- United Kingdom

- /

- Capital Markets

- /

- LSE:CMCX

CMC Markets plc (LON:CMCX) Soars 26% But It's A Story Of Risk Vs Reward

Despite an already strong run, CMC Markets plc (LON:CMCX) shares have been powering on, with a gain of 26% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 32% over that time.

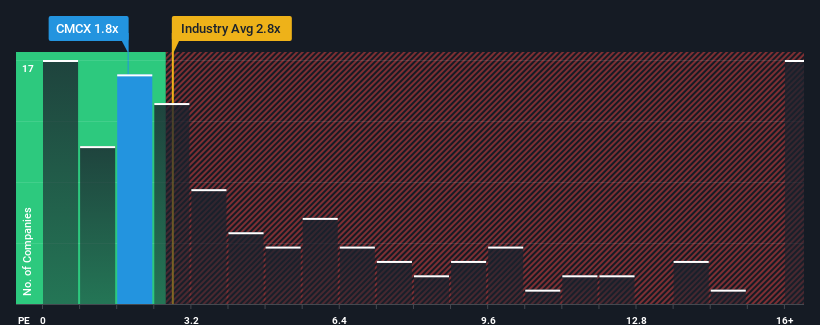

In spite of the firm bounce in price, CMC Markets may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.8x, since almost half of all companies in the Capital Markets industry in the United Kingdom have P/S ratios greater than 2.8x and even P/S higher than 9x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for CMC Markets

What Does CMC Markets' Recent Performance Look Like?

CMC Markets could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on CMC Markets will help you uncover what's on the horizon.How Is CMC Markets' Revenue Growth Trending?

In order to justify its P/S ratio, CMC Markets would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. As a result, revenue from three years ago have also fallen 32% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 16% during the coming year according to the five analysts following the company. That would be an excellent outcome when the industry is expected to decline by 0.2%.

With this information, we find it very odd that CMC Markets is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Bottom Line On CMC Markets' P/S

The latest share price surge wasn't enough to lift CMC Markets' P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that CMC Markets currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for CMC Markets you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CMCX

CMC Markets

Provides online retail financial services to retail, professional, stockbroking, and institutional clients in the United Kingdom, Ireland, rest of Europe, Australia, Germany, New Zealand, Singapore, Canada, and Sweden.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives