The UK market has recently experienced volatility, with the FTSE 100 index closing lower amid concerns over weak trade data from China and its impact on global demand. In such a climate, investors may seek opportunities in smaller or less-established companies that can offer potential value. Penny stocks, though an older term, highlight these types of companies and can still present intriguing opportunities when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.615 | £516.68M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.175 | £175.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.405 | £43.82M | ✅ 4 ⚠️ 3 View Analysis > |

| Ingenta (AIM:ING) | £0.70 | £10.57M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.60 | $348.8M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.95 | £303.02M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.25 | £116.87M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.225 | £195.02M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.75 | £10.33M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.54 | £77.39M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Audioboom Group (AIM:BOOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Audioboom Group plc is a podcast company that operates a spoken-word audio platform for hosting, distributing, and monetizing content primarily in the United Kingdom and the United States, with a market cap of £89.86 million.

Operations: The company's revenue primarily comes from its Internet Software & Services segment, totaling $74.41 million.

Market Cap: £89.86M

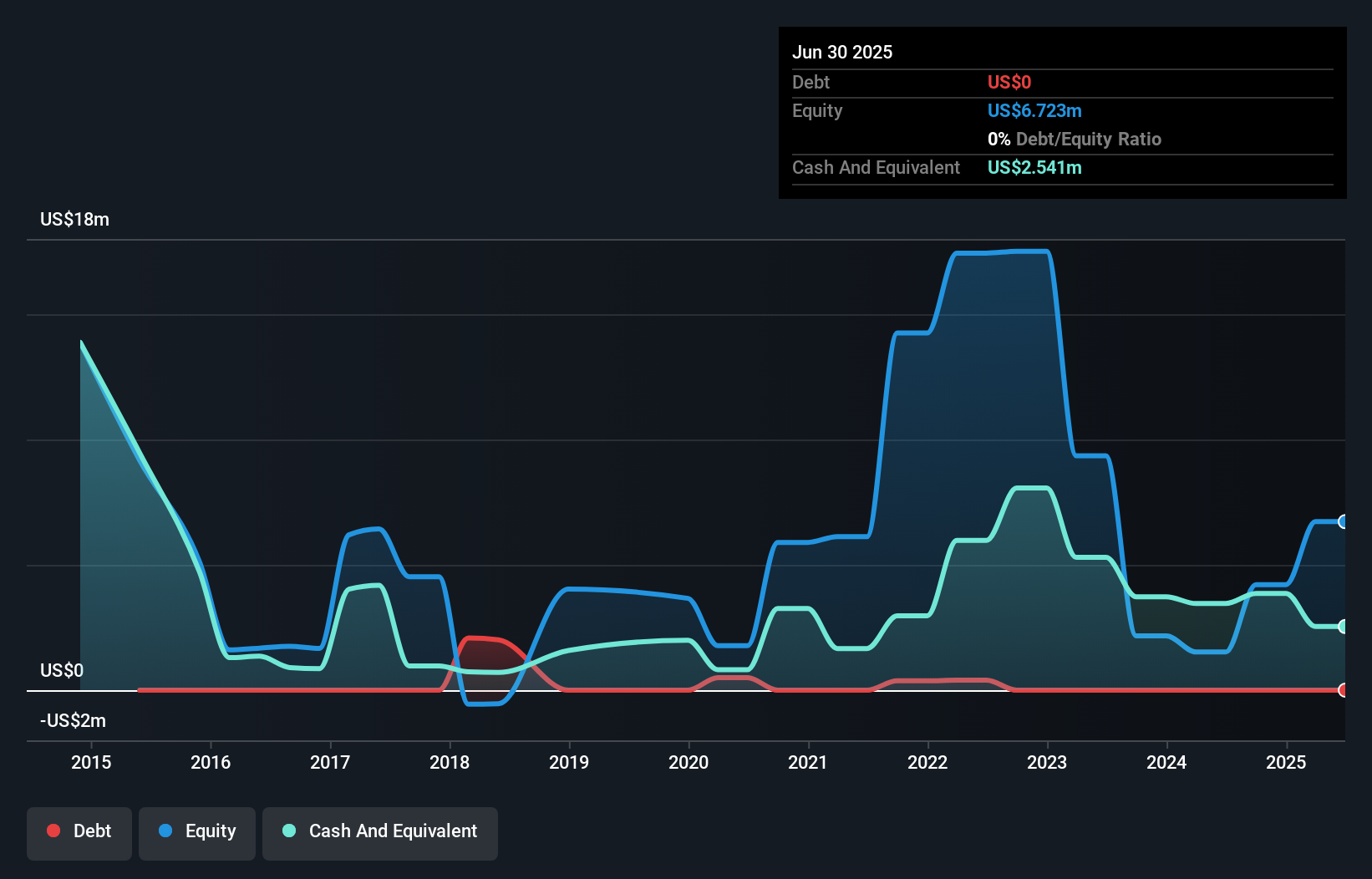

Audioboom Group has recently become profitable, reporting a net income of US$1.26 million for the first half of 2025, compared to a loss in the previous year. The company operates debt-free and boasts high-quality earnings with an outstanding return on equity of 52.5%. While its revenue is projected to grow by 14.91% annually, earnings are expected to decline slightly over the next three years. Despite stable weekly volatility and experienced management, Audioboom's share price remains highly volatile short-term but trades significantly below estimated fair value, presenting both opportunities and risks for investors in penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Audioboom Group.

- Understand Audioboom Group's earnings outlook by examining our growth report.

ECO Animal Health Group (AIM:EAH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ECO Animal Health Group plc, along with its subsidiaries, manufactures and supplies animal health products internationally and has a market cap of £55.56 million.

Operations: The company generates revenue from its Pharmaceuticals segment, which amounts to £79.60 million.

Market Cap: £55.56M

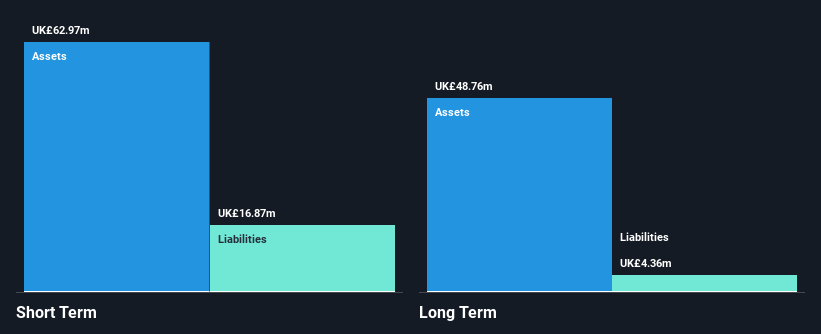

ECO Animal Health Group has demonstrated financial resilience with a market cap of £55.56 million and revenues of £79.6 million, despite a decline from the previous year. The company operates debt-free, enhancing its financial stability and reducing risk for investors in penny stocks. Earnings grew significantly by 60.9% over the past year, surpassing industry averages, although this was partly influenced by a large one-off gain of £954K. The company's net profit margin improved to 2.1%, supported by strong asset coverage against liabilities and an experienced management team with an average tenure of 3.4 years.

- Click here to discover the nuances of ECO Animal Health Group with our detailed analytical financial health report.

- Explore ECO Animal Health Group's analyst forecasts in our growth report.

City of London Investment Group (LSE:CLIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £194.67 million.

Operations: City of London Investment Group PLC has not reported any specific revenue segments.

Market Cap: £194.67M

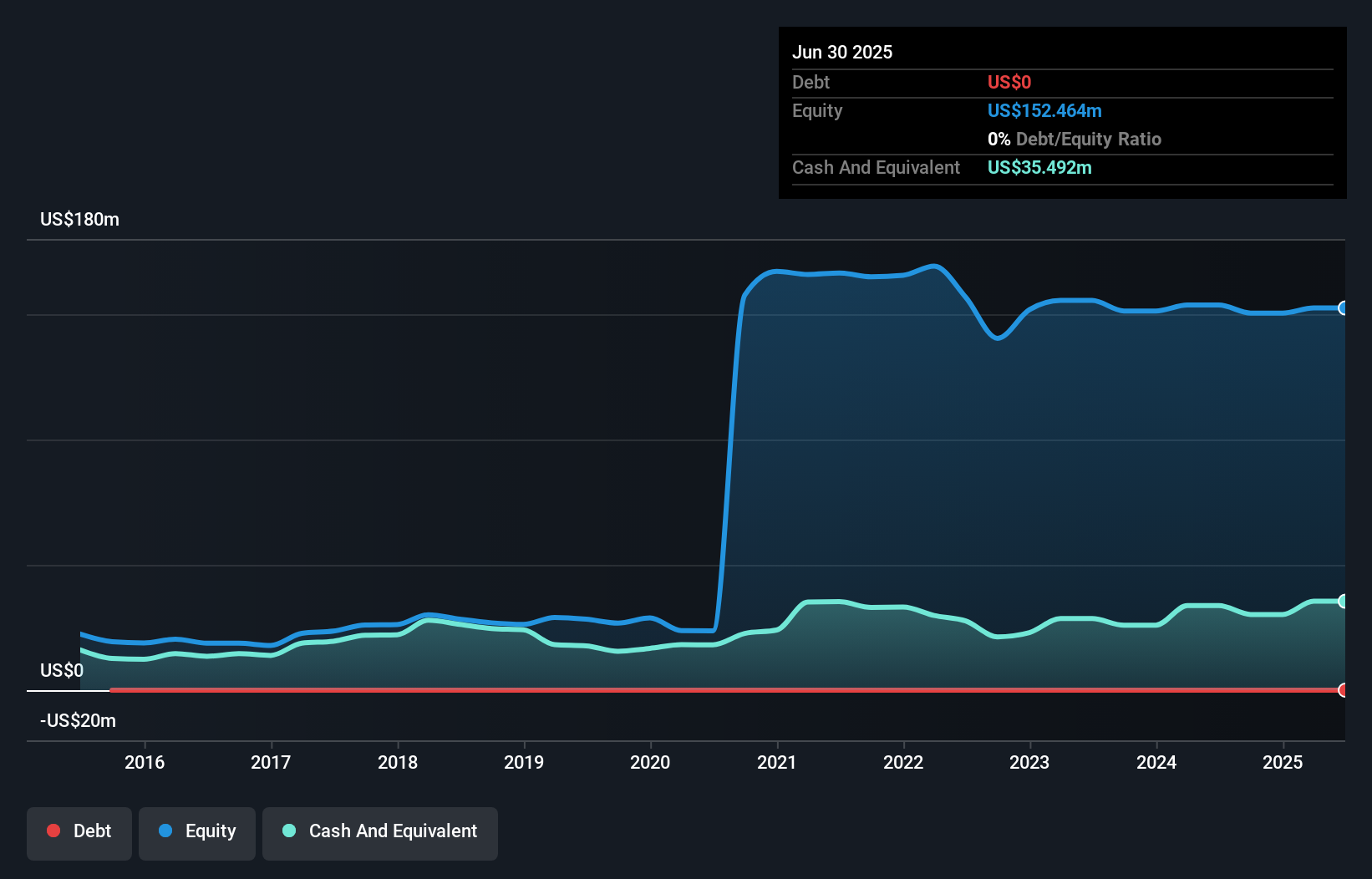

City of London Investment Group demonstrates financial stability with a market cap of £194.67 million and no debt, offering a solid foundation for investors in penny stocks. The company reported net income growth to US$19.68 million for the year ended June 2025, with earnings per share improving from the previous year. Its short-term assets exceed both short and long-term liabilities, indicating strong asset coverage. Despite having a low return on equity at 12.9%, its price-to-earnings ratio of 13.5x suggests it may be undervalued compared to the broader UK market average of 16.6x.

- Navigate through the intricacies of City of London Investment Group with our comprehensive balance sheet health report here.

- Gain insights into City of London Investment Group's past trends and performance with our report on the company's historical track record.

Next Steps

- Click this link to deep-dive into the 295 companies within our UK Penny Stocks screener.

- Ready For A Different Approach? This technology could replace computers: discover the 24 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BOOM

Audioboom Group

A podcast company, operates a spoken-word audio platform for hosting, distributing, and monetizing content primarily in the United Kingdom and the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives