- United Kingdom

- /

- Capital Markets

- /

- LSE:CLIG

UK Exchange Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, which has impacted companies closely tied to its economic performance. In these uncertain times, identifying growth companies with high insider ownership can be particularly appealing as it often indicates strong confidence from those within the company and potential resilience in fluctuating markets.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Energean (LSE:ENOG) | 10.6% | 30.4% |

| Helios Underwriting (AIM:HUW) | 23.9% | 16.7% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 28.2% |

| Judges Scientific (AIM:JDG) | 11% | 23% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| Enteq Technologies (AIM:NTQ) | 20.1% | 53.8% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

Let's dive into some prime choices out of the screener.

City of London Investment Group (LSE:CLIG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £187.09 million.

Operations: City of London Investment Group PLC generates $69.45 million from its Asset Management segment.

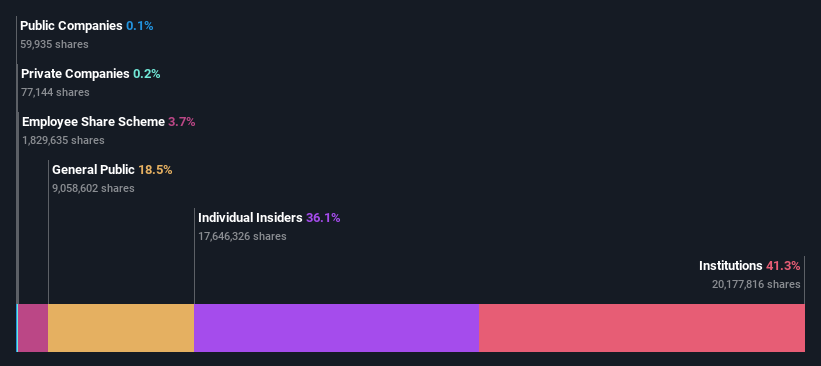

Insider Ownership: 36.1%

Earnings Growth Forecast: 24.4% p.a.

City of London Investment Group, with high insider ownership, is forecasted to grow earnings at 24.4% annually, outpacing the UK market's 14.4%. Despite trading at 23.1% below its estimated fair value and showing significant profit growth potential, recent earnings reports indicate a slight decline in net income from US$17.5 million to US$17.12 million year-over-year. The dividend yield of 8.58% isn't well covered by earnings or free cash flows, posing sustainability concerns.

- Click here to discover the nuances of City of London Investment Group with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of City of London Investment Group shares in the market.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £251.59 million.

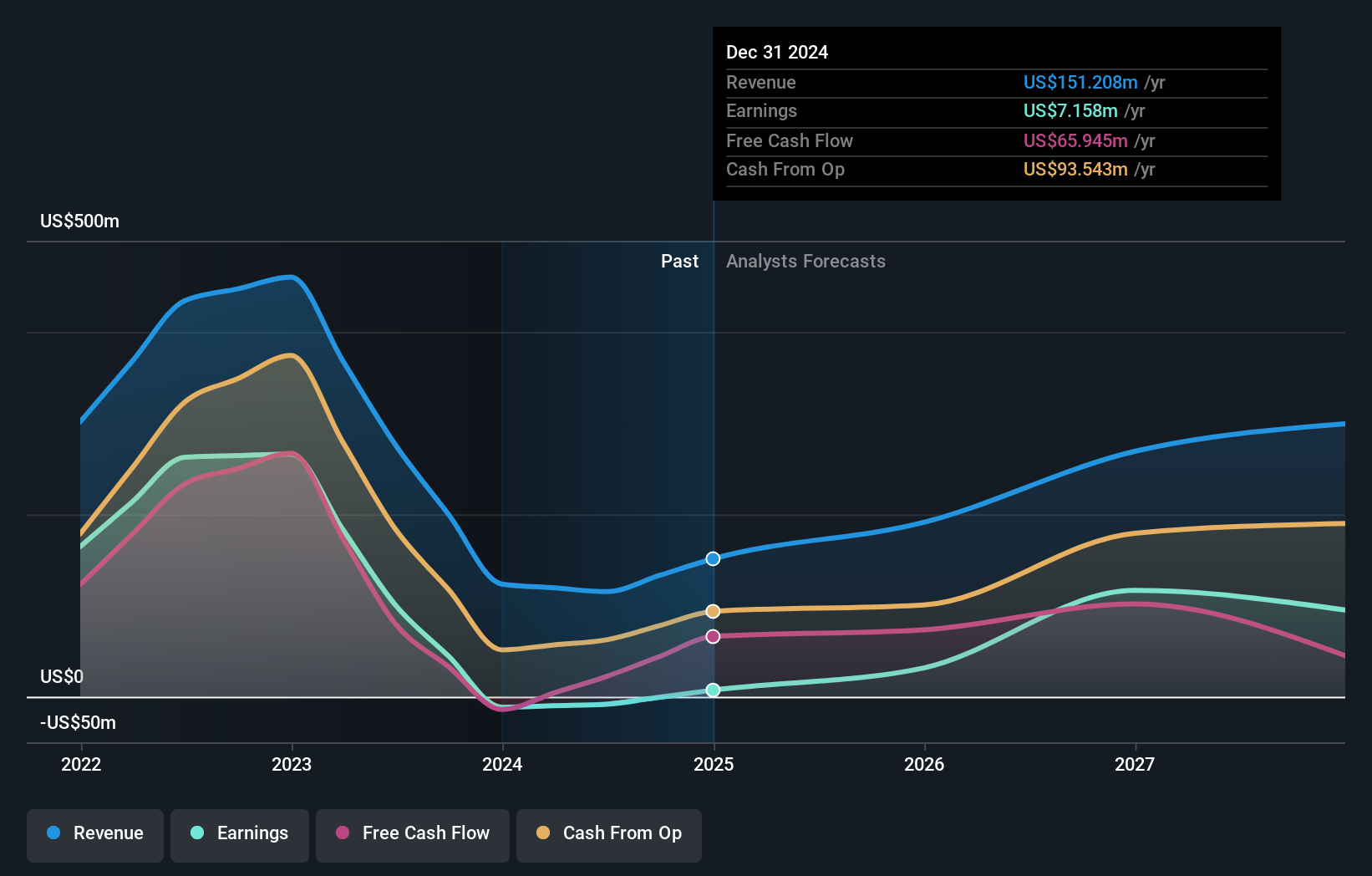

Operations: The company's revenue segment is derived entirely from the exploration and production of oil and gas, amounting to $115.15 million.

Insider Ownership: 12.1%

Earnings Growth Forecast: 80.6% p.a.

Gulf Keystone Petroleum, with substantial insider ownership, is forecast to grow revenue by 42.8% annually and become profitable within three years. Despite trading at 43.4% below its estimated fair value, the company recently reported a net income of US$0.44 million for H1 2024, reversing a loss from the previous year. Recent board changes include appointing two experienced Non-Executive Directors and an interim Chair following the passing of Martin Angle.

- Delve into the full analysis future growth report here for a deeper understanding of Gulf Keystone Petroleum.

- The valuation report we've compiled suggests that Gulf Keystone Petroleum's current price could be inflated.

PPHE Hotel Group (LSE:PPH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PPHE Hotel Group Limited owns, co-owns, develops, leases, operates, and franchises upscale and lifestyle hotels across several European countries including the Netherlands, Germany, Hungary, Croatia, Serbia, Italy, Austria and the United Kingdom with a market cap of £517.92 million.

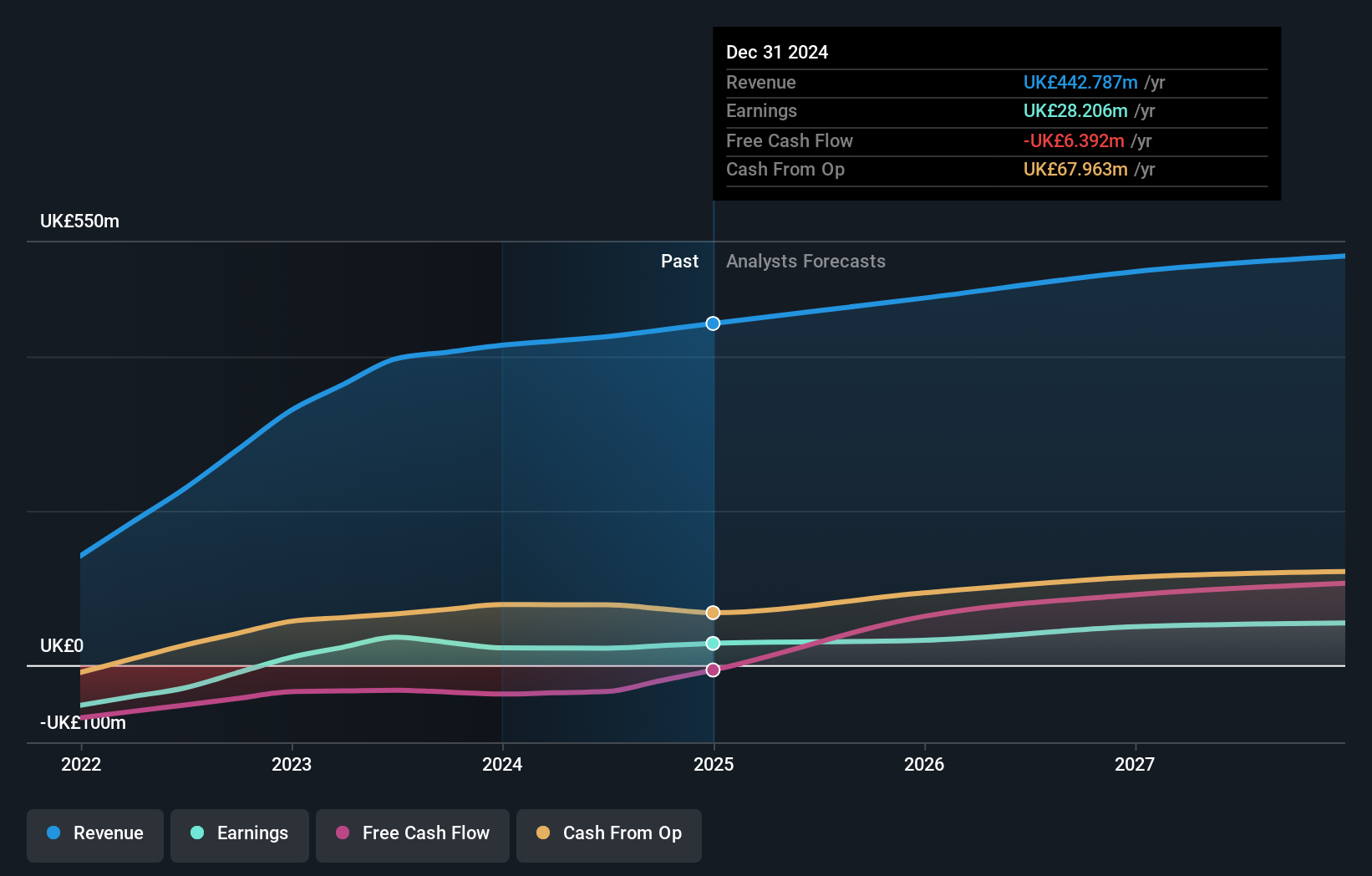

Operations: The company's revenue segments include Owned Hotel Operations in the United Kingdom (£236.99 million), Croatia (£81.63 million), the Netherlands (£65.92 million), and Germany, Hungary, and Serbia (£24.10 million), as well as Management and Central Services (£50.09 million).

Insider Ownership: 14.8%

Earnings Growth Forecast: 31.6% p.a.

PPHE Hotel Group, with high insider ownership, is forecast to grow revenue by 5.4% annually and earnings by 31.6% per year, outperforming the UK market's growth rate. Despite trading at 67.1% below its estimated fair value, the company faces challenges like lower profit margins and interest payments not well covered by earnings. Recent events include refinancing loans for its Dutch hotels and Holmes Hotel London, an interim dividend increase, and a share repurchase program.

- Click to explore a detailed breakdown of our findings in PPHE Hotel Group's earnings growth report.

- According our valuation report, there's an indication that PPHE Hotel Group's share price might be on the cheaper side.

Next Steps

- Delve into our full catalog of 65 Fast Growing UK Companies With High Insider Ownership here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CLIG

City of London Investment Group

City of London Investment Group PLC is a publically owned investment manager.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives