- United Kingdom

- /

- Medical Equipment

- /

- AIM:FORF

3 UK Penny Stocks Under £40M Market Cap

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Amidst these broader market fluctuations, investors may find opportunities in lesser-known areas such as penny stocks. Though the term "penny stocks" might seem outdated, it still represents an intriguing segment where smaller or newer companies can offer potential growth when backed by strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.905 | £470.9M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.09 | £776.24M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £178.85M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.932 | £148.21M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.81 | £417.98M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.44 | £82.58M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.88 | £367.99M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.05 | £87.29M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.08 | £148.39M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.435 | £181.48M | ★★★★★☆ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Deltic Energy (AIM:DELT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Deltic Energy Plc is a natural resources investing company focused on the exploration, evaluation, and development of gas and oil licenses in the Southern and Central North Sea, with a market cap of £4.65 million.

Operations: Deltic Energy Plc has not reported any revenue segments.

Market Cap: £4.65M

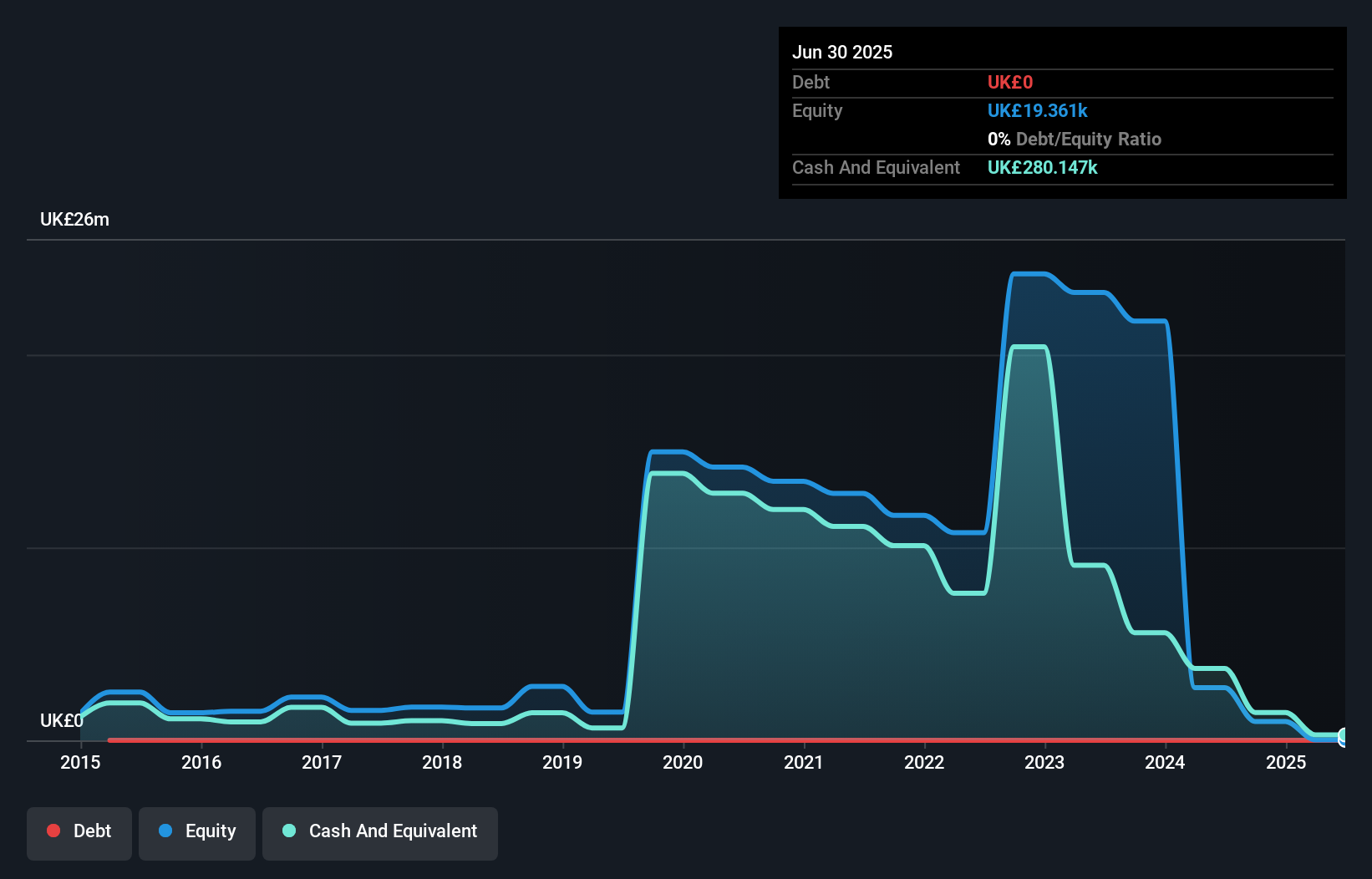

Deltic Energy, with a market cap of £4.65 million, is pre-revenue and focuses on gas exploration in the North Sea. Recent developments at the Selene prospect have been promising, confirming a significant gas discovery with updated estimates of 131 BCF recoverable resources. The company has no long-term liabilities and maintains sufficient short-term assets to cover its liabilities. However, it faces challenges such as high share price volatility and limited cash runway under a year if free cash flow trends continue. Despite these hurdles, Deltic's debt-free status and strategic partnerships might support future project development.

- Jump into the full analysis health report here for a deeper understanding of Deltic Energy.

- Assess Deltic Energy's future earnings estimates with our detailed growth reports.

MyHealthChecked (AIM:MHC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MyHealthChecked PLC develops, distributes, and commercializes at-home healthcare and wellness tests in the United Kingdom with a market cap of £9.99 million.

Operations: The company generates revenue of £9.39 million from its diagnostic healthcare products segment.

Market Cap: £9.99M

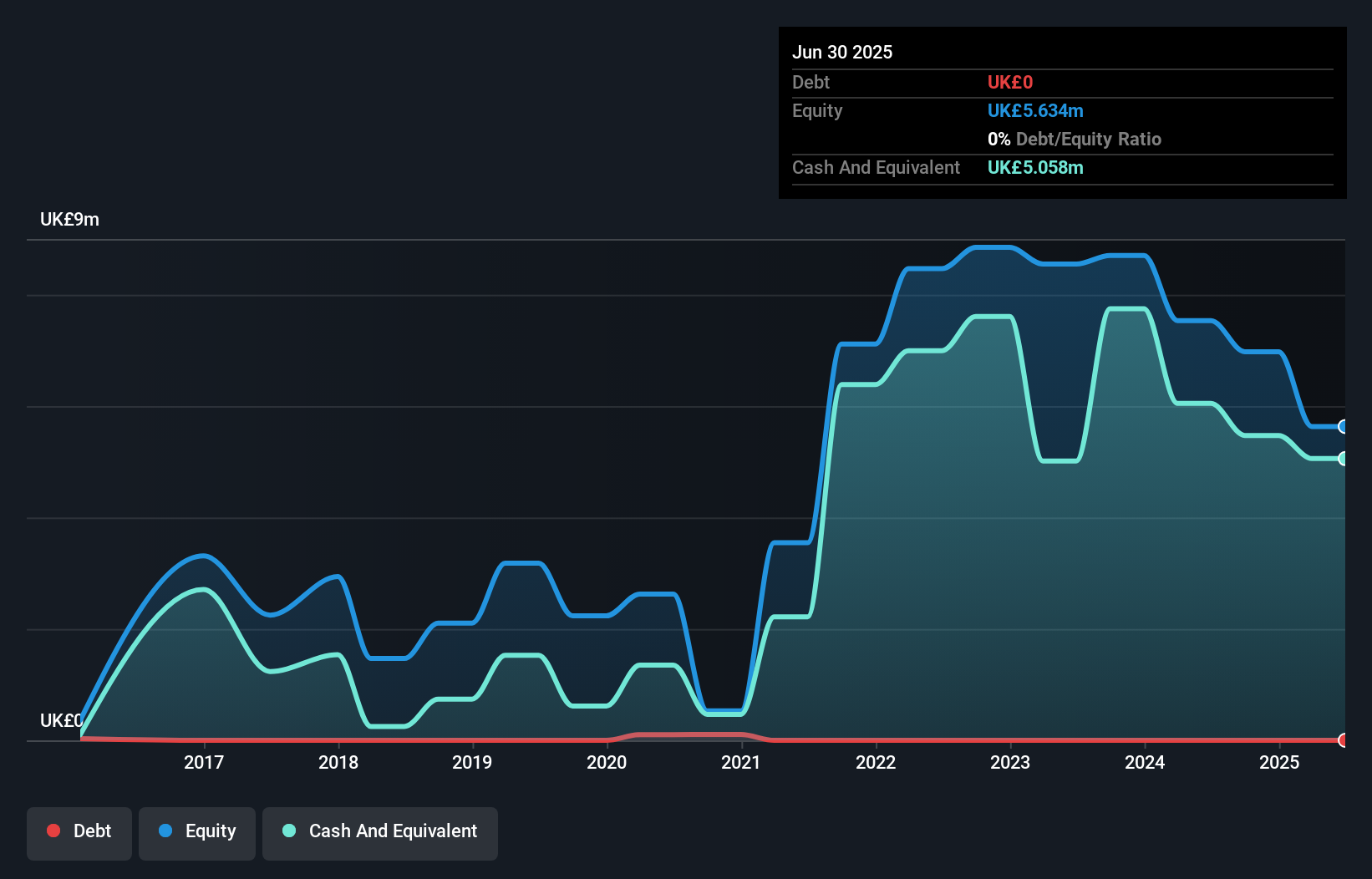

MyHealthChecked PLC, with a market cap of £9.99 million, is navigating the penny stock landscape by expanding its product offerings with newly registered phlebotomy test kits in the UK and EU. Despite being unprofitable, the company maintains a positive cash flow and has a stable cash runway exceeding three years. Its experienced management team and board bolster strategic decision-making. While short-term assets significantly cover liabilities, high share price volatility persists. The absence of debt provides financial flexibility as MyHealthChecked aims to commercialize its phlebotomy service in H1 2025, complementing existing at-home tests.

- Unlock comprehensive insights into our analysis of MyHealthChecked stock in this financial health report.

- Evaluate MyHealthChecked's historical performance by accessing our past performance report.

NAHL Group (AIM:NAH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NAHL Group Plc operates in the United Kingdom, offering products and services in the consumer legal services and catastrophic injury markets, with a market cap of £32.43 million.

Operations: The company generates revenue from two main segments: £15.37 million from Critical Care and £25.26 million from Consumer Legal Services.

Market Cap: £32.43M

NAHL Group Plc, with a market cap of £32.43 million, operates in the consumer legal services and catastrophic injury markets, generating significant revenue from these segments. The company's earnings have grown substantially by 172.9% over the past year, outpacing industry averages. Its debt is well managed with a net debt to equity ratio of 15.3%, and short-term assets exceed both short and long-term liabilities, indicating strong liquidity positions. However, recent guidance indicates an 8% decline in expected revenues for FY2024 due to reduced personal injury business income, aligning with market expectations but highlighting potential sector challenges.

- Click to explore a detailed breakdown of our findings in NAHL Group's financial health report.

- Gain insights into NAHL Group's outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Click here to access our complete index of 445 UK Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FORF

Fortis Frontier

Develops, distributes, and commercializes at-home healthcare and wellness tests in the United Kingdom.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)