- United Kingdom

- /

- Banks

- /

- LSE:TBCG

UK Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces challenges due to weak trade data from China, investors are paying close attention to how global economic conditions impact market performance. In this environment, growth companies with high insider ownership can be particularly appealing, as they often demonstrate strong alignment between management and shareholders, which may provide resilience in uncertain times.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 24.2% | 91.4% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 20.3% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 20% |

| Hochschild Mining (LSE:HOC) | 38.4% | 24.1% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.4% | 62.7% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 23.5% | 55.0% |

| ENGAGE XR Holdings (AIM:EXR) | 15.3% | 84.5% |

| Audioboom Group (AIM:BOOM) | 15.7% | 59.3% |

| AOTI (AIM:AOTI) | 11.1% | 70.3% |

| Anglo Asian Mining (AIM:AAZ) | 39.7% | 112.4% |

We're going to check out a few of the best picks from our screener tool.

Aston Martin Lagonda Global Holdings (LSE:AML)

Simply Wall St Growth Rating: ★★★★☆☆

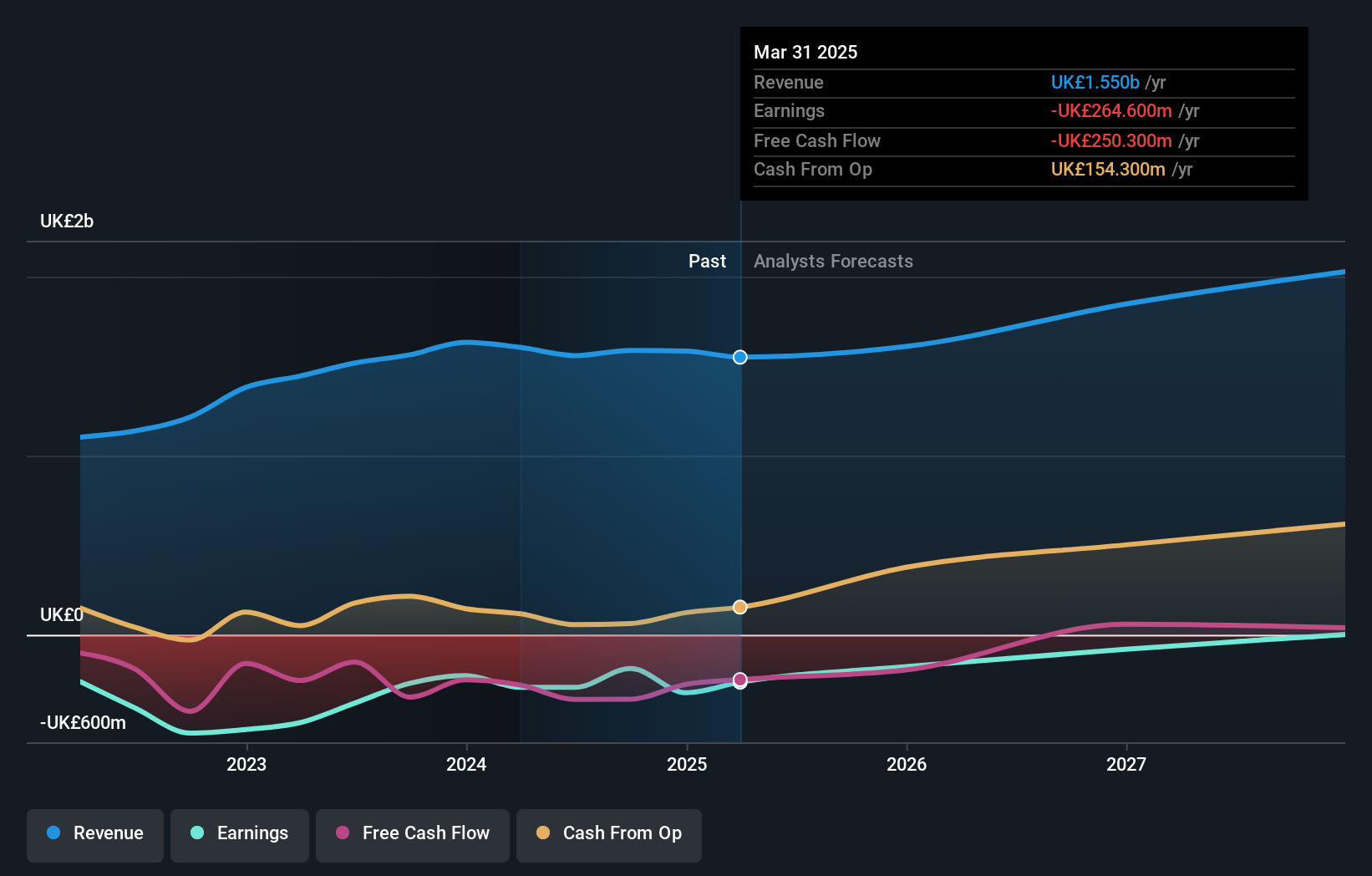

Overview: Aston Martin Lagonda Global Holdings plc designs, develops, manufactures, and markets luxury sports cars across various regions including the UK, Americas, Middle East, Africa, Europe, and Asia Pacific with a market cap of approximately £847.95 million.

Operations: The company generates revenue primarily from its automotive segment, amounting to £1.55 billion.

Insider Ownership: 31.7%

Earnings Growth Forecast: 71.5% p.a.

Aston Martin Lagonda Global Holdings shows potential as a growth company with high insider ownership. Despite recent shareholder dilution from a £52.5 million equity offering, the company is forecast to achieve revenue growth of 10.3% per year, outpacing the UK market average. Insiders have been net buyers recently, albeit in small volumes. While currently unprofitable, Aston Martin is expected to achieve profitability within three years, indicating strong future growth prospects despite current challenges in sales performance.

- Unlock comprehensive insights into our analysis of Aston Martin Lagonda Global Holdings stock in this growth report.

- In light of our recent valuation report, it seems possible that Aston Martin Lagonda Global Holdings is trading beyond its estimated value.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver across several countries including Peru, Argentina, the United Kingdom, Canada, Brazil, and Chile with a market cap of £1.40 billion.

Operations: The company's revenue segments include San Jose at $293.34 million, Mara Rosa at $149.82 million, Inmaculada at $504.34 million, and Pallancata at -$0.26 million.

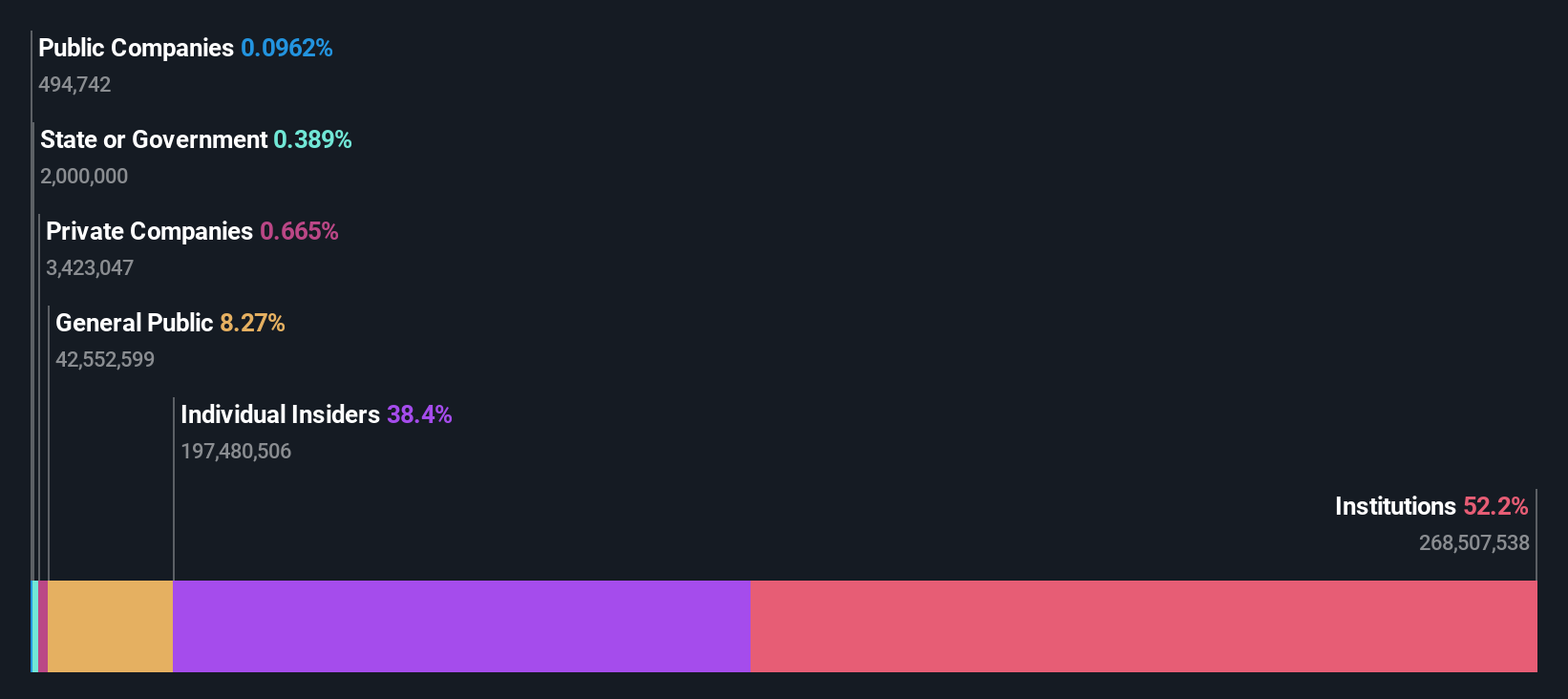

Insider Ownership: 38.4%

Earnings Growth Forecast: 24.1% p.a.

Hochschild Mining is experiencing significant growth potential with earnings forecasted to grow at 24.15% per year, outpacing the UK market average. Despite recent operational challenges at Mara Rosa impacting gold production and costs, the company remains profitable this year. Revenue is projected to increase by 8.4% annually, surpassing the market's pace. The stock trades significantly below its estimated fair value, suggesting potential upside as analysts predict a 23.4% price rise despite high share price volatility recently observed.

- Click to explore a detailed breakdown of our findings in Hochschild Mining's earnings growth report.

- Our comprehensive valuation report raises the possibility that Hochschild Mining is priced lower than what may be justified by its financials.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★★☆

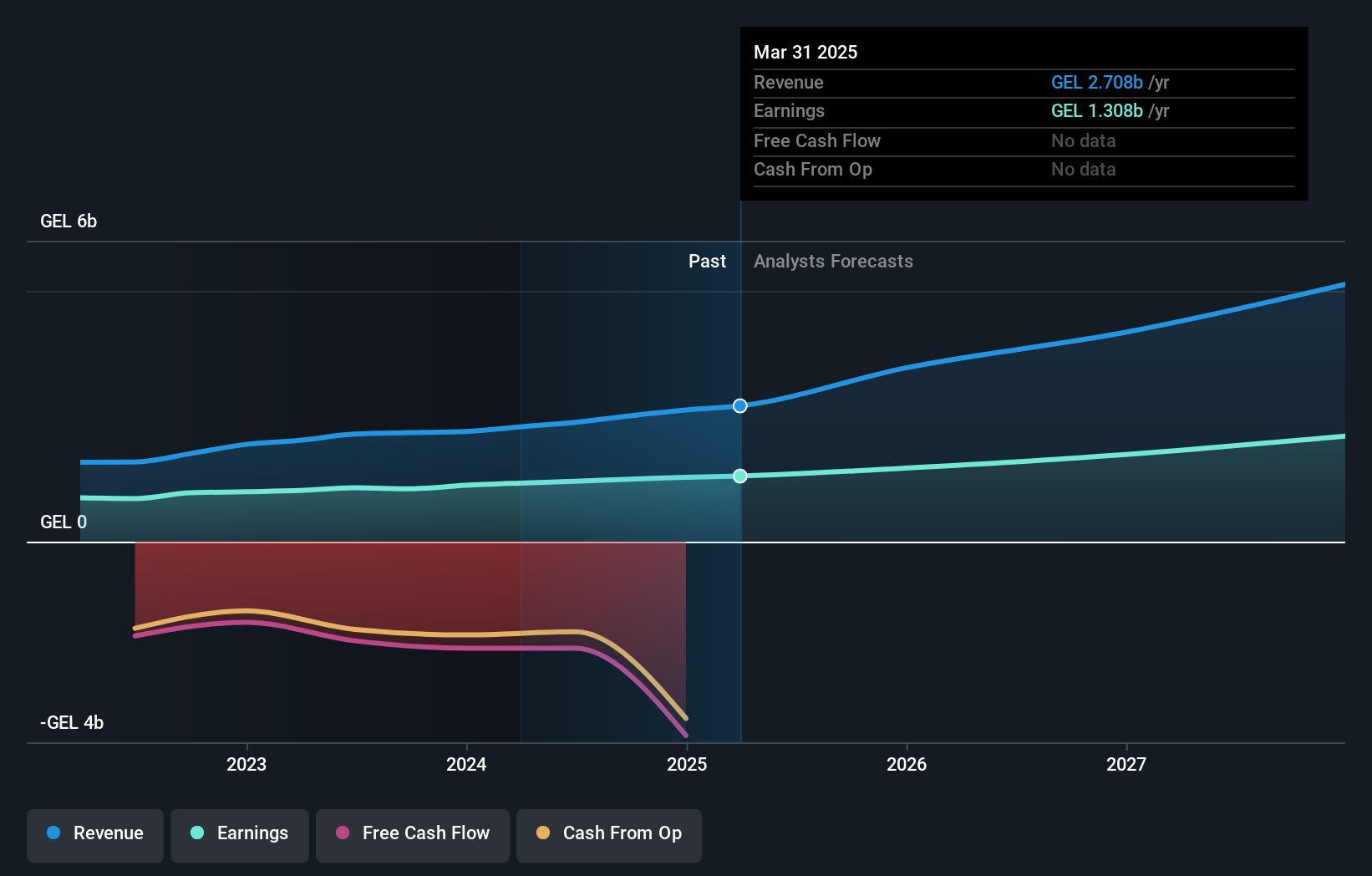

Overview: TBC Bank Group PLC, with a market cap of £2.67 billion, operates through its subsidiaries to offer banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan.

Operations: The company's revenue segments include Georgian Financial Services, which generated GEL 2.34 billion.

Insider Ownership: 17.6%

Earnings Growth Forecast: 17.2% p.a.

TBC Bank Group is experiencing robust growth, with revenue expected to rise 22.2% annually, outpacing the UK market. Earnings are forecasted to grow at 17.2% per year, surpassing market averages. The stock trades at a significant discount to its estimated fair value, indicating potential upside despite high levels of bad loans (2.5%) and low allowance for them (69%). Recent earnings showed increased net income and interest income compared to last year’s figures.

- Take a closer look at TBC Bank Group's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that TBC Bank Group is trading behind its estimated value.

Key Takeaways

- Click here to access our complete index of 59 Fast Growing UK Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if TBC Bank Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TBCG

TBC Bank Group

Through its subsidiaries, provides banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives