- United Kingdom

- /

- Consumer Durables

- /

- AIM:TUNE

Frontier Developments And 2 Other UK Penny Stocks To Watch Closely

Reviewed by Simply Wall St

The London stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market fluctuations, penny stocks in the UK continue to attract attention for their potential to offer both value and growth. Although the term "penny stocks" may seem outdated, it still refers to smaller or emerging companies that can provide opportunities when supported by strong financial fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.55M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.288 | £198.65M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.88 | £385.89M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £4.00 | £458.26M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.155 | £98.68M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.43 | £310.49M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.435 | $252.88M | ★★★★★★ |

Click here to see the full list of 471 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Frontier Developments (AIM:FDEV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frontier Developments plc is a company that develops and publishes video games for the interactive entertainment sector, with a market cap of £77.23 million.

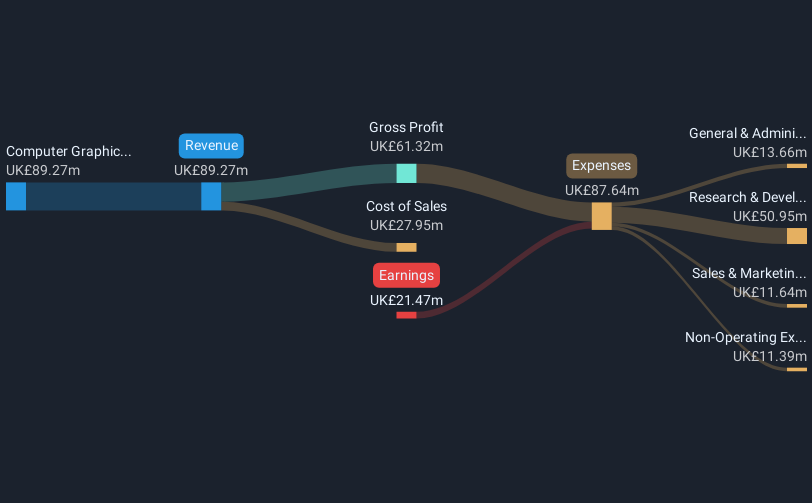

Operations: The company generates revenue from its Computer Graphics segment, which accounts for £89.27 million.

Market Cap: £77.23M

Frontier Developments, with a market cap of £77.23 million, operates in the video game sector and faces challenges typical of penny stocks. Despite being debt-free and having short-term assets exceeding liabilities, the company remains unprofitable with increasing losses over five years. Its share price has been highly volatile recently, reflecting investor uncertainty. However, it trades at good value relative to peers and industry standards, offering potential upside if earnings growth forecasts materialize as expected at 123.3% per year. The experienced board and management team may provide stability amidst its current financial struggles.

- Navigate through the intricacies of Frontier Developments with our comprehensive balance sheet health report here.

- Explore Frontier Developments' analyst forecasts in our growth report.

Next 15 Group (AIM:NFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Next 15 Group plc, along with its subsidiaries, offers communications services across the United Kingdom, Europe, Africa, the United States, and the Asia Pacific with a market cap of £385.89 million.

Operations: No specific revenue segments are reported for Next 15 Group plc.

Market Cap: £385.89M

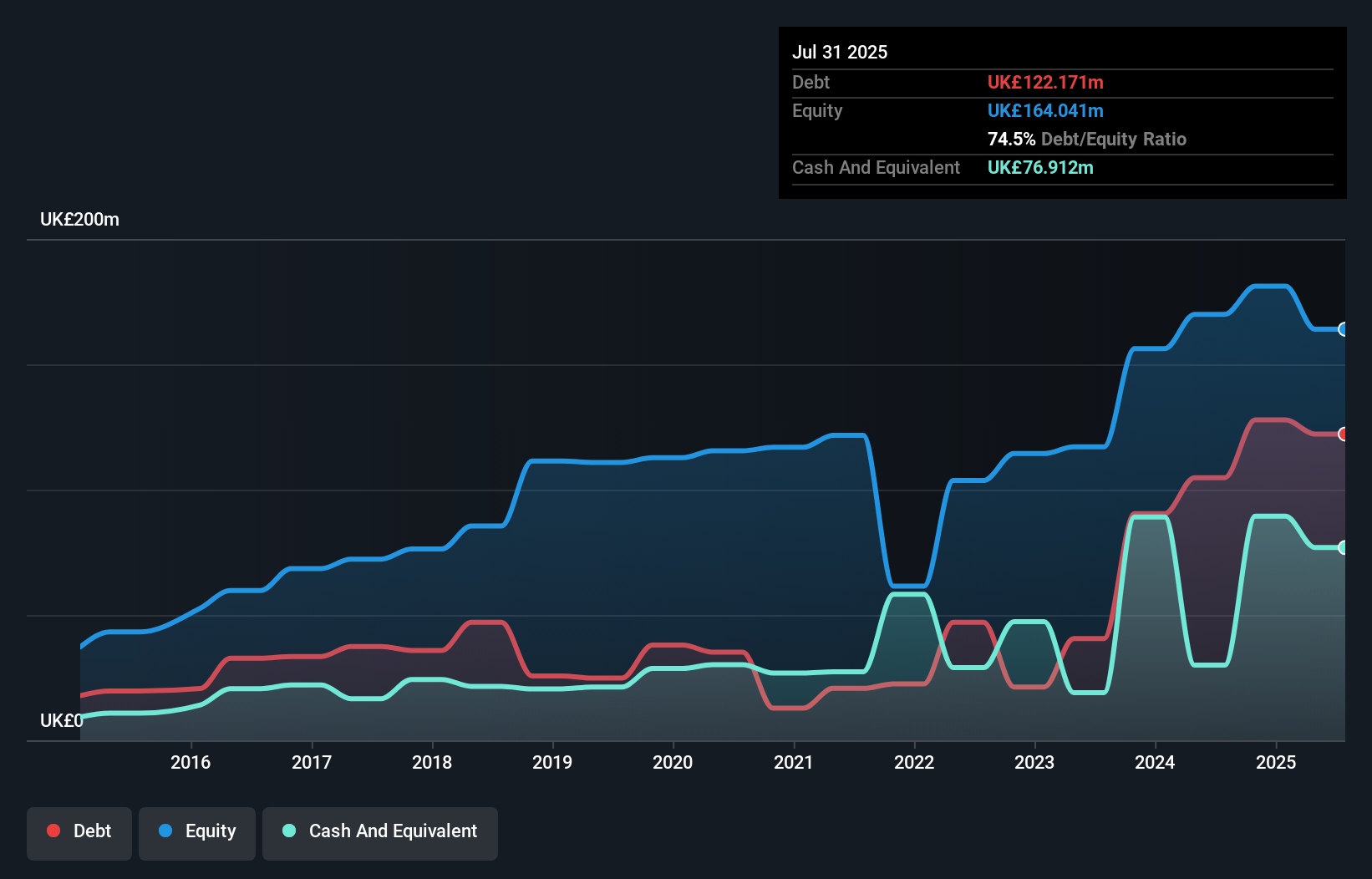

Next 15 Group, with a market cap of £385.89 million, presents mixed attributes for penny stock investors. The company trades significantly below its estimated fair value and has shown impressive earnings growth of 132% over the past year, surpassing industry averages. However, it carries a high net debt to equity ratio of 44%, which has increased over five years. While short-term assets exceed both short- and long-term liabilities, the dividend track record remains unstable. Analysts expect earnings to decline by an average of 8% annually over the next three years despite strong past performance and high return on equity at 36.7%.

- Take a closer look at Next 15 Group's potential here in our financial health report.

- Examine Next 15 Group's earnings growth report to understand how analysts expect it to perform.

Focusrite (AIM:TUNE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Focusrite plc develops, manufactures, and markets professional audio and electronic music products across North America, Europe, the Middle East, Africa, and other international regions with a market cap of £153.89 million.

Operations: The company's revenue is generated from various segments, including Focusrite (£60.28 million), Martin Audio (£47.71 million), ADAM Audio (£22.61 million), Novation (£16.26 million), Sequential (£9.71 million), and Sonnox (£1.97 million).

Market Cap: £153.89M

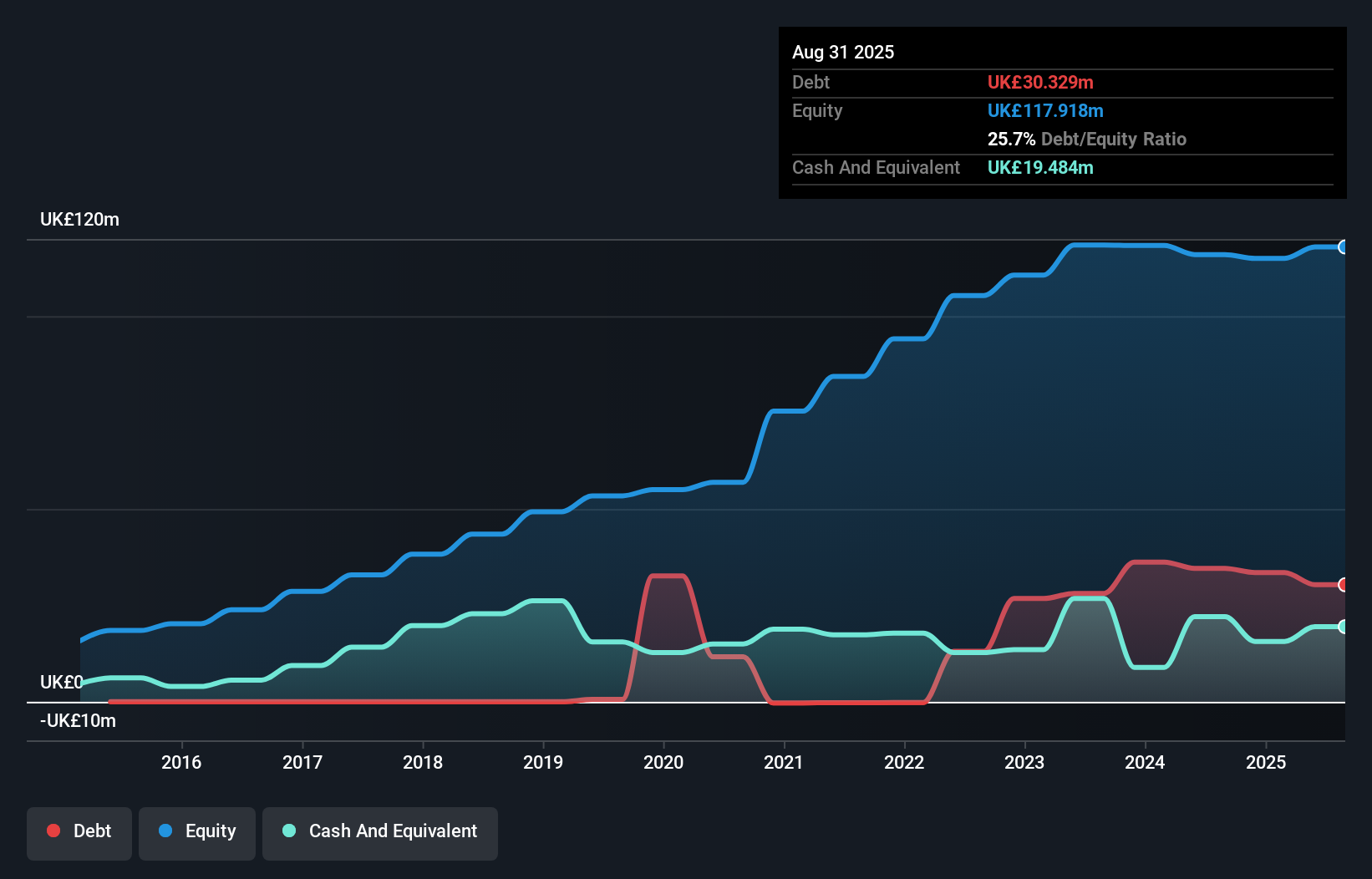

Focusrite plc, with a market cap of £153.89 million, offers a mixed outlook for penny stock investors. The company's short-term assets (£108.9M) comfortably cover both short- and long-term liabilities, indicating sound financial health in the near term. However, recent earnings have declined significantly to £2.61 million from £17.8 million the previous year, affecting profit margins and basic earnings per share (now £0.045). Despite stable weekly volatility at 5% and satisfactory net debt to equity ratio (10.8%), Focusrite's profitability challenges are underscored by large one-off losses and negative earnings growth over the past year (-85.4%).

- Dive into the specifics of Focusrite here with our thorough balance sheet health report.

- Understand Focusrite's earnings outlook by examining our growth report.

Seize The Opportunity

- Dive into all 471 of the UK Penny Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TUNE

Focusrite

Engages in the development, manufacturing, and marketing of professional audio and electronic music products in North America, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives