- United Kingdom

- /

- Personal Products

- /

- AIM:CRL

UK Penny Stocks With Market Caps Over £20M

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China. Despite these broader market pressures, certain investment opportunities continue to attract attention. Penny stocks, a term often associated with smaller or newer companies, still hold potential for growth when they possess strong financials and sound fundamentals. In this article, we explore several UK penny stocks that stand out for their financial health and growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.855 | £11.77M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.88 | £297.21M | ✅ 5 ⚠️ 1 View Analysis > |

| One Media iP Group (AIM:OMIP) | £0.0375 | £8.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £3.80 | £306.99M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.755 | £424.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.04 | £389.44M | ✅ 3 ⚠️ 2 View Analysis > |

| Character Group (AIM:CCT) | £2.44 | £44.6M | ✅ 2 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.6M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.008 | £2.2B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.35 | £37.87M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 395 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Cake Box Holdings (AIM:CBOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cake Box Holdings Plc, with a market cap of £82.94 million, operates in the United Kingdom retail sector specializing in fresh cream celebration cakes through its subsidiaries.

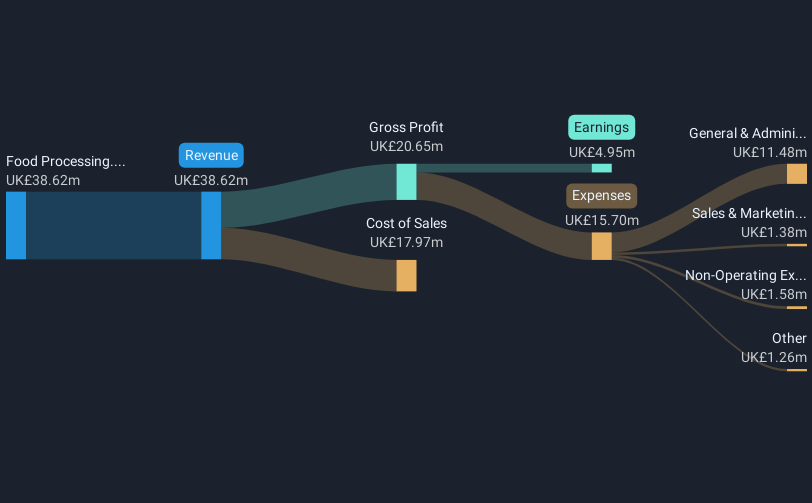

Operations: The company generates its revenue from the food processing segment, amounting to £38.62 million.

Market Cap: £82.94M

Cake Box Holdings Plc, with a market cap of £82.94 million, has demonstrated financial stability with its debt well covered by operating cash flow and more cash than total debt. Its recent follow-on equity offerings raised £7.2 million, potentially bolstering growth initiatives. The company shows consistent earnings growth, exceeding its five-year average and maintaining high-quality earnings with improved profit margins. However, the dividend is not well covered by free cash flows and the board's average tenure suggests a lack of experience. Trading at 49.8% below estimated fair value presents potential opportunities for investors seeking undervalued stocks in the retail sector.

- Take a closer look at Cake Box Holdings' potential here in our financial health report.

- Learn about Cake Box Holdings' future growth trajectory here.

Creightons (AIM:CRL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Creightons Plc, along with its subsidiaries, develops, manufactures, and markets toiletries and fragrances both in the United Kingdom and internationally, with a market cap of £24.29 million.

Operations: The company generates revenue of £52.72 million from its Personal Products segment.

Market Cap: £24.29M

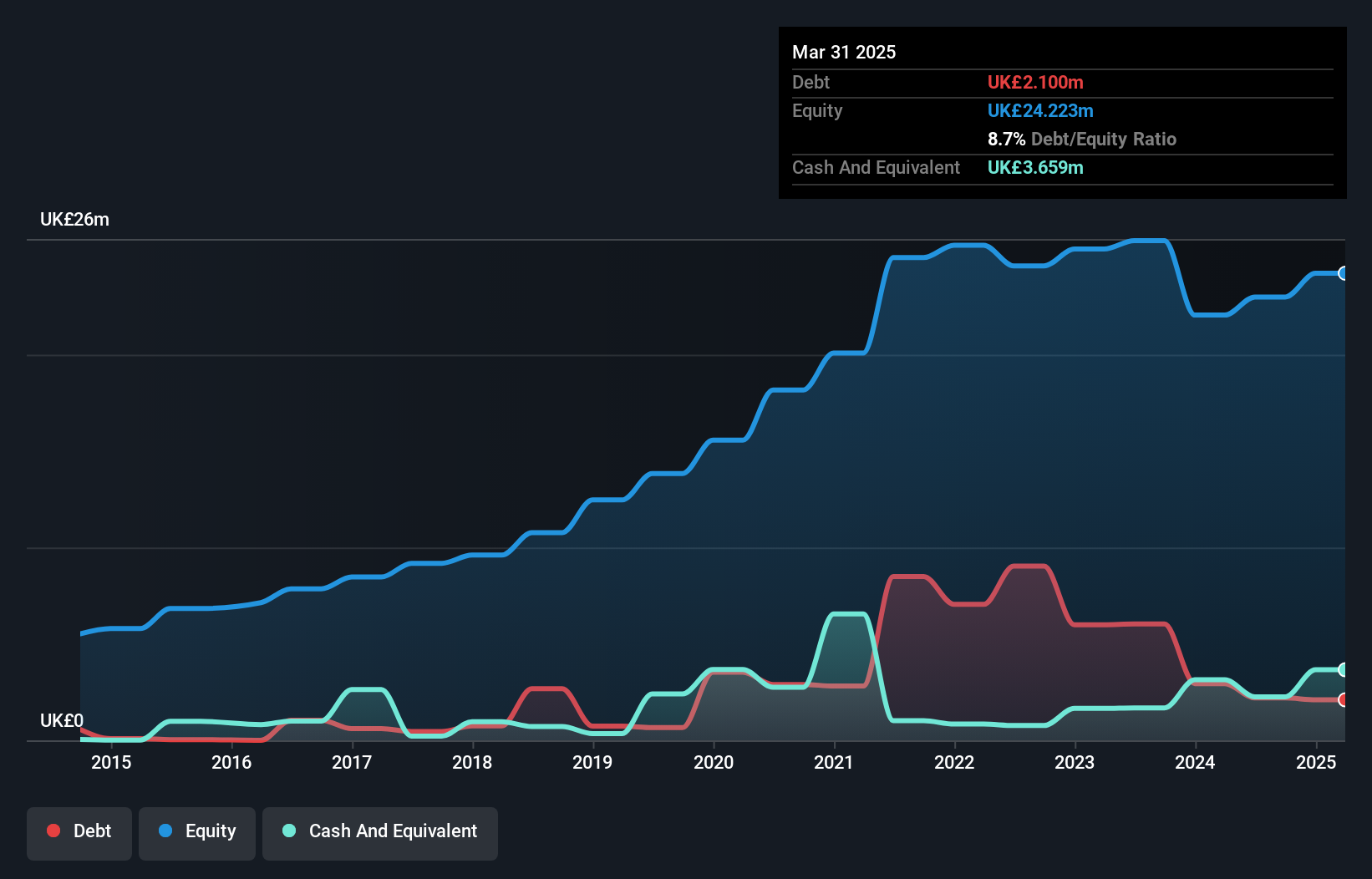

Creightons Plc, with a market cap of £24.29 million, presents a mixed picture for investors interested in penny stocks. The company has more cash than total debt and its debt is well covered by operating cash flow, yet it remains unprofitable with losses increasing at 51.9% annually over the past five years. Despite trading at 76.6% below estimated fair value, potential investors should consider its high share price volatility and negative return on equity of -11.29%. Recent board changes include the promotion of CFO Mohammed Qadeer to the Board of Directors and Jemima Bird's appointment as an Independent Non-Executive Director.

- Navigate through the intricacies of Creightons with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Creightons' track record.

TPXimpact Holdings (AIM:TPX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TPXimpact Holdings plc, along with its subsidiaries, offers digital native technology services across various countries including the United Kingdom, Norway, Switzerland, Germany, the United States, and Malaysia; it has a market cap of £20.07 million.

Operations: No specific revenue segments are reported for TPXimpact Holdings plc.

Market Cap: £20.07M

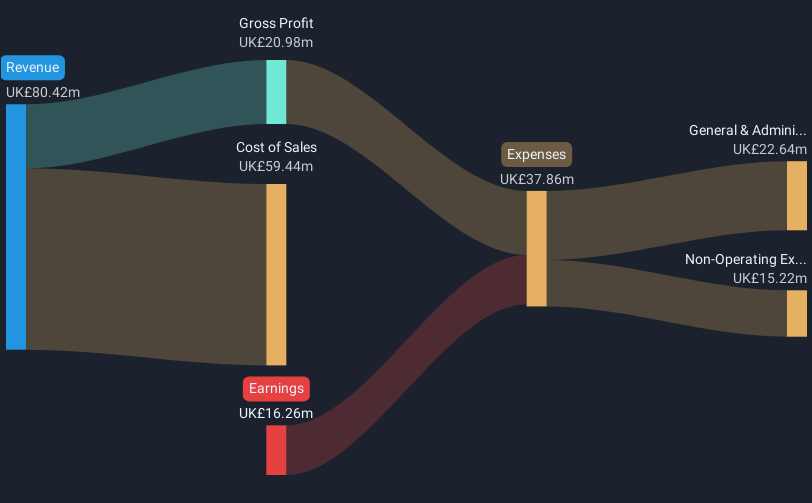

TPXimpact Holdings, with a market cap of £20.07 million, offers potential value by trading at 34.8% below estimated fair value and maintaining a cash runway exceeding three years due to positive free cash flow. However, it remains unprofitable with losses increasing annually by 51.9% over the past five years and an elevated debt-to-equity ratio of 26.8%. The company's short-term assets cover both its short- and long-term liabilities, providing some financial stability despite high share price volatility and negative return on equity (-36.16%). Recent changes include Neal Gandhi's resignation from the board after serving as a non-executive director.

- Dive into the specifics of TPXimpact Holdings here with our thorough balance sheet health report.

- Assess TPXimpact Holdings' future earnings estimates with our detailed growth reports.

Taking Advantage

- Click here to access our complete index of 395 UK Penny Stocks.

- Ready For A Different Approach? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CRL

Creightons

Develops, manufactures, and markets toiletries and fragrances in the United Kingdom and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives