- United Kingdom

- /

- Medical Equipment

- /

- AIM:SPEC

3 Promising UK Penny Stocks With Market Caps Over £40M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market headwinds, penny stocks remain an intriguing investment area for those looking beyond established blue-chip companies. Although the term "penny stocks" might seem outdated, these smaller or newer firms can offer unique opportunities for growth and value when backed by solid financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.84 | £11.57M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.00 | £309.52M | ✅ 5 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.27 | £344.96M | ✅ 4 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.344 | $199.98M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.89 | £438.67M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.16 | £401.01M | ✅ 2 ⚠️ 2 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.31 | £166.83M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £148.96M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.116 | £2.25B | ✅ 4 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 399 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Afentra (AIM:AET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Afentra plc, with a market cap of £89.33 million, operates as an upstream oil and gas company primarily in Africa through its subsidiaries.

Operations: There are no specific revenue segments reported for this upstream oil and gas company operating primarily in Africa.

Market Cap: £89.33M

Afentra plc, with a market cap of £89.33 million, has transitioned to profitability, reporting US$52.35 million in net income for 2024 compared to a loss the previous year. The company is strategically expanding its presence in Angola's onshore Kwanza basin with new licenses like KON-15. Financially robust, Afentra's short-term assets exceed liabilities and it holds more cash than total debt. Its interest payments are well covered by EBIT, and operating cash flow covers debt significantly. Although its debt-to-equity ratio increased over five years, the firm trades at good value compared to peers and industry standards.

- Click here to discover the nuances of Afentra with our detailed analytical financial health report.

- Learn about Afentra's future growth trajectory here.

INSPECS Group (AIM:SPEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: INSPECS Group plc is involved in the design, production, sale, marketing, and distribution of fashion eyewear, lenses, and OEM products across multiple continents including the United Kingdom with a market cap of £44.74 million.

Operations: The company's revenue is primarily derived from Frames and Optics (£175.99 million), followed by Manufacturing (£22.21 million) and Lenses (£5.21 million).

Market Cap: £44.74M

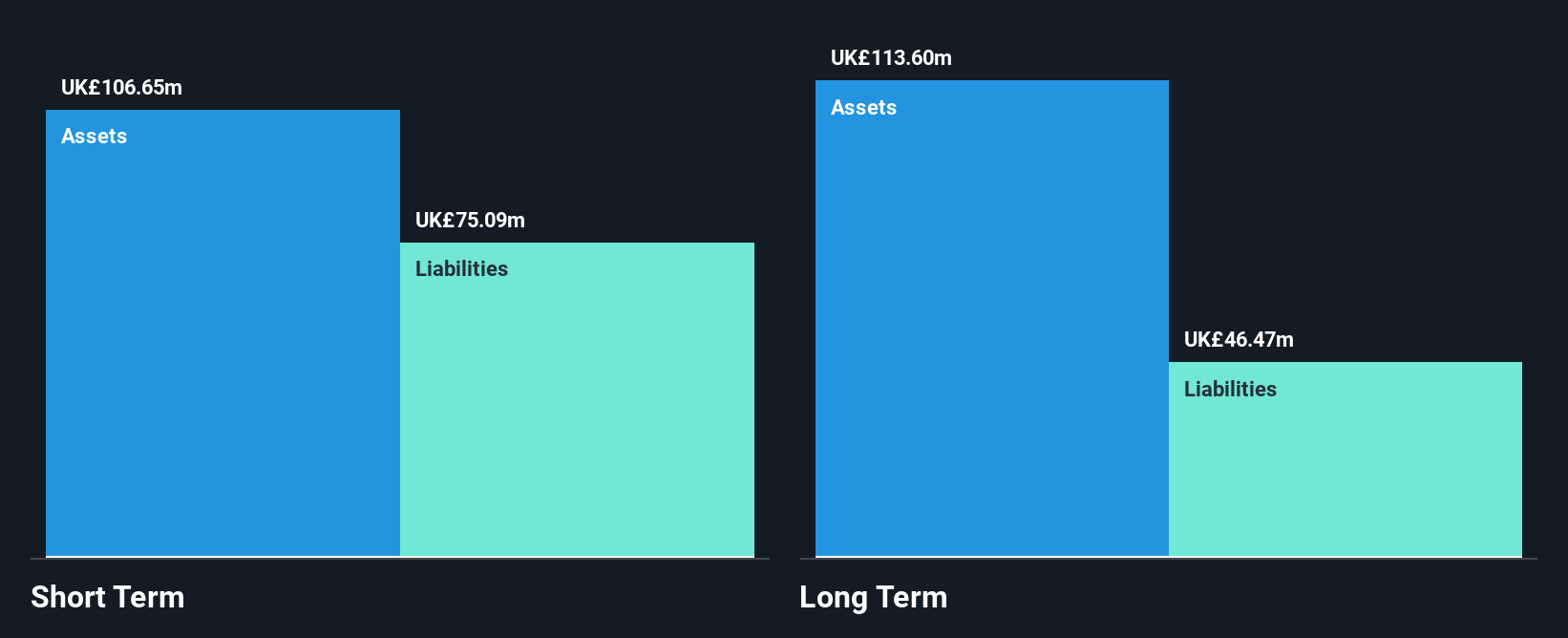

INSPECS Group plc, with a market cap of £44.74 million, faces challenges as it remains unprofitable, reporting a net loss of £4.61 million for 2024 despite sales reaching £198.26 million. The company's cash runway is strong, supporting operations for over three years due to positive free cash flow growth. While its debt-to-equity ratio has improved from 60.8% to 47.5% over five years and is satisfactory at 23.2%, the share price remains highly volatile and trades below estimated fair value by more than half, reflecting investor caution amid recent board changes and management transitions.

- Jump into the full analysis health report here for a deeper understanding of INSPECS Group.

- Understand INSPECS Group's earnings outlook by examining our growth report.

System1 Group (AIM:SYS1)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: System1 Group PLC, with a market cap of £55.83 million, offers market research data and insight services across the United Kingdom, the United States, Latin America, Europe, and the Asia Pacific.

Operations: The company's revenue is derived from Data, generating £24.11 million, Other Consultancy (non-platform) contributing £4.51 million, and Improve Your (data-led Consultancy) adding £6.44 million.

Market Cap: £55.83M

System1 Group PLC, with a market cap of £55.83 million, demonstrates a strong financial position as it operates debt-free and maintains high-quality earnings. The company has shown significant profit growth, with earnings increasing by 155% over the past year and an average annual growth rate of 26.9% over five years. Its return on equity is robust at 26.2%, while short-term assets comfortably cover both short and long-term liabilities. Trading significantly below estimated fair value, System1's stable weekly volatility and experienced board enhance its appeal in the penny stock segment despite broader market uncertainties.

- Navigate through the intricacies of System1 Group with our comprehensive balance sheet health report here.

- Explore System1 Group's analyst forecasts in our growth report.

Seize The Opportunity

- Access the full spectrum of 399 UK Penny Stocks by clicking on this link.

- Seeking Other Investments? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SPEC

INSPECS Group

Designs, produces, sells, markets, and distributes fashion eyewear, lenses, and OEM products in the United Kingdom, Europe, North America, South America, Asia, Africa, and Australia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives