- United Kingdom

- /

- Food and Staples Retail

- /

- LSE:SBRY

Top UK Dividend Stocks To Watch In September 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting concerns over global economic recovery. In such uncertain times, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate these volatile conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.20% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.90% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 5.72% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.18% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.90% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.08% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.83% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.12% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.07% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.10% | ★★★★★☆ |

Click here to see the full list of 52 stocks from our Top UK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

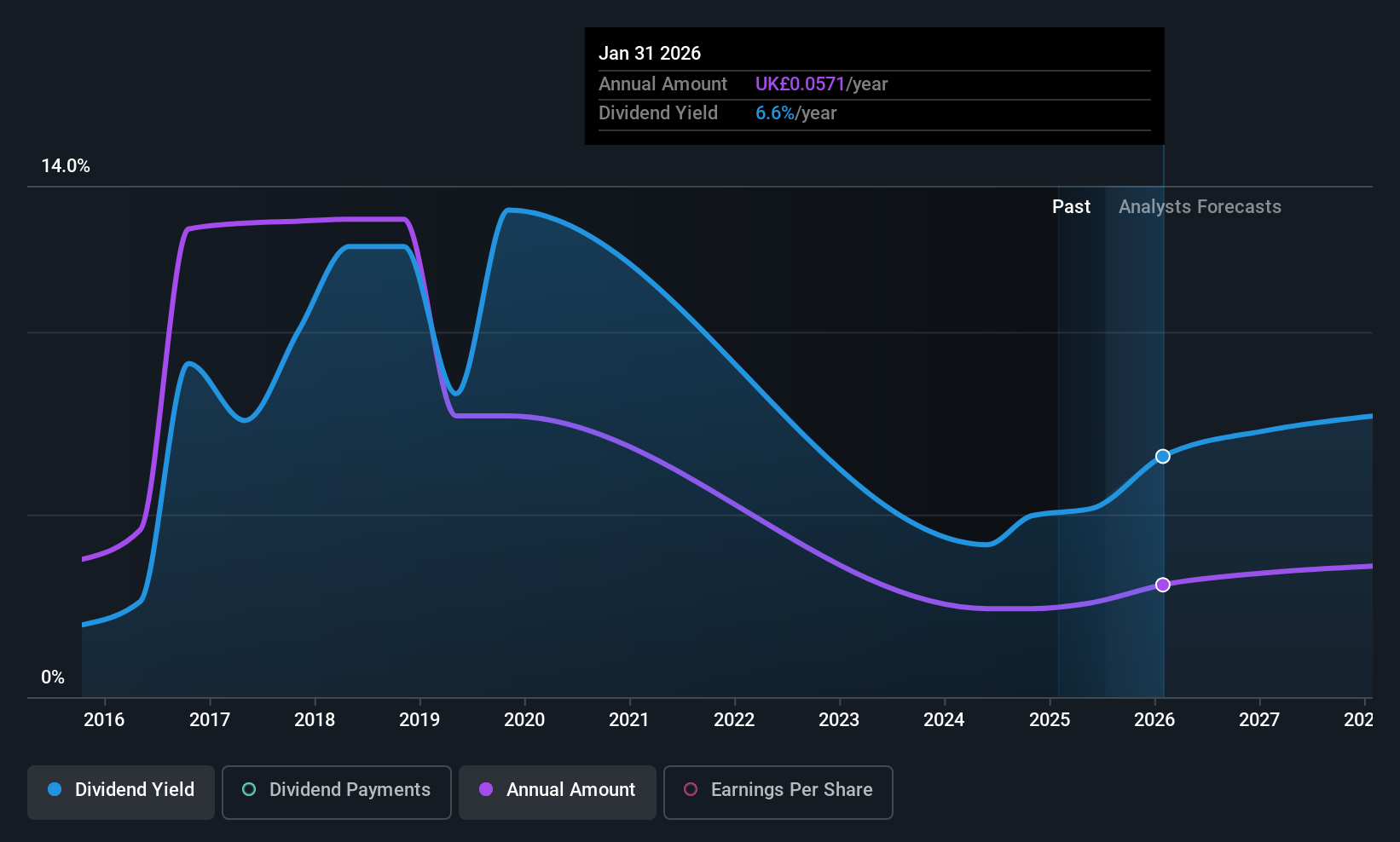

Card Factory (LSE:CARD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Card Factory plc is a specialist retailer of cards, gifts, and celebration essentials with operations in the United Kingdom, South Africa, Republic of Ireland, the United States, and internationally; it has a market cap of £370.25 million.

Operations: Card Factory plc generates revenue through its Cardfactory Stores (£506.80 million), Partnerships (£22.20 million), and Cardfactory Online (Including Getting Personal) (£13.20 million).

Dividend Yield: 4.6%

Card Factory's dividend payments are well covered by both earnings and cash flows, with a low payout ratio of 34.8% and a cash payout ratio of 23.9%. Despite an unstable dividend track record marked by volatility, dividends have grown over the past decade. The stock trades at a good value, 44% below its fair value estimate, though its yield is lower than the top UK dividend payers. Earnings growth is expected to continue into fiscal year 2026.

- Take a closer look at Card Factory's potential here in our dividend report.

- Our valuation report unveils the possibility Card Factory's shares may be trading at a discount.

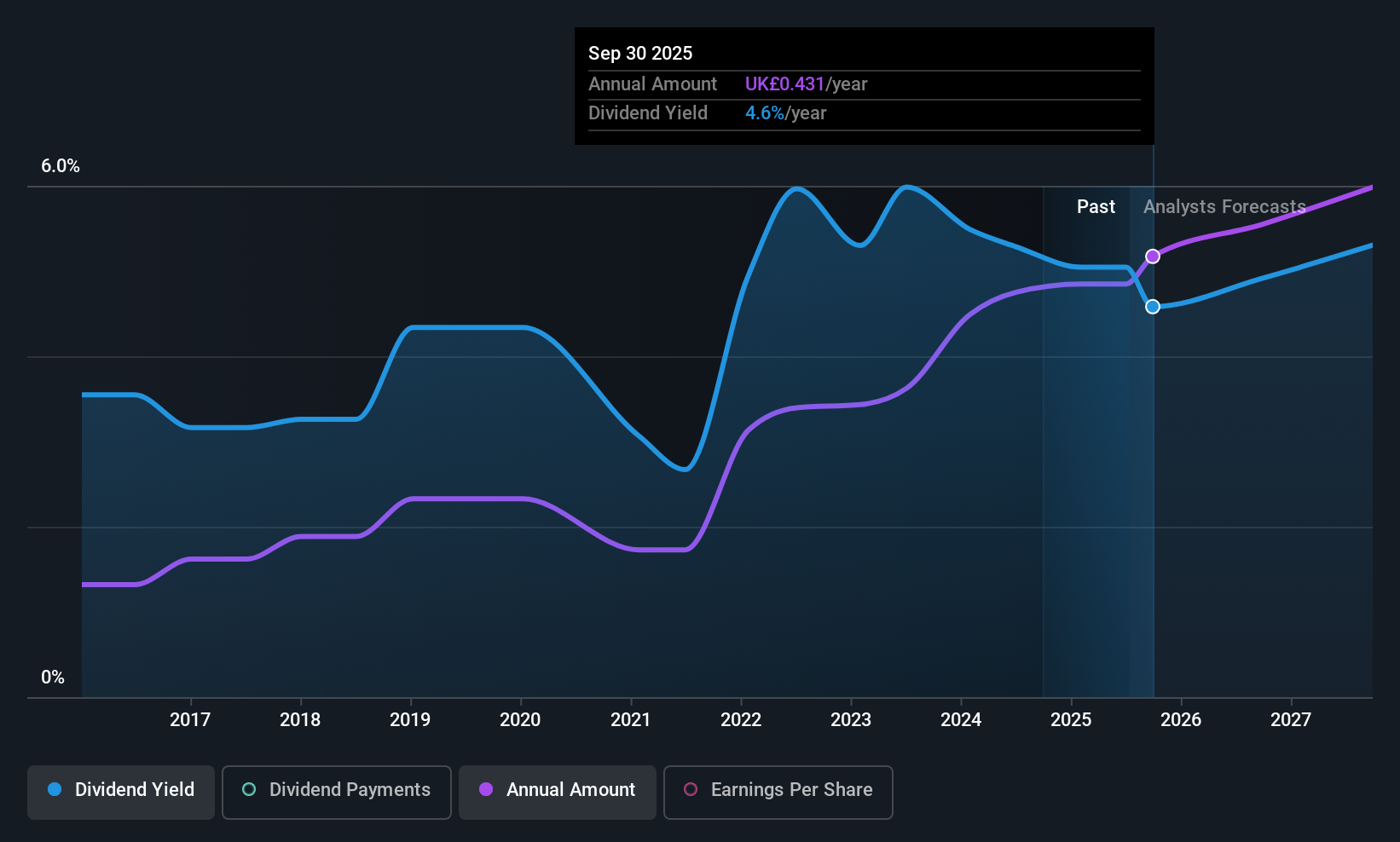

Paragon Banking Group (LSE:PAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Paragon Banking Group PLC provides financial products and services in the United Kingdom with a market cap of £1.66 billion.

Operations: Paragon Banking Group PLC generates revenue through its Mortgage Lending segment, which accounts for £278.30 million, and its Commercial Lending segment, contributing £106.80 million.

Dividend Yield: 4.7%

Paragon Banking Group's dividend payments are well covered by earnings, with a payout ratio of 40.6%, and cash flows, with a cash payout ratio of 17.6%. Despite past volatility in dividends, they have grown over the last decade. The stock trades at 37% below its estimated fair value and offers good relative value compared to peers. However, its dividend yield of 4.66% is lower than the top UK dividend payers' average of 5.51%.

- Delve into the full analysis dividend report here for a deeper understanding of Paragon Banking Group.

- According our valuation report, there's an indication that Paragon Banking Group's share price might be on the cheaper side.

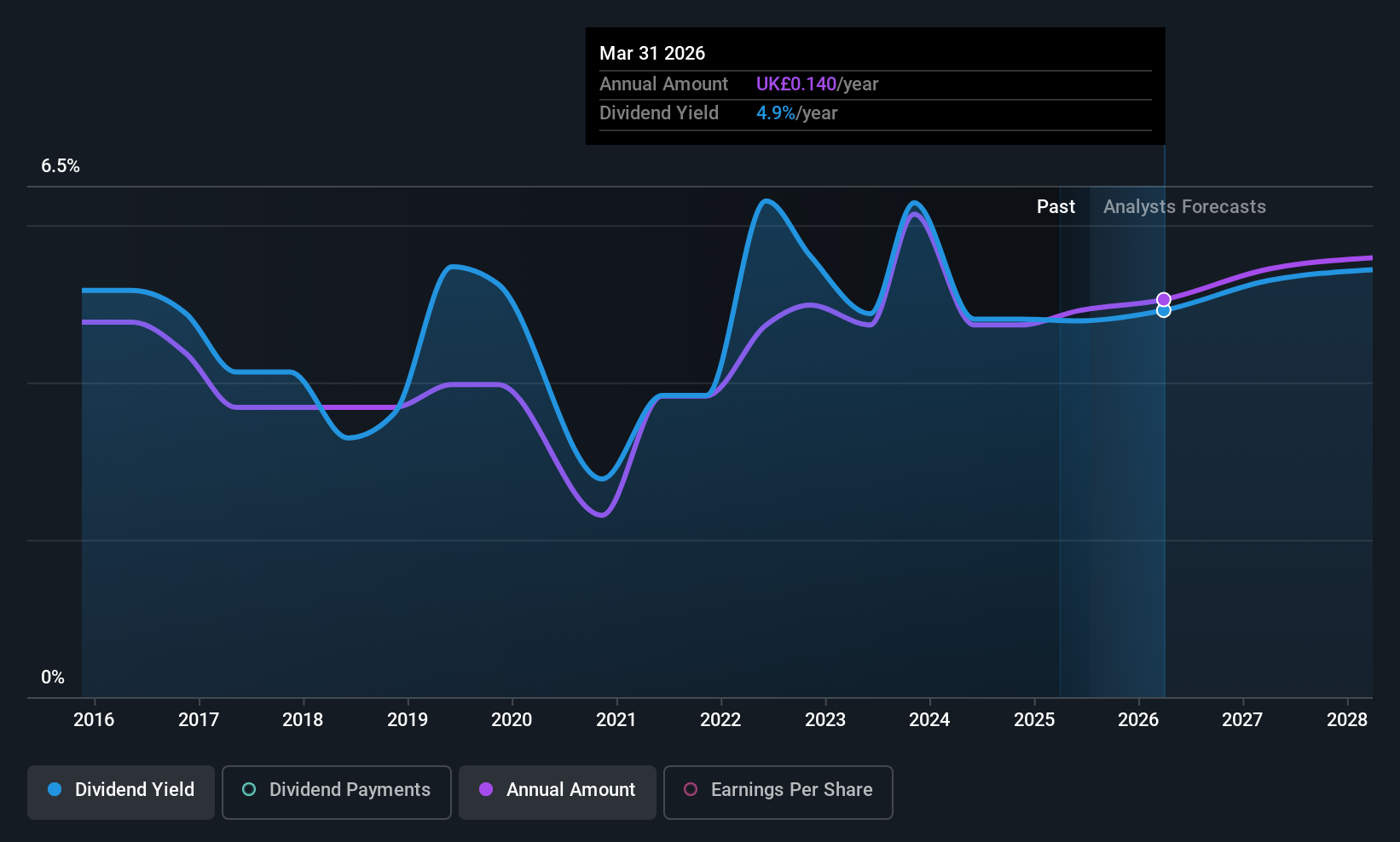

J Sainsbury (LSE:SBRY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: J Sainsbury plc, with a market cap of £6.90 billion, operates in the United Kingdom through its subsidiaries, focusing on food, general merchandise and clothing retailing as well as financial services.

Operations: J Sainsbury plc generates its revenue primarily from retail activities, amounting to £32.63 billion, and financial services, contributing £182 million.

Dividend Yield: 4.4%

J Sainsbury's dividends are supported by earnings and cash flows, with a payout ratio of 75.5% and a cash payout ratio of 27.4%. Despite increased dividend payments over the past decade, they have been inconsistent. Recent approval of a final dividend reflects ongoing commitment to shareholders, though the yield is below top UK payers at 4.44%. The company trades at good value relative to peers and expects retail operating profit around £1 billion for 2025-2026.

- Navigate through the intricacies of J Sainsbury with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, J Sainsbury's share price might be too pessimistic.

Key Takeaways

- Click here to access our complete index of 52 Top UK Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SBRY

J Sainsbury

Engages in the food, general merchandise and clothing retailing, and financial services activities in the United Kingdom.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives