- United Kingdom

- /

- Capital Markets

- /

- LSE:CLIG

Solid State Leads These 3 UK Penny Stocks To Consider

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently faced a downturn, impacted by weak trade data from China and declining commodity prices, highlighting the interconnectedness of global markets. In such fluctuating conditions, investors may turn their attention to penny stocks—an investment area that remains relevant despite its somewhat outdated terminology. These smaller or newer companies can offer unique opportunities when backed by strong financials, potentially providing both value and growth that larger firms might overlook.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.095 | £467M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.06 | £166.42M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.165 | £316.77M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.975 | £14.72M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.08 | £26.39M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.67 | $389.49M | ✅ 4 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.465 | £70.76M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.505 | £43.53M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.11 | £177.16M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 301 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Solid State (AIM:SOLI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Solid State plc, with a market cap of £89.24 million, designs, manufactures, distributes and supplies electronic equipment across the United Kingdom and internationally.

Operations: Revenue segments for this company are not reported.

Market Cap: £89.24M

Solid State plc, with a market cap of £89.24 million, has shown resilience despite a challenging year marked by a large one-off loss impacting its financial results. The company reported improved sales of £85.65 million for the half-year ended September 2025, up from £61.78 million the previous year, and net income rose to £2.89 million from £0.975 million. While profit margins have declined to 1.6% from last year's 3.9%, debt is well-covered by cash flow and interest payments are secure with EBIT coverage at 5.6x. Recent board changes include appointing Victor Chavez CBE as Non-Executive Deputy Chairman to bolster leadership stability following CEO Gary Marsh's passing.

- Click to explore a detailed breakdown of our findings in Solid State's financial health report.

- Evaluate Solid State's prospects by accessing our earnings growth report.

Volex (AIM:VLX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Volex plc is a company that manufactures and sells power and connectivity products across North America, Europe, and Asia with a market cap of £753.32 million.

Operations: The company's revenue is derived from North America ($571.20 million), Europe ($429.70 million), and Asia ($151.30 million).

Market Cap: £753.32M

Volex plc, with a market cap of £753.32 million, has demonstrated robust financial performance and strategic growth. Recent earnings for the half-year ended September 2025 show sales of US$583.9 million and net income of US$28.5 million, reflecting a significant increase from the previous year. The company's debt is well-managed with operating cash flow covering 49.4% of its debt and a satisfactory net debt to equity ratio of 35.7%. Volex's board is experienced, further strengthened by recent executive changes including Nat Rothschild as CEO and Dave Webster as Non-Executive Chair, positioning it for continued progress in its sector.

- Dive into the specifics of Volex here with our thorough balance sheet health report.

- Explore Volex's analyst forecasts in our growth report.

City of London Investment Group (LSE:CLIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £179.81 million.

Operations: The company's revenue is primarily derived from its Asset Management segment, totaling $73.04 million.

Market Cap: £179.81M

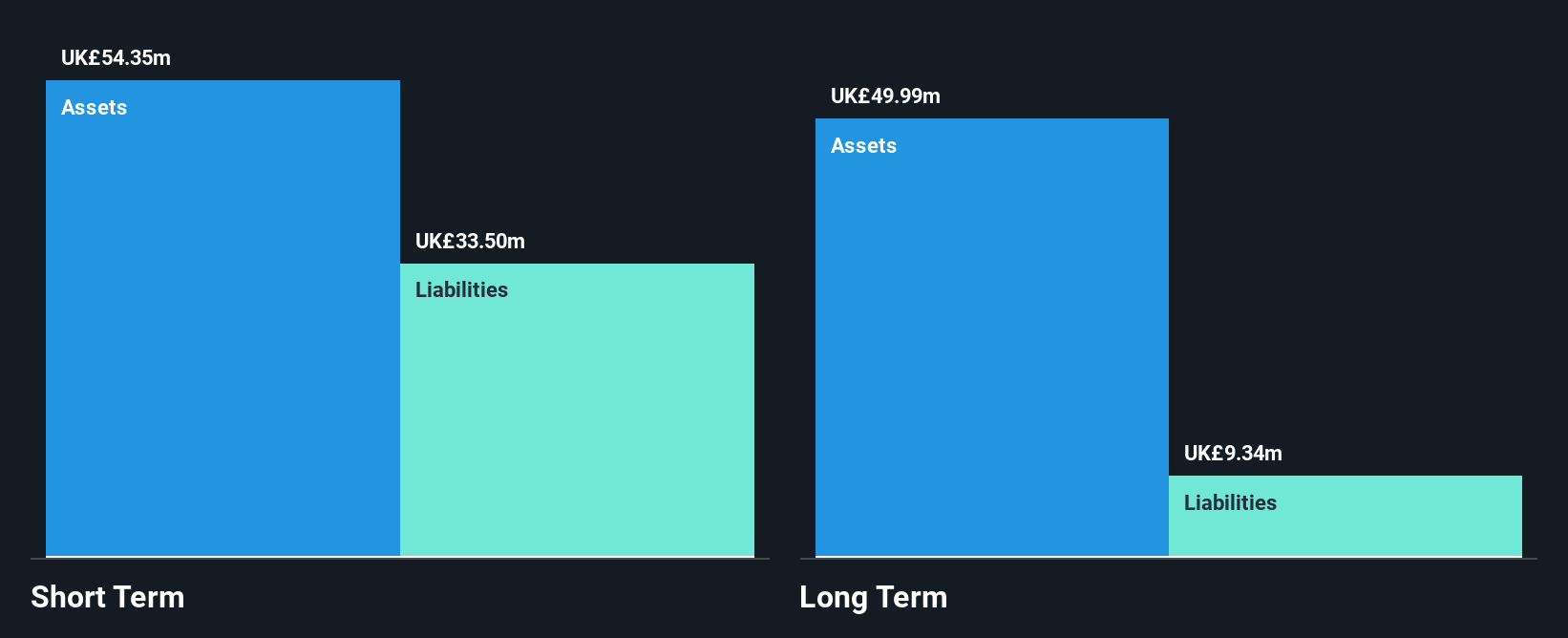

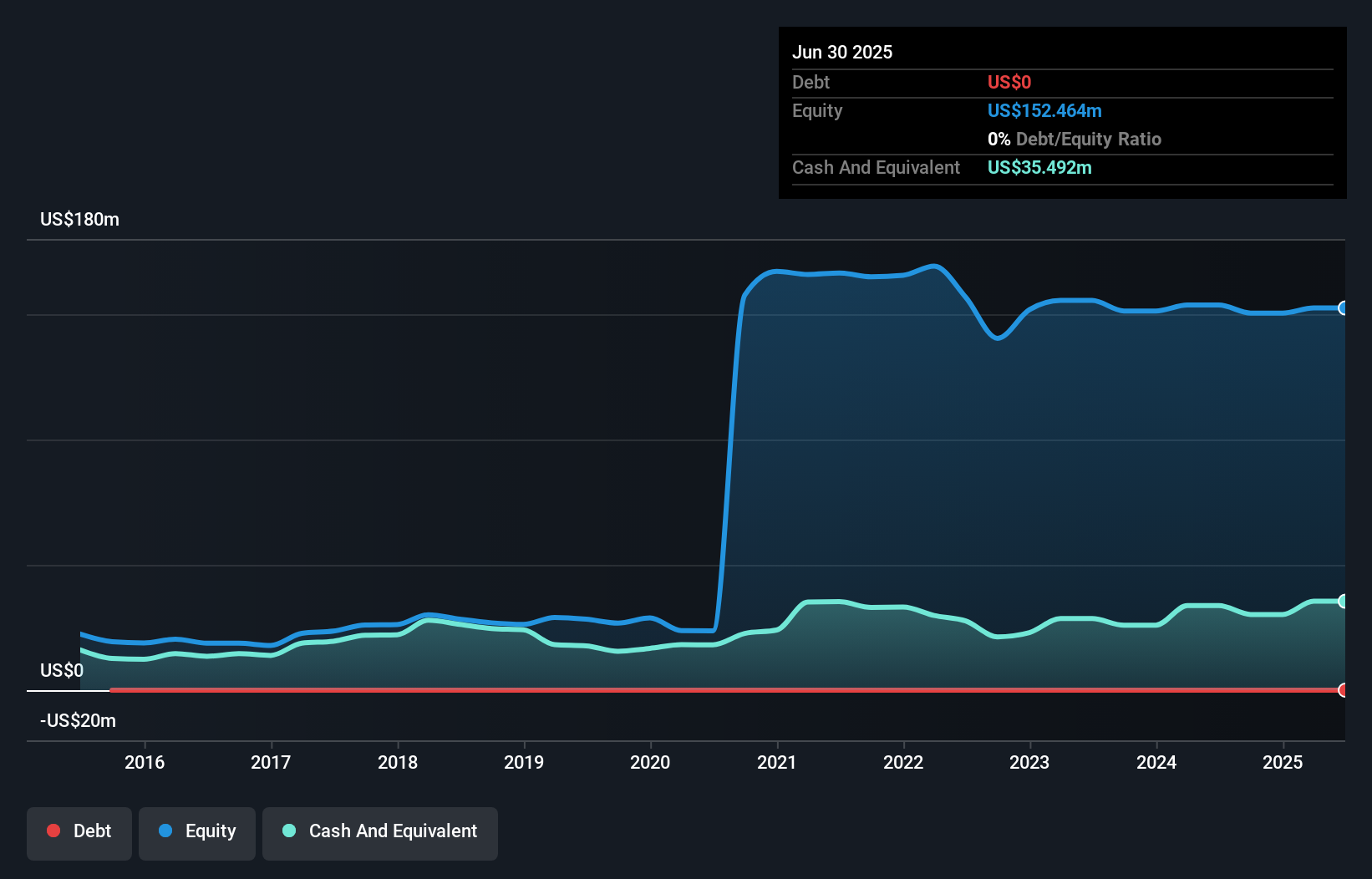

City of London Investment Group, with a market cap of £179.81 million, faces challenges despite recent earnings growth and stable operations. Its net income increased to US$19.68 million for the year ended June 2025, yet an auditor's report expressed doubts about its ability to continue as a going concern. The company declared a consistent dividend of 33 pence per share for 2025, but the high dividend yield is not well covered by earnings. Although debt-free with strong short-term asset coverage, significant insider selling raises concerns about future stability amidst ongoing management changes.

- Get an in-depth perspective on City of London Investment Group's performance by reading our balance sheet health report here.

- Gain insights into City of London Investment Group's historical outcomes by reviewing our past performance report.

Make It Happen

- Unlock more gems! Our UK Penny Stocks screener has unearthed 298 more companies for you to explore.Click here to unveil our expertly curated list of 301 UK Penny Stocks.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CLIG

City of London Investment Group

City of London Investment Group PLC is a publically owned investment manager.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026