- United Kingdom

- /

- Consumer Durables

- /

- LSE:CRN

UK's August 2025 Penny Stocks To Watch

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China and global economic uncertainties. Despite these broader market pressures, opportunities remain for investors willing to look beyond major blue-chip stocks. Penny stocks, often associated with smaller or newer companies, continue to offer potential growth opportunities when supported by strong financial fundamentals. In this article, we will explore three such penny stocks that stand out for their balance sheet resilience and growth potential in today's market landscape.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.57 | £511.64M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.55 | £286.79M | ✅ 4 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.24 | £135.55M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.40 | £43.28M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.793 | £293.23M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.80 | £288.03M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.715 | £133.6M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.175 | £186.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Braemar (LSE:BMS) | £2.53 | £77.75M | ✅ 3 ⚠️ 3 View Analysis > |

| Samuel Heath & Sons (AIM:HSM) | £3.35 | £8.49M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 297 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Serica Energy (AIM:SQZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Serica Energy plc, along with its subsidiaries, focuses on identifying, acquiring, and exploiting oil and gas reserves in the United Kingdom with a market cap of £648.49 million.

Operations: The company generates revenue of $570.52 million from its activities in oil and gas exploration, development, production, and related operations.

Market Cap: £648.49M

Serica Energy, with a market cap of £648.49 million, is navigating challenges and opportunities in the oil and gas sector. Recent earnings showed a decline in sales to US$304.9 million for H1 2025, resulting in a net loss of US$43.09 million compared to net income last year. The company's debt levels have increased but remain manageable with operating cash flow covering debt well. Production issues at the Triton FPSO have been addressed, with operations expected to stabilize soon, potentially boosting output from new wells. Despite being unprofitable currently, Serica's financial structure supports its operational commitments and future growth prospects.

- Dive into the specifics of Serica Energy here with our thorough balance sheet health report.

- Learn about Serica Energy's future growth trajectory here.

Cairn Homes (LSE:CRN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cairn Homes plc is a homebuilder operating in Ireland with a market capitalization of approximately £1.20 billion.

Operations: The company generates revenue primarily through its Building and Property Development segment, which accounted for €859.87 million.

Market Cap: £1.2B

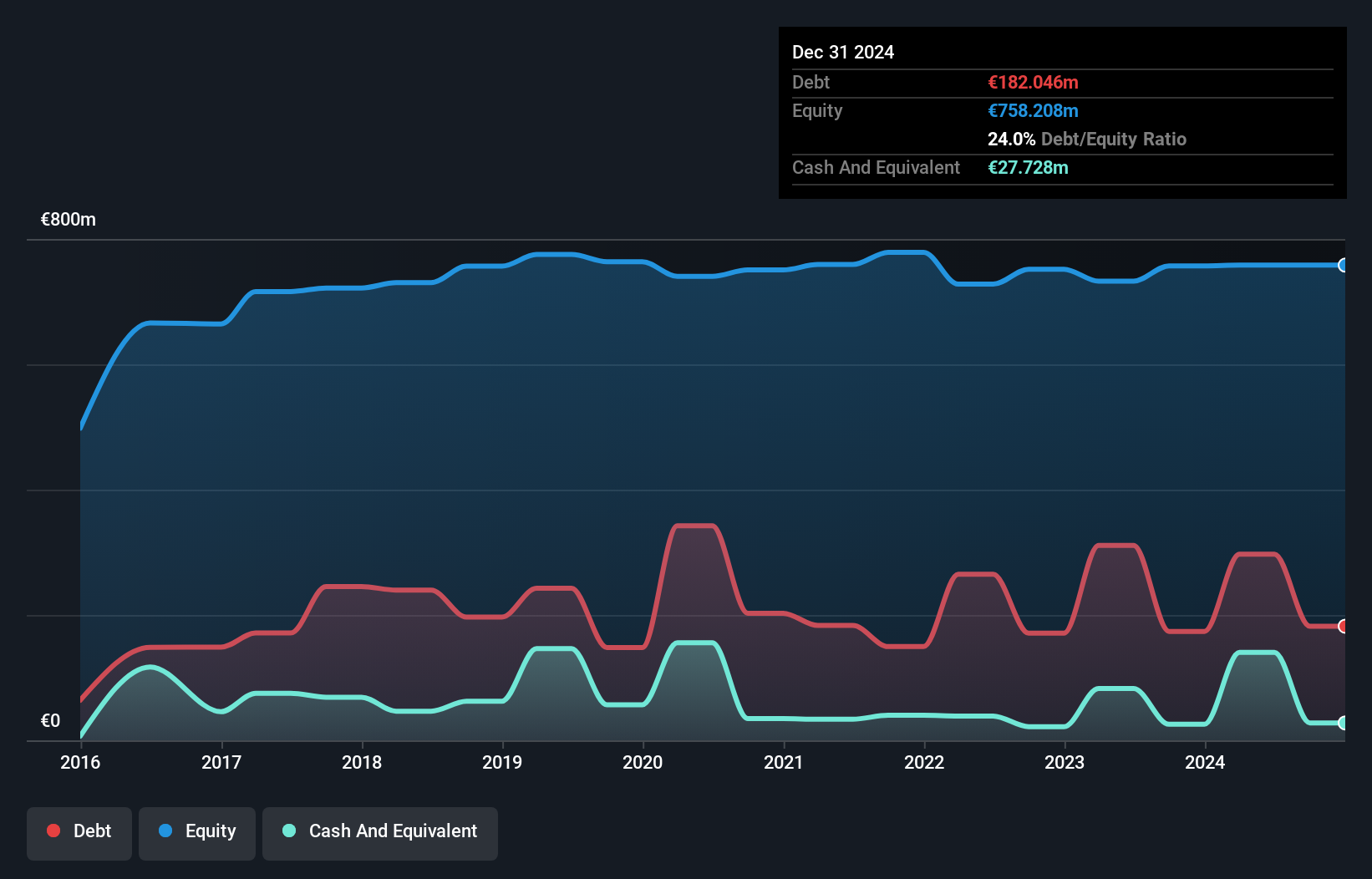

Cairn Homes, with a market cap of £1.20 billion, is experiencing robust financial health and growth potential in the homebuilding sector. The company reported revenue of approximately €280 million from 700 units in H1 2025, aligning with expectations due to its historically stronger second half. Cairn's short-term assets exceed both short and long-term liabilities significantly, indicating strong liquidity. Despite a rising debt-to-equity ratio over five years, its interest payments are well-covered by EBIT at 10.3 times coverage. Earnings have grown impressively by 34.1% over the past year, supported by a seasoned management team and board of directors.

- Click to explore a detailed breakdown of our findings in Cairn Homes' financial health report.

- Understand Cairn Homes' earnings outlook by examining our growth report.

Pensana (LSE:PRE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pensana Plc is involved in the exploration and development of mineral properties in the United Kingdom and Angola, with a market cap of £218.47 million.

Operations: Pensana Plc does not report any revenue segments.

Market Cap: £218.47M

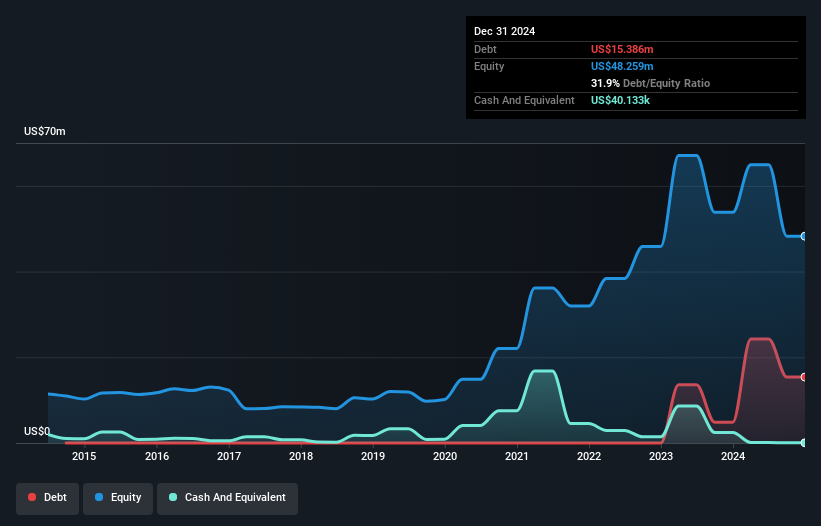

Pensana Plc, with a market cap of £218.47 million, is pre-revenue and currently unprofitable. The company recently filed for a £2 million follow-on equity offering at £0.35 per share, indicating potential capital needs or expansion plans. Despite trading 53% below its estimated fair value, Pensana's short-term liabilities significantly exceed its assets by $25.5M (US$). However, it maintains a satisfactory net debt to equity ratio of 31.8%, with no long-term liabilities and sufficient cash runway for over three years under current conditions. The management team and board are experienced but face challenges in stabilizing the highly volatile share price.

- Click here to discover the nuances of Pensana with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Pensana's track record.

Where To Now?

- Click this link to deep-dive into the 297 companies within our UK Penny Stocks screener.

- Contemplating Other Strategies? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CRN

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives