- United Kingdom

- /

- Metals and Mining

- /

- AIM:AAZ

3 Promising UK Penny Stocks With At Least £70M Market Cap

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over China's economic recovery. In such a climate, investors may find value in exploring opportunities beyond the major indices. Penny stocks, despite their somewhat outdated moniker, represent smaller or newer companies that can offer surprising potential when built on solid financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.56 | £510.52M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.12 | £252.06M | ✅ 5 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.236 | £135.11M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.851 | £314.68M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.70 | £277.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.65 | £131.26M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.155 | £183.58M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.775 | £10.67M | ✅ 2 ⚠️ 3 View Analysis > |

| Samuel Heath & Sons (AIM:HSM) | £3.35 | £8.49M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 298 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Anglo Asian Mining (AIM:AAZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Anglo Asian Mining PLC, along with its subsidiaries, operates gold, silver, and copper producing properties in the Republic of Azerbaijan with a market cap of £194.38 million.

Operations: The company generates $39.59 million in revenue from its mining operations.

Market Cap: £194.38M

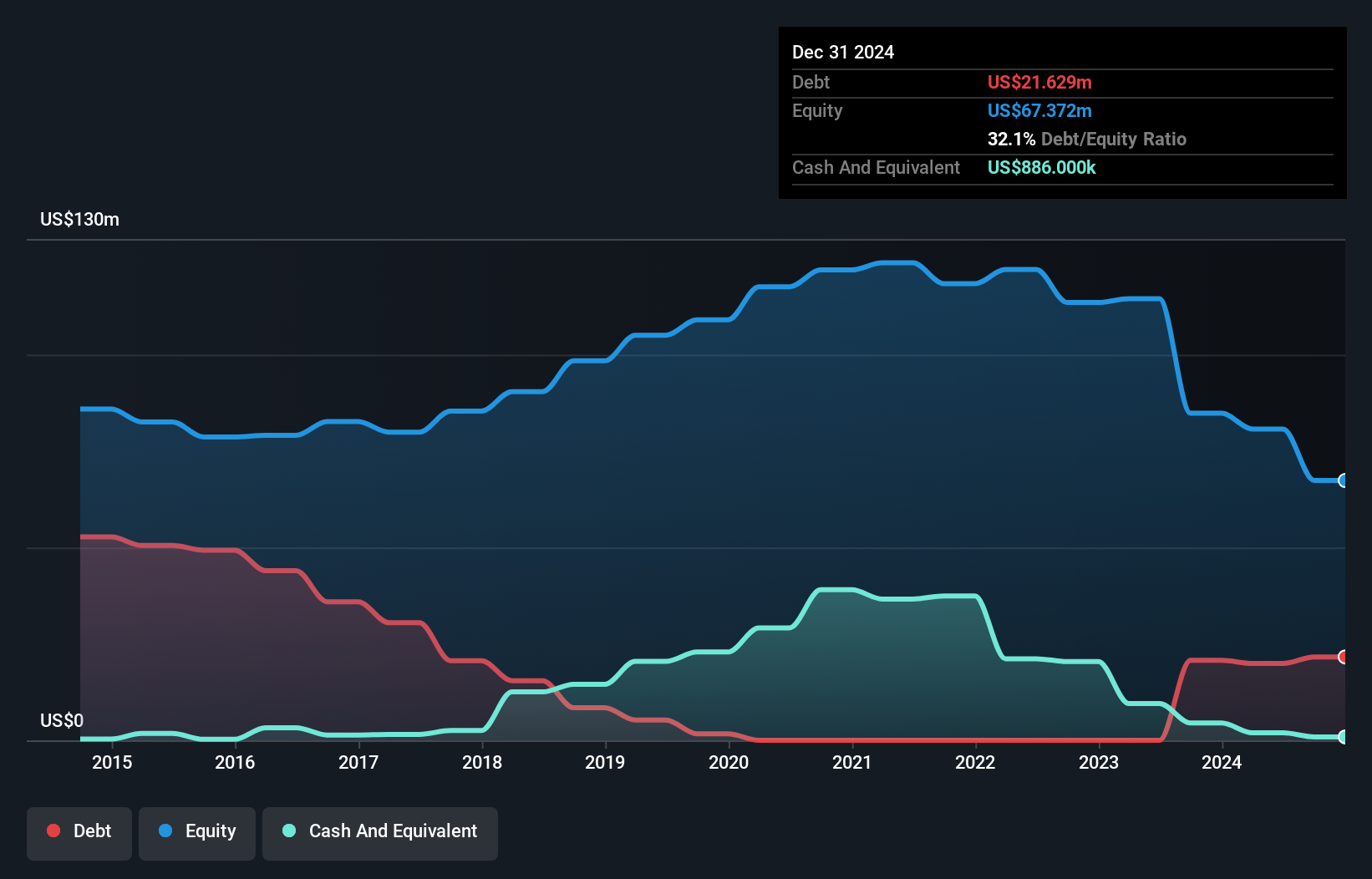

Anglo Asian Mining, with a market cap of £194.38 million and revenue of US$39.59 million, is navigating its unprofitable status by expanding its mining operations in Azerbaijan. The company has started commissioning the Demirli copper mine, expected to enhance production significantly from 2026 onwards. Despite increased debt levels over five years, Anglo Asian's short-term assets cover both short- and long-term liabilities. Recent production results show a marked increase in gold and copper output compared to last year, signaling potential growth as it transitions towards being a mid-tier copper producer with projects like the Gilar underground mine underway.

- Click to explore a detailed breakdown of our findings in Anglo Asian Mining's financial health report.

- Learn about Anglo Asian Mining's future growth trajectory here.

Audioboom Group (AIM:BOOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Audioboom Group plc is a podcast company that operates a spoken-word audio platform focused on hosting, distributing, and monetizing content mainly in the UK and US, with a market cap of £75.42 million.

Operations: The company generates revenue of $74.41 million from its Internet Software & Services segment.

Market Cap: £75.42M

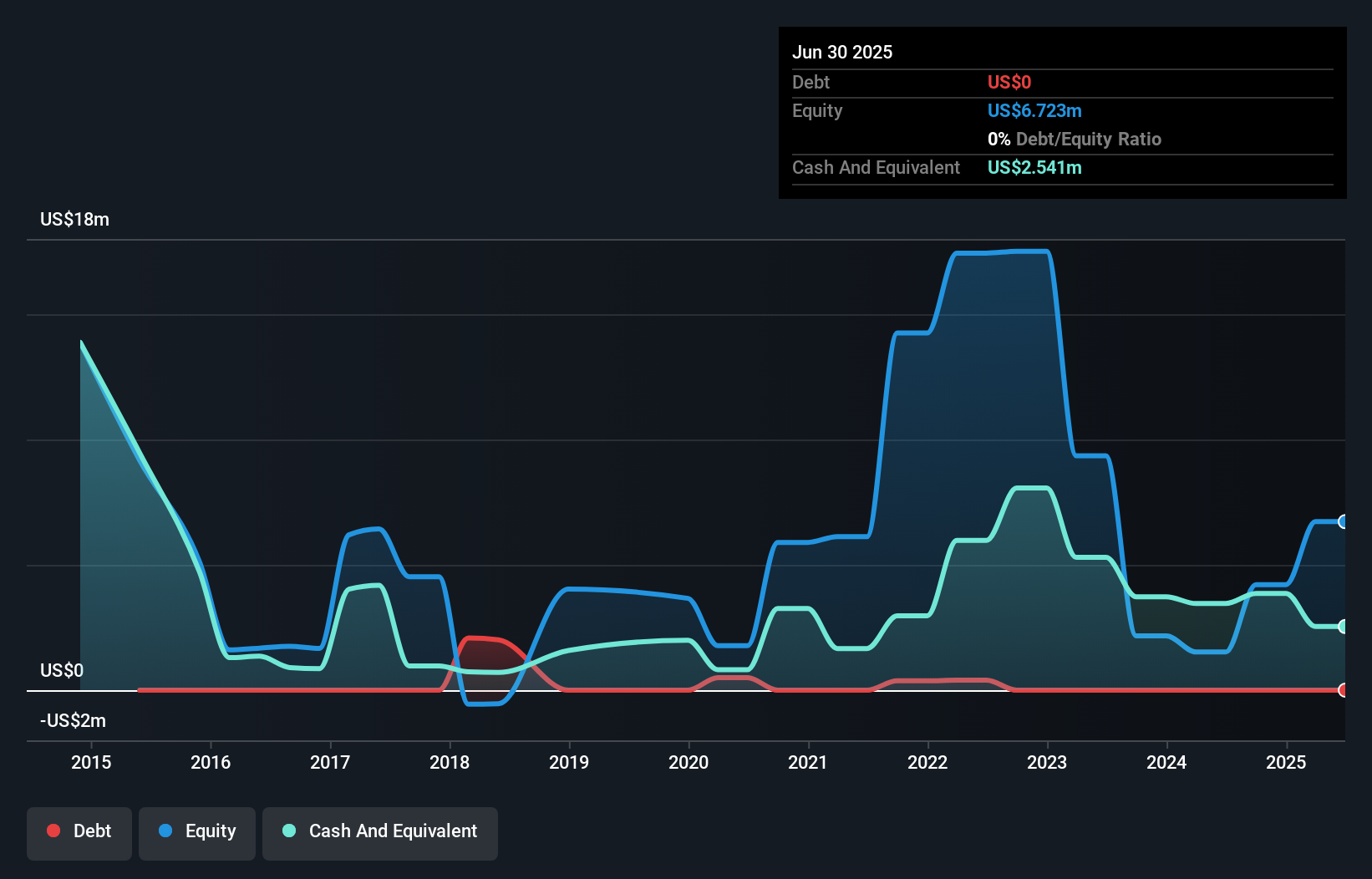

Audioboom Group, with a market cap of £75.42 million, has demonstrated financial progress by turning profitable over the past year. It reported H1 2025 sales of US$35.15 million and net income of US$1.26 million, reversing a previous loss. The company's debt-free status and strong asset coverage for liabilities highlight its solid balance sheet position. While trading significantly below estimated fair value, Audioboom's earnings are forecast to decline slightly in the coming years despite anticipated revenue growth of 15.79% annually. Recent equity offerings raised £3 million, indicating strategic capital management amidst high share price volatility.

- Jump into the full analysis health report here for a deeper understanding of Audioboom Group.

- Evaluate Audioboom Group's prospects by accessing our earnings growth report.

Griffin Mining (AIM:GFM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the exploration, development, and mining of mineral properties, with a market cap of £348.14 million.

Operations: The company's revenue is primarily derived from the Caijiaying Zinc Gold Mine, totaling $135.13 million.

Market Cap: £348.14M

Griffin Mining, with a market cap of £348.14 million, primarily generates revenue from the Caijiaying Zinc Gold Mine, reporting US$135.13 million in sales for 2024. Despite negative earnings growth and declining profit margins over the past year, Griffin remains debt-free with strong asset coverage for both short and long-term liabilities. The company has initiated a share buyback program worth $10 million to return excess funds to shareholders. Trading significantly below estimated fair value, Griffin's earnings are forecasted to grow by 25.6% annually despite recent volatility in production outputs and financial performance metrics like Return on Equity at 4.2%.

- Dive into the specifics of Griffin Mining here with our thorough balance sheet health report.

- Gain insights into Griffin Mining's future direction by reviewing our growth report.

Taking Advantage

- Unlock our comprehensive list of 298 UK Penny Stocks by clicking here.

- Interested In Other Possibilities? Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:AAZ

Anglo Asian Mining

Owns and operates gold, silver, and copper producing properties in the Republic of Azerbaijan.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives