- United Kingdom

- /

- Consumer Services

- /

- AIM:TRB

3 UK Penny Stocks With Market Caps Under £200M

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting the interconnectedness of global economies. Amid these broader market fluctuations, investors often look toward smaller companies for potential opportunities. Penny stocks, though an outdated term, continue to intrigue as they represent smaller or newer companies that might offer a blend of affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.855 | £11.77M | ✅ 3 ⚠️ 3 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.64 | £54.04M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.87 | £296.27M | ✅ 5 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £3.85 | £311.03M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.765 | £425.47M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.935 | £379.32M | ✅ 3 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.65 | £1.03B | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.924 | £147.37M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.974 | £2.18B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.35 | £37.87M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 398 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

M.T.I Wireless Edge (AIM:MWE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: M.T.I Wireless Edge Ltd. designs, develops, manufactures, and markets antennas for both military and civilian sectors with a market cap of £41.37 million.

Operations: The company's revenue is derived from three main segments: Antennas ($14.14 million), Water Solutions ($16.89 million), and Distribution & Consultation ($14.85 million).

Market Cap: £41.37M

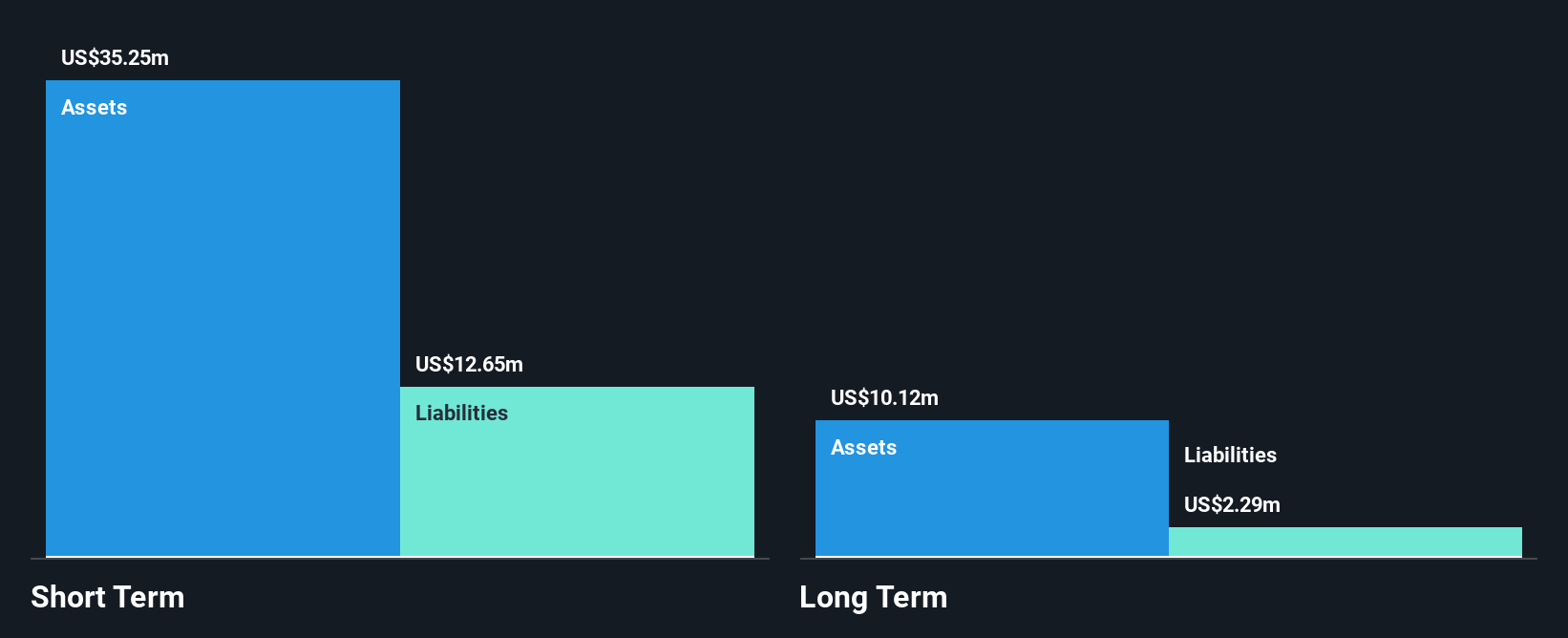

M.T.I Wireless Edge Ltd. has shown consistent earnings growth, with net income rising to US$4.36 million from US$4.05 million the previous year, supported by a solid balance sheet where short-term assets significantly exceed liabilities. Despite its relatively low Return on Equity of 14.2%, the company maintains high-quality earnings and stable cash flow coverage for its debt obligations, indicating financial prudence. Recent strategic moves include seeking acquisitions backed by a robust backlog exceeding US$25 million and an extended buyback plan through March 2026, reflecting proactive capital management amid volatile share price movements over recent months.

- Click to explore a detailed breakdown of our findings in M.T.I Wireless Edge's financial health report.

- Evaluate M.T.I Wireless Edge's prospects by accessing our earnings growth report.

Tribal Group (AIM:TRB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tribal Group plc, with a market cap of £88.06 million, provides software and services to education institutions worldwide through its subsidiaries.

Operations: The company's revenue is derived from two main segments: Student Information Systems (SIS) generating £72.74 million and Etio contributing £17.27 million.

Market Cap: £88.06M

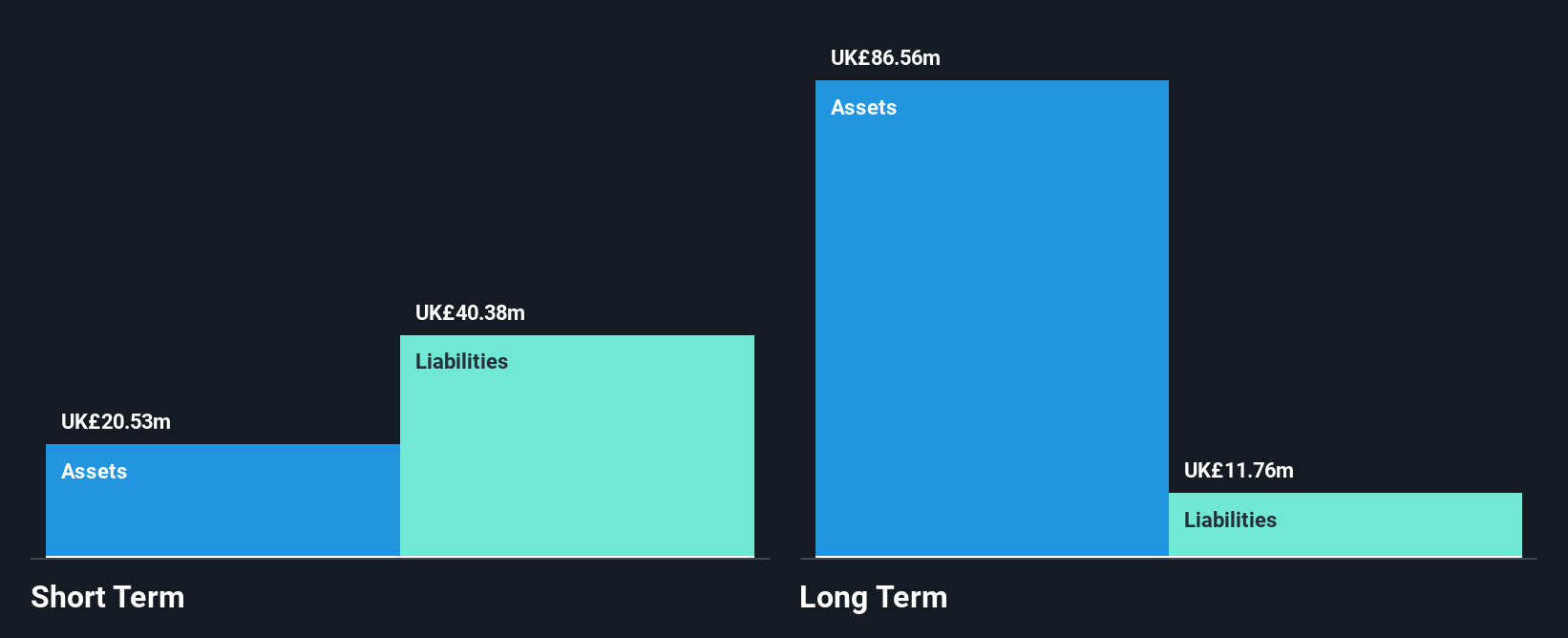

Tribal Group plc, with a market cap of £88.06 million, has demonstrated profitability growth over the past five years, although recent earnings growth of 3.7% fell short of its historical average. Its interest payments are well-covered by EBIT at 6.6 times, and the net debt to equity ratio remains satisfactory at 5.3%. Despite stable weekly volatility and high-quality earnings, Tribal's short-term assets do not cover its short-term liabilities (£49.6M). The company trades significantly below estimated fair value and recently affirmed a final dividend proposal for 2024 pending shareholder approval in May 2025.

- Dive into the specifics of Tribal Group here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Tribal Group's future.

Capital (LSE:CAPD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Capital Limited, with a market cap of £134.56 million, operates through its subsidiaries to offer drilling, mining, mineral assaying, and surveying services.

Operations: The company generates revenue of $348 million from its Business Services segment, which includes drilling, mining, mineral assaying, and surveying services.

Market Cap: £134.56M

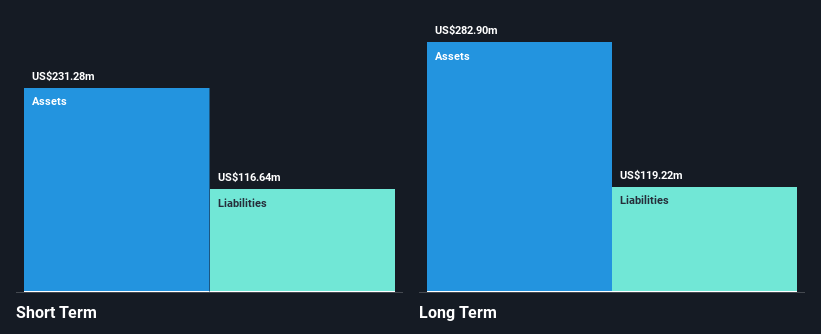

Capital Limited, with a market cap of £134.56 million, has secured a significant mining services contract with Reko Diq Mining Pakistan Limited, potentially generating over US$60 million annually starting late 2025. Despite this promising development, the company's financial performance for 2024 showed declining net income at US$17.32 million and reduced profit margins from the previous year. Capital's dividend was halved to 1.3 cents per share for 2024 due to these challenges. While its debt is well-covered by cash flow and liabilities are manageable, earnings volatility remains high and interest coverage is below ideal levels at 2.6 times EBIT.

- Jump into the full analysis health report here for a deeper understanding of Capital.

- Assess Capital's future earnings estimates with our detailed growth reports.

Make It Happen

- Unlock our comprehensive list of 398 UK Penny Stocks by clicking here.

- Curious About Other Options? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Tribal Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tribal Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TRB

Tribal Group

Through its subsidiaries, provides software and services to education institutions worldwide.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives