- United Kingdom

- /

- Consumer Durables

- /

- LSE:CRN

Exploring Three Undiscovered UK Stocks With Potential In July 2024

Reviewed by Simply Wall St

In the past year, the United Kingdom's stock market has shown modest growth, rising 4.1%, with a stable performance in the last week and earnings forecasted to grow by 13% annually. In such an environment, stocks that have not yet caught widespread attention but show potential for growth can be particularly compelling for investors looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| Georgia Capital | NA | -27.80% | 18.94% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Ros Agro | 57.18% | 17.80% | 18.35% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

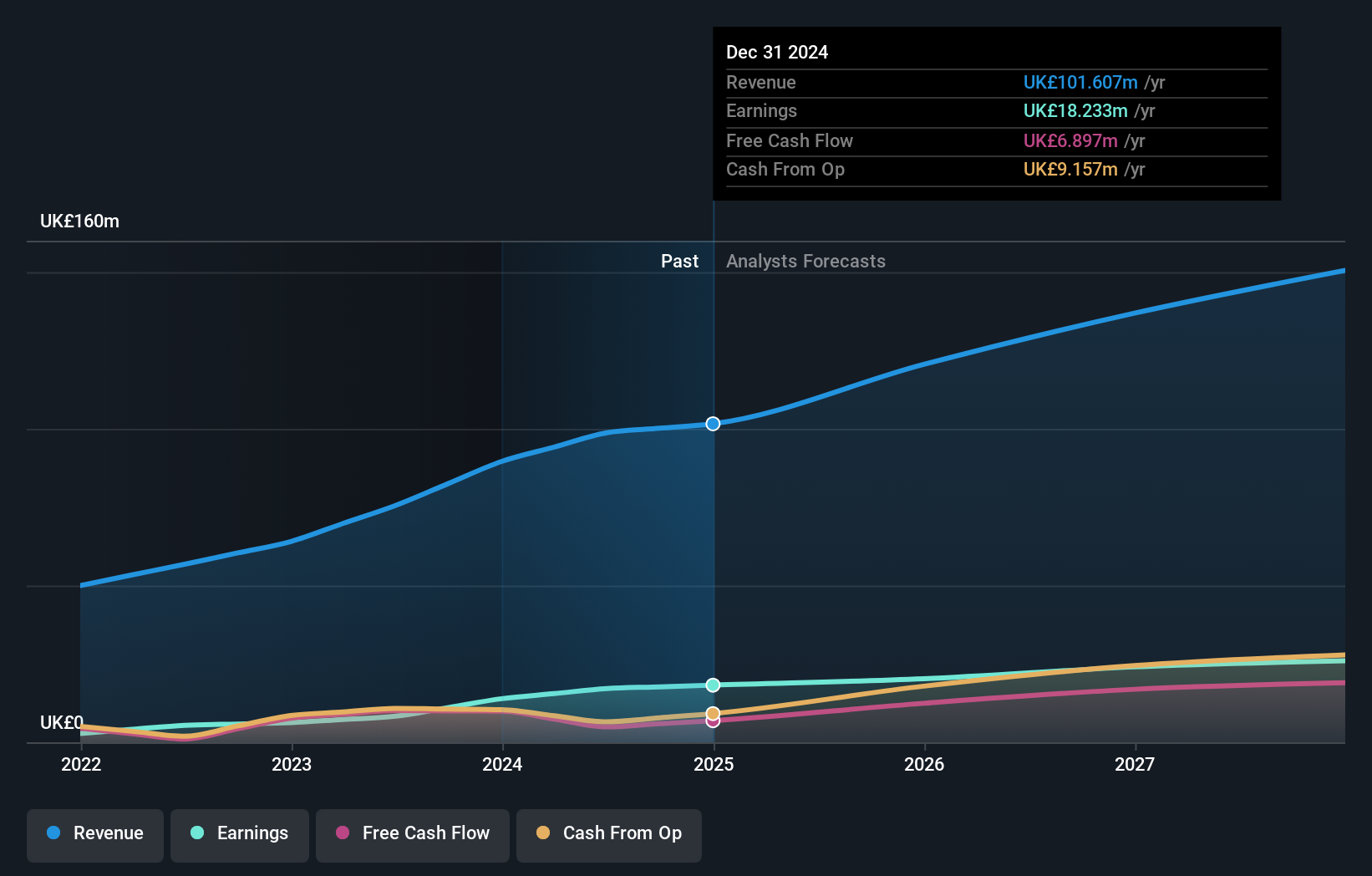

Overview: Warpaint London PLC, together with its subsidiaries, produces and sells cosmetics and has a market capitalization of £485.20 million.

Operations: The company generates the majority of its revenue from its own brand products, contributing £87.07 million, while close-out sales add an additional £2.52 million. Its business model showcases a gross profit margin that has improved over time, reaching 39.87% by the end of 2023, reflecting increasing efficiency in managing production costs relative to sales revenue.

Warpaint London, a lesser-known player in the personal products industry, has demonstrated robust growth with earnings surging by 122.4% over the past year, significantly outpacing the industry's average of 16.5%. This growth is supported by high-quality earnings and a positive free cash flow. Recently, Warpaint increased its dividend to 6 pence per share and successfully raised £31.5 million through an equity offering, indicating strong financial health and investor confidence. These developments make Warpaint an intriguing prospect for those looking into undiscovered gems in the UK market.

- Click here to discover the nuances of Warpaint London with our detailed analytical health report.

Explore historical data to track Warpaint London's performance over time in our Past section.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★★

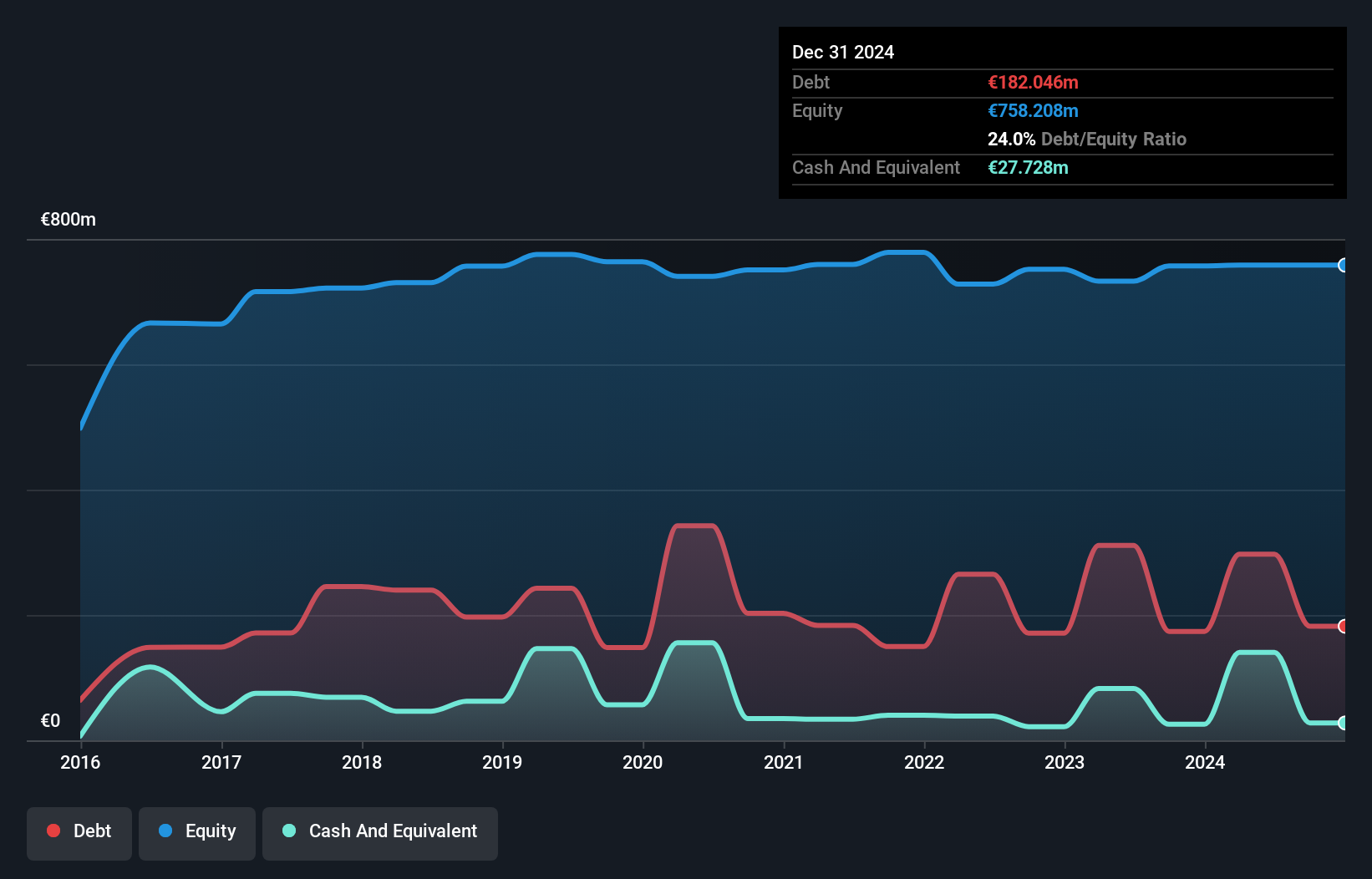

Overview: Cairn Homes plc is a home and community builder based in Ireland, with a market capitalization of £1.02 billion.

Operations: Cairn Homes primarily engages in building and property development, with its recent revenue reported at €666.81 million. The company's business model reflects a consistent increase in gross profit margins, recently reaching 22.14%, indicative of efficient cost management and value creation from its construction projects.

Cairn Homes stands out in the UK market, trading at 4.8% below its fair value, signaling potential underappreciation. With earnings growth of 5.4% last year—outpacing the Consumer Durables industry's 21.1% decline—it showcases resilience and growth potential. The company's net debt to equity ratio has improved from 26% to 23%, reflecting prudent financial management, while an interest coverage ratio of 8.4 times indicates strong profit relative to debt obligations. These figures suggest a robust foundation for future performance.

- Click to explore a detailed breakdown of our findings in Cairn Homes' health report.

Review our historical performance report to gain insights into Cairn Homes''s past performance.

Wilmington (LSE:WIL)

Simply Wall St Value Rating: ★★★★★★

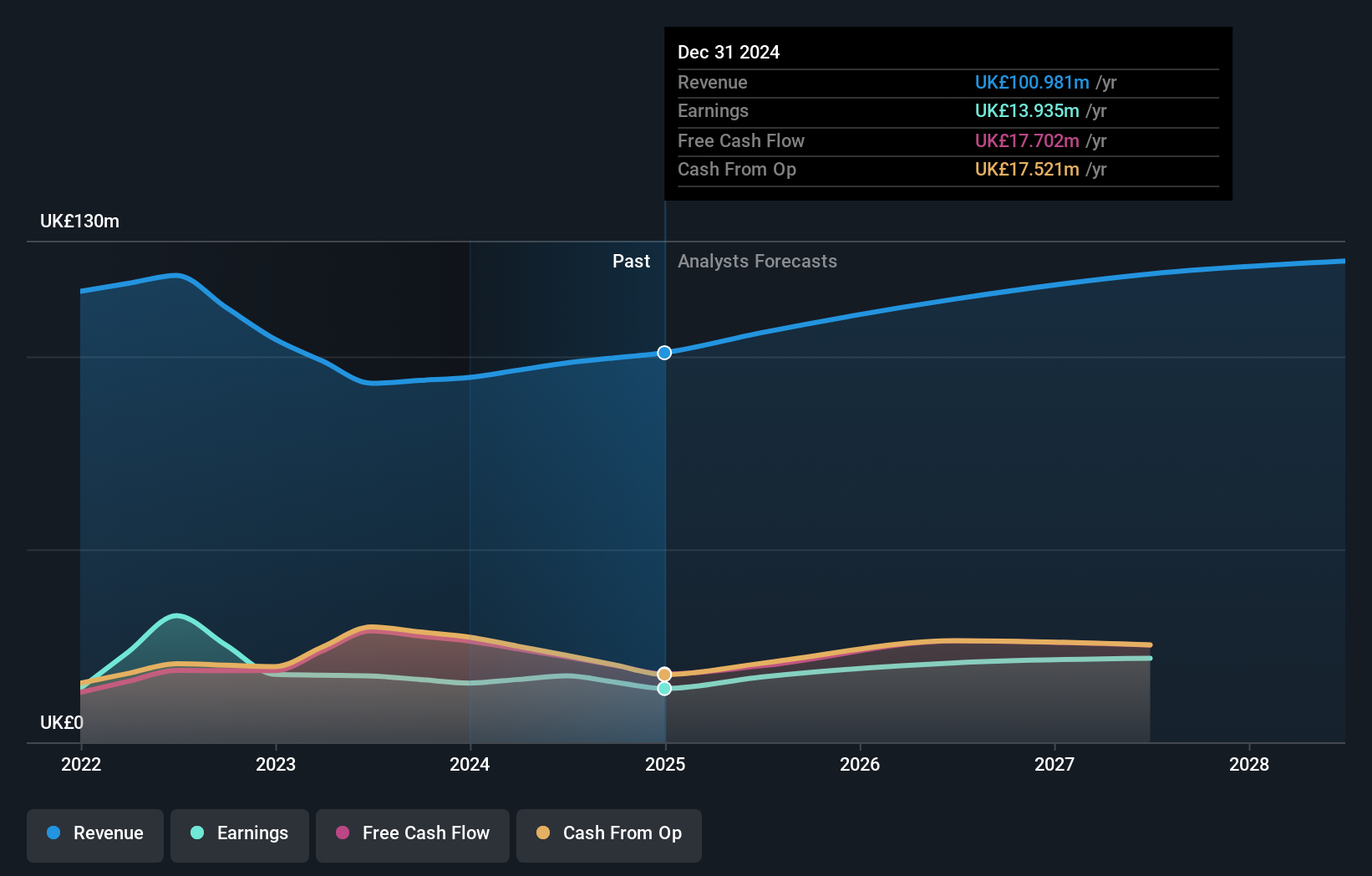

Overview: Wilmington plc operates as a provider of information, data, training, and education solutions aimed at professional markets across the UK, Europe, North America, and other international regions with a market capitalization of £335.46 million.

Operations: The company generates revenue primarily through two segments: Intelligence and Training & Education, which collectively brought in £124.99 million as of the latest reporting period. It incurs costs mainly from goods sold, with recent figures showing a cost of goods sold (COGS) at £100.45 million, reflecting its operational focus on maintaining efficiency in service delivery and product offerings.

Wilmington, a lesser-known yet intriguing UK entity, trades at a compelling 56.1% below its estimated fair value, highlighting potential for discerning investors. Over the past year, the company's earnings outpaced the professional services industry with a 4.4% growth compared to the industry's 1%. Despite forecasts suggesting an average earnings decrease of 7.1% annually over three years, Wilmington remains debt-free and maintains positive free cash flow, reinforcing its financial stability without relying on debt leverage.

- Take a closer look at Wilmington's potential here in our health report.

Gain insights into Wilmington's past trends and performance with our Past report.

Taking Advantage

- Take a closer look at our UK Undiscovered Gems With Strong Fundamentals list of 79 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CRN

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)