- United Kingdom

- /

- Capital Markets

- /

- AIM:MERC

UK Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting concerns over global economic recovery. Despite these broader market uncertainties, penny stocks remain an intriguing area for investors seeking growth opportunities at lower price points. Though often associated with smaller or newer companies, these stocks can offer significant potential when backed by strong financials and clear growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.24 | £307.58M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.25 | £343.35M | ✅ 4 ⚠️ 3 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.768 | £1.1B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.44 | £47.61M | ✅ 5 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.345 | $200.56M | ✅ 4 ⚠️ 0 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.858 | £317.27M | ✅ 4 ⚠️ 3 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.70 | £133.06M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.09 | £173.89M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.845 | £11.63M | ✅ 4 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.20 | £68.23M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Mercia Asset Management (AIM:MERC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mercia Asset Management PLC is a private equity and venture capital firm focusing on various investment stages including incubation, seed EIS, early stage, emerging growth, mid venture, late stage and growth capital investments with a market cap of £142.38 million.

Operations: Mercia Asset Management PLC has not reported any specific revenue segments.

Market Cap: £142.38M

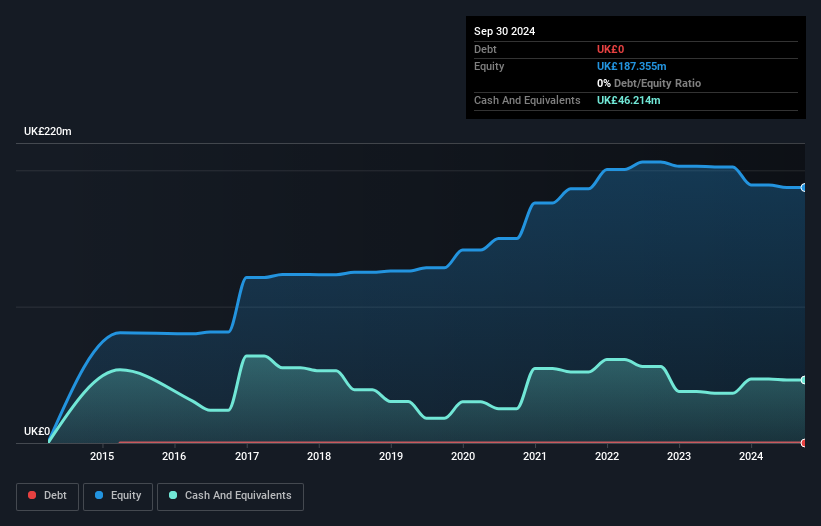

Mercia Asset Management has shown resilience by becoming profitable and reporting a net income of £3.46 million for the year ended March 31, 2025, compared to a loss previously. The company is debt-free, with strong short-term assets exceeding liabilities, and plans to leverage its balance sheet for acquisitions without raising external funds. A share buyback program worth £3 million aims to reduce capital and return value to shareholders, financed from existing resources. Despite low return on equity at 1.8%, the seasoned management team underpins strategic growth initiatives including a progressive dividend policy with an increase proposed for the year.

- Click here and access our complete financial health analysis report to understand the dynamics of Mercia Asset Management.

- Explore Mercia Asset Management's analyst forecasts in our growth report.

Cobra Resources (LSE:COBR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cobra Resources plc is involved in the exploration, development, and mining of precious and base metal projects in the United Kingdom and Australia, with a market cap of £16.38 million.

Operations: No revenue segments are reported for the company.

Market Cap: £16.38M

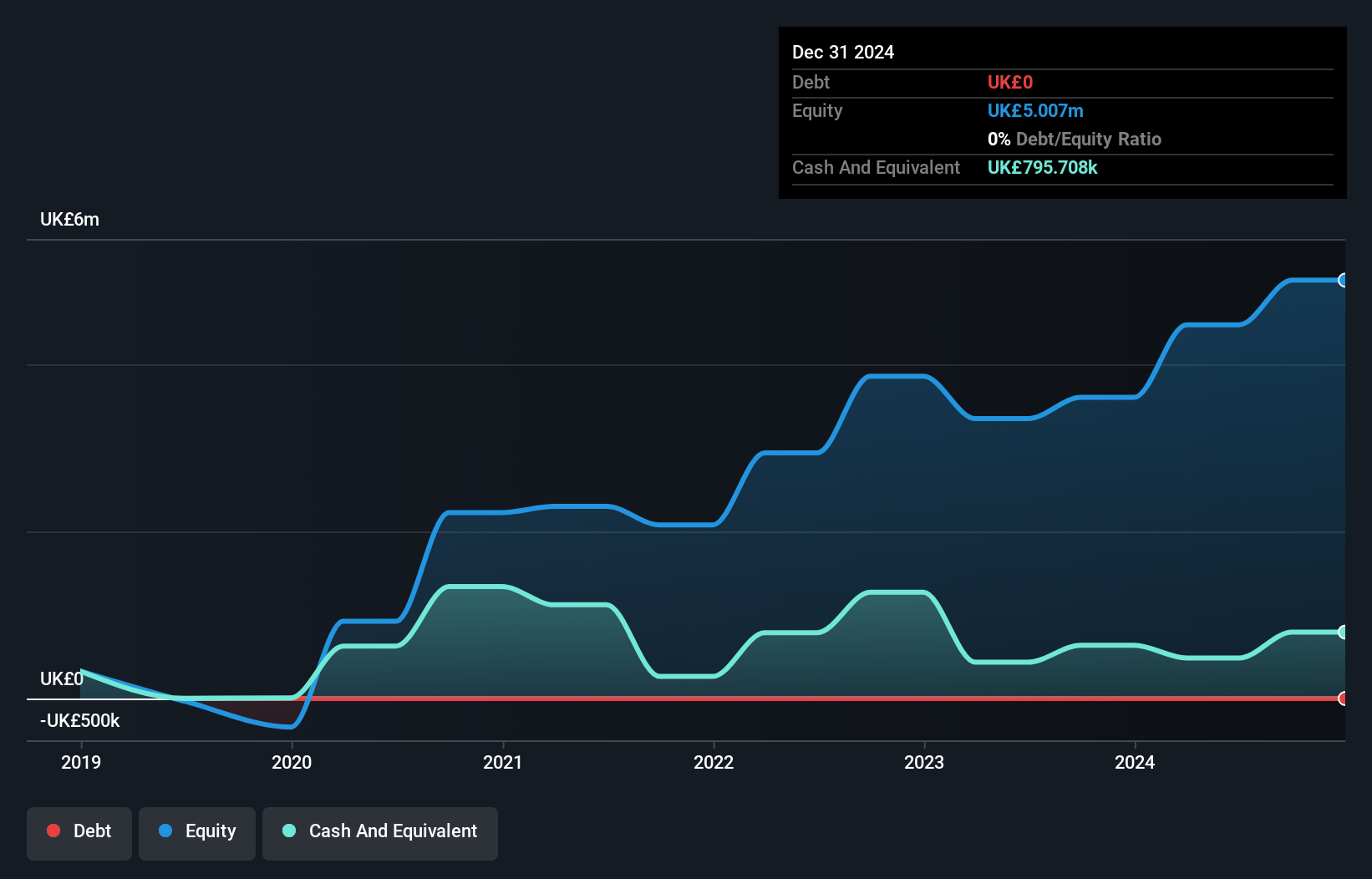

Cobra Resources plc, with a market cap of £16.38 million, remains pre-revenue as it focuses on advancing its Boland Project in Australia. Recent exploration updates highlight the company's strategic acquisition of new tenements, expanding its palaeochannel landholding to 3,365 km². The project aims for low-cost in situ recovery (ISR) mining of rare earth elements (REEs), with promising sonic core drilling results expected soon. However, financial challenges persist as auditors express doubts about Cobra's ability to continue as a going concern. Despite no debt and reduced losses over five years, Cobra faces high volatility and limited cash runway under one year.

- Dive into the specifics of Cobra Resources here with our thorough balance sheet health report.

- Learn about Cobra Resources' historical performance here.

Funding Circle Holdings (LSE:FCH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Funding Circle Holdings plc operates online lending platforms in the United Kingdom and internationally, with a market capitalization of £392.91 million.

Operations: The company generates revenue through its FlexiPay service (£17.5 million) and Term Loans (£142.6 million) in the UK.

Market Cap: £392.91M

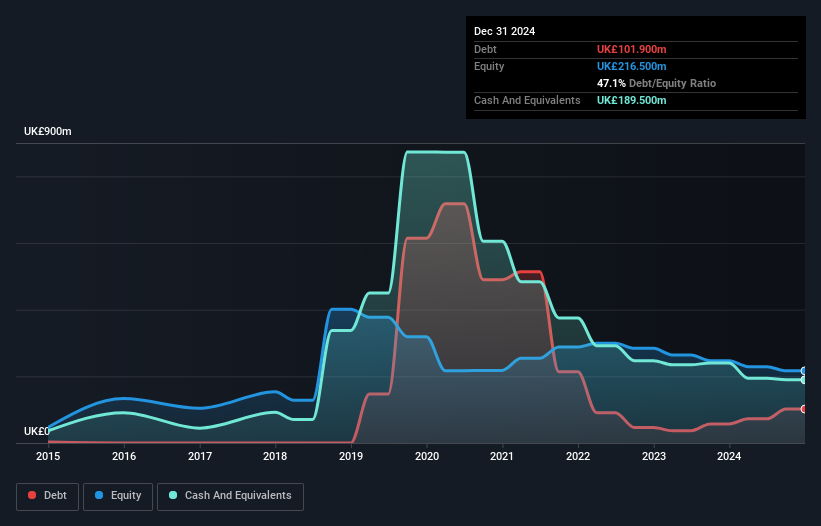

Funding Circle Holdings, with a market cap of £392.91 million, has shown significant financial developments recently. The company has become profitable this year and forecasts suggest earnings growth of 67.89% annually. Despite a low return on equity at 0.1%, its debt levels have improved significantly over five years, and it possesses more cash than total debt, although operating cash flow remains negative. Recent strategic moves include a share repurchase program worth £25 million and leadership changes with Maeve Byrne appointed as Chair Designate of the Audit Committee, bringing extensive financial services experience to the board.

- Jump into the full analysis health report here for a deeper understanding of Funding Circle Holdings.

- Gain insights into Funding Circle Holdings' outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Reveal the 295 hidden gems among our UK Penny Stocks screener with a single click here.

- Searching for a Fresh Perspective? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MERC

Mercia Asset Management

A private equity and venture capital firm specializing in incubation, venture debt, loan, mezzanine, seed EIS, early stage, emerging growth, mid venture, late venture, later stage, buyout, and growth capital investments.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives