- United Kingdom

- /

- Retail Distributors

- /

- AIM:SUP

Polar Capital Holdings And 2 Other UK Penny Stocks To Consider

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, reflecting broader global economic uncertainties. Despite these conditions, investors may find opportunities in penny stocks—an investment area that remains relevant even if the term feels somewhat outdated. These smaller or newer companies can offer surprising value when built on solid financial foundations, potentially providing stability and long-term potential for those willing to explore beyond well-known names.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.64 | £54.07M | ✅ 4 ⚠️ 4 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.615 | £260.08M | ✅ 4 ⚠️ 5 View Analysis > |

| Central Asia Metals (AIM:CAML) | £1.55 | £269.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.55 | £286.79M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.41 | £386.35M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.75 | £361.49M | ✅ 3 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.60 | £992.4M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.32M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.91 | £2.15B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.34 | £36.79M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 393 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Polar Capital Holdings (AIM:POLR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Polar Capital Holdings plc is a publicly owned investment manager with a market cap of £361.49 million.

Operations: The company's revenue primarily comes from its investment management business, generating £212.74 million.

Market Cap: £361.49M

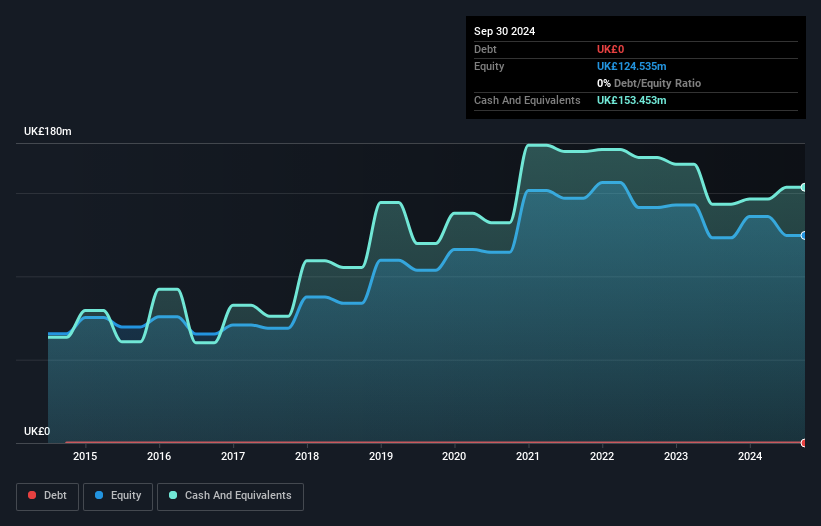

Polar Capital Holdings plc, with a market cap of £361.49 million, stands out in the penny stock arena due to its debt-free status and seasoned management team. The company's short-term assets (£180.6M) comfortably cover both short-term (£69.2M) and long-term liabilities (£6.5M). Despite a forecasted earnings decline of 7.9% annually over the next three years, recent growth of 22.4% surpasses industry averages, indicating potential resilience. Trading at 40.5% below estimated fair value suggests possible undervaluation; however, its high dividend yield (12.27%) is not well covered by earnings, posing sustainability concerns.

- Jump into the full analysis health report here for a deeper understanding of Polar Capital Holdings.

- Gain insights into Polar Capital Holdings' future direction by reviewing our growth report.

Supreme (AIM:SUP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Supreme Plc is a company that owns, manufactures, and distributes batteries, lighting, vaping products, sports nutrition and wellness items, and branded household consumer goods across the UK, Ireland, the Netherlands, France, other parts of Europe and internationally with a market cap of £187.70 million.

Operations: The company's revenue is primarily generated from its vaping segment (£77.29 million), followed by branded household consumer goods (£67.25 million), batteries (£42.00 million), sports nutrition and wellness (£18.52 million), and lighting (£17.13 million).

Market Cap: £187.7M

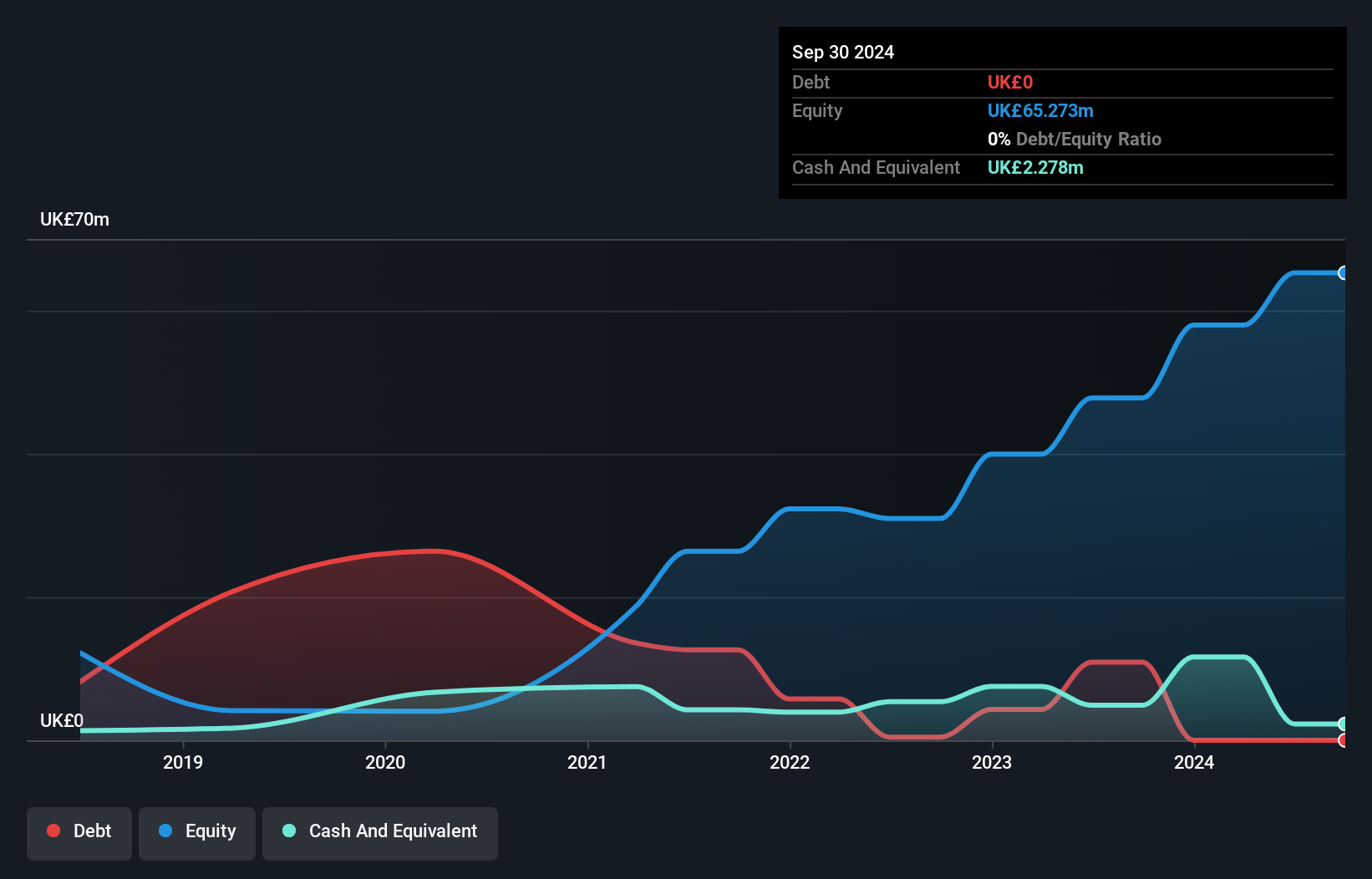

Supreme Plc, with a market cap of £187.70 million, presents a mixed picture in the penny stock landscape. The company has demonstrated strong earnings growth of 32.7% over the past year, surpassing industry averages and reflecting high-quality earnings with an impressive return on equity of 36.5%. Its financial health is robust, with short-term assets (£70.1M) covering both short-term (£38.2M) and long-term liabilities (£14.2M), and it remains debt-free after reducing significant past debt levels. However, an inexperienced management team and forecasted earnings decline by 9% annually over the next three years may temper investor enthusiasm despite trading slightly below estimated fair value.

- Take a closer look at Supreme's potential here in our financial health report.

- Understand Supreme's earnings outlook by examining our growth report.

Cairn Homes (LSE:CRN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cairn Homes plc is involved in the development of residential properties for sale in Ireland, with a market capitalization of £992.40 million.

Operations: The company generates revenue primarily through its building and property development activities, amounting to €859.87 million.

Market Cap: £992.4M

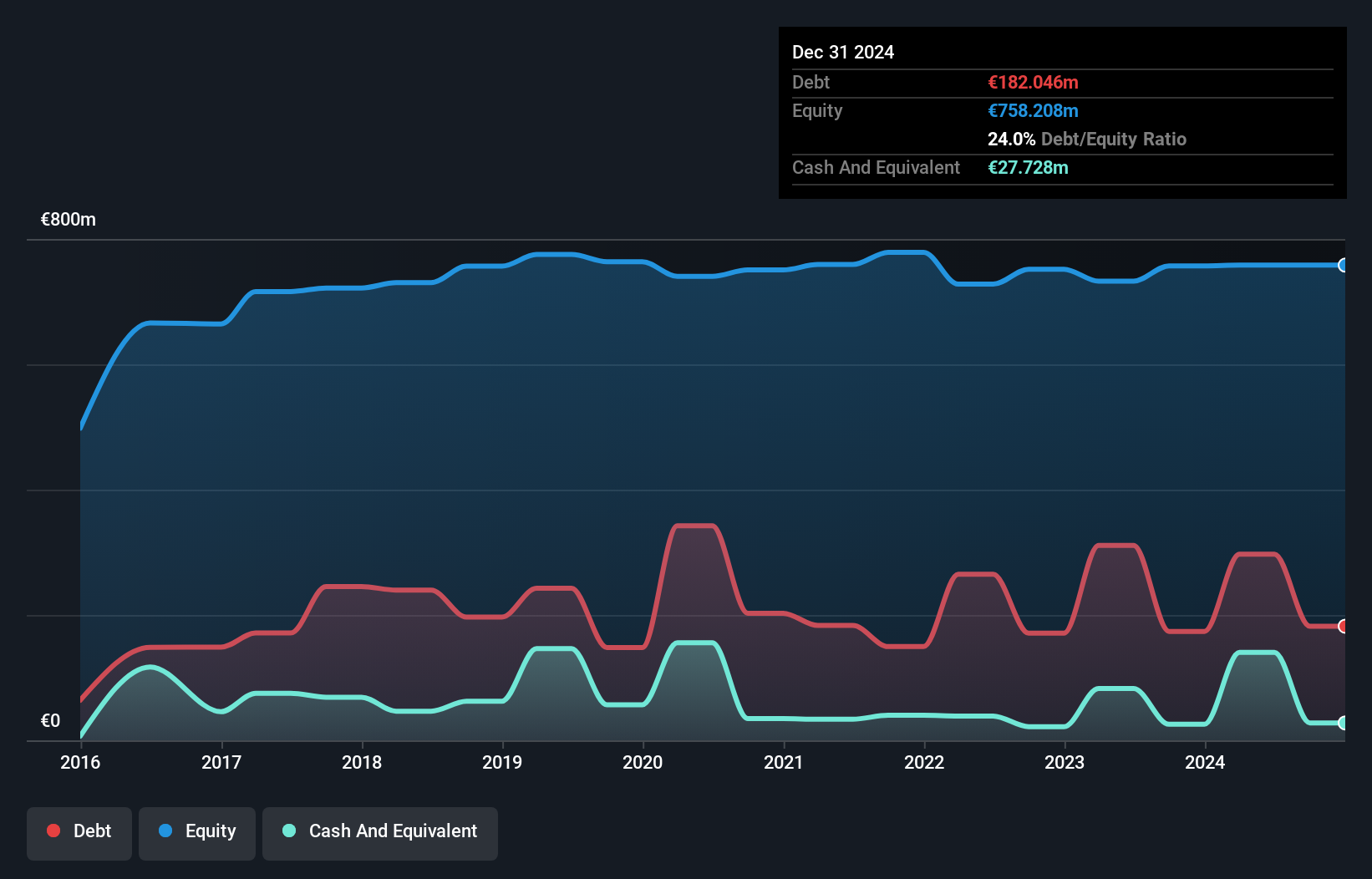

Cairn Homes, with a market capitalization of £992.40 million, stands out in the penny stock arena due to its robust financial performance and strategic positioning. The company reported significant earnings growth of 34.1% over the past year, outperforming industry averages and achieving high-quality earnings with improved net profit margins at 13.3%. Its short-term assets (€1 billion) comfortably cover both short-term (€138.7 million) and long-term liabilities (€175.3 million), while debt is well-managed with operating cash flow covering 74% of it. Despite a stable dividend history, insider selling could be a concern for potential investors seeking stability in this sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Cairn Homes.

- Gain insights into Cairn Homes' outlook and expected performance with our report on the company's earnings estimates.

Turning Ideas Into Actions

- Discover the full array of 393 UK Penny Stocks right here.

- Seeking Other Investments? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 21 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SUP

Supreme

Owns, manufactures, and distributes batteries, lighting, vaping, sports nutrition and wellness, and branded household consumer goods in the United Kingdom, Ireland, the Netherlands, France, rest of Europe, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives