- United Kingdom

- /

- Medical Equipment

- /

- AIM:SPEC

UK Penny Stocks To Consider In November 2024

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies. Despite these broader market pressures, penny stocks remain an intriguing area for investors seeking potential growth opportunities at lower price points. While the term "penny stock" might seem antiquated, these smaller or newer companies can still offer significant value when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| FRP Advisory Group (AIM:FRP) | £1.47 | £347M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.895 | £476.63M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.18 | £840.18M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.94 | £397.82M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £4.20 | £193.46M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.55 | £191.24M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.334 | £208.83M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.50 | £188.48M | ★★★★★☆ |

| Serabi Gold (AIM:SRB) | £0.91 | £70.81M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.35 | £110.77M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Character Group (AIM:CCT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Character Group plc is involved in the design, development, manufacturing, and distribution of toys, games, and gifts across the United Kingdom, Scandinavia, the Far East, and internationally with a market cap of £51.44 million.

Operations: The company generates revenue of £122.32 million from the design, development, and international distribution of toys, games, and gifts.

Market Cap: £51.44M

Character Group, with a market cap of £51.44 million, has demonstrated significant earnings growth of 41% over the past year, surpassing the Leisure industry average. Its debt is well-covered by operating cash flow and has reduced significantly over five years. The company maintains high-quality earnings and stable weekly volatility at 4%. Despite a low return on equity of 14.1%, Character Group's short-term assets effectively cover both short- and long-term liabilities. However, its dividend track record remains unstable despite trading well below estimated fair value, suggesting potential for cautious optimism among investors interested in penny stocks.

- Click here to discover the nuances of Character Group with our detailed analytical financial health report.

- Evaluate Character Group's historical performance by accessing our past performance report.

Eagle Eye Solutions Group (AIM:EYE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eagle Eye Solutions Group plc offers marketing technology software as a service (SaaS) solutions across the United Kingdom, the United States, Canada, Australia, Europe, and the Asia Pacific with a market capitalization of £138.59 million.

Operations: The company's revenue is generated from its Eagleai segment, contributing £4.42 million, and its Organic segment, which accounts for £43.31 million.

Market Cap: £138.59M

Eagle Eye Solutions Group, with a market cap of £138.59 million, has shown impressive earnings growth of 382.7% over the past year and maintains high-quality earnings. Its revenue increased to £47.73 million for the year ending June 2024, driven by its EagleAI segment and new contracts like E.Leclerc's adoption of its AI-powered 'Personalised Flyer'. The company's debt is well-covered by operating cash flow, and it holds more cash than total debt. Despite a low return on equity at 16.8%, Eagle Eye's seasoned management and board contribute to its strategic positioning in expanding digital marketing solutions globally.

- Get an in-depth perspective on Eagle Eye Solutions Group's performance by reading our balance sheet health report here.

- Understand Eagle Eye Solutions Group's earnings outlook by examining our growth report.

INSPECS Group (AIM:SPEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: INSPECS Group plc is a company that designs, produces, sells, markets, and distributes fashion eyewear, lenses, and OEM products globally with a market cap of £58.97 million.

Operations: The company's revenue is primarily derived from Frames and Optics (£174.94 million), with additional income from Manufacturing (£21.12 million) and Lenses (£4.92 million).

Market Cap: £58.97M

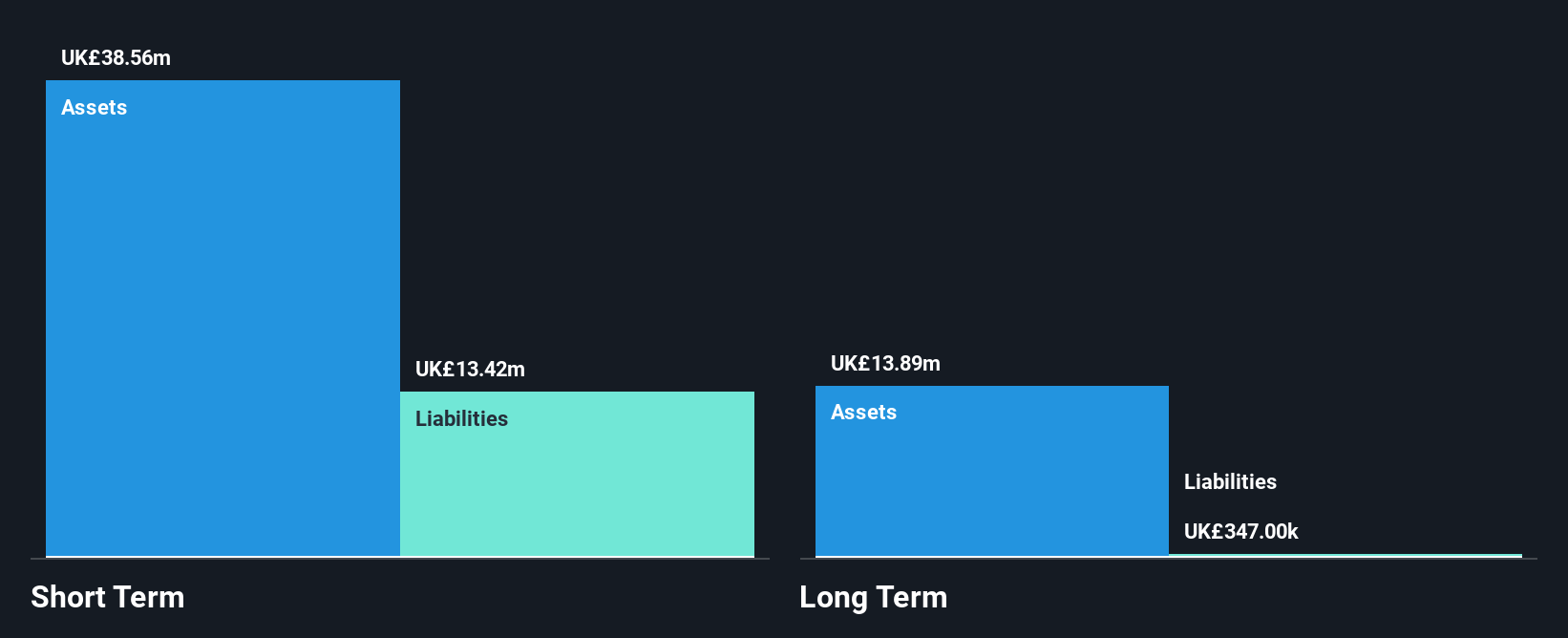

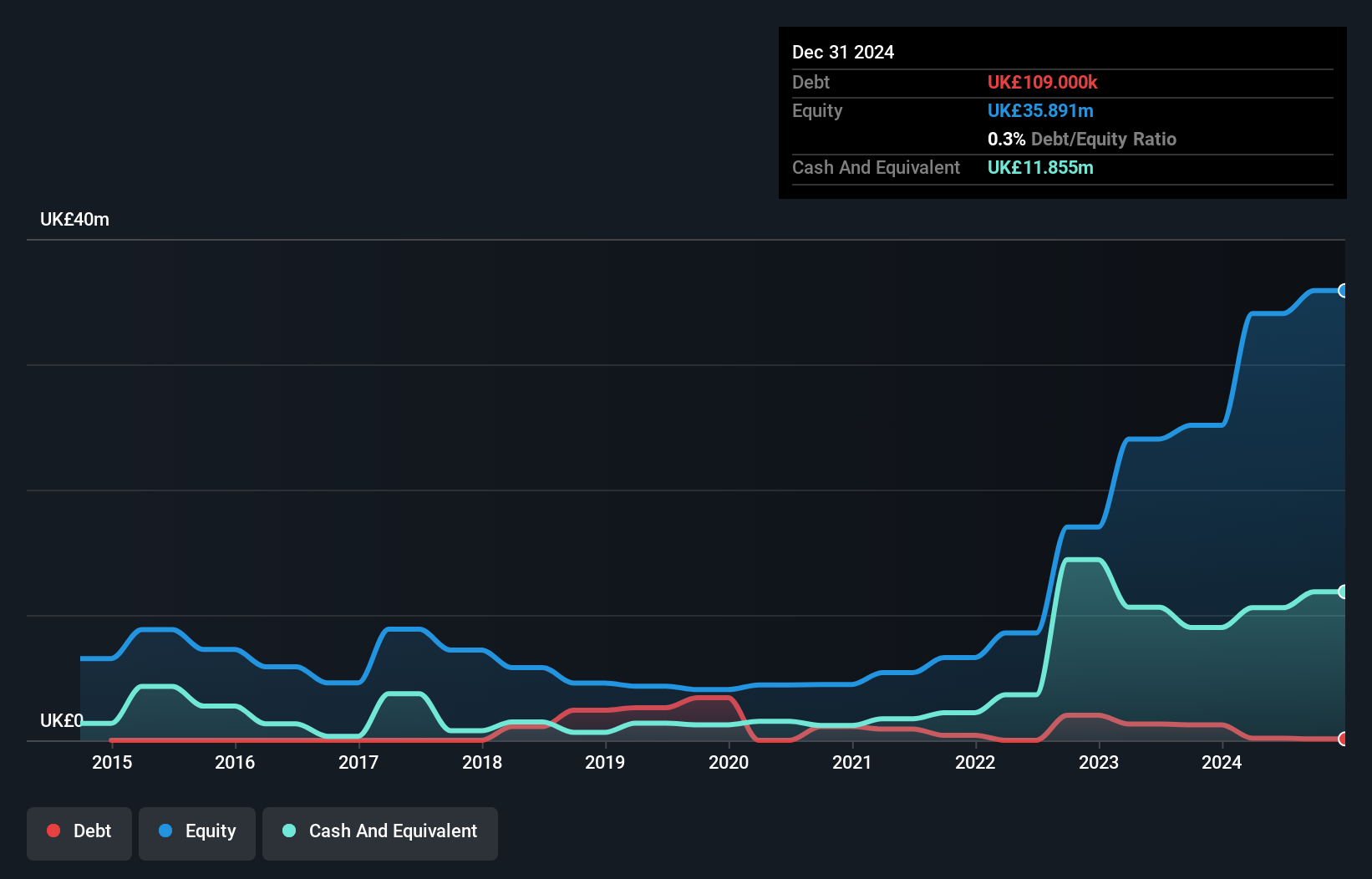

INSPECS Group plc, with a market cap of £58.97 million, reported half-year sales of £103.05 million but incurred a net loss of £1.03 million, reflecting challenges in profitability despite revenue generation primarily from Frames and Optics. The company trades at 61.1% below its estimated fair value and maintains a satisfactory net debt to equity ratio of 19.4%, with short-term assets exceeding both short-term and long-term liabilities, indicating financial stability amidst losses. INSPECS benefits from an experienced management team and board while having sufficient cash runway for over three years due to positive free cash flow trends despite increasing losses over the past five years.

- Click here and access our complete financial health analysis report to understand the dynamics of INSPECS Group.

- Gain insights into INSPECS Group's future direction by reviewing our growth report.

Summing It All Up

- Explore the 472 names from our UK Penny Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SPEC

INSPECS Group

Designs, produces, sells, markets, and distributes fashion eyewear, lenses, and OEM products worldwide.

Flawless balance sheet and undervalued.