- United Kingdom

- /

- Software

- /

- AIM:CRTA

3 UK Penny Stocks With Market Caps Larger Than £20M

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing a decline following weak trade data from China, indicating ongoing struggles in the global economic landscape. Despite these broader market pressures, certain segments like penny stocks continue to capture investor interest due to their potential for significant returns. Although the term 'penny stock' may seem outdated, these smaller or newer companies can still offer substantial value when they possess solid financial foundations and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.83 | £11.43M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.79 | £287.89M | ✅ 5 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.23 | £161.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £4.125 | £333.25M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.885 | £439.03M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.095 | £394.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Character Group (AIM:CCT) | £2.50 | £45.67M | ✅ 2 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.936 | £149.28M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.26 | £2.33B | ✅ 4 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 394 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Cirata (AIM:CRTA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cirata plc, along with its subsidiaries, develops and provides collaboration software across North America, Europe, China, and other international markets with a market cap of £29.06 million.

Operations: The company generates revenue of $7.68 million from the development and sale of software licenses, along with related maintenance and support services.

Market Cap: £29.06M

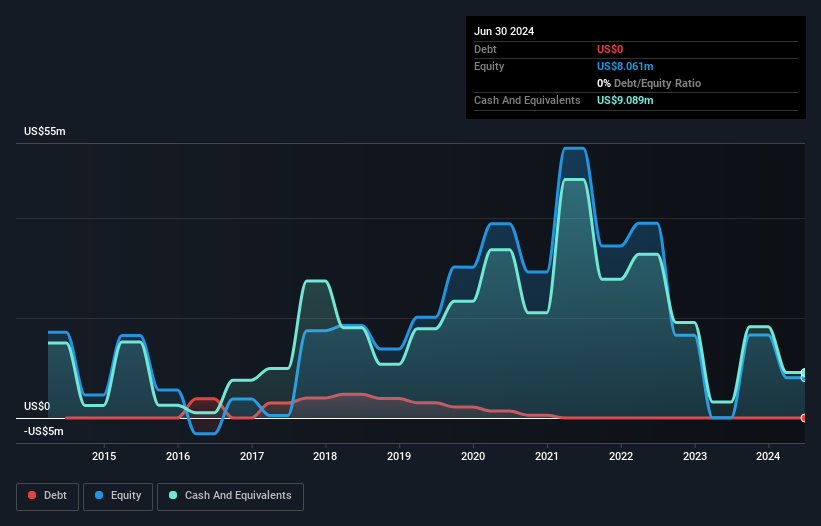

Cirata plc, with a market cap of £29.06 million, is navigating the challenges typical of penny stocks, including high volatility and ongoing unprofitability. Despite generating US$7.68 million in revenue from software licenses and services, it remains debt-free but has limited cash runway and significant losses (US$13.51 million for 2024). Recent strategic wins include a $2 million contract with a UK retailer and an innovative data migration project in the UAE, indicating potential growth avenues. However, auditor concerns about its viability as a going concern highlight financial risks that investors should carefully consider.

- Click to explore a detailed breakdown of our findings in Cirata's financial health report.

- Learn about Cirata's future growth trajectory here.

Aptitude Software Group (LSE:APTD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aptitude Software Group plc, along with its subsidiaries, offers financial management software in the UK and internationally, with a market cap of £162.01 million.

Operations: The company generates revenue of £70.04 million from its financial management software operations in the UK and abroad.

Market Cap: £162.01M

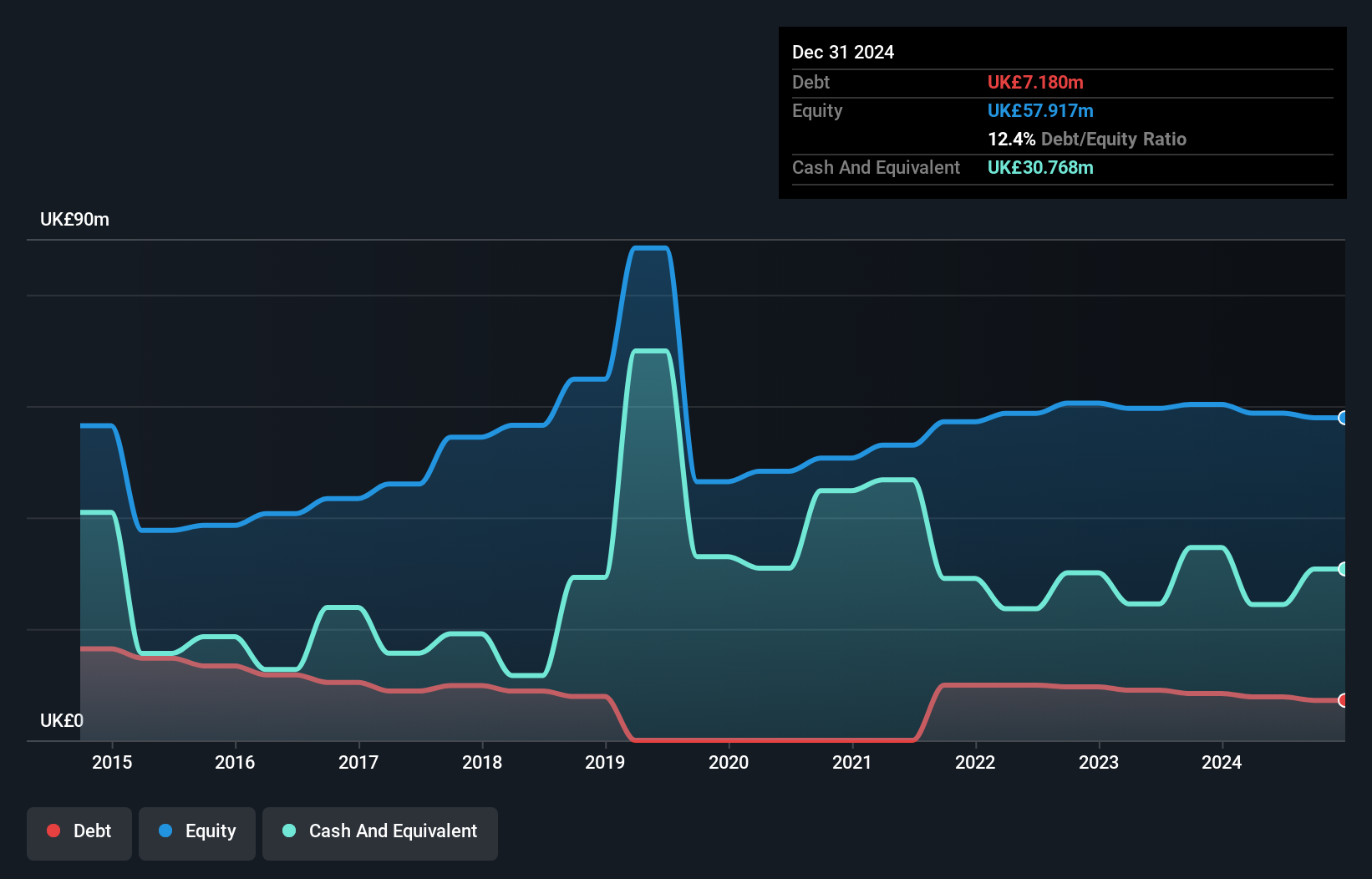

Aptitude Software Group, with a market cap of £162.01 million, is navigating the penny stock landscape with both strengths and challenges. The company reported revenues of £70.04 million for 2024, though earnings have declined by 15% annually over five years. However, recent performance shows a positive shift with profits growing by 20.7% last year and net profit margins improving to 7.1%. Aptitude's financial health is bolstered by more cash than debt and strong interest coverage (79.7x EBIT). A recent $1 million Fynapse contract win underscores its competitive edge in finance data management solutions amidst an evolving AI strategy landscape.

- Unlock comprehensive insights into our analysis of Aptitude Software Group stock in this financial health report.

- Examine Aptitude Software Group's earnings growth report to understand how analysts expect it to perform.

Intuitive Investments Group (LSE:IIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Intuitive Investments Group Plc focuses on investing in early and later-stage life sciences businesses across the United Kingdom, continental Europe, and the United States, with a market cap of £222.79 million.

Operations: The company does not have classified revenue segments available for reporting.

Market Cap: £222.79M

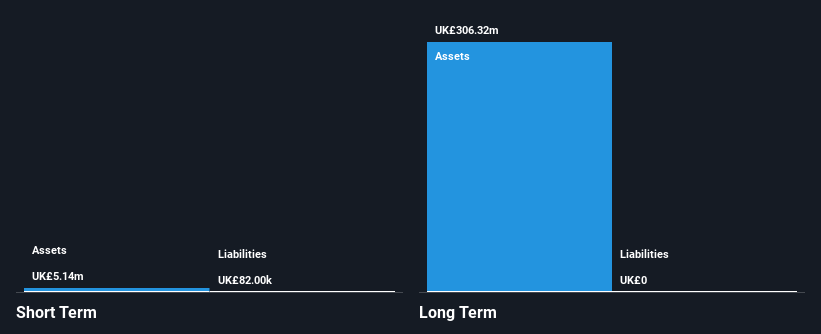

Intuitive Investments Group, with a market cap of £222.79 million, focuses on life sciences investments but remains pre-revenue with less than US$1 million in earnings. The company is debt-free and has no long-term liabilities, which provides some financial stability. Recent executive changes saw Giles Willits become CEO, bringing significant experience in corporate transformations. Although the board is relatively inexperienced and the company unprofitable with a negative return on equity of -0.73%, it recently completed a £1.56 million equity offering to extend its cash runway beyond six months, indicating efforts to stabilize its financial position amidst volatility concerns.

- Click here to discover the nuances of Intuitive Investments Group with our detailed analytical financial health report.

- Gain insights into Intuitive Investments Group's past trends and performance with our report on the company's historical track record.

Taking Advantage

- Explore the 394 names from our UK Penny Stocks screener here.

- Searching for a Fresh Perspective? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CRTA

Cirata

Engages in the development and provision of collaboration software in North America, Europe, China, and internationally.

Excellent balance sheet low.

Market Insights

Community Narratives