- United Kingdom

- /

- Life Sciences

- /

- AIM:FAB

ADVFN And 2 Other UK Penny Stocks To Watch Closely

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, investors often look to penny stocks as potential opportunities for growth, particularly in smaller or newer companies that might offer unique value propositions. While the term "penny stocks" might seem outdated, it still signifies a segment of the market where financial resilience can lead to unexpected opportunities.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.644 | £54.45M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.58 | £266.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.335 | £232.23M | ✅ 4 ⚠️ 5 View Analysis > |

| Central Asia Metals (AIM:CAML) | £1.478 | £257.13M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.19 | £257.71M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.09 | £350.1M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.50 | £337.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £153.75M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.616 | £2B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.325 | £35.17M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 391 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

ADVFN (AIM:AFN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ADVFN Plc, with a market cap of £2.55 million, develops and provides financial information and research services online in the United Kingdom and internationally.

Operations: The company does not report specific revenue segments.

Market Cap: £2.55M

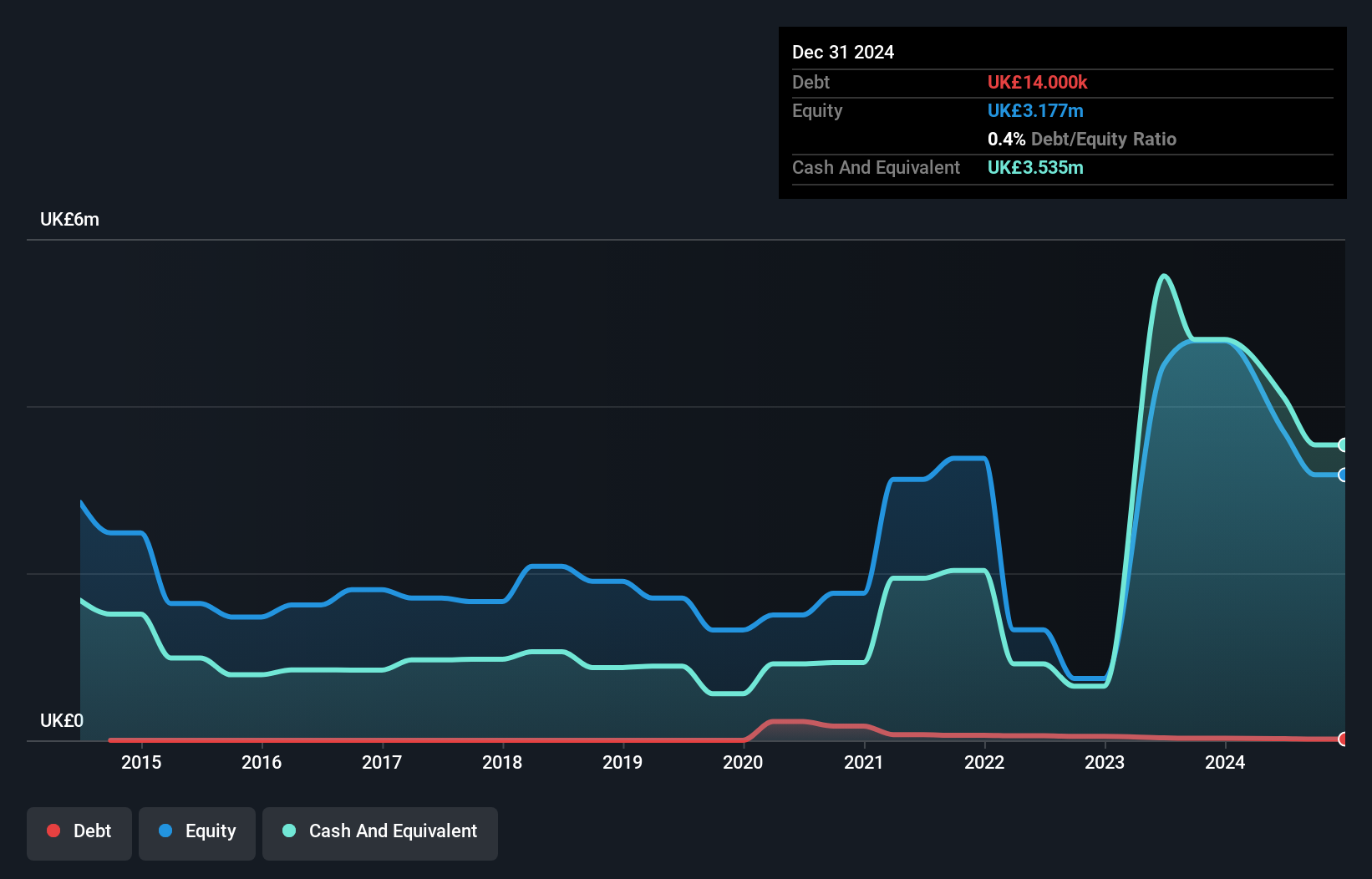

ADVFN Plc, with a market cap of £2.55 million, reported half-year sales of £2.02 million and a net loss of £0.453 million for the period ending December 31, 2024. Despite being unprofitable with increasing losses over the past five years, its short-term assets exceed both short-term and long-term liabilities, indicating some financial stability. The company has more cash than total debt and a sufficient cash runway for over a year based on current free cash flow trends. Shareholder dilution has not been significant in the past year, but share price volatility remains high.

- Jump into the full analysis health report here for a deeper understanding of ADVFN.

- Evaluate ADVFN's historical performance by accessing our past performance report.

Fusion Antibodies (AIM:FAB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fusion Antibodies plc is a contract research organization focused on the research, development, and manufacture of recombinant proteins and antibodies for cancer and infectious diseases across various regions including the UK, Europe, North America, and internationally, with a market cap of £6.28 million.

Operations: The company generates revenue of £1.80 million from its activities in the research, development, and production of recombinant proteins and antibodies.

Market Cap: £6.28M

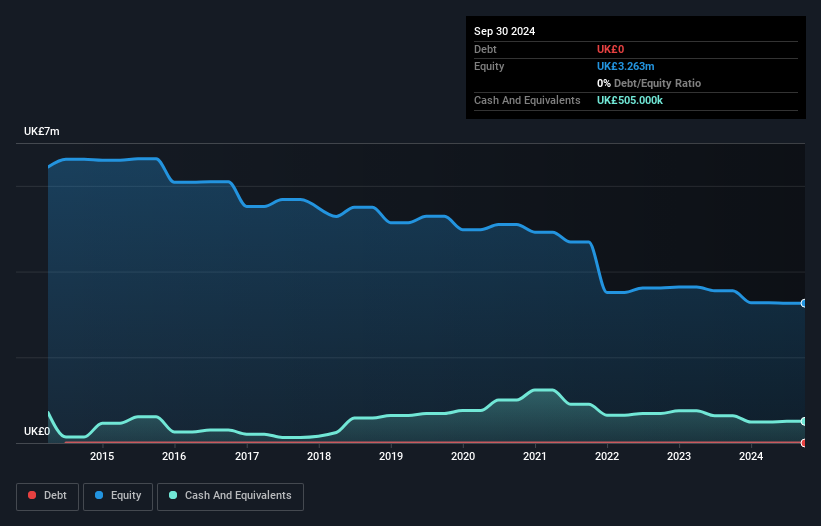

Fusion Antibodies plc, with a market cap of £6.28 million, recently completed a follow-on equity offering raising £1.17 million, which may extend its cash runway beyond the current four months. Despite generating revenue of £1.80 million from its research and development activities, the company remains unprofitable and has experienced increasing losses over the past five years. The management team is considered experienced with an average tenure of 2.2 years, while recent collaborations such as the CLD Project could potentially enhance future revenue streams. However, share price volatility is high and earnings have declined significantly over time.

- Click here and access our complete financial health analysis report to understand the dynamics of Fusion Antibodies.

- Examine Fusion Antibodies' past performance report to understand how it has performed in prior years.

PHSC (AIM:PHSC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PHSC plc, with a market cap of £1.70 million, operates in the United Kingdom offering health, safety, hygiene, and environmental consultancy services alongside security solutions to both public and private sectors through its subsidiaries.

Operations: The company's revenue is derived from several segments, including £1.12 million from Security Division - B2BSG Systems LTD, £0.768 million from Systems Division: QCS International LTD, and a total of £1.81 million from its Health & Safety Division across Inspection Services (UK) LTD, RSA Environmental Health LTD, Quality Leisure Management LTD, and Personnel Health & Safety Consultants LTD.

Market Cap: £1.7M

PHSC plc, with a market cap of £1.70 million, faces challenges as recent earnings growth was negative at -55.7%, and profit margins have decreased from 7.6% to 3.1%. Despite these setbacks, the company remains debt-free and has short-term assets (£1.4M) exceeding both its short-term (£627K) and long-term liabilities (£148K). Trading at 73% below estimated fair value suggests potential undervaluation, though investor caution is advised due to a large one-off loss impacting financial results and an inexperienced board with an average tenure of just 1.3 years. Recent leadership changes may influence future direction positively or negatively.

- Dive into the specifics of PHSC here with our thorough balance sheet health report.

- Explore historical data to track PHSC's performance over time in our past results report.

Next Steps

- Click through to start exploring the rest of the 388 UK Penny Stocks now.

- Curious About Other Options? We've found 27 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FAB

Fusion Antibodies

A contract research organization, engages in the research, development, and manufacture of recombinant proteins and antibodies primarily for cancer and infectious diseases in the United Kingdom, the rest of Europe, North America, and internationally.

Flawless balance sheet moderate.

Market Insights

Community Narratives