- United Kingdom

- /

- Chemicals

- /

- AIM:EDEN

Braveheart Investment Group Leads The Charge Among 3 UK Penny Stocks

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced a downturn, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic challenges. Despite these broader market pressures, certain investment opportunities remain attractive, particularly in the realm of penny stocks. While often seen as relics of past market trends, penny stocks continue to offer potential growth at more accessible price points when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.065 | £778.02M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £148.28M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.155 | £98.68M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.26 | £194.33M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.34 | £170.65M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.925 | £390.36M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.433 | $251.71M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.875 | £184.81M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.30 | £293.88M | ★★★★★★ |

Click here to see the full list of 468 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Braveheart Investment Group (AIM:BRH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Braveheart Investment Group plc is a private equity and venture capital firm that focuses on various investment stages including seed, early venture, late stage, and buyouts in growth capital companies, with a market cap of £3.03 million.

Operations: The company's revenue segment is primarily from the United Kingdom, reporting -£4.78 million.

Market Cap: £3.03M

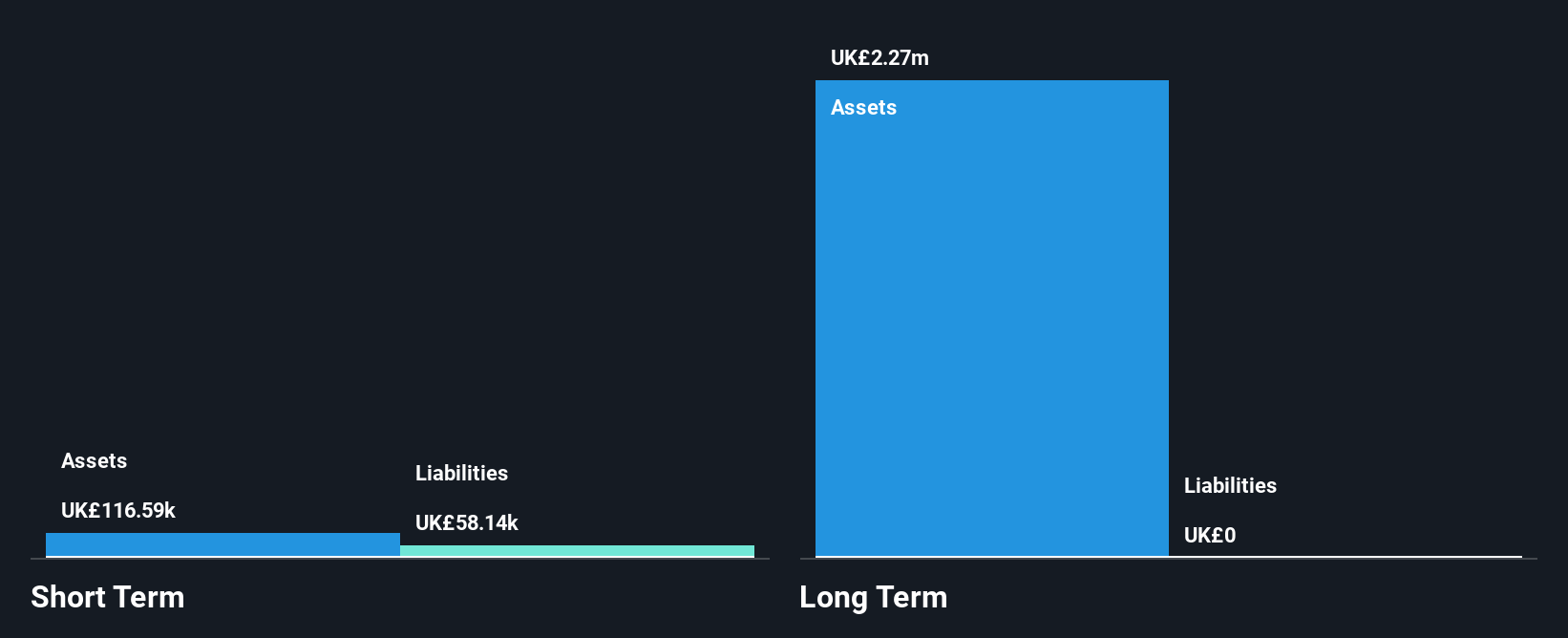

Braveheart Investment Group, with a market cap of £3.03 million, operates as a pre-revenue firm primarily in the UK. The company is debt-free and has short-term assets (£1.2M) comfortably exceeding its short-term liabilities (£43.6K). Despite trading below estimated fair value and having an experienced board (average tenure 5.5 years), it remains unprofitable with increased losses over five years at 42.4% annually and negative return on equity (-187.19%). Recent earnings showed improvement with net income of £0.0436 million compared to a significant loss previously, but revenue remains minimal at GBP 0.431477 million for the half year ended September 2024.

- Jump into the full analysis health report here for a deeper understanding of Braveheart Investment Group.

- Review our historical performance report to gain insights into Braveheart Investment Group's track record.

Eden Research (AIM:EDEN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eden Research plc develops and sells biopesticide solutions for the crop protection, animal health, and consumer products industries in the United Kingdom and Europe, with a market capitalization of £20.53 million.

Operations: Eden Research generates revenue primarily from its Agrochemicals segment, which accounts for £3.86 million, and a smaller portion from Consumer Products at £0.07 million.

Market Cap: £20.53M

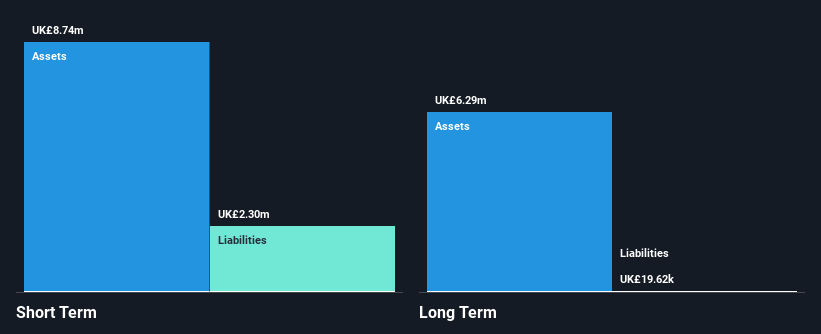

Eden Research plc, with a market cap of £20.53 million, focuses on biopesticide solutions and generates revenue primarily from its Agrochemicals segment (£3.86 million). Despite being unprofitable and experiencing increased losses over the past five years, Eden is debt-free with sufficient cash runway for over three years. Recent strategic developments include regulatory approval in Mexico for Novellus+ and distribution agreements in Austria for Mevalone, enhancing its market reach. The delisting from the OTCQB exchange reflects a refined capital markets strategy while maintaining AIM trading. These initiatives signify potential growth amid ongoing challenges in profitability.

- Dive into the specifics of Eden Research here with our thorough balance sheet health report.

- Examine Eden Research's earnings growth report to understand how analysts expect it to perform.

MYCELX Technologies (AIM:MYX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MYCELX Technologies Corporation is a clean water technology company offering water treatment solutions to sectors such as oil and gas, power, marine, and heavy manufacturing across the Middle East, the United States, Australia, and internationally with a market cap of £8.89 million.

Operations: The company generates revenue from its Pollution and Treatment Control Products segment, totaling $8.84 million.

Market Cap: £8.89M

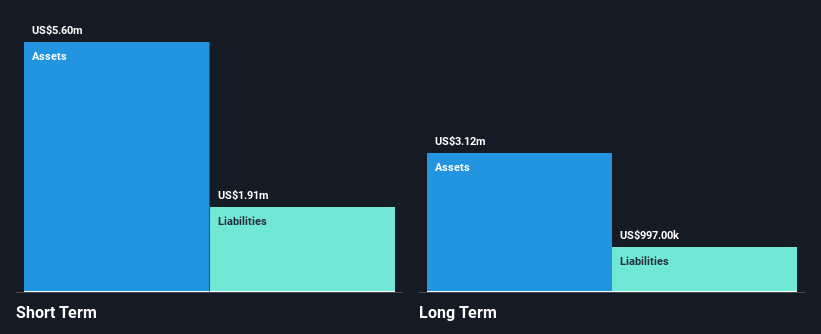

MYCELX Technologies Corporation, with a market cap of £8.89 million, is navigating challenges as an unprofitable entity with increased losses over five years. However, it remains debt-free and boasts seasoned management and board teams. Recent developments include securing a CAD 1.5 million project for its REGEN installation in the Middle East, underpinning future revenue forecasts and enhancing its position in water treatment solutions for Enhanced Oil Recovery production. Despite shareholder dilution by 6% last year, MYCELX has sufficient cash runway for over a year and anticipates revenue growth of 55% annually according to analyst estimates.

- Click here to discover the nuances of MYCELX Technologies with our detailed analytical financial health report.

- Understand MYCELX Technologies' earnings outlook by examining our growth report.

Next Steps

- Embark on your investment journey to our 468 UK Penny Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eden Research might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EDEN

Eden Research

Develops and sells biopesticides solution for crop protection, animal health, and consumer products industries in the United Kingdom and Europe.

Flawless balance sheet low.

Market Insights

Community Narratives