- United Kingdom

- /

- Banks

- /

- LSE:TBCG

UK Growth Stocks Insiders Are Backing: 3 Top Picks

Reviewed by Simply Wall St

In the current climate, the UK market is experiencing some turbulence, with the FTSE 100 and FTSE 250 indices facing downward pressure amid weak trade data from China. This environment highlights the importance of identifying growth companies that insiders are backing, as high insider ownership can signal confidence in a company's potential to thrive despite broader economic challenges.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 28.2% |

| Judges Scientific (AIM:JDG) | 10.6% | 23% |

| Enteq Technologies (AIM:NTQ) | 20% | 53.8% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| Foresight Group Holdings (LSE:FSG) | 31.9% | 29.0% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 81.3% |

| Beeks Financial Cloud Group (AIM:BKS) | 32.7% | 36.9% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

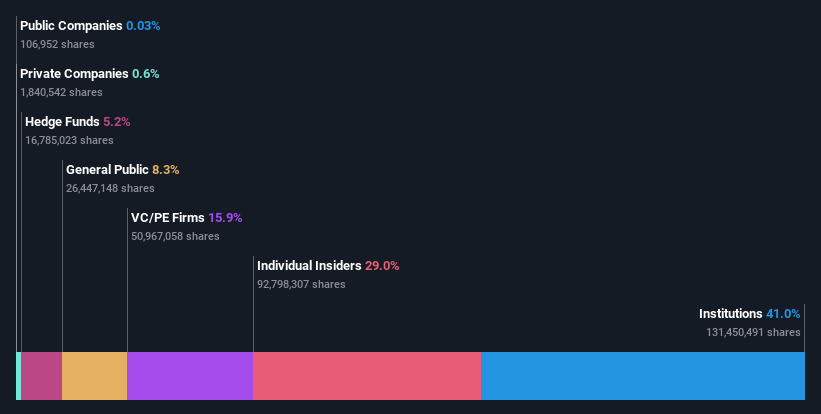

Brickability Group (AIM:BRCK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brickability Group Plc, along with its subsidiaries, operates in the United Kingdom by supplying, distributing, and importing building products, with a market cap of £194.60 million.

Operations: The company's revenue is primarily derived from its Bricks and Building Materials segment at £403.25 million, followed by Importing at £94.77 million, Distribution at £62.72 million, and Contracting at £58.17 million.

Insider Ownership: 28.9%

Brickability Group's earnings are forecast to grow significantly at 34.6% per year, outperforming the UK market's expected growth of 14%. Despite trading at a good value and having more insider buying than selling recently, the company faces challenges with declining profit margins and revenue down from £681.09 million to £594.08 million last year. The unstable dividend track record and low future return on equity forecast may raise concerns for some investors.

- Click here to discover the nuances of Brickability Group with our detailed analytical future growth report.

- According our valuation report, there's an indication that Brickability Group's share price might be on the cheaper side.

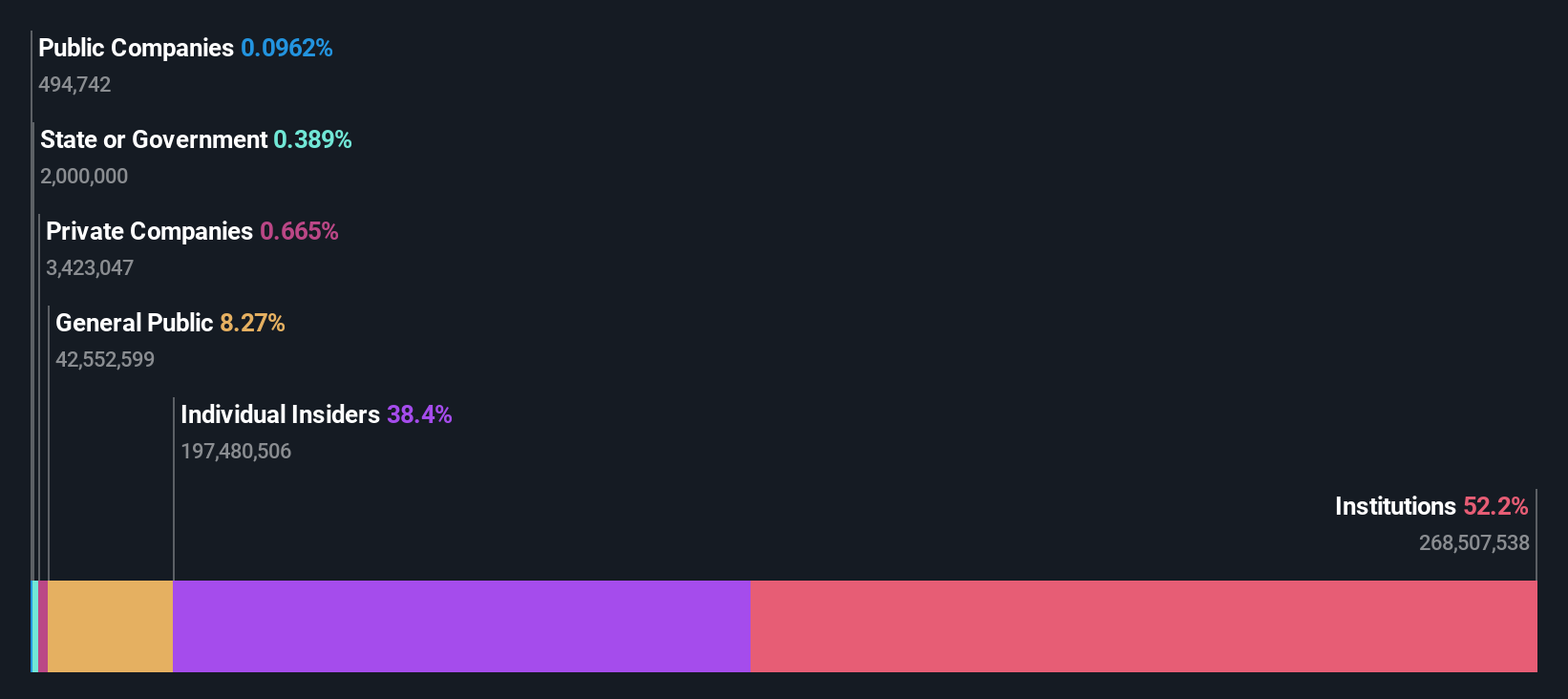

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £1.05 billion.

Operations: The company's revenue segments include $266.70 million from San Jose and $451.91 million from Inmaculada.

Insider Ownership: 38.4%

Hochschild Mining's earnings are forecast to grow significantly at 49.8% annually, outpacing the UK market's 14% growth rate. Despite a high debt level and volatile share price, the company has become profitable this year with net income of US$39.52 million for H1 2024, reversing a previous loss. Trading at a significant discount to estimated fair value, its revenue is expected to grow faster than the market average but remains below high-growth benchmarks.

- Delve into the full analysis future growth report here for a deeper understanding of Hochschild Mining.

- Our valuation report unveils the possibility Hochschild Mining's shares may be trading at a premium.

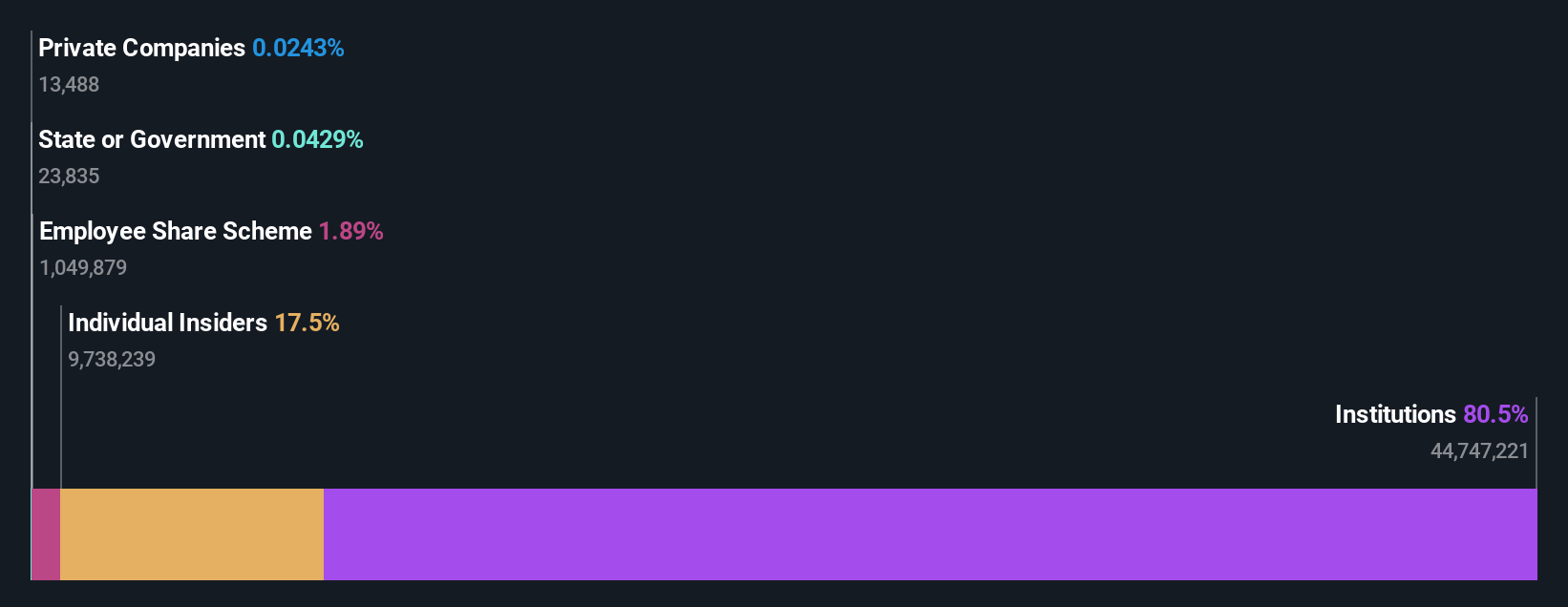

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates through its subsidiaries to offer banking, leasing, insurance, brokerage, and card processing services to both corporate and individual clients in Georgia, Azerbaijan, and Uzbekistan with a market cap of £1.49 billion.

Operations: The company's revenue segments include GEL 2.13 billion from Segment Adjustment and GEL 236.42 million from Uzbekistan Operations.

Insider Ownership: 17.6%

TBC Bank Group is trading at 53.7% below its estimated fair value and shows strong growth potential, with revenue projected to grow at 18.9% annually, surpassing the UK market's average. Despite a low allowance for bad loans and an unstable dividend history, earnings are forecast to grow faster than the market at 15.3% per year. Recent executive changes include Giorgi Giguashvili as Company Secretary, enhancing corporate governance expertise within the firm.

- Click here and access our complete growth analysis report to understand the dynamics of TBC Bank Group.

- Our valuation report unveils the possibility TBC Bank Group's shares may be trading at a discount.

Make It Happen

- Navigate through the entire inventory of 63 Fast Growing UK Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if TBC Bank Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TBCG

TBC Bank Group

Through its subsidiaries, provides banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan.

High growth potential, good value and pays a dividend.