- United Kingdom

- /

- Consumer Finance

- /

- LSE:SUS

Market Cool On S&U plc's (LON:SUS) Earnings Pushing Shares 27% Lower

S&U plc (LON:SUS) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 40% share price drop.

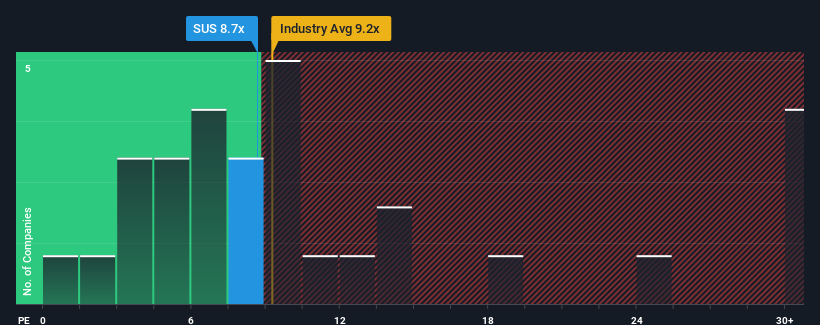

In spite of the heavy fall in price, S&U may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.7x, since almost half of all companies in the United Kingdom have P/E ratios greater than 17x and even P/E's higher than 28x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

S&U hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for S&U

What Are Growth Metrics Telling Us About The Low P/E?

S&U's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 43%. As a result, earnings from three years ago have also fallen 27% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 20% per annum as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 13% per annum, which is noticeably less attractive.

In light of this, it's peculiar that S&U's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

S&U's recently weak share price has pulled its P/E below most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that S&U currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with S&U (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

You might be able to find a better investment than S&U. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SUS

S&U

Provides motor, property bridging, and specialist finance services in the United Kingdom.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives