- United Kingdom

- /

- Building

- /

- AIM:JHD

Advanced Medical Solutions Group And 2 Other UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting ongoing global economic challenges. In such times, investors often look beyond large-cap stocks to explore opportunities in lesser-known areas of the market. Penny stocks, although an older term, remain relevant as they often represent smaller or newer companies that can offer growth potential at lower price points. This article will explore three UK penny stocks that stand out for their strong financials and potential for stability and upside in today's market conditions.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.94 | £303.33M | ✅ 5 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.25 | £163M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.97 | £320.73M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.975 | £448.25M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.1189 | £397.05M | ✅ 3 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.692 | £216.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.98 | £156.34M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.228 | £2.31B | ✅ 4 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 401 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Advanced Medical Solutions Group (AIM:AMS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Advanced Medical Solutions Group plc develops, manufactures, and distributes products for the surgical, woundcare, and wound-closure markets across the UK, Germany, Europe, the US, and internationally with a market cap of £418.48 million.

Operations: The company's revenue is primarily derived from its Surgical segment, which generated £135.77 million, and its Woundcare segment, contributing £41.75 million.

Market Cap: £418.48M

Advanced Medical Solutions Group plc, with a market cap of £418.48 million, has shown mixed performance in the context of penny stocks. Despite a stable net debt to equity ratio at 23.1% and short-term assets exceeding liabilities, its earnings have declined by 2.4% annually over five years and suffered negative growth last year. Recent developments include board changes with Susan Searle's appointment as Non-Executive Director and ongoing M&A discussions involving Montagu Private Equity LLP considering a potential offer for AMS. Additionally, the company reported lower net income despite increased sales and proposed a higher dividend payout for shareholders this year.

- Take a closer look at Advanced Medical Solutions Group's potential here in our financial health report.

- Learn about Advanced Medical Solutions Group's future growth trajectory here.

James Halstead (AIM:JHD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: James Halstead plc is a manufacturer and supplier of flooring products for both commercial and domestic markets globally, with a market cap of £687.70 million.

Operations: The company generates revenue of £268.52 million from the manufacture and distribution of flooring products.

Market Cap: £687.7M

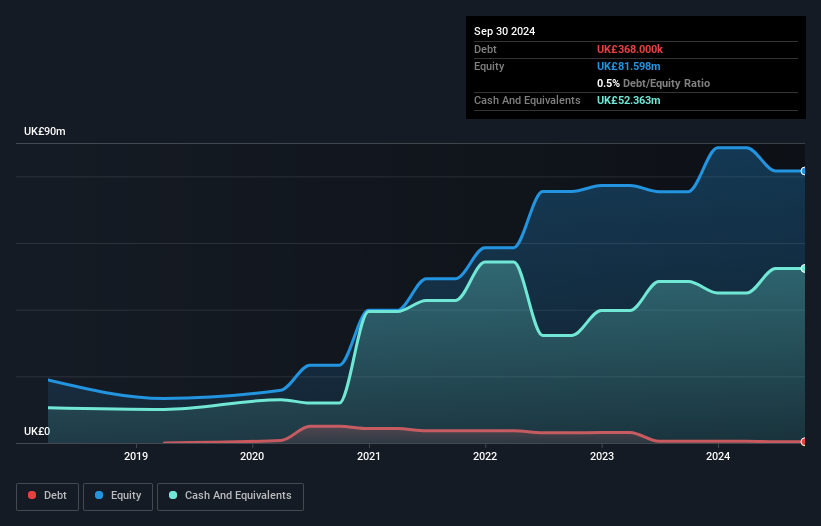

James Halstead plc, with a market cap of £687.70 million, offers a mixed investment profile for penny stock investors. Recent earnings show stable net income growth to £20.97 million despite a decline in sales to £130.09 million for the half-year ended December 2024. The company declared an increased interim dividend of 2.75 pence per share, reflecting its commitment to shareholder returns despite free cash flow concerns. James Halstead's financial stability is bolstered by short-term assets exceeding liabilities and more cash than total debt, while its management team lacks experience with an average tenure of just 0.4 years.

- Click to explore a detailed breakdown of our findings in James Halstead's financial health report.

- Assess James Halstead's future earnings estimates with our detailed growth reports.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £448.25 million.

Operations: The company's revenue is derived from three main segments: Infrastructure (£87.79 million), Private Equity (£50.78 million), and Foresight Capital Management (£8.10 million).

Market Cap: £448.25M

Foresight Group Holdings, with a market cap of £448.25 million, offers an intriguing opportunity for penny stock investors. The company has demonstrated robust financial health, with short-term assets (£81.9M) comfortably exceeding both short and long-term liabilities. Its strong Return on Equity (37.5%) and substantial operating cash flow coverage of debt highlight efficient management practices. Recent buyback announcements totaling up to £50 million indicate confidence in future prospects and aim to enhance shareholder value. Despite a significant one-off loss impacting recent results, Foresight's earnings growth remains impressive at 45.9% over the past year, outpacing industry averages significantly.

- Click here to discover the nuances of Foresight Group Holdings with our detailed analytical financial health report.

- Gain insights into Foresight Group Holdings' future direction by reviewing our growth report.

Next Steps

- Discover the full array of 401 UK Penny Stocks right here.

- Contemplating Other Strategies? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JHD

James Halstead

Manufactures and supplies flooring products for commercial and domestic uses in the United Kingdom, rest of Europe, Scandinavia, Australasia, Asia, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives