- United Kingdom

- /

- Diversified Financial

- /

- AIM:LIT

3 UK Penny Stocks With Market Caps Under £300M

Reviewed by Simply Wall St

The UK market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting challenges in global economic recovery. In such uncertain times, investors may look towards penny stocks as an opportunity to explore smaller or newer companies that offer potential value and growth prospects. Despite their somewhat outdated name, penny stocks can still represent an attractive investment area when they exhibit strong financials and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.26 | £315.06M | ✅ 5 ⚠️ 0 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.56 | £511.62M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.075 | £329.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ✅ 5 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.852 | £315.05M | ✅ 5 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.02 | £310.88M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.21 | £192.78M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.35 | £72.6M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.175 | £821.42M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 301 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Litigation Capital Management (AIM:LIT)

Simply Wall St Financial Health Rating: ★★★★☆☆

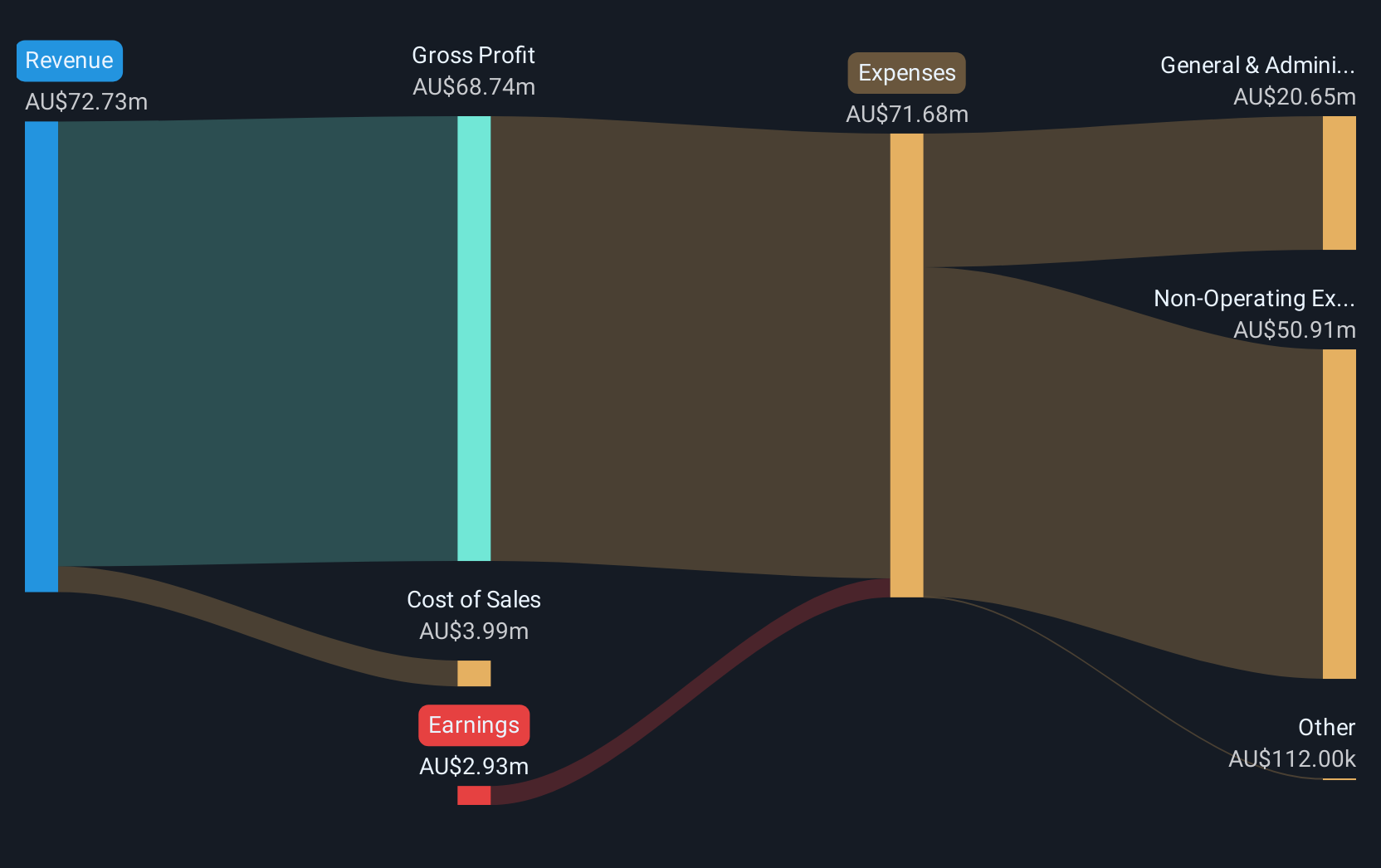

Overview: Litigation Capital Management Limited offers dispute finance and risk management services in Australia and the United Kingdom, with a market cap of £30.72 million.

Operations: No revenue segments have been reported for this company.

Market Cap: £30.72M

Litigation Capital Management, with a market cap of £30.72 million, is pre-revenue and currently unprofitable. Despite this, the company shows potential through its experienced management team and board of directors. Its short-term assets significantly exceed liabilities, indicating strong liquidity. The company's debt level is manageable with more cash than total debt, although its operating cash flow remains negative. Trading at a substantial discount to estimated fair value suggests it could be undervalued relative to peers. However, high volatility persists in its share price and the dividend yield lacks coverage from earnings or free cash flows.

- Click here to discover the nuances of Litigation Capital Management with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Litigation Capital Management's future.

Stelrad Group (LSE:SRAD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Stelrad Group PLC manufactures and distributes radiators across the United Kingdom, Ireland, Europe, Turkey, and internationally with a market capitalization of £220.96 million.

Operations: The company's revenue segment is focused on the manufacture and distribution of radiators, generating £290.58 million.

Market Cap: £220.96M

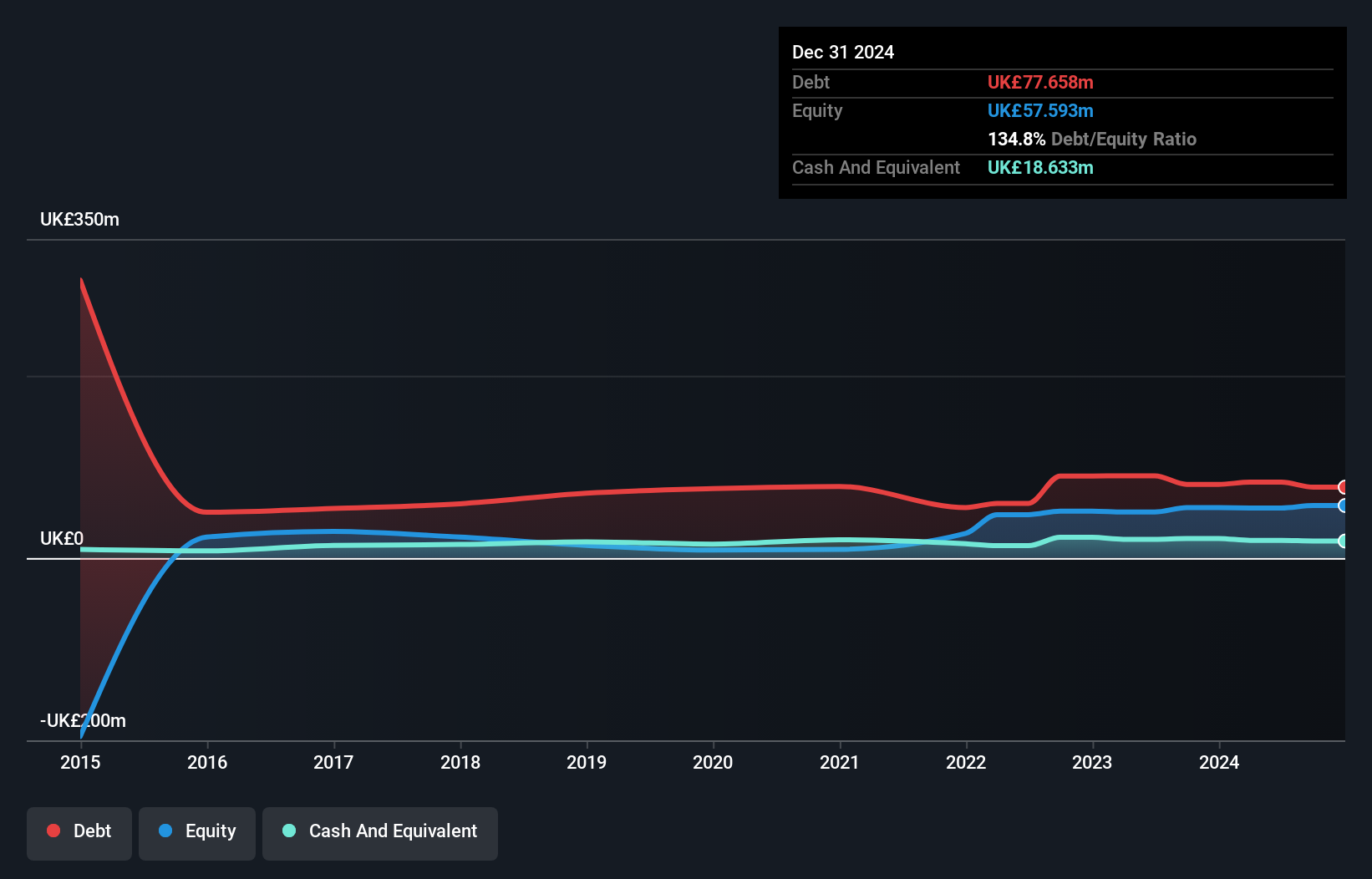

Stelrad Group PLC, with a market cap of £220.96 million, demonstrates solid financial health through well-covered interest payments and debt by operating cash flow. Its board is experienced with an average tenure of 6.7 years, enhancing governance stability. The company trades at a significant discount to its estimated fair value and has not diluted shareholders recently, indicating potential undervaluation. Despite high debt levels, the reduction in the debt-to-equity ratio over five years reflects improved financial management. Earnings growth forecasted at 9.85% annually suggests positive momentum, although dividend sustainability remains uncertain due to an unstable track record.

- Unlock comprehensive insights into our analysis of Stelrad Group stock in this financial health report.

- Gain insights into Stelrad Group's future direction by reviewing our growth report.

Daniel Thwaites (OFEX:THW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Daniel Thwaites PLC, with a market cap of £52.43 million, operates and manages pubs, inns, hotels, and spas across the United Kingdom.

Operations: The company's revenue is derived from its Hotels & Spas segment, contributing £57 million, and its Pubs and Inns segment, which adds £63.6 million.

Market Cap: £52.43M

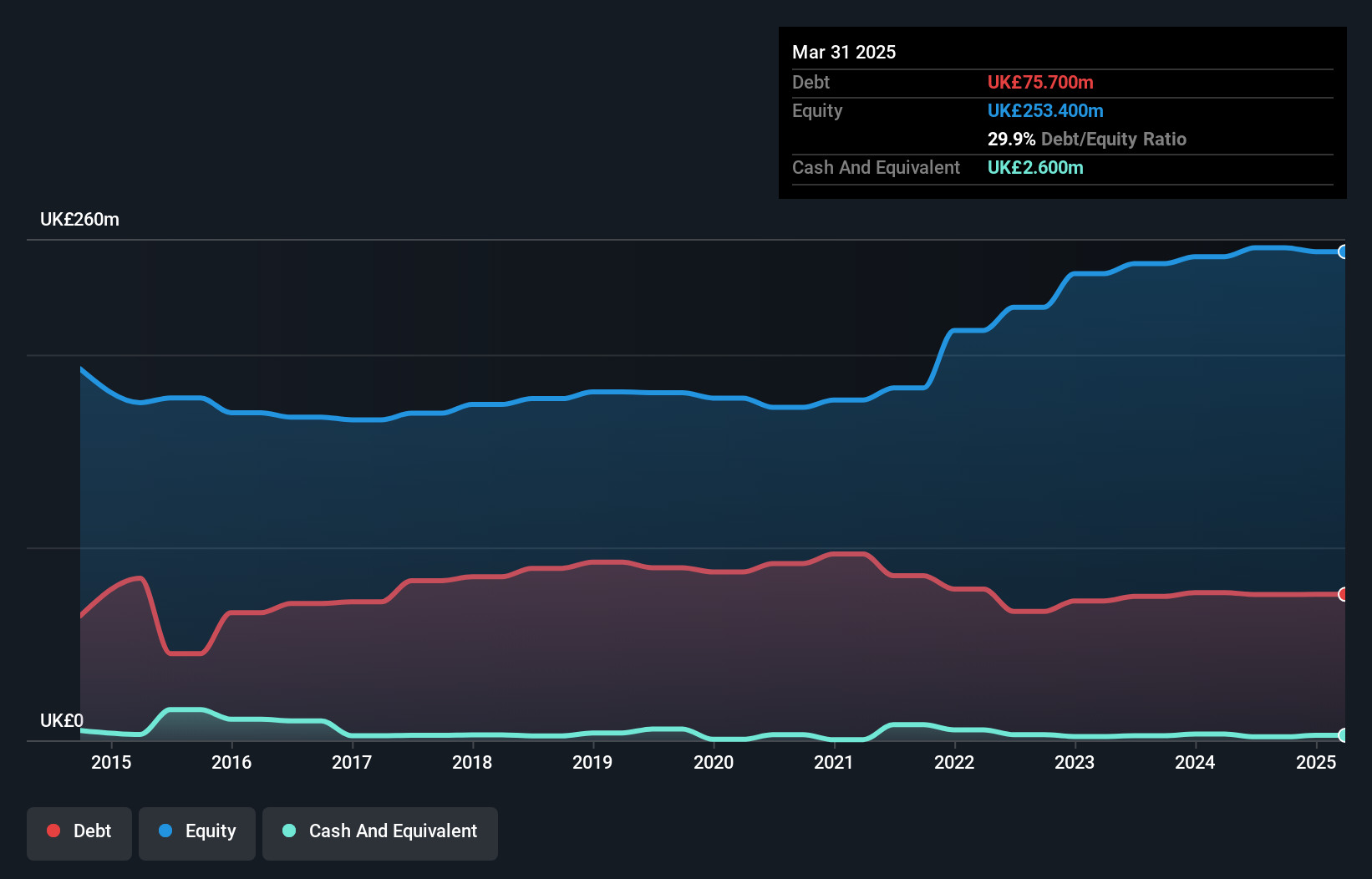

Daniel Thwaites PLC, with a market cap of £52.43 million, shows financial stability through its well-covered debt by operating cash flow and interest payments. Despite trading at 24.6% below estimated fair value, indicating potential undervaluation, the company's earnings growth of 4.1% over the past year lags behind its five-year average of 31%. The board and management team are seasoned with tenures averaging 6.5 and 14.3 years respectively, supporting strong governance. However, short-term assets do not cover liabilities, posing a liquidity concern while an unstable dividend track record raises questions about income reliability for investors.

- Click here and access our complete financial health analysis report to understand the dynamics of Daniel Thwaites.

- Review our historical performance report to gain insights into Daniel Thwaites' track record.

Make It Happen

- Investigate our full lineup of 301 UK Penny Stocks right here.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:LIT

Litigation Capital Management

Provides dispute finance and risk management services in Australia and the United Kingdom.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives