- United Kingdom

- /

- Entertainment

- /

- OFEX:ATC

3 UK Penny Stocks With Over £20M Market Cap

Reviewed by Simply Wall St

The United Kingdom market has recently faced headwinds, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, impacting sectors closely tied to global demand. Amid these broader market challenges, investors often seek opportunities in less conventional areas like penny stocks. Although the term "penny stocks" may seem outdated, these typically smaller or newer companies can offer valuable growth potential when they possess strong balance sheets and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.70 | £526.2M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.10 | £169.65M | ✅ 3 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.69 | £10.42M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.53 | $308.1M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.894 | £330.58M | ✅ 5 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.425 | £123.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.155 | £183.88M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.74 | £10.19M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.43 | £74.04M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £1.852 | £699.54M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 298 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Afentra (AIM:AET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Afentra plc is an upstream oil and gas company operating primarily in Africa, with a market capitalization of £113.08 million.

Operations: The company's revenue is primarily derived from its Oil & Gas - Exploration & Production segment, totaling $180.86 million.

Market Cap: £113.08M

Afentra plc, with a market capitalization of £113.08 million, has recently transitioned to profitability, showing strong earnings growth and high-quality earnings. The company is trading below analyst price targets and at a good value relative to peers. Its financial health is robust, with cash exceeding total debt and interest payments well covered by EBIT. Recent strategic developments include signing Heads of Terms for the Risk Service Contract for offshore Block 3/24 in Angola, expanding its gross offshore acreage significantly and marking its first offshore operatorship—potentially enhancing short-cycle development opportunities given its proximity to existing assets.

- Get an in-depth perspective on Afentra's performance by reading our balance sheet health report here.

- Examine Afentra's earnings growth report to understand how analysts expect it to perform.

Deliveroo (LSE:ROO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deliveroo plc operates an online on-demand food and non-food delivery platform across several countries including the United Kingdom, Ireland, and Hong Kong, with a market cap of £2.69 billion.

Operations: The company generates £2.15 billion from its on-demand food delivery platform operations.

Market Cap: £2.69B

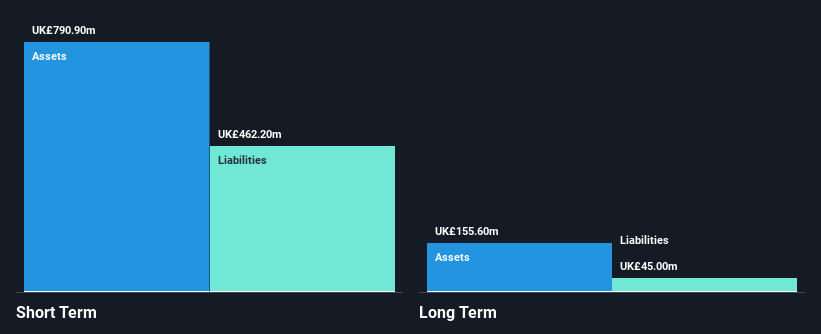

Deliveroo plc, with a market cap of £2.69 billion, remains unprofitable but has shown resilience through positive free cash flow growth and sufficient cash runway for over three years. Despite a negative return on equity, its short-term assets outweigh liabilities significantly, indicating strong liquidity. The company is debt-free and has not diluted shareholders recently. However, recent executive changes are noteworthy; Founder and CEO Will Shu plans to step down following an acquisition scheme by DoorDash Inc., effective October 2025. Deliveroo's earnings have increased year-on-year despite reporting a net loss of £19.2 million for H1 2025.

- Click here to discover the nuances of Deliveroo with our detailed analytical financial health report.

- Assess Deliveroo's future earnings estimates with our detailed growth reports.

All Things Considered Group (OFEX:ATC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: All Things Considered Group Plc is an independent music company offering music industry services across the United Kingdom, Europe, the United States, and internationally, with a market cap of £23.16 million.

Operations: No specific revenue segments have been reported for All Things Considered Group Plc.

Market Cap: £23.16M

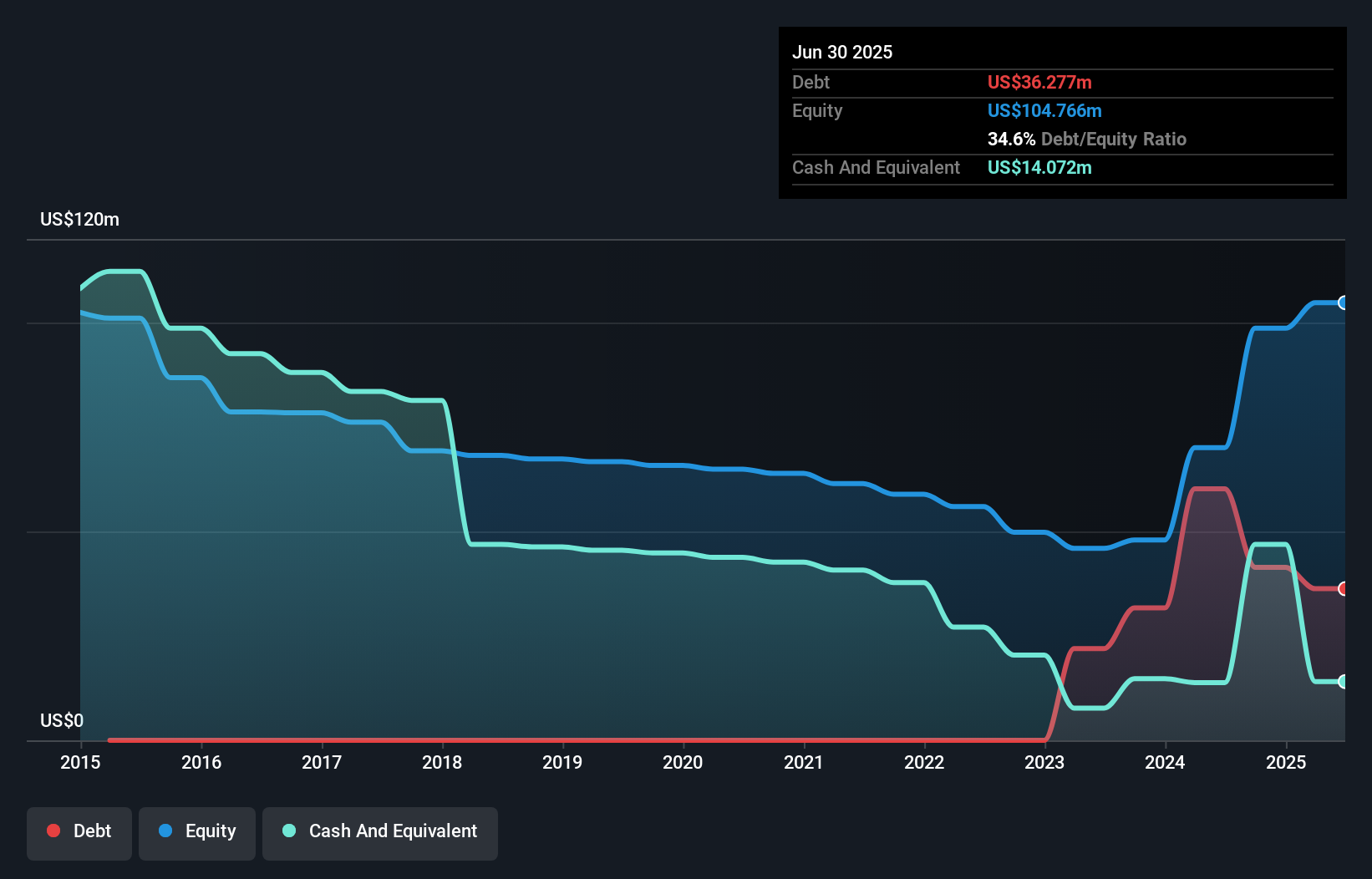

All Things Considered Group Plc, with a market cap of £23.16 million, has shown some financial resilience despite being unprofitable. The company reported sales of £22.07 million for the first half of 2025, up from £19.59 million the previous year, though net losses increased to £1.78 million from £1.24 million. While its cash position surpasses total debt and provides a runway exceeding three years even if free cash flow declines at historical rates, short-term liabilities slightly exceed assets by £0.1M, indicating liquidity constraints. Shareholders have not faced dilution recently despite ongoing volatility in share price and negative return on equity at -35.43%.

- Navigate through the intricacies of All Things Considered Group with our comprehensive balance sheet health report here.

- Examine All Things Considered Group's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Click here to access our complete index of 298 UK Penny Stocks.

- Seeking Other Investments? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OFEX:ATC

All Things Considered Group

An independent music company, provides music industry services in the United Kingdom, rest of Europe, the United States, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success