- United Kingdom

- /

- Oil and Gas

- /

- LSE:GENL

3 UK Growth Companies With Up To 25% Insider Ownership

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index experiences fluctuations due to global economic pressures, such as weak trade data from China affecting commodity-linked stocks, investors are increasingly seeking stability through companies with strong fundamentals. In this challenging environment, growth companies with significant insider ownership can offer a compelling proposition, as insider stakes often align management interests with those of shareholders and may indicate confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Foresight Group Holdings (LSE:FSG) | 31.8% | 27.9% |

| LSL Property Services (LSE:LSL) | 10.8% | 28.2% |

| Judges Scientific (AIM:JDG) | 10.6% | 23% |

| Enteq Technologies (AIM:NTQ) | 20% | 53.8% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| RUA Life Sciences (AIM:RUA) | 13.3% | 98.2% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 80.6% |

Let's uncover some gems from our specialized screener.

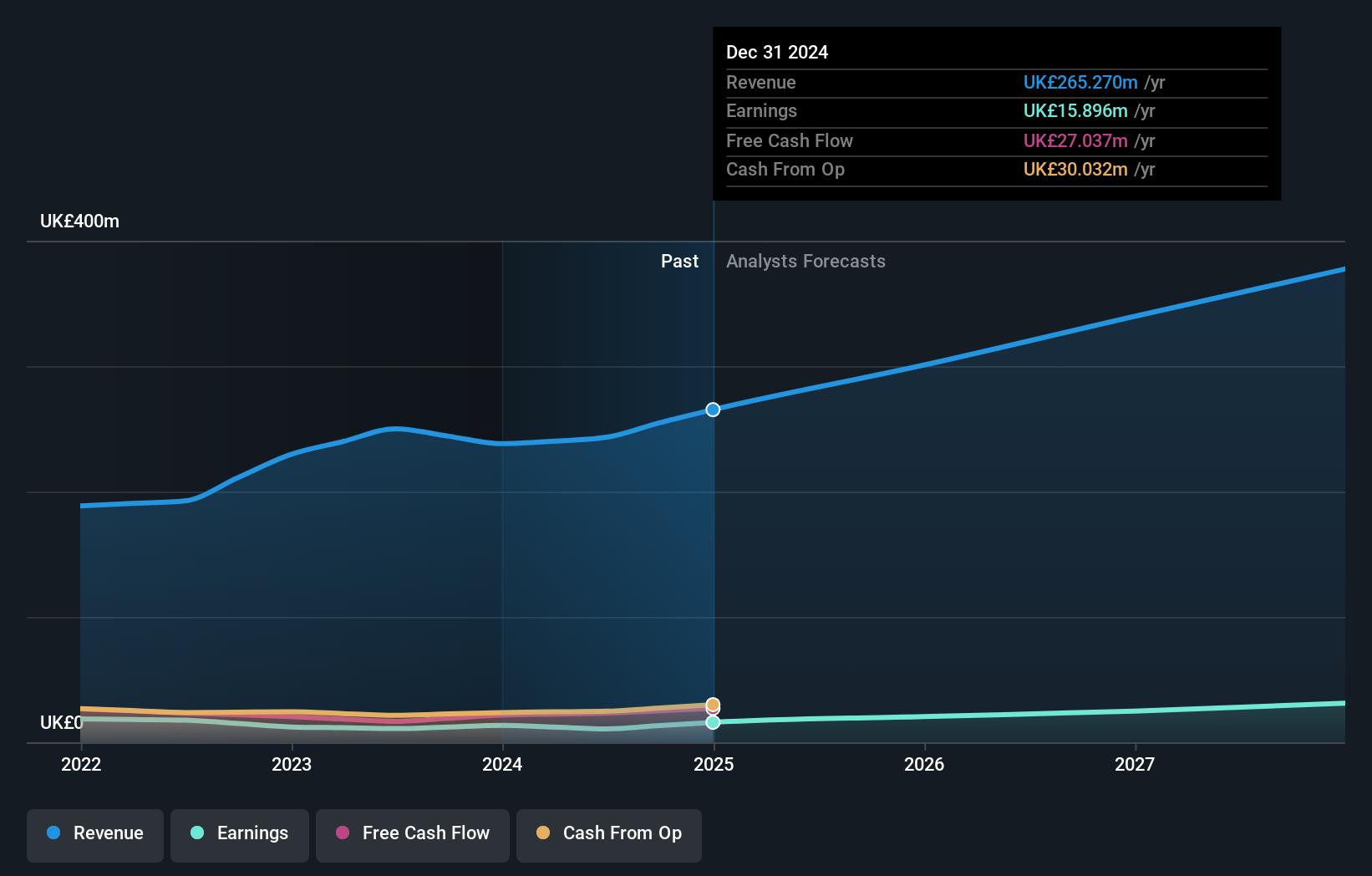

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mortgage Advice Bureau (Holdings) plc, with a market cap of £411.49 million, operates in the United Kingdom offering mortgage advice services through its subsidiaries.

Operations: The company generates revenue of £243.31 million from its provision of financial services segment in the United Kingdom.

Insider Ownership: 19.8%

Mortgage Advice Bureau (Holdings) is experiencing significant earnings growth, projected at 29.57% annually over the next three years, outpacing the UK market's 14.2%. Despite a volatile share price recently, insider confidence remains strong with substantial buying and no significant selling in the past three months. However, revenue growth of 15.3% per year is below the high-growth threshold and recent earnings have declined to £3.7 million for H1 2024 from £6.42 million a year ago.

- Click here to discover the nuances of Mortgage Advice Bureau (Holdings) with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Mortgage Advice Bureau (Holdings) shares in the market.

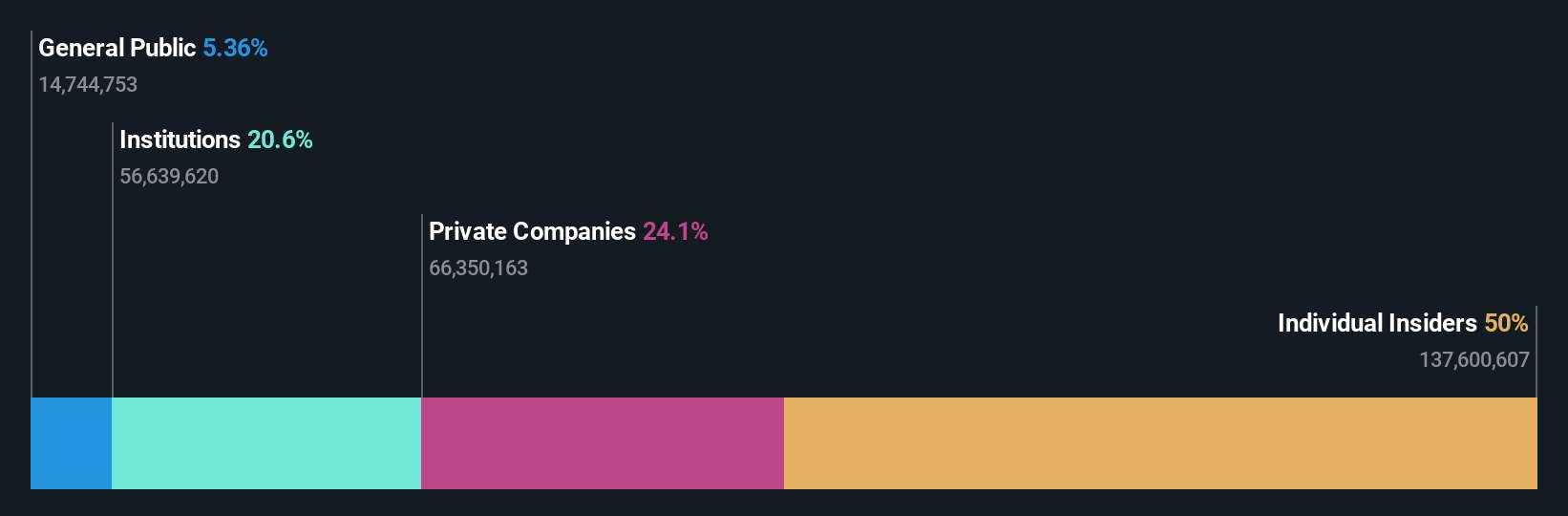

Genel Energy (LSE:GENL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genel Energy plc is an independent oil and gas exploration and production company with a market cap of £218.97 million.

Operations: The company generates revenue from its oil and gas production segment, totaling $74.40 million.

Insider Ownership: 25.7%

Genel Energy is trading significantly below its estimated fair value, with analysts predicting a 27.4% price increase. The company exhibits strong insider confidence, evidenced by substantial buying and no significant selling in the past three months. Although revenue growth of 14.5% annually is slower than high-growth benchmarks, earnings are forecast to grow substantially at 50.18% per year, with profitability expected within three years. Recent board appointments aim to strengthen governance amidst improving production metrics despite declining sales figures.

- Dive into the specifics of Genel Energy here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Genel Energy's share price might be too pessimistic.

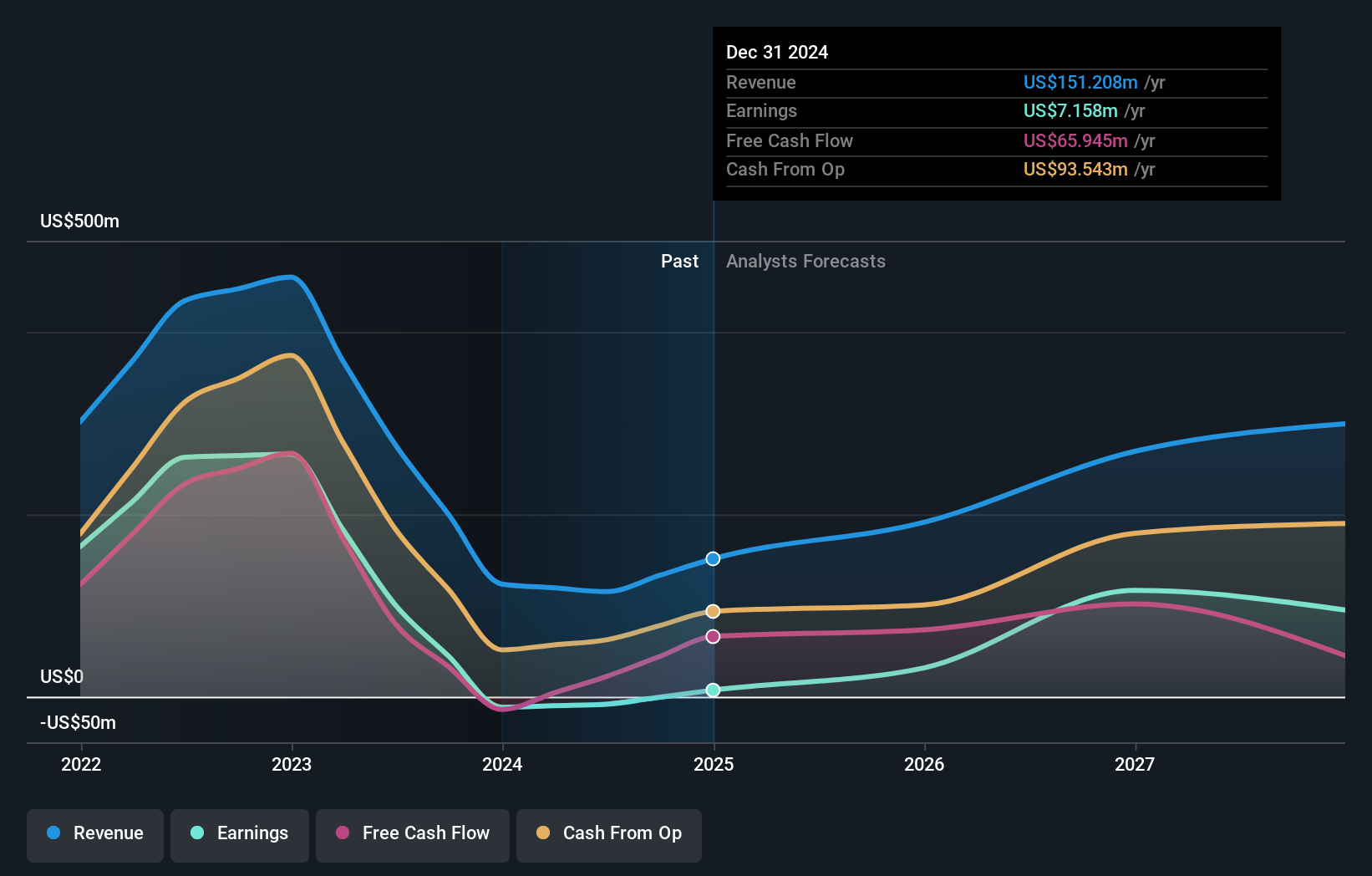

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £275.66 million.

Operations: The company's revenue is primarily derived from the exploration and production of oil and gas, totaling $115.15 million.

Insider Ownership: 12.2%

Gulf Keystone Petroleum shows strong insider confidence with substantial insider buying and no significant selling in the past three months. The company's revenue is forecast to grow at 42.8% annually, outpacing the UK market, while earnings are expected to rise by 80.57% per year, leading to profitability within three years. Recent board changes aim to enhance governance as Gulf Keystone maintains a strategic focus despite reporting lower sales of $71.19 million for H1 2024 compared to last year.

- Click to explore a detailed breakdown of our findings in Gulf Keystone Petroleum's earnings growth report.

- Upon reviewing our latest valuation report, Gulf Keystone Petroleum's share price might be too optimistic.

Summing It All Up

- Investigate our full lineup of 65 Fast Growing UK Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GENL

Genel Energy

Through its subsidiaries, operates as an independent oil and gas exploration and production company.

Reasonable growth potential with adequate balance sheet.