- United Kingdom

- /

- Hospitality

- /

- LSE:GRG

Greggs (LSE:GRG): Exploring Valuation as Shares See Modest Recent Bump

Reviewed by Kshitija Bhandaru

See our latest analysis for Greggs.

While Greggs’ share price has ticked up recently, overall momentum has cooled this year, with a modest 1-year total shareholder return just below flat. Markets seem to be weighing growth prospects against ongoing challenges, so investors are watching to see if positive sentiment can remain.

If you’re weighing up what else is making moves right now, this could be your moment to branch out and discover fast growing stocks with high insider ownership

But with the shares trading below analyst targets and a mixed track record over the last year, is Greggs now trading at a bargain? Or is all of the future growth already built into the price?

Most Popular Narrative: 18.9% Undervalued

With Greggs’ most popular narrative assigning a fair value nearly 19% above the last close, the stock looks discounted on this measure. That figure reflects optimistic expectations for revenue growth and margin resilience, setting the backdrop for a potentially upbeat outlook.

The accelerating adoption of digital ordering, delivery platforms, and loyalty app engagement (now at 25% of shop visits) enables Greggs to grow incremental sales, boost frequency of visits through personalized marketing, and potentially lift average transaction values. This could have positive implications for both revenue and earnings.

What quantifiable shift is at the core of this bullish narrative? Behind the high fair value sits a formula driven by projected surges in digital-driven sales and a future profit multiple seldom seen in this industry. Curious what numbers underpin such optimism? Uncover the financial leaps the consensus is betting on for Greggs.

Result: Fair Value of £20.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weak underlying demand or sustained cost pressures could quickly undermine the positive outlook that analysts have built into their valuation assumptions.

Find out about the key risks to this Greggs narrative.

Another View: What Does the SWS DCF Model Say?

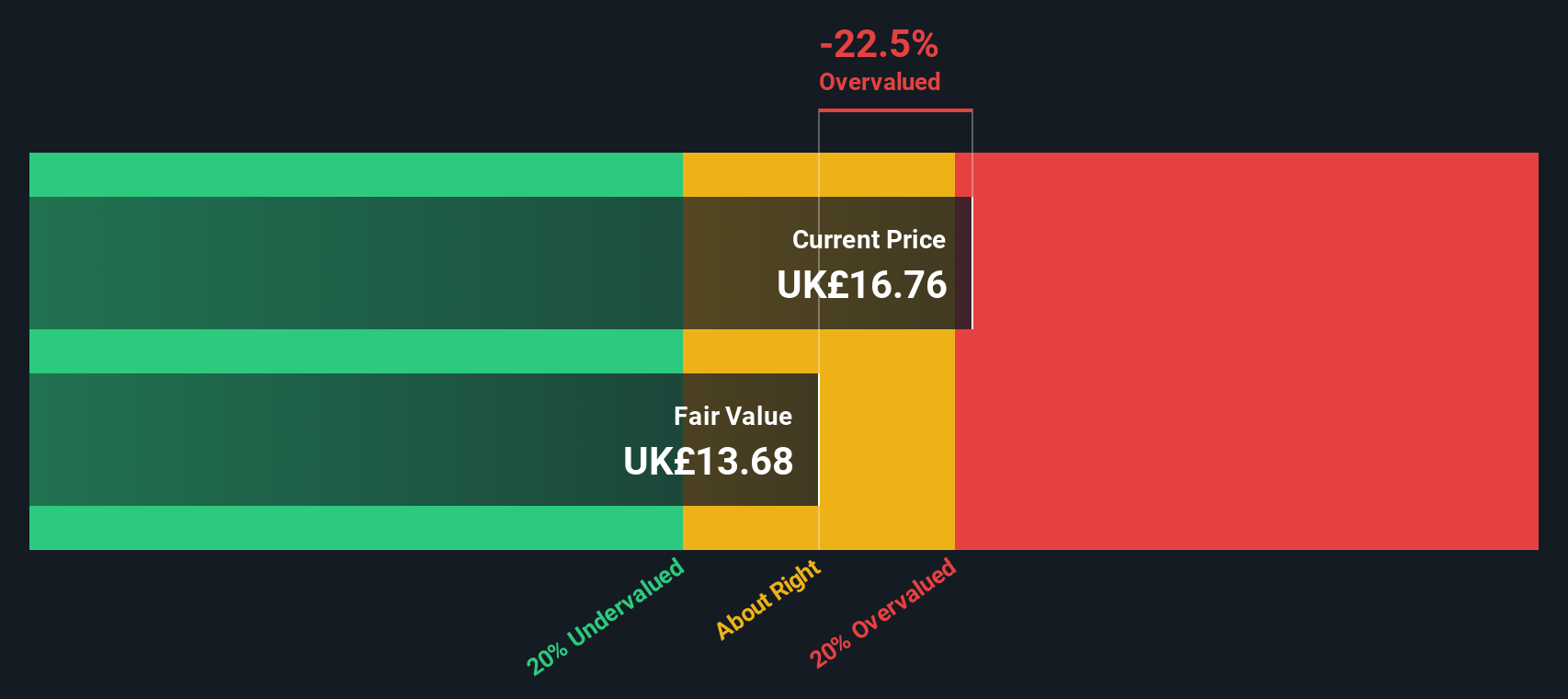

While the most popular narrative values Greggs’ shares nearly 19% higher than today’s close, our SWS DCF model tells a more cautious story. Using projected cash flows, the model estimates a fair value of £13.70. This suggests shares are currently trading well above this level. Does the market know something the model does not, or are expectations running ahead of reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Greggs for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Greggs Narrative

If you want a different perspective or would rather dig into the data yourself, you can craft your own narrative in just a few minutes by using Do it your way.

A great starting point for your Greggs research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let today’s opportunity be tomorrow’s regret. Expand your search now and put powerful research tools to work uncovering stock gems you might be missing out on.

- Unlock the income advantage by checking out these 19 dividend stocks with yields > 3% with reliable yields for steady returns in uncertain markets.

- Spot future growth stories early as you scan these 3566 penny stocks with strong financials with strong financial foundations and compelling upside potential.

- Capitalize on tech’s hottest trend by following these 24 AI penny stocks to see which companies are harnessing artificial intelligence to disrupt entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GRG

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)