- United Kingdom

- /

- Metals and Mining

- /

- LSE:CAPD

3 UK Penny Stocks With Market Caps Under £400M To Watch

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 closing lower due to weak trade data from China, highlighting the interconnectedness of global economies. Despite these broader market fluctuations, certain investment opportunities remain attractive, particularly in smaller or less-established companies. Penny stocks, though an outdated term for some, still represent a viable investment area where strong financials can lead to substantial returns.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.65 | £520.6M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.22 | £179.35M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.78 | £11.78M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.095 | £15.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.5375 | $312.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.50 | £72.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £181.49M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.70 | £9.64M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.43 | £74.04M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £1.89 | £713.9M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 291 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Cirata (AIM:CRTA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cirata plc, along with its subsidiaries, develops and provides collaboration software across North America, Germany, the rest of Europe, China, and internationally with a market cap of £26.66 million.

Operations: The company generates revenue of $9.52 million from the development and sale of software licenses, as well as related maintenance and support services.

Market Cap: £26.66M

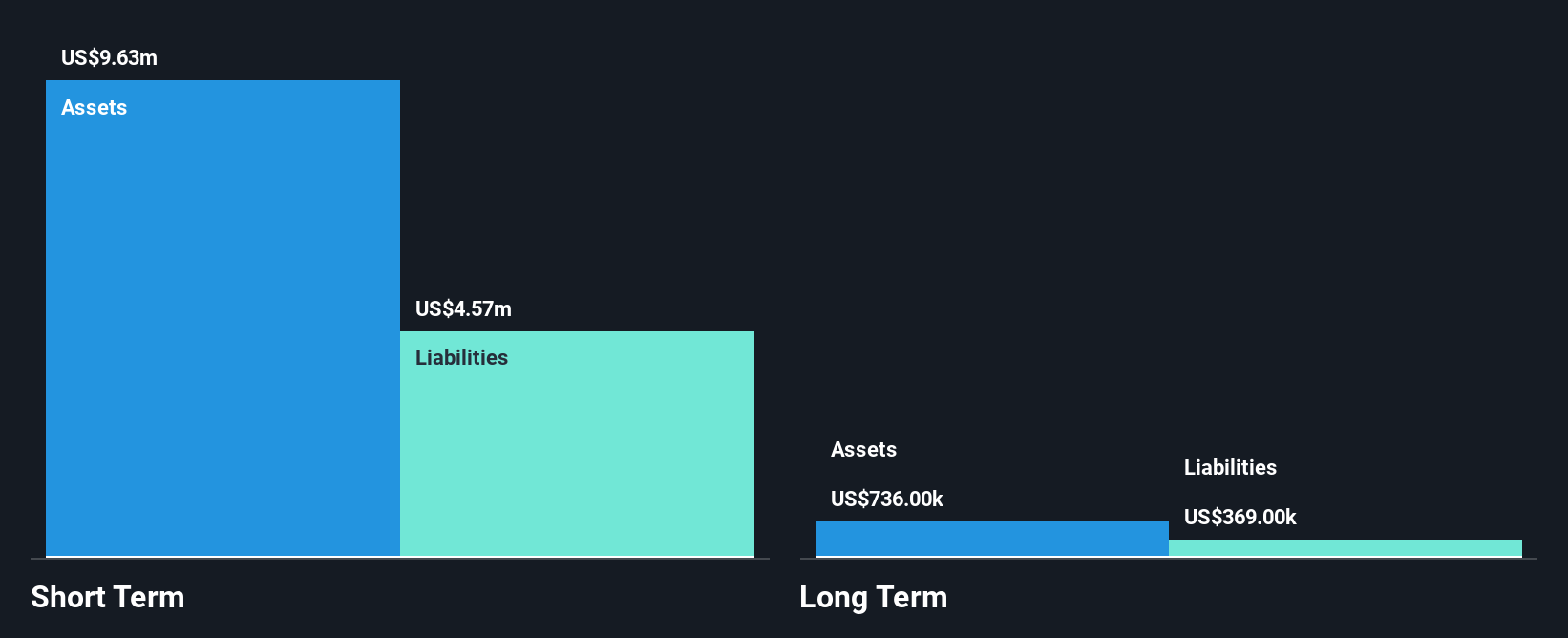

Cirata plc, with a market cap of £26.66 million, is navigating the penny stock landscape by focusing on data integration and orchestration solutions. Recent developments include a $3.1 million contract with a US insurer and the launch of Cirata Symphony, enhancing its position in the growing data management sector. Despite being unprofitable, Cirata has shown revenue growth from $1.37 million to $3.21 million year-over-year for H1 2025 and maintains no debt liabilities while covering short-term obligations with assets totaling $9.6M against liabilities of $4.6M, though it faces cash runway challenges under current conditions.

- Click here and access our complete financial health analysis report to understand the dynamics of Cirata.

- Gain insights into Cirata's outlook and expected performance with our report on the company's earnings estimates.

Capital (LSE:CAPD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Capital Limited, along with its subsidiaries, offers drilling, mining, mineral assaying, and surveying services and has a market cap of £206.07 million.

Operations: The company's revenue is primarily derived from its Business Services segment, which generated $337.77 million.

Market Cap: £206.07M

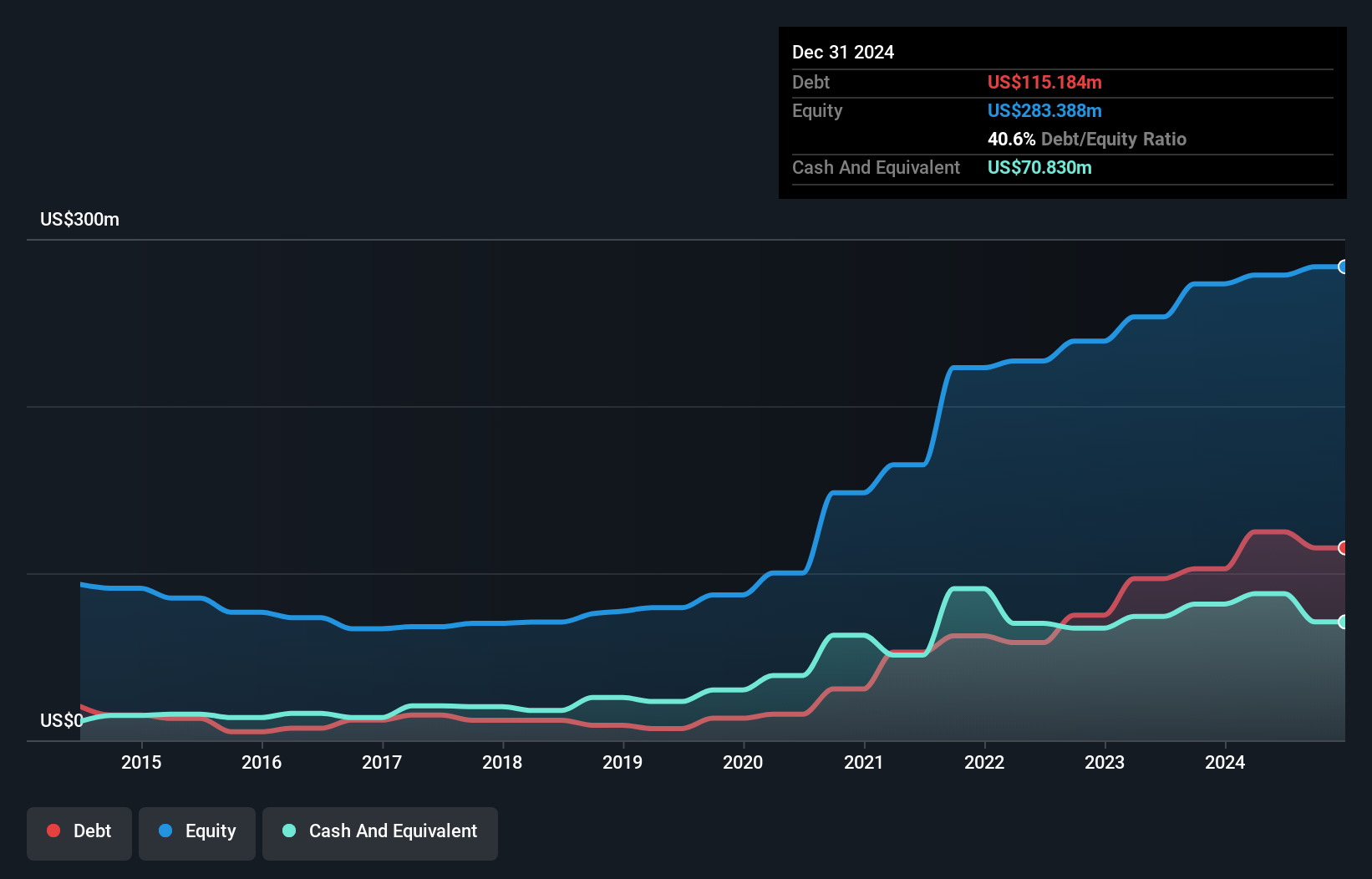

Capital Limited, with a market cap of £206.07 million, is navigating financial challenges typical for stocks in its category. Despite negative earnings growth over the past year and a low return on equity of 7.9%, the company has managed to cover its debt well with operating cash flow at 57.7%. The company's short-term assets exceed both short-term and long-term liabilities, indicating strong liquidity management. Recent financial results show improved net income to US$14.84 million for H1 2025, despite a drop in sales from the previous year, while maintaining stable shareholder value without significant dilution recently.

- Navigate through the intricacies of Capital with our comprehensive balance sheet health report here.

- Evaluate Capital's prospects by accessing our earnings growth report.

PensionBee Group (LSE:PBEE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PensionBee Group plc offers online retirement saving services in the United Kingdom and the United States, with a market cap of £390.09 million.

Operations: The company's revenue segment is derived entirely from its Internet Information Providers business line, generating £36.69 million.

Market Cap: £390.09M

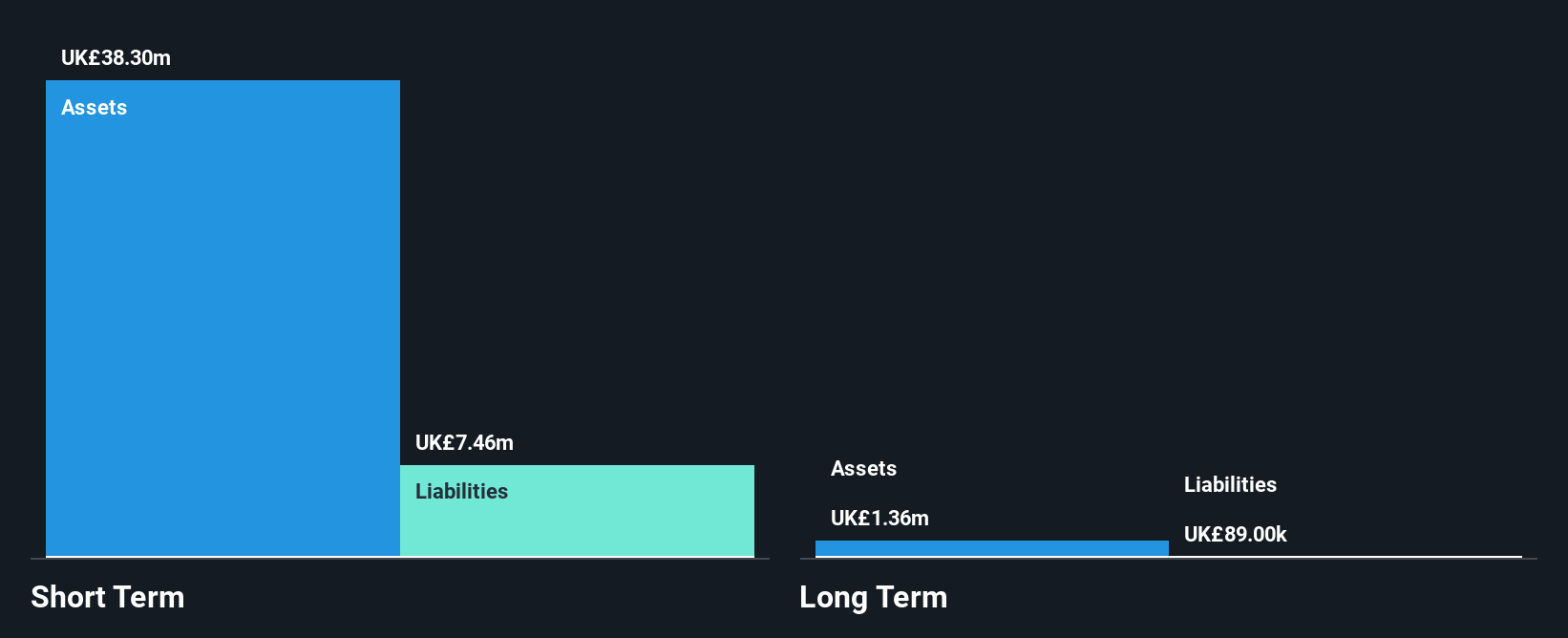

PensionBee Group, with a market cap of £390.09 million, is navigating its position in the penny stock landscape by leveraging its online retirement saving services. The company remains unprofitable but has shown resilience with revenue reaching £18.86 million for H1 2025, up from £15.37 million the previous year. Despite a net loss of £5.06 million, PensionBee's financial health is supported by being debt-free and having short-term assets significantly exceeding liabilities. While insider selling was significant recently, the management team and board are seasoned, contributing to strategic stability as they aim for future profitability improvements.

- Click here to discover the nuances of PensionBee Group with our detailed analytical financial health report.

- Examine PensionBee Group's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Unlock more gems! Our UK Penny Stocks screener has unearthed 288 more companies for you to explore.Click here to unveil our expertly curated list of 291 UK Penny Stocks.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CAPD

Capital

Provides drilling, mining, mineral assaying, and surveying services.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives