- United Kingdom

- /

- Marine and Shipping

- /

- LSE:ICGC

UK Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices experience downturns following weak trade data from China, investors are closely monitoring the implications for UK markets. Despite these challenges, there remains potential in exploring lesser-known investment avenues such as penny stocks. Though often considered a throwback to earlier trading days, penny stocks can still offer intriguing opportunities when grounded in solid financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.86 | £294.94M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.55 | £367.58M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.88 | £437.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.225 | £407.28M | ✅ 2 ⚠️ 2 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.844 | £1.15B | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £153.79M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.398 | £2.4B | ✅ 4 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.395 | £42.74M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 399 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Diaceutics (AIM:DXRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Diaceutics PLC is a diagnostic commercialisation company that offers data, data analytics, and implementation services to pharmaceutical companies globally, with a market cap of £117.49 million.

Operations: Diaceutics PLC has not reported any specific revenue segments.

Market Cap: £117.49M

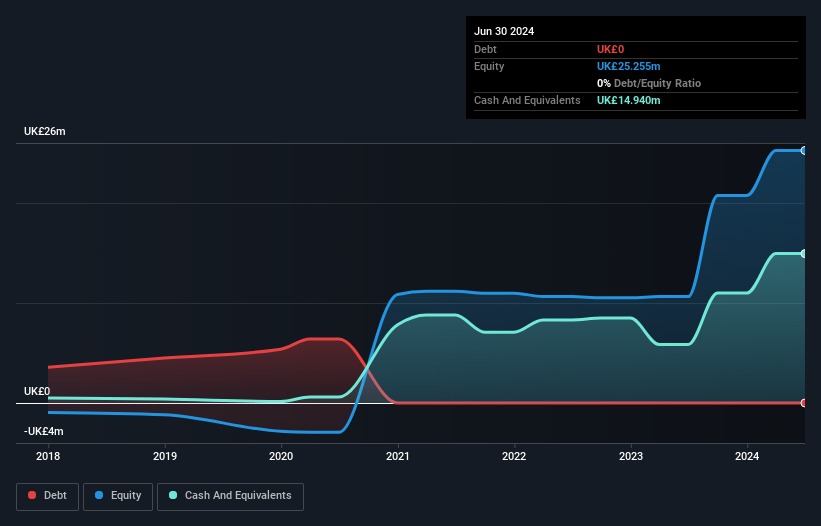

Diaceutics PLC, with a market cap of £117.49 million, is navigating the penny stock space by leveraging its diagnostic commercialisation services to secure strategic contracts. Recently, it entered into an agreement with Partner Therapeutics to deploy its PMx solutions for BIZENGRI®, potentially generating up to £4.5 million in recurring service revenues through September 2026. Despite being unprofitable and having a negative return on equity of -7.34%, Diaceutics benefits from strong short-term asset coverage over liabilities and remains debt-free, providing some financial stability amidst the challenges faced by new management and board teams with limited tenure experience.

- Navigate through the intricacies of Diaceutics with our comprehensive balance sheet health report here.

- Evaluate Diaceutics' prospects by accessing our earnings growth report.

Kooth (AIM:KOO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kooth plc, with a market cap of £56.54 million, offers digital mental health services to children, young people, and adults in the United Kingdom.

Operations: The company's revenue segment is Pharmacy Services, generating £66.74 million.

Market Cap: £56.54M

Kooth plc, with a market cap of £56.54 million, has shown significant progress in the penny stock arena by reporting sales of £66.74 million for 2024, doubling from the previous year and achieving a net income of £8.03 million. The company is trading at 32% below its estimated fair value and offers high quality earnings with a strong return on equity of 27%. Despite having no debt or long-term liabilities, Kooth's share price remains highly volatile and earnings are forecast to decline by an average of 24.1% per year over the next three years due to new management challenges.

- Click to explore a detailed breakdown of our findings in Kooth's financial health report.

- Gain insights into Kooth's future direction by reviewing our growth report.

Irish Continental Group (LSE:ICGC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Irish Continental Group plc is a maritime transport company operating in Ireland, the United Kingdom, and Continental Europe with a market cap of £753.25 million.

Operations: The company generates revenue through its Ferries segment, accounting for €433.5 million, and its Container and Terminal segment, contributing €203.5 million.

Market Cap: £753.25M

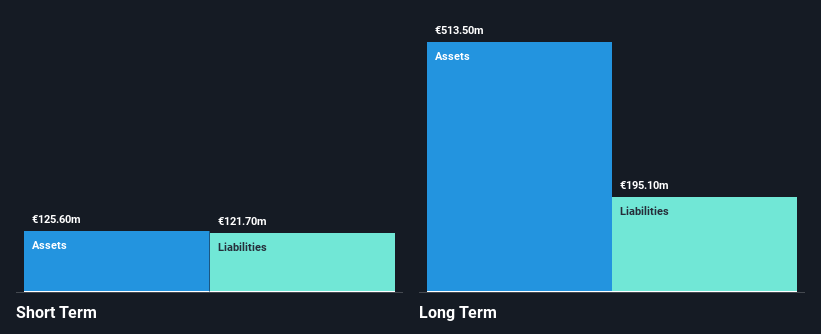

Irish Continental Group, with a market cap of £753.25 million, operates in the maritime transport sector and reported €603.8 million in sales for 2024, up from €572 million the previous year. Despite stable weekly volatility and satisfactory net debt to equity ratio of 17.1%, its net profit margin has slightly decreased to 9.9%. The company’s debt is well covered by operating cash flow (136.7%), and interest payments are adequately managed with an EBIT coverage of 8.5 times interest expenses. However, recent earnings growth has been negative at -2.8%, contrasting its strong five-year average growth history.

- Click here and access our complete financial health analysis report to understand the dynamics of Irish Continental Group.

- Understand Irish Continental Group's earnings outlook by examining our growth report.

Where To Now?

- Click this link to deep-dive into the 399 companies within our UK Penny Stocks screener.

- Contemplating Other Strategies? AI is about to change healthcare. These 21 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ICGC

Irish Continental Group

Operates as a maritime transport company in Ireland, the United Kingdom, and Continental Europe.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives