Big Technologies And 2 Other Promising Penny Stocks On The UK Exchange

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, certain smaller companies continue to offer intriguing opportunities for investors. Penny stocks, though an older term, still hold relevance as they often represent smaller or newer companies that can provide growth potential at lower price points when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.02 | £761.16M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £153.63M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.395 | £177.66M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £3.69 | £420.84M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.67 | £365M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.085 | £92.7M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.04 | £192.68M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.26 | £194.33M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.18 | £155.53M | ★★★★★☆ |

Click here to see the full list of 440 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Big Technologies (AIM:BIG)

Simply Wall St Financial Health Rating: ★★★★★★

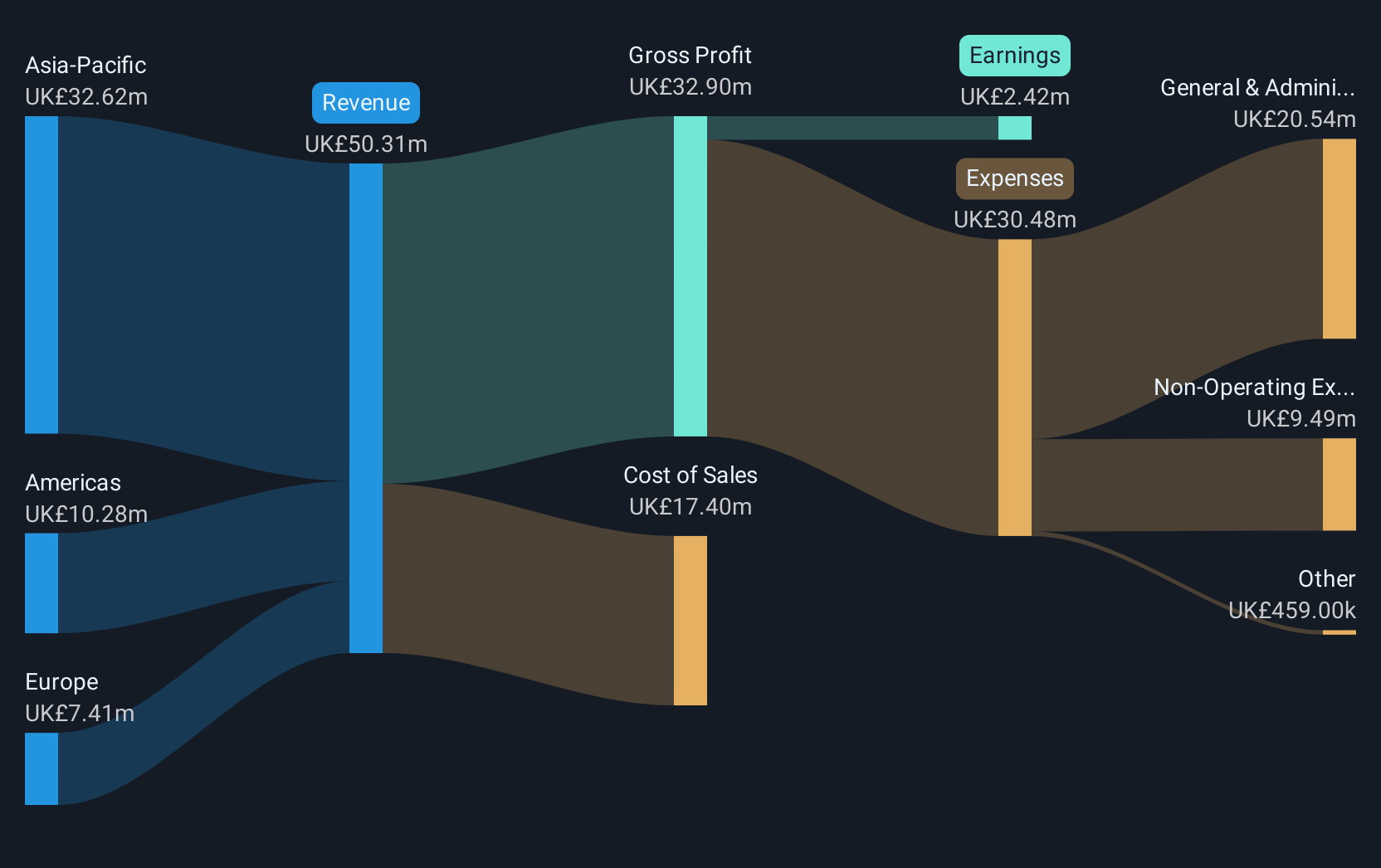

Overview: Big Technologies PLC, operating under the Buddi brand, develops and provides remote monitoring technologies and services for the offender and personal monitoring industry across the Americas, Europe, and Asia-Pacific, with a market cap of £381.70 million.

Operations: The company's revenue of £54.45 million is derived from its electronic tracking devices, products, and services segment.

Market Cap: £381.7M

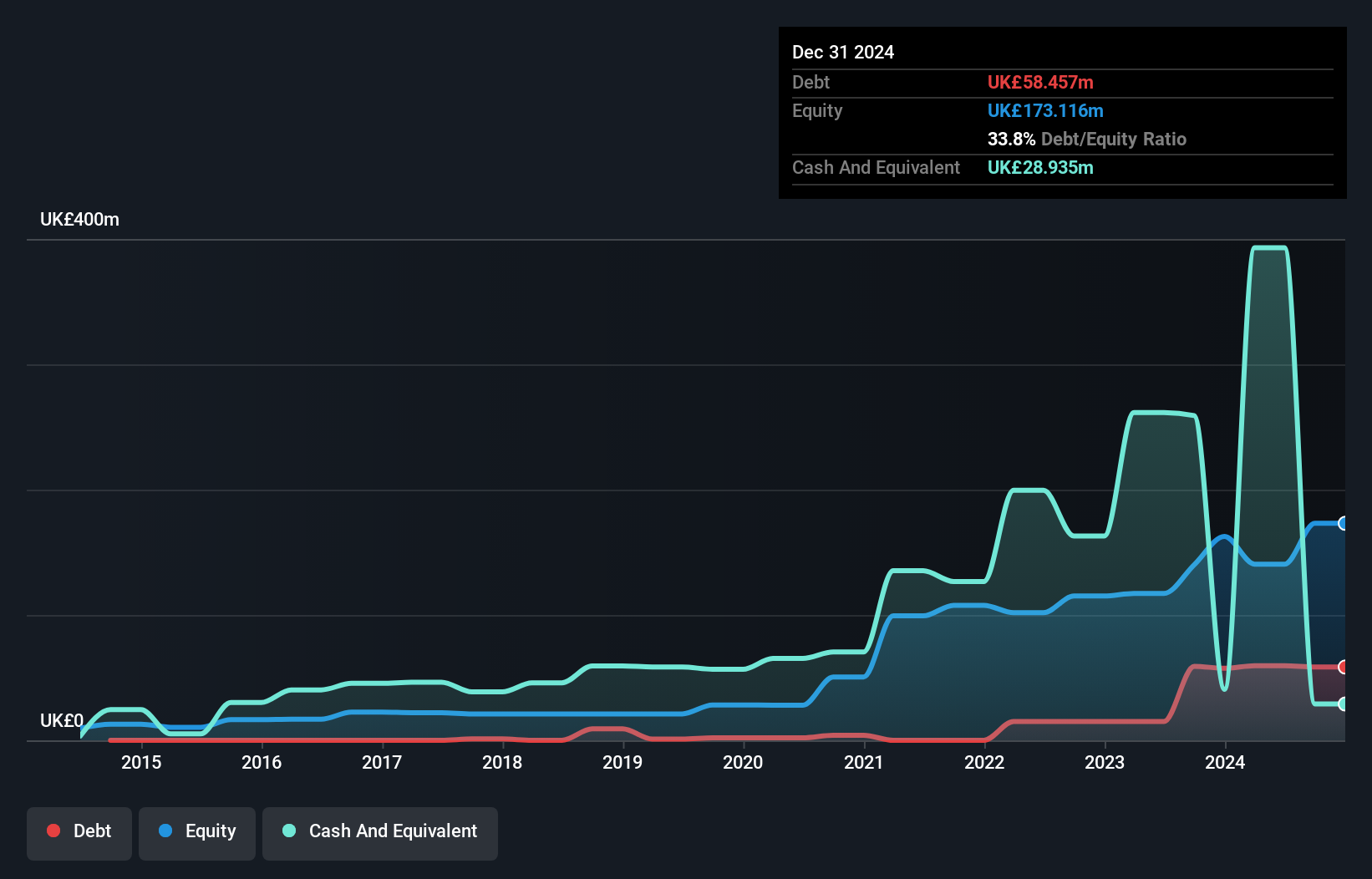

Big Technologies PLC, with a market cap of £381.70 million and revenue of £54.45 million, operates in the electronic tracking devices sector. The company is debt-free, showcasing financial stability as its short-term assets (£111.9M) comfortably cover both short and long-term liabilities. Despite high-quality earnings, recent performance has been mixed; earnings growth was negative last year (-36.9%), contrasting with a 13.9% annual growth over five years. The Return on Equity remains low at 9.4%, and profit margins have decreased to 23%. Insider selling has been significant recently, which may warrant attention from potential investors.

- Click to explore a detailed breakdown of our findings in Big Technologies' financial health report.

- Gain insights into Big Technologies' future direction by reviewing our growth report.

Helios Underwriting (AIM:HUW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Helios Underwriting plc, with a market cap of £155.53 million, offers limited liability investment opportunities for its shareholders in the Lloyd’s insurance market in the United Kingdom through its subsidiaries.

Operations: The company's revenue is primarily derived from Syndicate Participation, contributing £258.32 million, and Investment Management, which adds £4.62 million.

Market Cap: £155.53M

Helios Underwriting plc, with a market cap of £155.53 million, presents an intriguing opportunity in the Lloyd’s insurance market. It boasts strong financial health, as its short-term assets (£900M) exceed both short (£858.2M) and long-term liabilities (£22.9M). The company trades at a favorable price-to-earnings ratio of 8.8x compared to the UK market average of 16x, indicating potential value relative to peers. Earnings have surged by 236.7% over the past year, outpacing industry growth significantly; however, share price volatility remains high and dividend stability is uncertain despite high-quality earnings and manageable debt levels supported by cash flow.

- Get an in-depth perspective on Helios Underwriting's performance by reading our balance sheet health report here.

- Evaluate Helios Underwriting's prospects by accessing our earnings growth report.

Jersey Oil and Gas (AIM:JOG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jersey Oil and Gas Plc is involved in the exploration, appraisal, development, and production of oil and gas properties in the UK's North Sea, with a market cap of £23.52 million.

Operations: Jersey Oil and Gas Plc currently does not report any revenue segments.

Market Cap: £23.52M

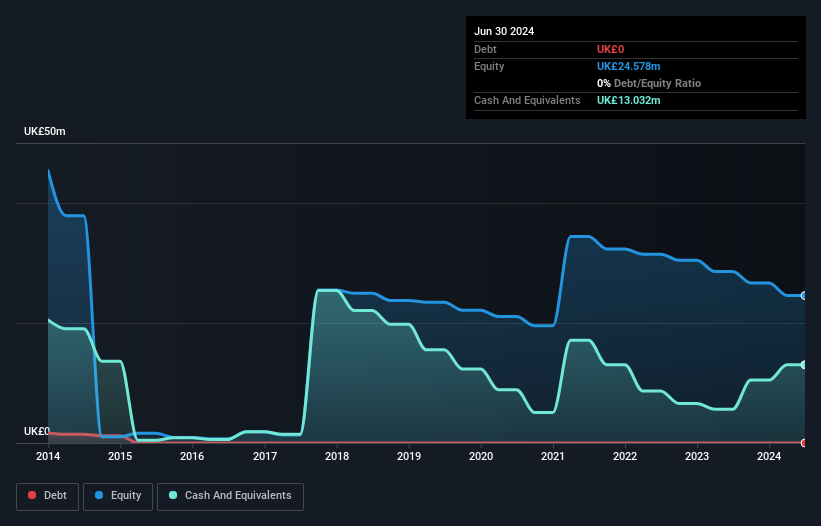

Jersey Oil and Gas Plc, with a market cap of £23.52 million, is pre-revenue and remains unprofitable, as losses have increased by 20% annually over the past five years. Despite its financial challenges, the company has no debt and maintains a stable cash runway exceeding three years if free cash flow trends persist. Its short-term assets (£13.3M) comfortably cover both short-term (£192.7K) and long-term liabilities (£43.1K). Recent board changes include the retirement of Marcus Stanton as Non-Executive Director and Chairman of the Audit Committee after nearly a decade with the company since its 2015 listing.

- Click here and access our complete financial health analysis report to understand the dynamics of Jersey Oil and Gas.

- Learn about Jersey Oil and Gas' future growth trajectory here.

Key Takeaways

- Dive into all 440 of the UK Penny Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Big Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Big Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BIG

Big Technologies

Engages in the development and delivery of remote monitoring technologies and services to the offender and remote personal monitoring industry under the Buddi brand name in the Americas, Europe, and the Asia-Pacific.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives