- United Kingdom

- /

- Luxury

- /

- LSE:COA

UK Stocks Including Serica Energy That May Be Priced Below Intrinsic Estimates

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, as evidenced by the FTSE 100 index closing lower due to weak trade data from China and declining commodity prices affecting key sectors. In this environment, investors may find potential opportunities in stocks that are priced below their intrinsic value, such as Serica Energy and others, which could offer resilience amidst global economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SigmaRoc (AIM:SRC) | £1.182 | £2.32 | 49% |

| Pinewood Technologies Group (LSE:PINE) | £4.01 | £7.85 | 48.9% |

| PageGroup (LSE:PAGE) | £2.348 | £4.46 | 47.3% |

| On the Beach Group (LSE:OTB) | £2.17 | £4.28 | 49.3% |

| Hollywood Bowl Group (LSE:BOWL) | £2.555 | £4.93 | 48.2% |

| Gym Group (LSE:GYM) | £1.47 | £2.93 | 49.8% |

| Gooch & Housego (AIM:GHH) | £5.80 | £11.24 | 48.4% |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £2.22 | 47.6% |

| AstraZeneca (LSE:AZN) | £128.06 | £239.47 | 46.5% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.27 | £4.39 | 48.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

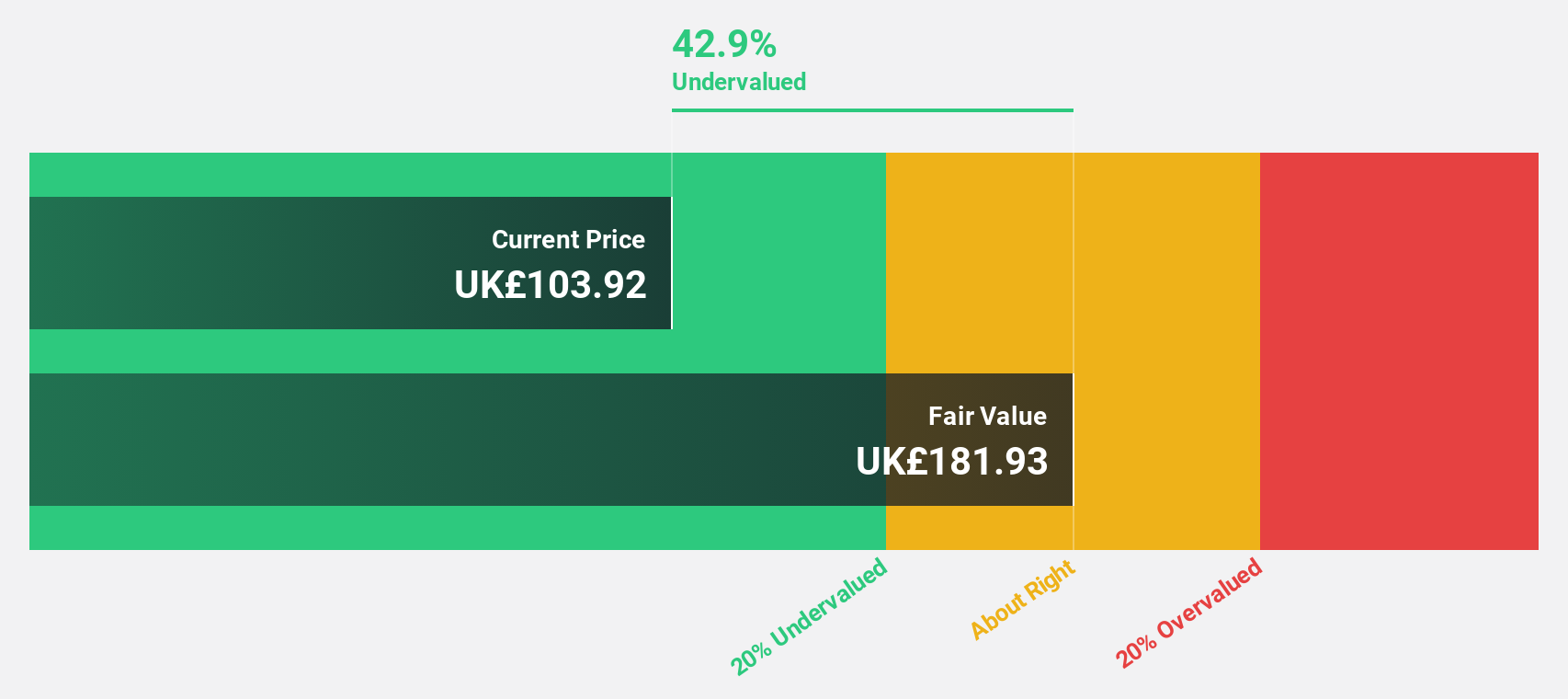

Serica Energy (AIM:SQZ)

Overview: Serica Energy plc, along with its subsidiaries, focuses on identifying, acquiring, and exploiting oil and gas reserves in the United Kingdom and has a market capitalization of £749.89 million.

Operations: The company generates $570.52 million from its oil and gas exploration, development, production, and related activities.

Estimated Discount To Fair Value: 45.4%

Serica Energy is trading at £1.91, significantly below its estimated fair value of £3.5, suggesting it may be undervalued based on cash flows. Despite a recent net loss of US$43.09 million for H1 2025, the company is poised for profitability within three years and forecasts a revenue growth rate of 6% annually, outpacing the UK market average. The ongoing ramp-up in production from key North Sea assets could bolster future cash flows and support M&A activities.

- Our earnings growth report unveils the potential for significant increases in Serica Energy's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Serica Energy.

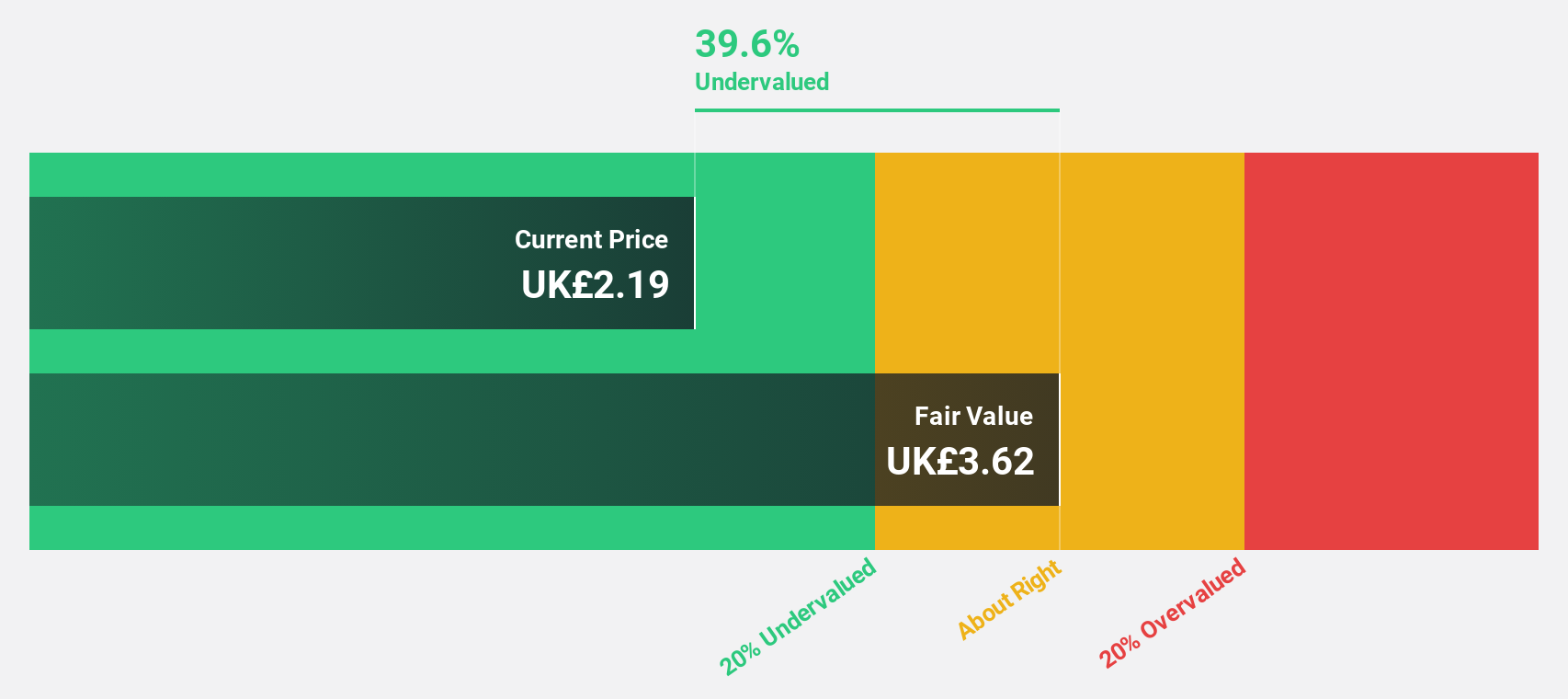

AstraZeneca (LSE:AZN)

Overview: AstraZeneca PLC is a biopharmaceutical company engaged in the discovery, development, manufacture, and commercialization of prescription medicines with a market cap of approximately £198.58 billion.

Operations: AstraZeneca's revenue is primarily derived from its pharmaceuticals segment, totaling $56.50 billion.

Estimated Discount To Fair Value: 46.5%

AstraZeneca trades at £128.06, well below its estimated fair value of £239.47, indicating potential undervaluation based on cash flows. Recent announcements highlight promising developments in its drug pipeline, such as the successful Bax24 Phase III trial for baxdrostat in hypertension and advancements in breast cancer treatments with DATROWAY®. Despite high debt levels, AstraZeneca's forecasted earnings growth of 15.62% annually outpaces the UK market average, suggesting robust future cash flow potential amidst ongoing product innovation.

- Our expertly prepared growth report on AstraZeneca implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of AstraZeneca with our comprehensive financial health report here.

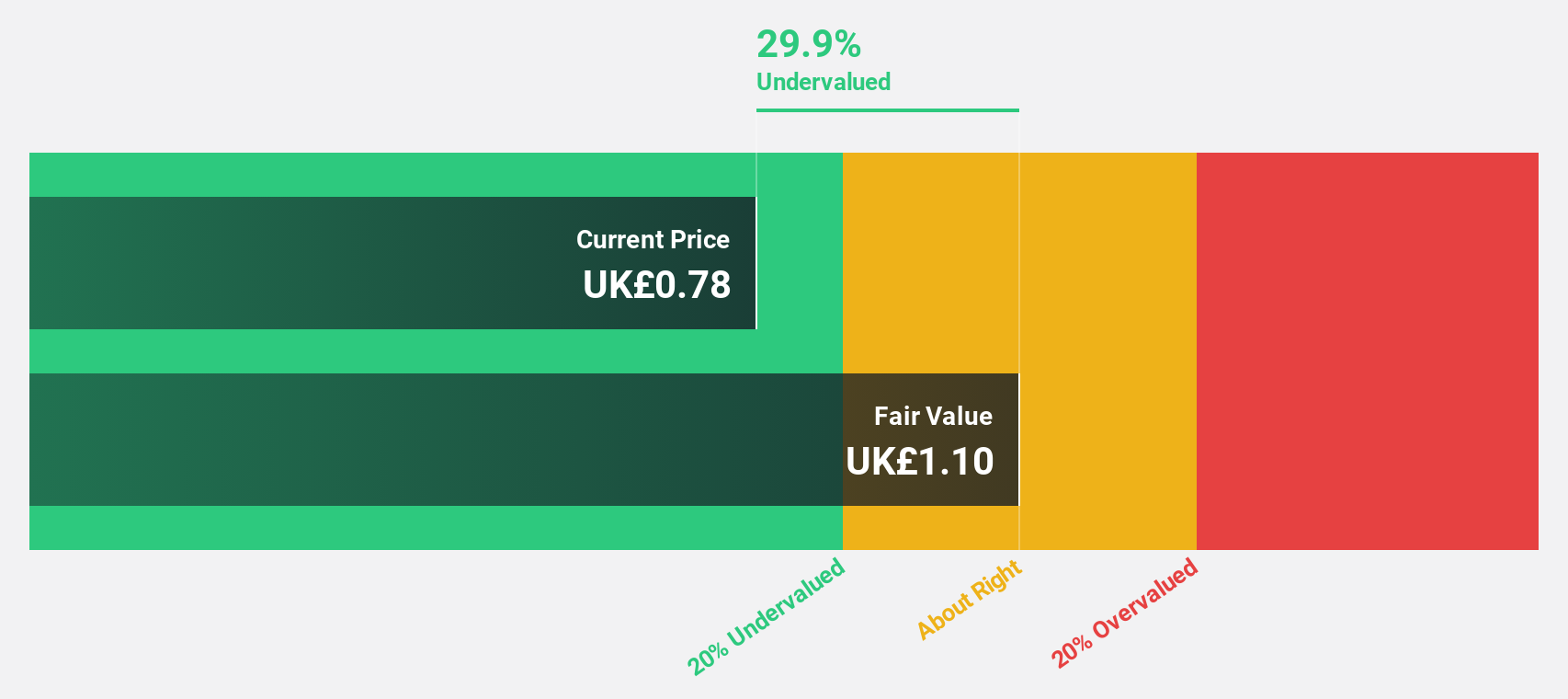

Coats Group (LSE:COA)

Overview: Coats Group plc operates globally in the manufacturing of threads, structural components for apparel and footwear, and performance materials, with a market cap of £1.53 billion.

Operations: The company's revenue segments include $775.30 million from apparel, $405.20 million from footwear, and $321.80 million from performance materials.

Estimated Discount To Fair Value: 37%

Coats Group is trading at £0.8, significantly below its estimated fair value of £1.27, reflecting potential undervaluation based on cash flows. Despite recent shareholder dilution from a follow-on equity offering totaling approximately £250 million, Coats' earnings are expected to grow substantially at 27.5% annually, outpacing the UK market average of 14.2%. However, the company's dividend yield of 2.98% is not well covered by free cash flows and debt coverage remains a concern.

- Our comprehensive growth report raises the possibility that Coats Group is poised for substantial financial growth.

- Take a closer look at Coats Group's balance sheet health here in our report.

Key Takeaways

- Get an in-depth perspective on all 56 Undervalued UK Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:COA

Coats Group

Engages in thread manufacturing, structural components for apparel and footwear, and performance materials worldwide.

High growth potential and good value.

Market Insights

Community Narratives