- United Kingdom

- /

- Software

- /

- AIM:CNS

Discover UK Penny Stocks: 3 Picks With Market Caps Under £200M

Reviewed by Simply Wall St

The UK market has faced challenges recently, with the FTSE 100 index experiencing a decline due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market fluctuations, there remains an intriguing opportunity within the realm of penny stocks. Though often considered a relic of past eras, penny stocks—typically representing smaller or newer companies—can offer significant potential when backed by strong financials. In this article, we explore three such promising candidates in the UK market that stand out for their financial strength and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.64 | £54.06M | ✅ 4 ⚠️ 4 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.15 | £155.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.41 | £386.35M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.69 | £355.7M | ✅ 3 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.368 | £174.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.626 | £1.01B | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.00 | £159.49M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.998 | £2.2B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.34 | £36.79M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 391 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

accesso Technology Group (AIM:ACSO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: accesso Technology Group plc develops technology solutions for the attractions and leisure industry across various regions including the UK, Europe, and the Americas, with a market cap of £171.54 million.

Operations: No specific revenue segments are reported for this company.

Market Cap: £171.54M

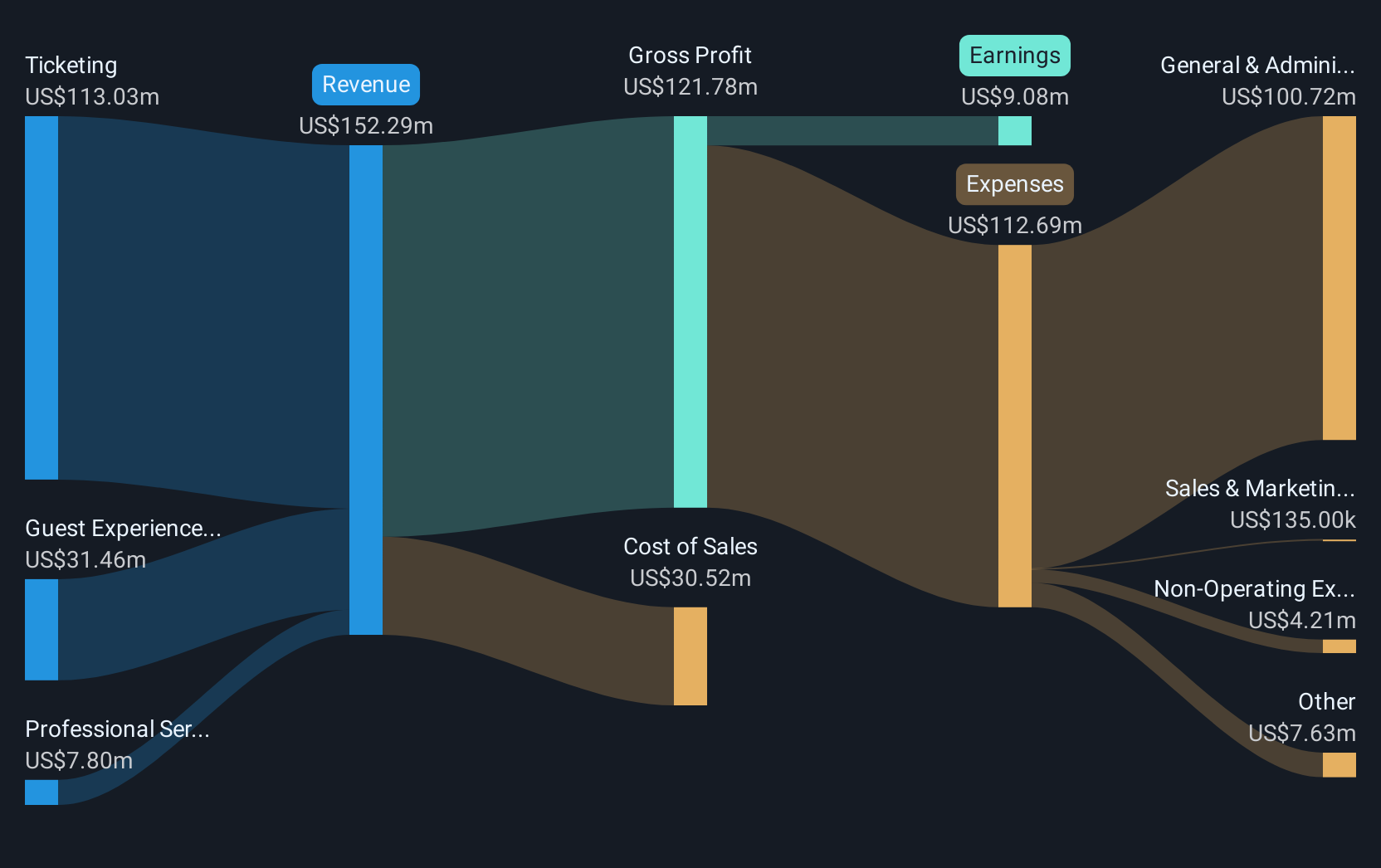

accesso Technology Group plc has demonstrated solid financial performance with a reported net income of US$9.08 million for 2024, marking an improvement from the previous year. The company benefits from strong liquidity, as its short-term assets exceed both its short- and long-term liabilities. Recent selection as the technology provider for Saudi Arabia's Qiddiya project underscores accesso's strategic positioning in high-growth markets. Despite a relatively new management team, the company's debt levels are well-managed with more cash than total debt and interest payments are well covered by EBIT. However, return on equity remains low at 4.6%.

- Unlock comprehensive insights into our analysis of accesso Technology Group stock in this financial health report.

- Assess accesso Technology Group's future earnings estimates with our detailed growth reports.

Corero Network Security (AIM:CNS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Corero Network Security plc offers distributed denial of service (DDoS) protection solutions globally and has a market cap of £88.35 million.

Operations: The company generates revenue of $24.56 million from its distributed denial of service (DDoS) protection solutions worldwide.

Market Cap: £88.35M

Corero Network Security plc, with a market cap of £88.35 million, has recently renewed its strategic partnership with NorthC Data Centers and expanded its DDoS Protection-as-a-Service contract with TechEnabler for $0.6 million. The company reported revenues of US$24.56 million for 2024 and achieved profitability, showing net income of US$0.498 million compared to a loss the previous year. Corero's financial stability is supported by strong liquidity, as short-term assets exceed liabilities, and the company operates debt-free. Despite having a relatively new management team, Corero's strategic partnerships enhance growth opportunities in cybersecurity markets globally.

- Take a closer look at Corero Network Security's potential here in our financial health report.

- Learn about Corero Network Security's future growth trajectory here.

CAB Payments Holdings (LSE:CABP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CAB Payments Holdings Limited, with a market cap of £107.38 million, operates through its subsidiaries to offer foreign exchange and cross-border payment services to banks, fintech companies, development organizations, and governments both in the United Kingdom and internationally.

Operations: The company's revenue segment includes unclassified services generating £91.04 million.

Market Cap: £107.38M

CAB Payments Holdings, with a market cap of £107.38 million, is trading significantly below its estimated fair value, presenting potential investment appeal. Despite recent negative earnings growth and declining profit margins from 28.8% to 15.6%, the company remains debt-free and has substantial short-term assets (£1.5 billion), though these slightly fall short of covering liabilities (£1.6 billion). Recent leadership changes aim to bolster strategic direction with experienced executives like James Hopkinson as CFO, enhancing the management team's capability to drive future growth amidst challenging income performance in 2024 and efforts to boost revenue in 2025.

- Jump into the full analysis health report here for a deeper understanding of CAB Payments Holdings.

- Gain insights into CAB Payments Holdings' future direction by reviewing our growth report.

Where To Now?

- Explore the 391 names from our UK Penny Stocks screener here.

- Seeking Other Investments? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CNS

Corero Network Security

Provides distributed denial of service (DDoS) protection solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives