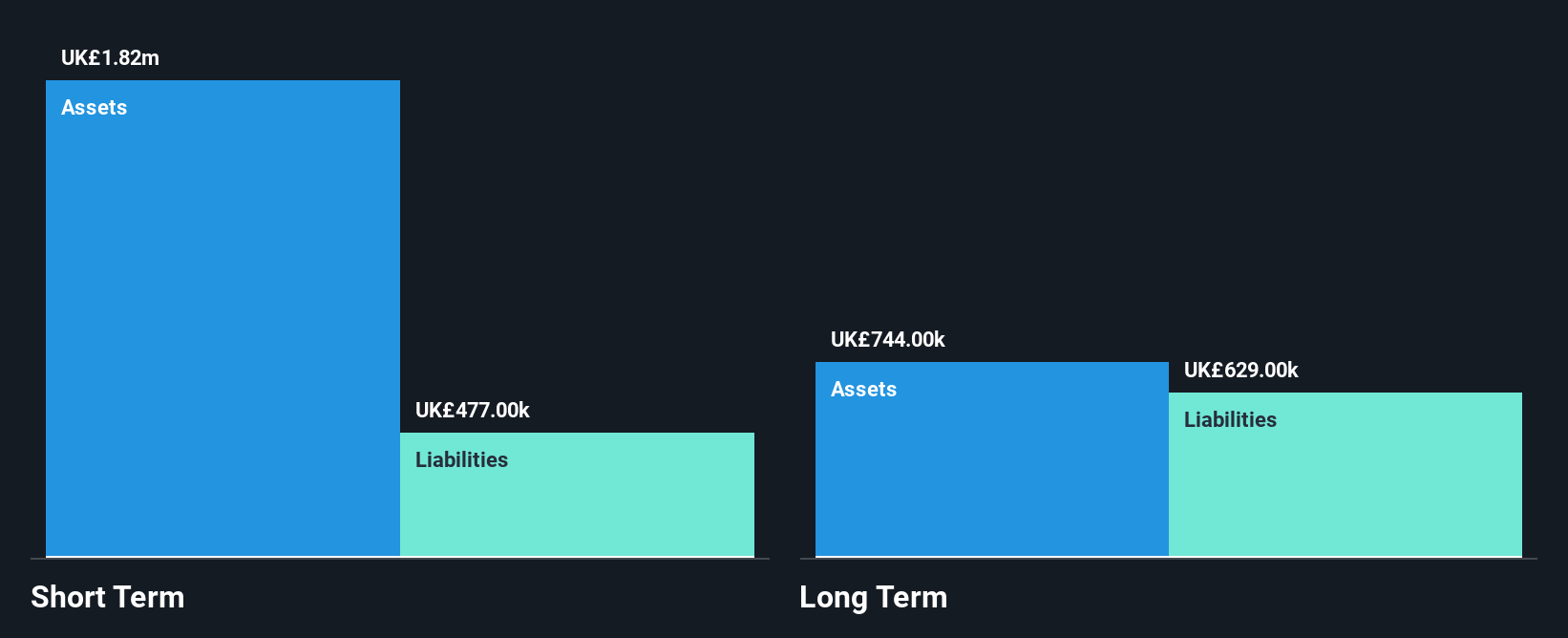

Xeros Technology Group, with a market cap of £9.48 million, operates as a pre-revenue company in the polymer technology sector. The company's short-term assets (£1.8M) exceed both its short-term (£477K) and long-term liabilities (£629K), maintaining a debt-free status for five years. Despite being unprofitable, Xeros has reduced its losses by 19.3% annually over the past five years and reported a net loss reduction to £1.73 million for H1 2025 from £2.55 million the previous year. However, it faces high share price volatility and less than one year of cash runway based on current free cash flow trends.

- Click here and access our complete financial health analysis report to understand the dynamics of Xeros Technology Group.

- Examine Xeros Technology Group's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Explore the 288 names from our UK Penny Stocks screener here.

- Interested In Other Possibilities? AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:XSG

Xeros Technology Group

Researches, develops, and commercializes polymer-based technology alternatives to traditional aqueous based technologies in Europe, North America, and internationally.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives