- United Kingdom

- /

- Real Estate

- /

- LSE:LSL

Top UK Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines following weak trade data from China, highlighting global economic interdependencies. Despite these broader market pressures, penny stocks continue to attract attention for their potential to offer growth opportunities at a lower cost entry point. While the term may seem outdated, these stocks often represent smaller or newer companies that can provide significant value when backed by strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.97 | £479.09M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.04 | £459.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.30 | £866.67M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.25 | £160.52M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.30 | £82.01M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.34 | £332.18M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.476 | £227.64M | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Eagle Eye Solutions Group (AIM:EYE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eagle Eye Solutions Group plc offers marketing technology software as a service across various regions including the UK, France, the US, Canada, Australia, Europe, and Asia Pacific, with a market cap of £109.95 million.

Operations: Eagle Eye Solutions Group generates revenue from two primary segments: Eagleai, contributing £4.42 million, and Organic, which accounts for £43.31 million.

Market Cap: £109.95M

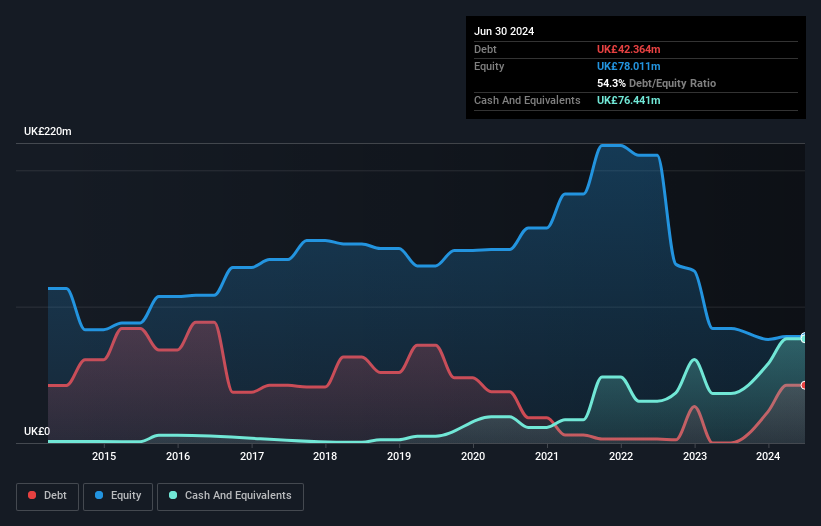

Eagle Eye Solutions Group, with a market cap of £109.95 million, is positioned for growth through its recent five-year OEM agreement with a major enterprise software vendor. This deal integrates Eagle Eye's AIR platform into the vendor's new cloud-based loyalty solution, marking a significant global expansion opportunity. The company has demonstrated strong earnings growth of 382.7% over the past year and maintains stable financial health with more cash than debt and short-term assets exceeding liabilities. However, its Return on Equity remains low at 16.8%, and earnings are forecast to decline by 8.6% annually over the next three years.

- Click here and access our complete financial health analysis report to understand the dynamics of Eagle Eye Solutions Group.

- Examine Eagle Eye Solutions Group's earnings growth report to understand how analysts expect it to perform.

MJ Gleeson (LSE:GLE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MJ Gleeson plc operates in the United Kingdom, focusing on house building and land promotion and sales, with a market cap of £288.08 million.

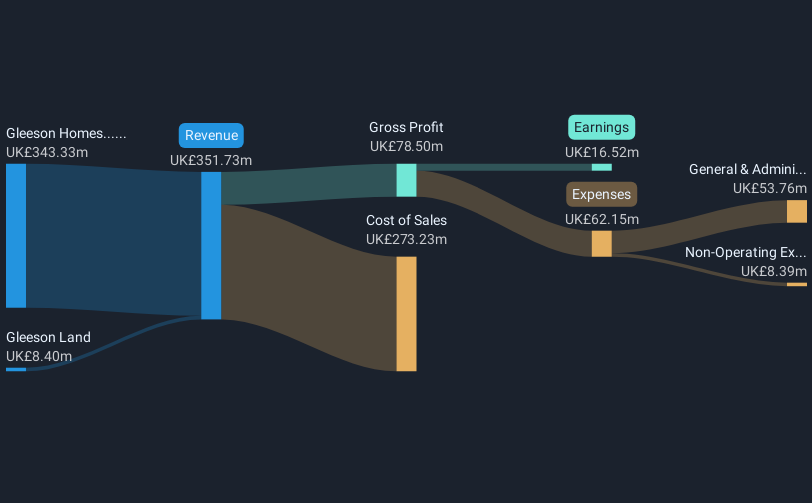

Operations: The company's revenue is derived from two main segments: Gleeson Homes, generating £343.33 million, and Gleeson Land, contributing £8.40 million.

Market Cap: £288.08M

MJ Gleeson, with a market cap of £288.08 million, shows mixed signals as a penny stock in the UK. Despite satisfactory debt levels and an experienced board and management team, the company faces challenges with declining net income (£2.8 million) compared to the previous year (£5.59 million). Its earnings growth has been negative recently, although it outperformed its industry average decline. The company's dividend policy remains stable despite an unstable track record. Analysts agree on potential stock price appreciation by 35.4%, but current low return on equity (5.6%) and reduced profit margins indicate areas for improvement in financial performance.

- Click here to discover the nuances of MJ Gleeson with our detailed analytical financial health report.

- Learn about MJ Gleeson's future growth trajectory here.

LSL Property Services (LSE:LSL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LSL Property Services plc operates in the United Kingdom, providing business-to-business services to mortgage intermediaries and estate agency franchisees, as well as valuation services to lenders, with a market cap of £298.21 million.

Operations: The company's revenue is derived from three main segments: Financial Services (£47.22 million), Surveying and Valuation (£79.49 million), and Estate Agency excluding Financial Services (£30.61 million).

Market Cap: £298.21M

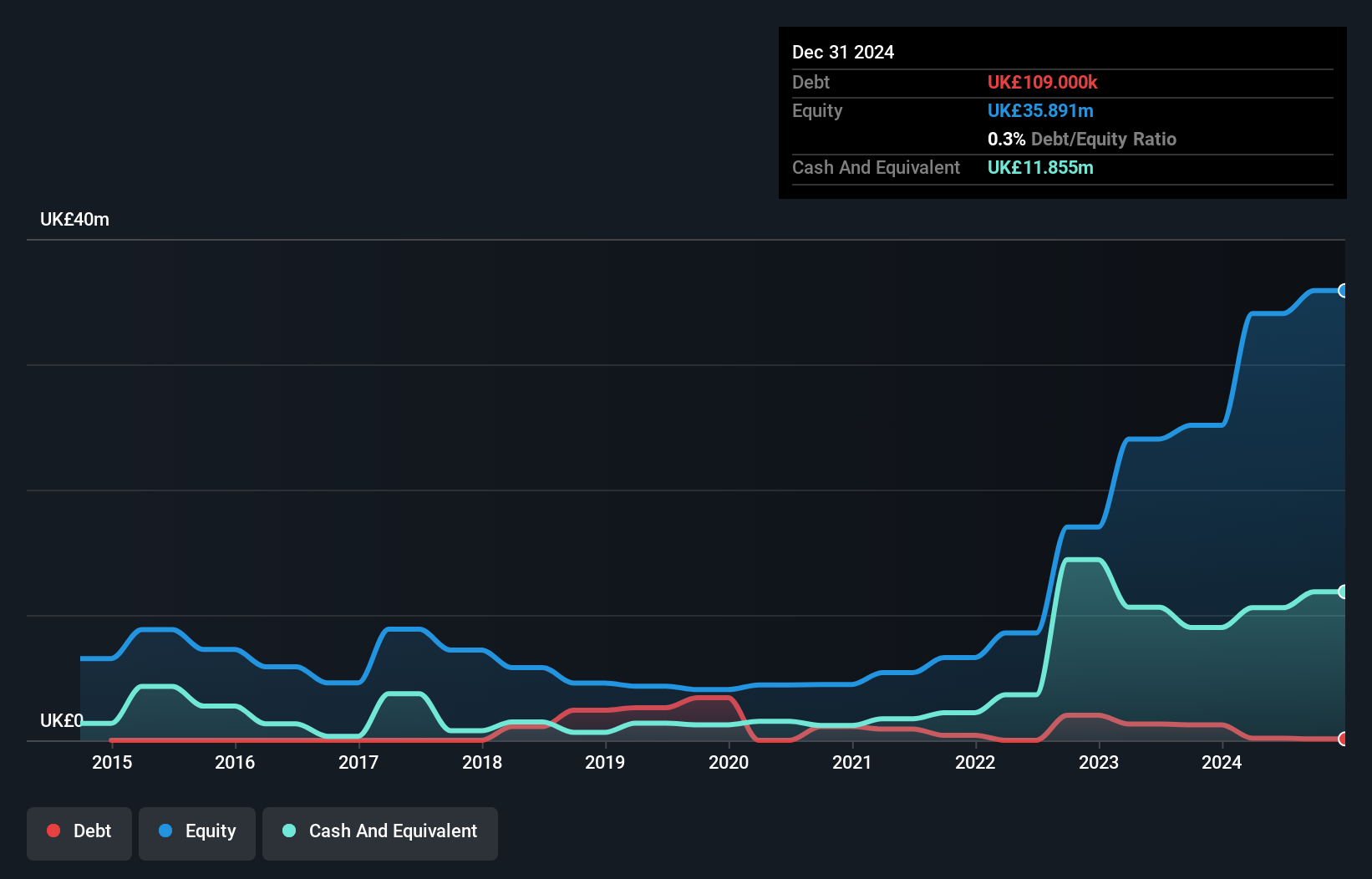

LSL Property Services, with a market cap of £298.21 million, presents a nuanced picture within the penny stock landscape. The company's financial stability is underscored by its cash reserves exceeding total debt and its ability to cover short and long-term liabilities with assets (£105.2M). Despite recent profitability, earnings have been impacted by significant one-off losses (£9.1M). Leadership changes are underway, with Adam Castleton set to become CEO in May 2025, bringing extensive experience from his tenure as CFO since 2015. While trading below estimated fair value and forecasted earnings growth (26.92%) offer potential upside, dividend sustainability remains questionable due to inadequate coverage by earnings.

- Unlock comprehensive insights into our analysis of LSL Property Services stock in this financial health report.

- Gain insights into LSL Property Services' future direction by reviewing our growth report.

Key Takeaways

- Dive into all 443 of the UK Penny Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LSL

LSL Property Services

Engages in the provision of business-to-business services to mortgage intermediaries and estate agent franchisees, and valuation services to lenders in the United Kingdom.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives