- United Kingdom

- /

- Marine and Shipping

- /

- LSE:TMI

ActiveOps Leads The Charge In UK Penny Stocks

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over China's economic recovery. Despite these broader market uncertainties, penny stocks remain an intriguing investment area for those seeking growth opportunities in smaller or newer companies. These stocks, though often overlooked, can offer a unique combination of value and potential when backed by strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.57 | £511.64M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.12 | £252.06M | ✅ 5 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.282 | £140.14M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.853 | £315.42M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.71 | £278.68M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.55 | £127.67M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.17 | £185.96M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.775 | £10.67M | ✅ 2 ⚠️ 3 View Analysis > |

| Samuel Heath & Sons (AIM:HSM) | £3.35 | £8.49M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 298 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ActiveOps (AIM:AOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ActiveOps Plc provides hosted operations management software as a service to various industries across Europe, the Middle East, India, Africa, North America, and Asia Pacific with a market cap of £118.46 million.

Operations: The company's revenue is primarily generated from its SaaS offerings, which account for £26.77 million, complemented by £3.69 million from training and implementation services.

Market Cap: £118.46M

ActiveOps Plc, with a market cap of £118.46 million, generates substantial revenue from its SaaS offerings (£26.77 million) and training services (£3.69 million). The company has shown stable weekly volatility (6%) and improved net profit margins (3.6% from 3.2%). With no debt and short-term assets exceeding liabilities, ActiveOps is financially sound. Earnings have grown by 30.7% over the past year but are below the five-year average growth rate of 69.4%. Recent earnings showed increased sales (£30.46 million) and net income (£1.1 million). Analysts expect continued growth in earnings by 43.34% annually.

- Get an in-depth perspective on ActiveOps' performance by reading our balance sheet health report here.

- Understand ActiveOps' earnings outlook by examining our growth report.

Tribal Group (AIM:TRB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tribal Group plc, with a market cap of £113.52 million, provides software and services to education institutions worldwide through its subsidiaries.

Operations: Tribal Group plc does not report any specific revenue segments.

Market Cap: £113.52M

Tribal Group plc, with a market cap of £113.52 million, has demonstrated significant earnings growth of 318.2% over the past year, surpassing its five-year average and industry standards. Despite high volatility and a low return on equity (14.6%), the company maintains satisfactory debt levels with strong interest coverage (14x) and operating cash flow coverage (165.3%). Recent earnings reports show improved net profit margins at 8.9%, up from 2.2% last year, alongside modest revenue growth to £45.29 million for the half-year ended June 2025. However, short-term liabilities exceed assets (£40.4M vs £20.5M), highlighting potential liquidity concerns.

- Unlock comprehensive insights into our analysis of Tribal Group stock in this financial health report.

- Assess Tribal Group's future earnings estimates with our detailed growth reports.

Taylor Maritime (LSE:TMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Taylor Maritime Limited is an investment company focused on acquiring, managing, and operating dry bulk ships with a market cap of $268.29 million.

Operations: The company generates revenue through its shipping vessels, which are used to achieve investment returns while preserving capital, amounting to -$66.35 million.

Market Cap: $268.29M

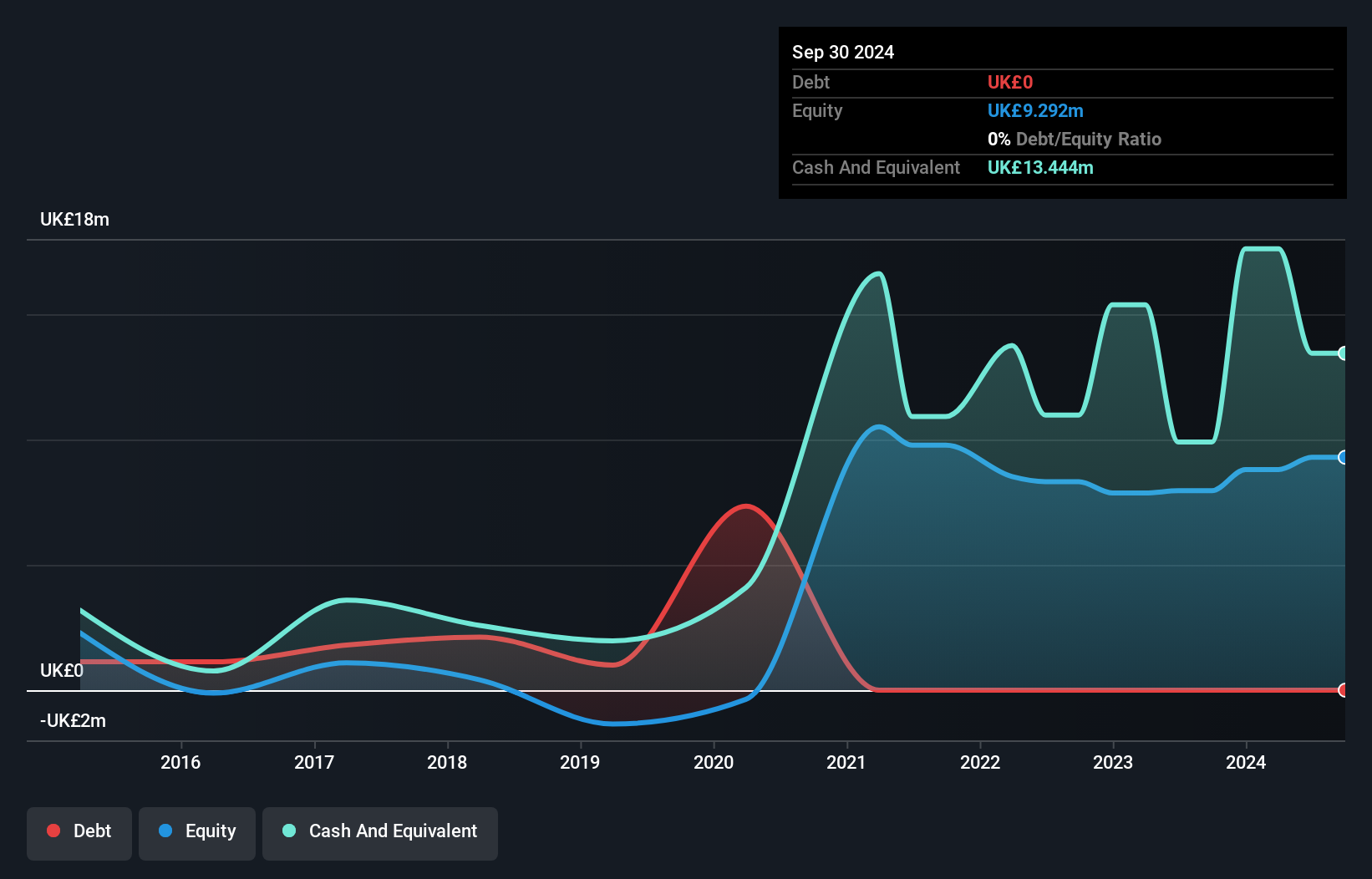

Taylor Maritime Limited, with a market cap of $268.29 million, is currently pre-revenue and unprofitable, reporting a net loss of $78.61 million for the year ended March 2025. Despite being debt-free and having short-term assets ($6.2M) exceeding liabilities ($4M), its negative revenue of -$66.51 million highlights operational challenges in generating income from its dry bulk shipping operations. The company declared an interim dividend of 2 US cents per share, though this is not well covered by earnings due to ongoing losses. With earnings forecasted to grow significantly annually, investors may anticipate potential future improvements amidst current financial hurdles.

- Navigate through the intricacies of Taylor Maritime with our comprehensive balance sheet health report here.

- Explore Taylor Maritime's analyst forecasts in our growth report.

Taking Advantage

- Unlock our comprehensive list of 298 UK Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taylor Maritime might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TMI

Taylor Maritime

An investment company, engages in the acquisition, management, and operation of dry bulk ships.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives